[ad_1]

Updated on May 23rd, 2023 by Bob Ciura

Income investors are always on the hunt for high-quality dividend growth stocks. There are many ways to measure high-quality stocks. One way for investors to find great dividend stocks is to focus on those with the longest histories of raising dividends.

With this in mind, we created a downloadable list of all 278 dividend growth stocks. We define dividend growth stocks as all stocks with 14+ years of rising dividends in the Sure Analysis Research Database.

You can download your free copy of the Dividend Growth Stocks list, along with relevant financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the link below:

Click here to instantly download your free spreadsheet of all Dividend Growth Stocks now, along with important investing metrics.

Quality dividend growth stocks (like the ones on the dividend growth stocks list) have demonstrated an ability to survive recessions while continuing to raise their dividends. Their impressive dividend streaks are due to their strong business models and consistent profits, through the economic cycle.

This article will discuss the top 10 Dividend Growth Stocks, ranked according to expected total returns in the Sure Analysis Research Database.

Table of Contents

This section discusses the top 10 dividend growth stocks right now. All 10 dividend growth stocks have increased their dividends for 14+ years in a row. There are no more than three stocks allowed from any single market sector, to ensure the list is diversified.

You can instantly jump to any specific section of the article by clicking on the links below:

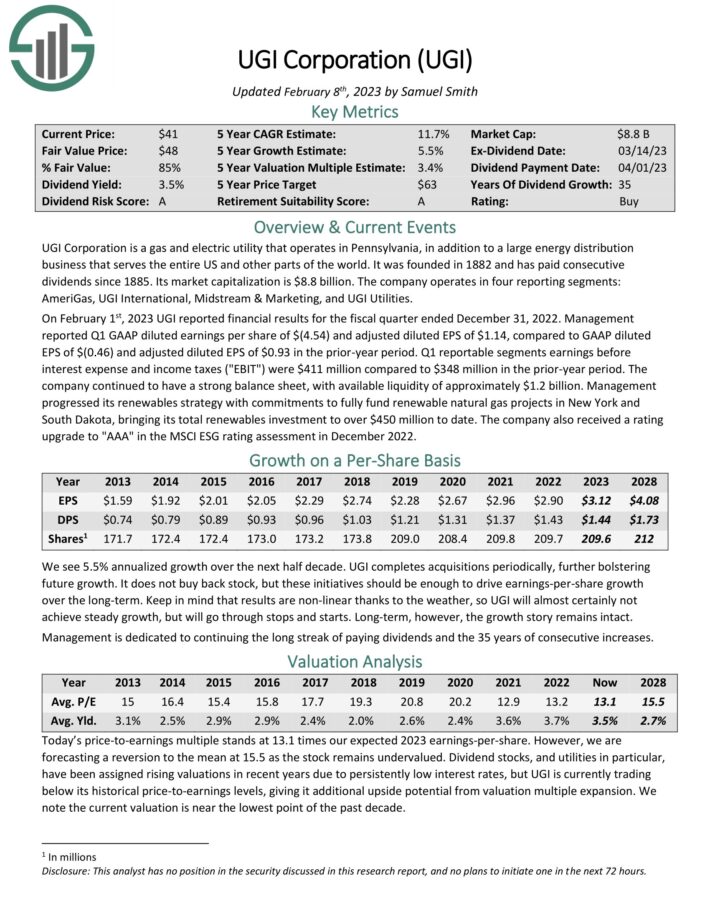

Dividend Growth Stock #10: UGI Corp. (UGI)

5-year expected returns: 16.6%

Years Of Consecutive Dividend Increases: 36

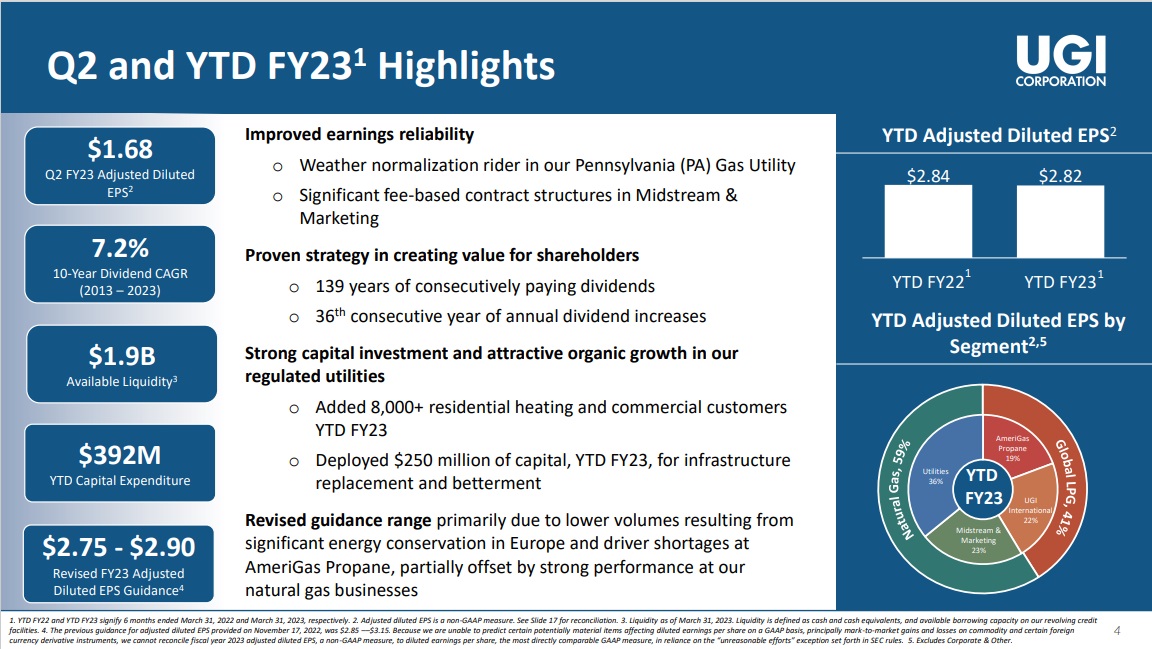

UGI Corporation is a gas and electric utility that operates in Pennsylvania, in addition to a large energy distribution business that serves the entire US and other parts of the world. It was founded in 1882 and has paid consecutive dividends since 1885.

The company operates in four reporting segments: AmeriGas, UGI International, Midstream & Marketing, and UGI Utilities.

Source: Investor Presentation

On February 1st, 2023 UGI reported financial results for the fiscal quarter ended December 31, 2022. Management reported Q1 GAAP diluted earnings per share of $(4.54) and adjusted diluted EPS of $1.14, compared to GAAP diluted EPS of $(0.46) and adjusted diluted EPS of $0.93 in the prior-year period.

Click here to download our most recent Sure Analysis report on UGI (preview of page 1 of 3 shown below):

5-year expected returns: 16.6%

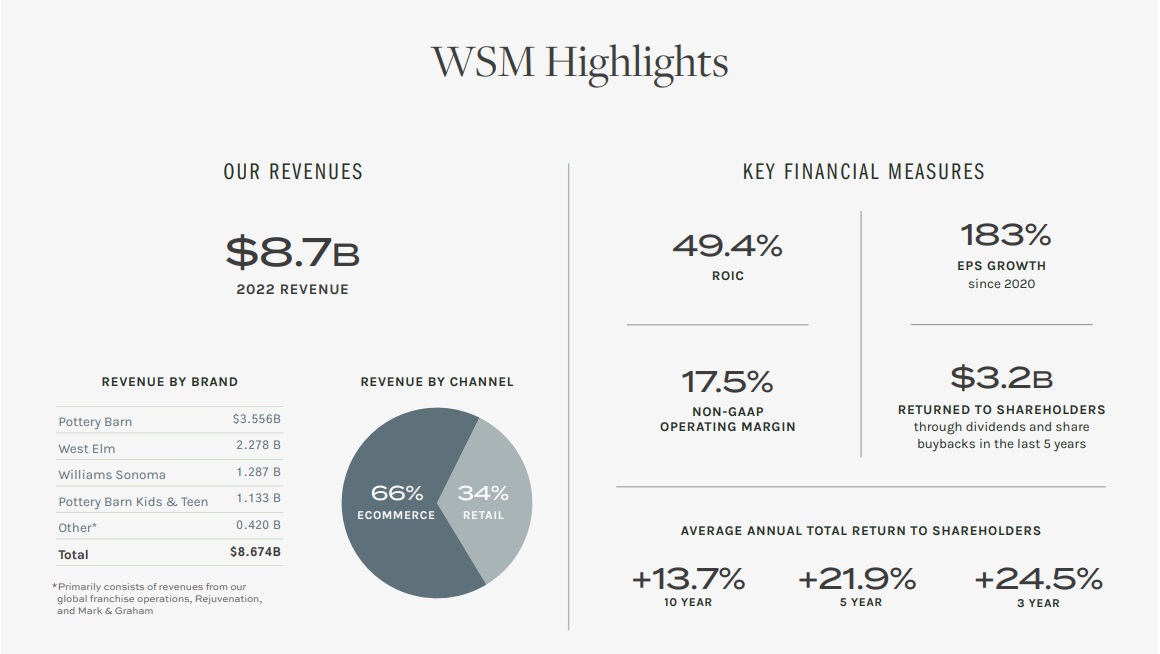

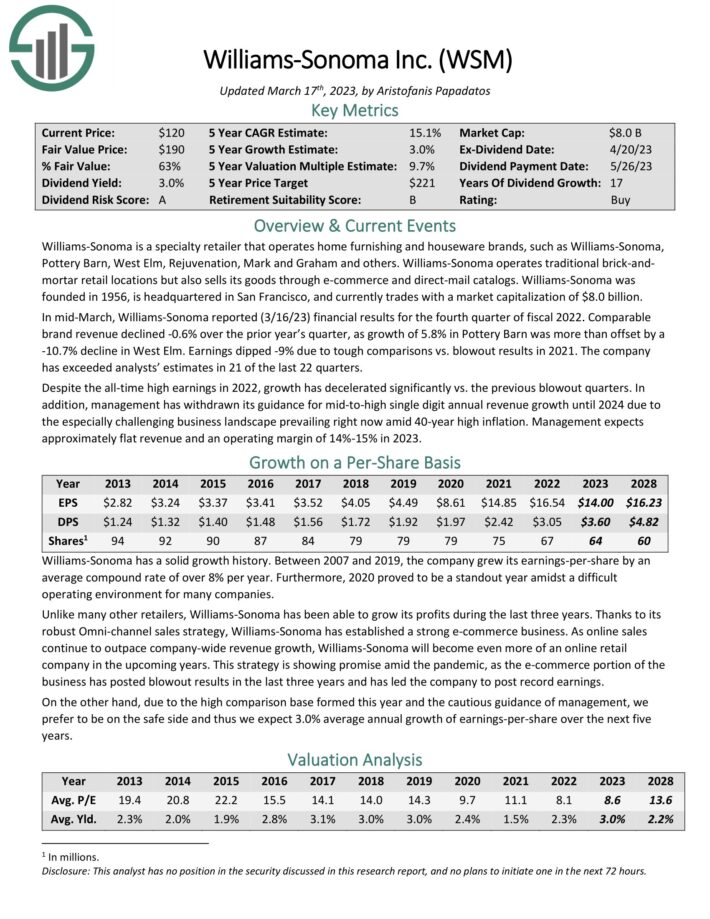

Years Of Consecutive Dividend Increases: 17

Williams-Sonoma is a specialty retailer that operates home furnishing and houseware brands, such as Williams-Sonoma, Pottery Barn, West Elm, Rejuvenation, Mark and Graham and others. Williams-Sonoma operates traditional brick-and-mortar retail locations but also sells its goods through e-commerce and direct-mail catalogs.

Source: Investor Presentation

In mid-March, Williams-Sonoma reported (3/16/23) financial results for the fourth quarter of fiscal 2022. Comparable brand revenue declined -0.6% over the prior year’s quarter, as growth of 5.8% in Pottery Barn was more than offset by a 10.7% decline in West Elm. The company has exceeded analysts’ estimates in 21 of the last 22 quarters.

Click here to download our most recent Sure Analysis report on Williams-Sonoma (preview of page 1 of 3 shown below):

5-year expected returns: 16.9%

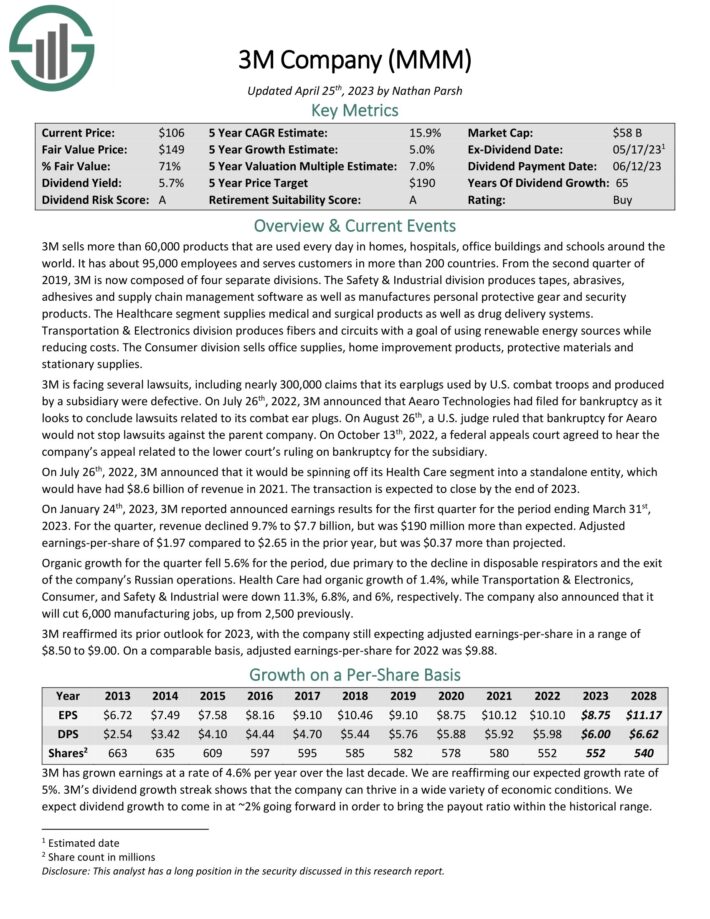

Years Of Consecutive Dividend Increases: 65

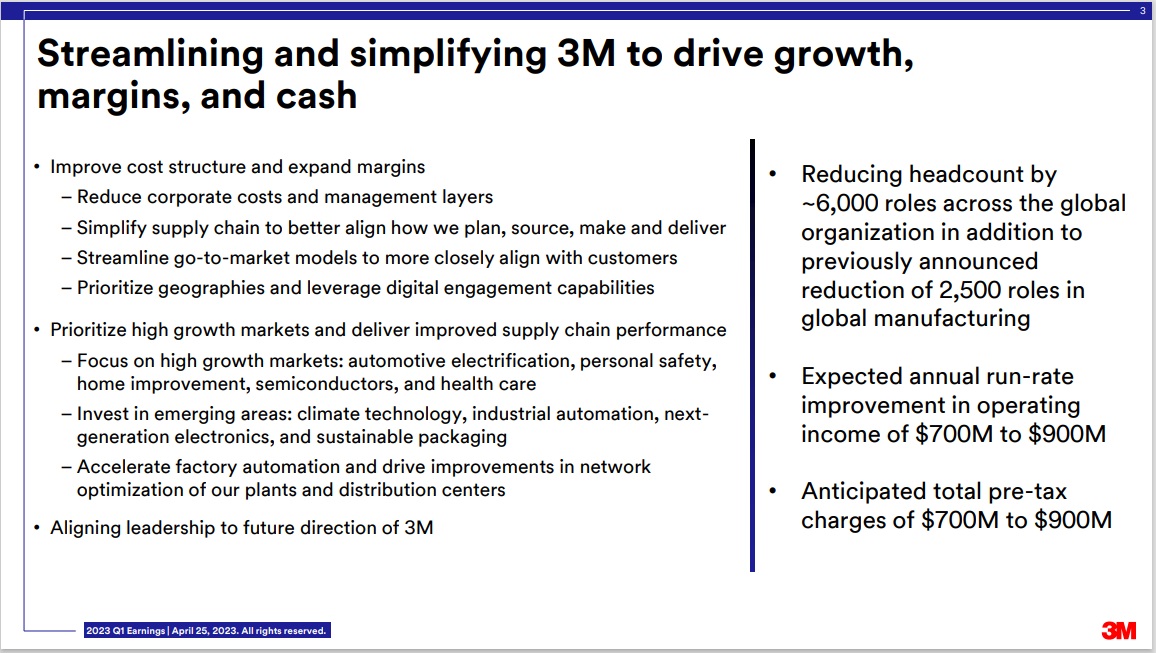

3M sells more than 60,000 products that are used every day in homes, hospitals, office buildings and schools around the world. It is now composed of four separate divisions: Safety & Industrial, Healthcare, Transportation & Electronics, and Consumer.

The company also announced that it would be spinning off its Health Care segment into a standalone entity. The transaction is expected to close by the end of 2023.

Source: Investor Presentation

On April 25th, 2023, 3M reported announced earnings results for the 2023 first quarter. For the quarter, revenue of $7.7 billion beat analyst estimates by $190 million. Adjusted EPS of $1.97 also beat estimates by $0.37.

Click here to download our most recent Sure Analysis report on 3M (preview of page 1 of 3 shown below):

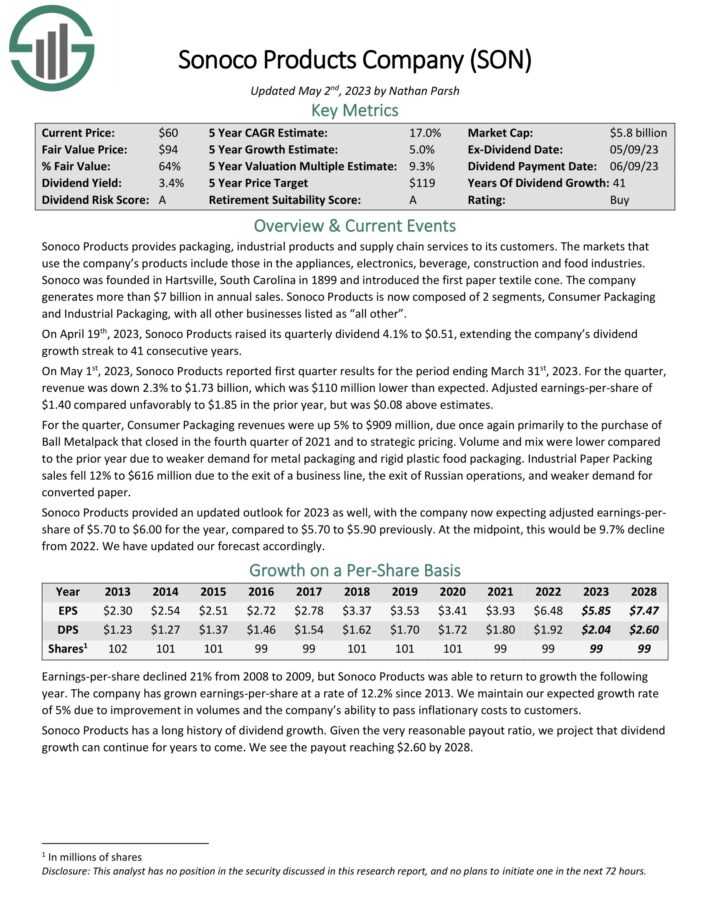

Dividend Growth Stock #7: Sonoco Products (SON)

5-year expected returns: 17.0%

Years Of Consecutive Dividend Increases: 41

Sonoco Products provides packaging, industrial products and supply chain services to its customers. The markets thatuse the company’s products include those in the appliances, electronics, beverage, construction and food industries. The company generates more than $7 billion in annual sales.

Source: Investor Presentation

On May 1st, 2023, Sonoco Products reported first quarter results for the period ending March 31st, 2023. For the quarter, revenue was down 2.3% to $1.73 billion, which was $110 million lower than expected. Adjusted earnings-per-share of $1.40 compared unfavorably to $1.85 in the prior year, but was $0.08 above estimates.

Click here to download our most recent Sure Analysis report on Sonoco (SON) (preview of page 1 of 3 shown below):

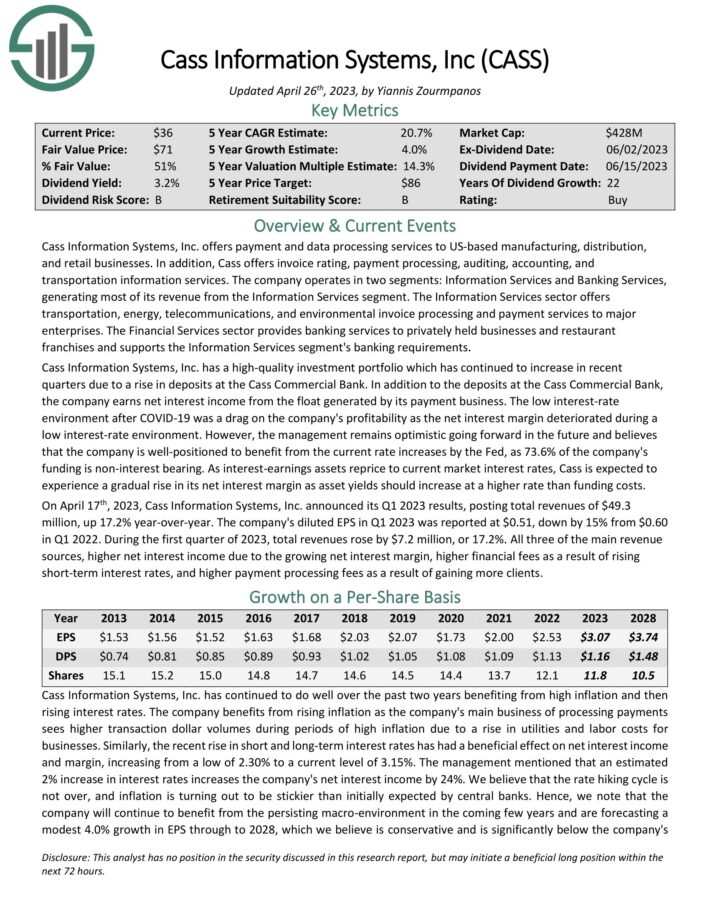

5-year expected returns: 18.7%

Years Of Consecutive Dividend Increases: 22

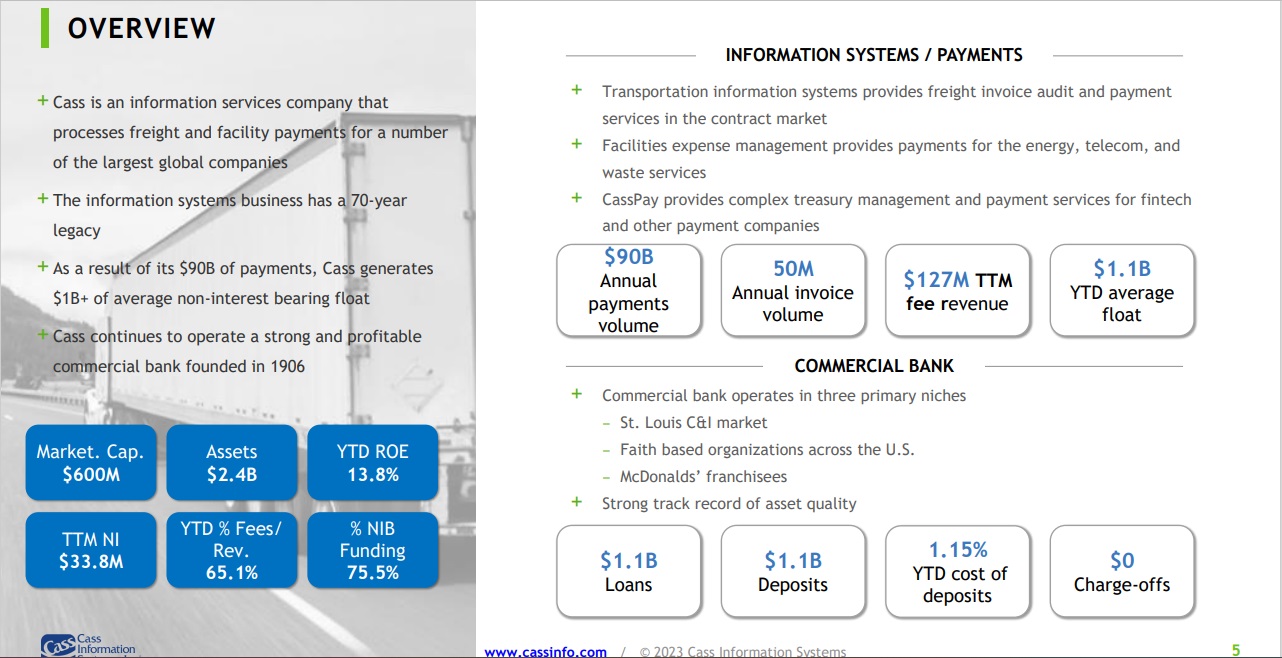

Cass Information Systems offers payment and data processing services to US-based manufacturing, distribution, and retail businesses. In addition, Cass offers invoice rating, payment processing, auditing, accounting, and transportation information services. The company operates in two segments: Information Services and Banking Services.

Source: Investor Presentation

On April 17th, 2023, Cass Information Systems, Inc. announced its Q1 2023 results, posting total revenues of $49.3 million, up 17.2% year-over-year. The company’s diluted EPS in Q1 2023 was reported at $0.51, down by 15% from $0.60 in Q1 2022. During the first quarter of 2023, total revenues rose by $7.2 million, or 17.2%.

Click here to download our most recent Sure Analysis report on Cass (CASS) (preview of page 1 of 3 shown below):

5-year expected returns: 18.9%

Years Of Consecutive Dividend Increases: 31

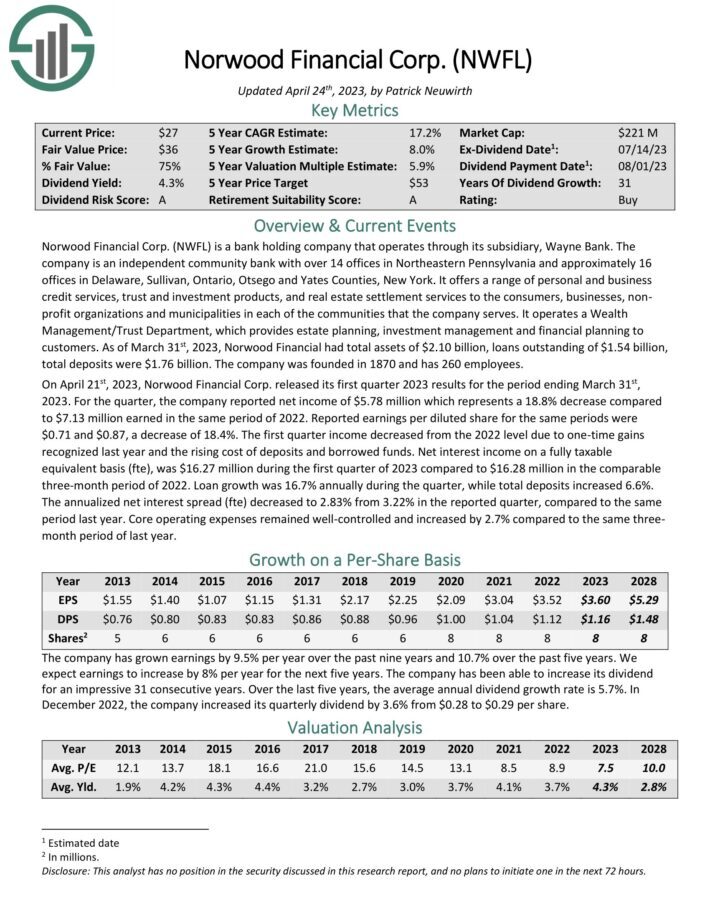

Norwood Financial is a bank holding company that operates through its subsidiary, Wayne Bank. The company is an independent community bank with over 14 offices in Northeastern Pennsylvania and approximately 16 offices in Delaware, Sullivan, Ontario, Otsego and Yates Counties, New York.

On April 21st, 2023, Norwood Financial Corp. released its first quarter 2023 results for the period ending March 31st, 2023. For the quarter, the company reported net income of $5.78 million which represents a 18.8% decrease compared to $7.13 million earned in the same period of 2022. Reported earnings per diluted share for the same periods were $0.71 and $0.87, a decrease of 18.4%.

Click here to download our most recent Sure Analysis report on NWFL (preview of page 1 of 3 shown below):

Dividend Growth Stock #4: Fulton Financial Corp. (FULT)

5-year expected returns: 20.2%

Years Of Consecutive Dividend Increases: 14

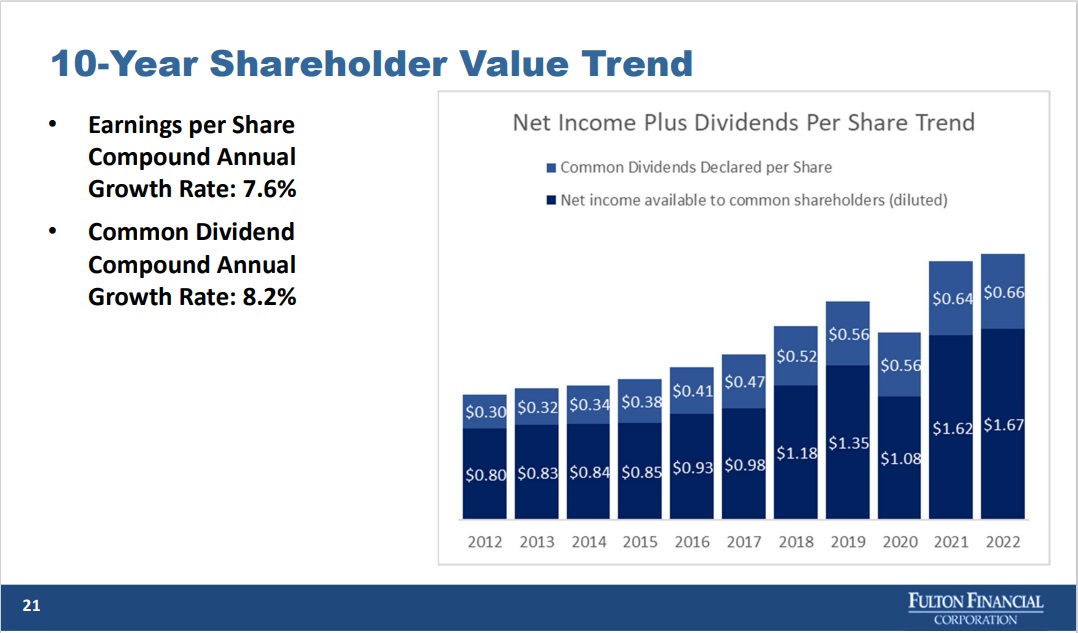

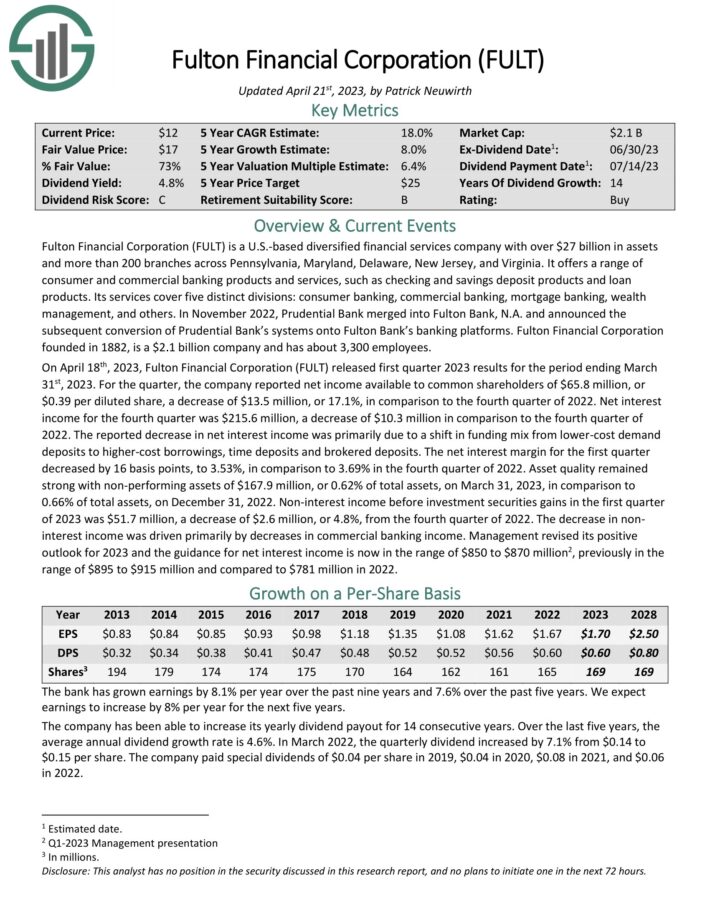

Fulton Financial Corporation is a U.S.-based diversified financial services company with over $27 billion in assets and more than 200 branches across Pennsylvania, Maryland, Delaware, New Jersey, and Virginia. It offers a range of consumer and commercial banking products and services, such as checking and savings deposit products and loan products.

The company has increased its dividend for 14 years.

Source: Investor Presentation

On April 18th, 2023, Fulton Financial Corporation released first quarter 2023 results for the period ending March 31st, 2023. For the quarter, the company reported net income available to common shareholders of $65.8 million, or $0.39 per diluted share, a decrease of $13.5 million, or 17.1%, in comparison to the fourth quarter of 2022.

Click here to download our most recent Sure Analysis report on FULT (preview of page 1 of 3 shown below):

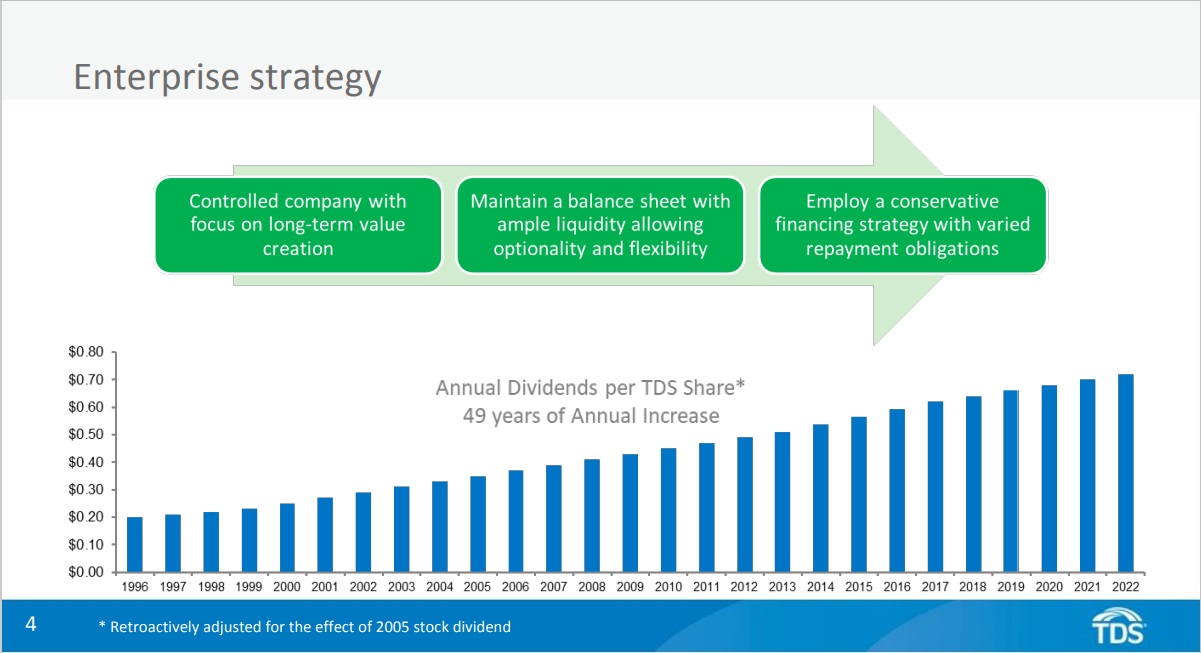

Dividend Growth Stock #3: Telephone & Data Systems (TDS)

5-year expected returns: 20.4%

Years Of Consecutive Dividend Increases: 49

Telephone & Data Systems is a telecommunications company that provides customers with cellular and landline services, wireless products, cable, broadband, and voice services across the U.S. The Cellular Division accounts for more than 75% of total operating revenue.

Telephone & Data Systems has an 82% stake in U.S. Cellular and essentially relies on this stake to achieve growth. The strong dependence of Telephone & Data Systems on U.S. Cellular results in an extremely volatile and unreliable performance.

Click here to download our most recent Sure Analysis report on Telephone & Data Systems (TDS) (preview of page 1 of 3 shown below):

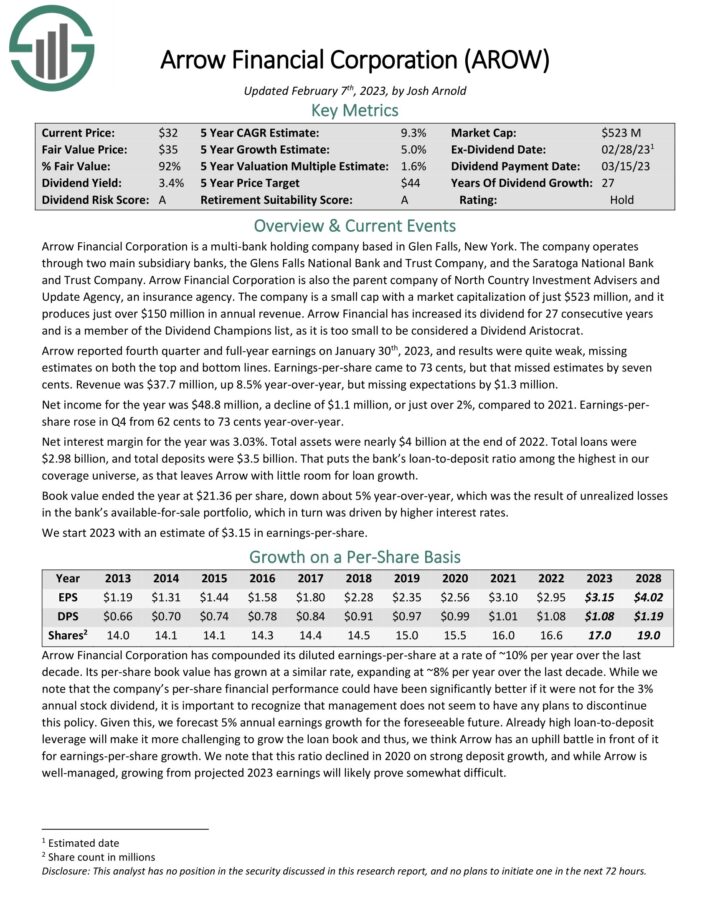

Dividend Growth Stock #2: Arrow Financial (AROW)

5-year expected returns: 20.4%

Years Of Consecutive Dividend Increases: 27

Arrow Financial Corporation is a multi-bank holding company. The company operates through two main subsidiary banks, the Glens Falls National Bank and Trust Company, and the Saratoga National Bank and Trust Company.

Arrow reported fourth quarter and full-year earnings on January 30th, 2023, and results were quite weak, missing estimates on both the top and bottom lines. Earnings-per-share came to 73 cents, but that missed estimates by seven cents. Revenue was $37.7 million, up 8.5% year-over-year, but missing expectations by $1.3 million.

Click here to download our most recent Sure Analysis report on AROW (preview of page 1 of 3 shown below):

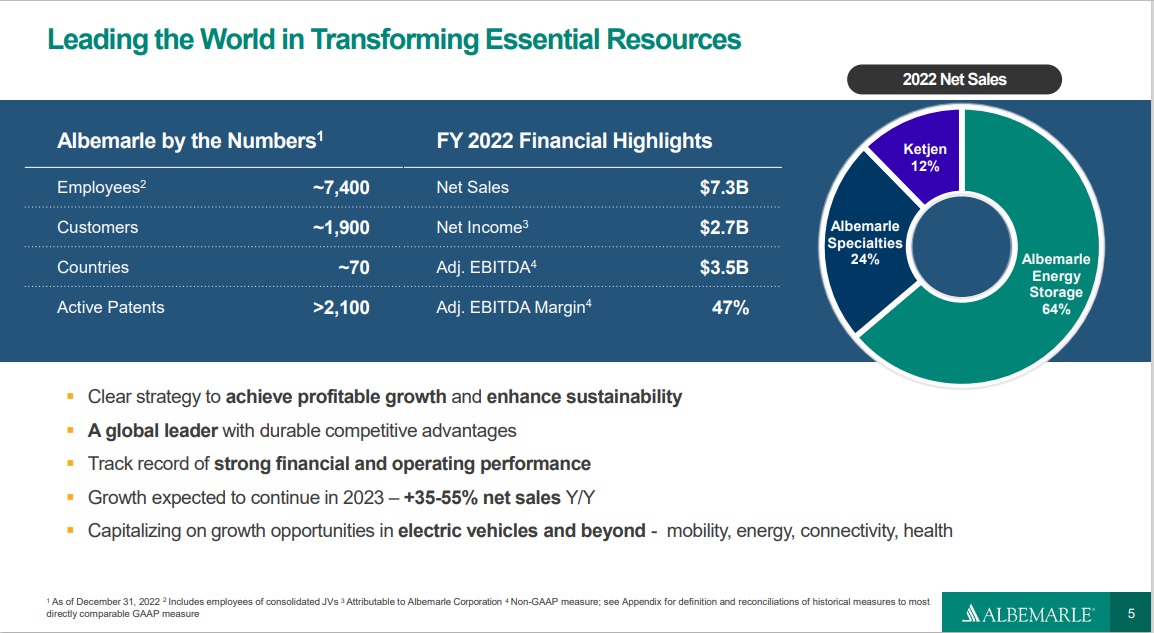

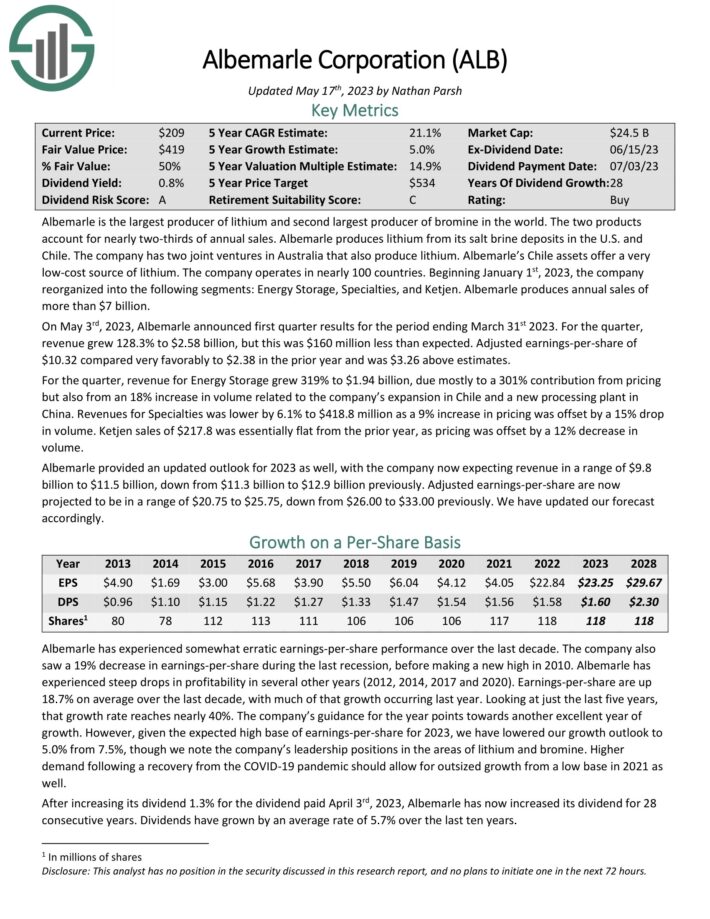

Dividend Growth Stock #1: Albemarle Corporation (ALB)

5-year expected returns: 21.4%

Years Of Consecutive Dividend Increases: 28

Albemarle is the largest producer of lithium and second largest producer of bromine in the world. The two products account for nearly two-thirds of annual sales. Albemarle produces lithium from its salt brine deposits in the U.S. and Chile.

The company has two joint ventures in Australia that also produce lithium. Albemarle’s Chile assets offer a very low-cost source of lithium.

Related: 2023 Lithium Stocks List

The company operates in nearly 100 countries and is composed of four segments: Lithium & Advanced Materials, Bromine Specialties, Catalysts and Other.

Source: Investor Presentation

On May 3rd, 2023, Albemarle announced first quarter results. For the quarter, revenue grew 128.3% to $2.58 billion, but this was $160 million less than expected. Adjusted earnings-per-share of $10.32 compared very favorably to $2.38 in the prior year and was $3.26 above estimates.

Click here to download our most recent Sure Analysis report on Albemarle (preview of page 1 of 3 shown below):

Final Thoughts

The various lists of stocks by length of dividend history are a good resource for investors who focus on high-quality dividend growth stocks.

In order for a company to raise its dividend for at least 14 years, it must have durable competitive advantages, highly profitable businesses, and leadership positions in their respective industries.

Dividend growth stocks also have long-term growth potential and the ability to navigate recessions while continuing to raise their dividends.

The top 10 Dividend Growth Stocks presented in this article have long histories of dividend growth, and the combination of high dividend yields, low valuations, and future earnings growth potential make them attractive buys right now.

The Dividend Growth Stocks list is not the only way to quickly screen for stocks that regularly pay rising dividends.

If you are interested in finding more dividend growth stocks, and other income investing opportunities, the following Sure Dividend resources will be of interest to you.

Blue Chip Stock Investing

Other Sure Dividend Resources

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.

[ad_2]