[ad_1]

Baris-Ozer

Gear up for the Fed Meeting (FOMC): Time for growth

Growth stocks are typically characterized by high revenue and earnings growth, high P/E ratios, no dividends, a future associated with innovation, and price momentum. The growth stocks that I am recommending are more well-rounded and rest collectively on the attributes of strong growth, excellent valuation frameworks, tremendous profitability, upward analysts’ earnings revisions, and superior long-term price momentum. One of the stocks even has a 5% dividend yield. On the back of a weak stock market in 2022, this may be an exceptional time to look at certain growth stocks.

With the Fed meeting slated to begin this week, the Asian markets experienced a plunge Monday. U.S. tech stocks like Microsoft (MSFT) and Intel (INTC) aren’t kicking off earnings season well either, as the markets continue to whipsaw in the new year. But as Warren Buffett emphasizes, “Be fearful when others are greedy and greedy when others are fearful.” One of my three Top Growth Stocks is a Chinese stock that experienced more than a 7% fall on Monday. However, according to Seeking Alpha’s quant ratings, each of my picks maintains a strong buy rating. Even with a fall in price, I don’t mind buying stocks while they are cheap, as long as they have strong fundamentals that draw on the best collective characteristics of valuation, growth, profitability, momentum, and EPS revisions.

Two of my picks are a testament to the powerful analytics of quant, maintaining them as top stocks. They were also included in my list of Top 10 Stocks for 2023.

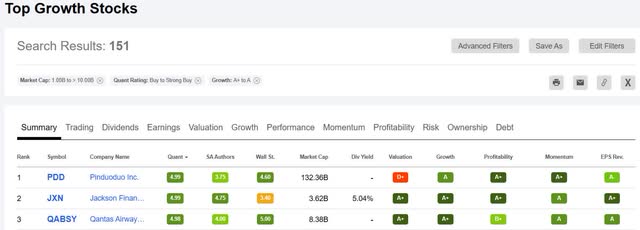

Top Growth Stocks (as of market close 1/30/23)

Top Growth Stocks (as of market close 1/30/23) (SA Premium)

Despite the volatile market swings of 2022 that resulted in brutal market selloffs for growth stocks, many investors have been looking for safe havens or opted to sit on cash, awaiting an optimal time to put their money to work. With the expectation that today’s Fed Meeting will result in continued tighter monetary policy, growth-oriented stocks could insulate from the high interest-rate environment. As such, I am highlighting three strong buy-rated stocks with solid fundamentals in varying sectors.

1. Qantas Airways (OTCPK:QABSY)

Market Capitalization: $8.38B

Quant Rating: Strong Buy

Quant Sector Ranking (as of 1/30): 2 out of 632

Quant Industry Ranking (as of 1/30): 1 out of 29

Australian airlines Qantas Airways operates domestic and international passenger and air cargo flights. As travel demand has increased post-pandemic, the company has started nonstop flights between Australia and the U.S. and U.K. Qantas is focused on driving profit and increased its profit expectations for the first half of FY2023. With more than one million domestic flights released by Qantas and Jetstar Airways, a Qantas subsidiary, Qantas’ fleet of 322 aircraft is flying high as its recovery from the COVID crisis continues to strengthen its balance sheet, priming it for solid growth and profitability.

Qantas Growth & Profitability

Strategic measures and increases in revenue inflows, plus a deferral of ~$200M in CapEX to the second half of 2023, Qantas anticipates an increase of $150M in profits before taxes. This ranges from $1.35B to $1.45B for the first half of 2023. Additionally, its net debt is expected to fall to $2.3B and $2.5B as of year-end. With more than 60% of customers’ COVID-related travel credits redeemed, Qantas is gearing up for standard operations, adding capacity and business as usual.

“Since August, we’ve seen a big improvement in our operational performance and an acceleration in our financial performance…Qantas’ operations are largely back to the standards people expect, and Jetstar’s performance has improved significantly in the past few weeks and will keep getting better with the extra investments we’re making. The fact our financial recovery has accelerated means we can invest more in rewarding our employees,” said Qantas Group CEO Alan Joyce.

Despite supply chain challenges involving airplane replacement parts and elevated fuel prices, Qantas has invested in critical areas to try and curb such issues through FY2023. In addition, for plans to invest $200M for staff in avoiding flight and supply chain delays and operational resilience against its sick leave policy, Qantas hopes to beat earnings estimates. Offering excellent factor grades on all metrics as highlighted below and higher yields to help offset macro headwinds, Qantas remains on an uptrend.

QANTAS Factor Grades

QANTAS Factor Grades (SA Premium)

On track for record earnings and to reach its FY23 EBIT target between $425M to $450M for 1H FY23, Qantas is focused on offering shareholder value once more by completing an on-market share buyback of up to $400M. With bullish momentum and a discounted valuation, the added perk of a company buyback to increase value makes this stock an attractive consideration.

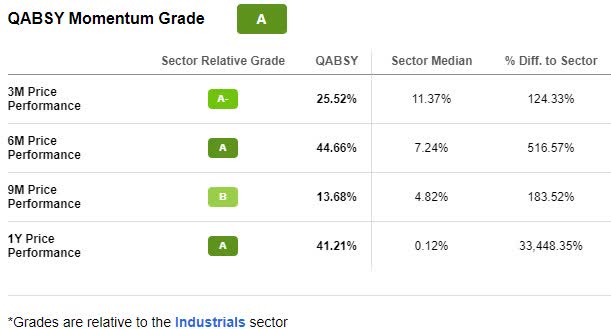

Qantas Stock Valuation & Momentum

In addition to Qantas flights rebounding to pre-covid levels, its stock has trended higher. With a one-year price performance of +33% and +12.55% YTD, QABSY is trading above the 200-day moving average. Showcasing excellent quarterly price performance compared to sector median peers, as exhibited by the momentum grades and percentage difference to the sector for six months and the whopping 33,448.35% one-year difference, Qantas outperforms.

Qantas Stock Momentum Grade (SA Premium)

In addition to bullish momentum, Qantas’ A+ valuation grade indicates the stock is trading at a discount. A forward P/E ratio of 6.82x versus the sector 19.12x; an A+ forward PEG of 0.12x, which is a -92.58% difference to the sector; QABSY is undervalued. As airline carriers steadily increase capacity, inflation cools, and costs begin to come down, Qantas could offer tremendous upside. Consider this strong buy stock for a portfolio, along with my next pick, a U.S.-based financial.

2. Jackson Financial (NYSE:JXN)

Market Capitalization: $3.62B

Quant Rating: Strong Buy

Quant Sector Ranking (as of 1/30): 1 out of 665

Quant Industry Ranking (as of 1/30): 1 out of 6

Jackson Financial is an industry-leading diversified financial services company headquartered in Michigan. Jackson offers investment management services, retirement income, and savings products through its subsidiaries. With a deeply low valuation and bullish momentum, the current environment provides the potential to take advantage of JXN’s top-and-bottom-line performance that has consecutively improved over the last several quarters.

Jackson Financial Stock Valuation & Momentum

With ‘A’ across all factor grades, this stock’s fundamentals look almost too good to be true. Boasting an experienced management team that prides itself on proven risk management, efficient and scalable operations, and industry-leading sales, it would be hard not to consider this strong buy-rated stock.

JXN Factor Grades

JXN Factor Grades (SA Premium)

Jackson Financial comes at an extreme discount. Showcasing an A+ valuation grade and underlying A+’s abounding, JXN’s P/E ratios and PEG are more than a -90% difference to the sector. To ring in the new year, Jackson Financial is +24% YTD and, over the last year, rallied +12% despite the market volatility.

JXN Stock Momentum Grade (SA Premium)

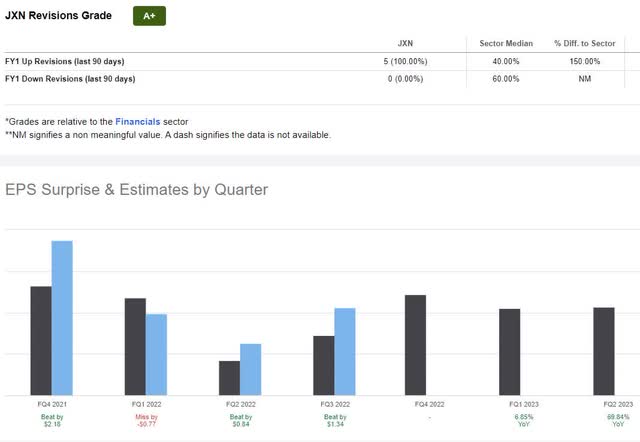

In addition to its low valuation, Jackson offers some downside protection as a Top Financial Stock compared to other stocks with significantly higher valuations. Its bullish momentum illustrated above highlights its quarterly price performance compared to its sector median peers. Boasting a 2,466% six-month difference, it’s no wonder that JXN is on a strong bullish trend, whose 200-day moving average is upward-sloping. Many analysts call the stock overbought as investors actively purchase shares, which drives its stock price higher. With consecutive earnings beats for the last two quarters, consider this stock before paying a premium.

JXN Stock Growth & Profitability

Boasting A+ growth, profitability, and revisions grades, not only do the quant ratings indicate this stock is a strong buy, five analysts have revised FY1 revisions up over the last 90 days, with zero downward revisions.

JXN Stock EPS & Revisions (SA Premium)

Q3 Non-GAAP EPS of $4.24 beat by $1.34, and revenue of $4.02B beat by $2.59B, a +156% year-over-year increase, with strong registered index-linked annuity (RILA) sales, up $72 million (Q2 2021 to Q2 2022) and anticipated demand increases on the heels of recession uncertainty. Where rising interest rates can negatively impact GAAP earnings yet lead to greater potential profitability in the long run, SA Contributor Bashar Issa writes,

“Our buy recommendation reflects JXN’s leading position in the fixed annuities market and its sizeable share in the market for variable annuities, powered by its robust distribution and market channels underpinned by a solid back office infrastructure. Jackson Financial: Undervalued And Underfollowed Market Leader.”

With expected double-digit growth in 2023 and a 5.04% forward dividend yield, consider Jackson Financial, a growth stock poised for potential upside in the new year.

3. Pinduoduo Inc. (NASDAQ:PDD)

Market Capitalization: $132.36B

Quant Rating: Strong Buy

Quant Sector Ranking (as of 1/30): 1 out of 550

Quant Industry Ranking (as of 1/30): 1 out of 63

Ranked #1 in its sector and industry as of 1/30/23, Pinduoduo Inc., a Chinese stock and e-commerce giant, Pinduoduo, operates a next-level platform. Although this week has prompted its fall in the share price of more than 7% amid concerns of another hawkish Fed before the FOMC meeting, PDD may be the sleeper stock you didn’t know you may have needed for your portfolio.

Boasting more active users than Alibaba (BABA), PDD is held by 103 ETFs. Offering a range of products that include cosmetics, apparel and shoes, bags, and personal care items, the popular “search-based” company is giving behemoths like JD.com (JD) and Amazon (AMZN) a run for their money. On the first trading day of the new year, PDD traded up 3.7% following news that foreign minister Qin Gang wants to establish better ties with the U.S. Despite the geopolitical headwinds that Chinese stocks have faced amid and post-pandemic, as Greenwood Investments writes in his article titled Stocks Are Stealthily Breaking Out In China, “Pinduoduo Inc. is potentially another big leader. Similar to TME, the stock has broken forcefully out of a big multi-month base.”

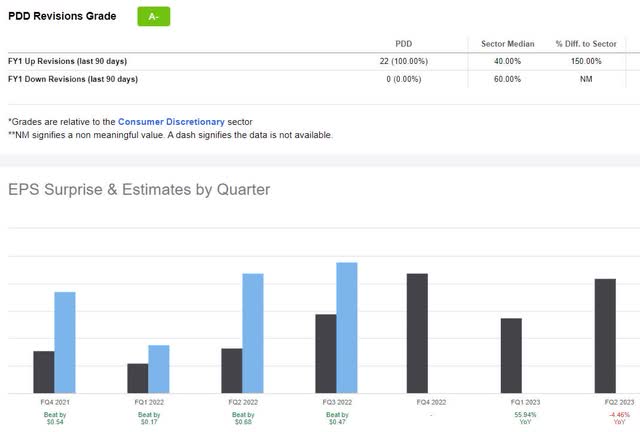

PDD Stock Growth & Profitability

With more than $5.39B cash from operations and 16% higher-than-consensus revenues (according to FactSet/PitchBook as of November 28th, 2022), PDD posted Q3 earnings that resulted in a year-over-year operating profit surge of 350%. Q3 EPS of $1.20 beat by $0.47, and revenue of $4.93B beat by more than 46% year-over-year, resulting in 22 FY1 Up revisions over the last 90 days.

PDD Stock EPS & Revisions (SA Premium)

What’s unique about PDD’s business strategy, which I highlighted in a previous article, is that PDD focuses on user experiences, social media, games, and Ai-driven algorithms for product recommendations and services. Its English-translated YouTube video asks:

“Shopping in real life is interactive because whether you’re grabbing the essentials or perusing the latest trends, you’re bound to interact with others, discover surprises, and maybe even enjoy some entertainment. So why can’t shopping online be just as fun and interactive?”

PDD’s unique business model and 259 million daily active users offer a narrow moat for the company. As it expands globally and lockdowns loosen, its focus on increasing agricultural sales and products and the consumer-to-manufacturing (C2M) business model may prove lucrative. With already strong consecutive quarterly results, an enhanced customer experience and improved production can aid PDD’s manufacturing by generating direct feedback for current and future products. Although the company has a strong portfolio of fundamentals, its stock price is a premium.

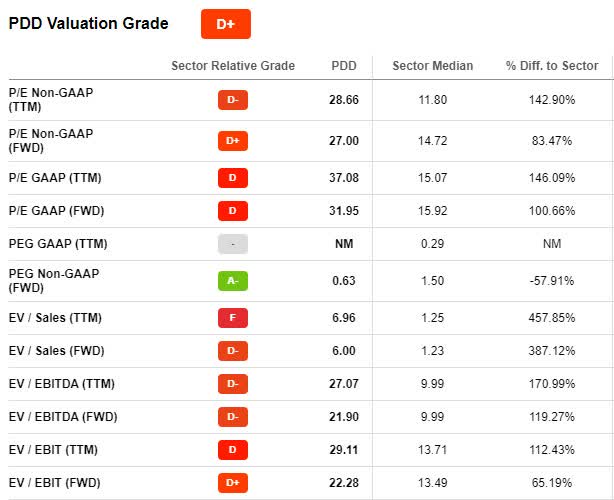

PDD Stock Valuation

Pinduoduo’s share price currently reflects a premium to the sector median. With an overall D valuation grade, PDD stock is currently priced with a forward P/E ratio of 31.95x and a forward EV/EBIT of 22.28x, reflecting a median industry valuation of 100.66% and 65.19%, respectively.

PDD Valuation Grade (SA Premium)

Despite these lackluster value grades, PDD has a highly attractive A- forward PEG of 0.63x that showcases a -57.91% discount to the sector. Up 61.85% over the last year, +15% YTD, and tremendous growth and profitability, although PDD may be overvalued, its other fundamentals indicate opportunistic room for upside and bullish momentum, making it a great consideration for portfolios, along with our previous two picks.

Conclusion

Ahead of this week’s FOMC meeting and following the start of some lackluster tech earnings results, growth stocks rated Strong Buys can be a great way to capture upside in an uncertain market environment, especially from stocks that may have fallen. Where many growth stocks continue declining, QABSY, JXN, and PDD are great considerations for long-term investors. While they may experience some volatility in the short term, each offers excellent fundamentals and strong momentum in diversified industries.

Consider my three growth stocks with strong analyst upward revisions. The professional analysts covering these stocks indicate that results will be better than expected, and each stock has robust fundamentals. In addition to the three picks, we have dozens more Top Growth Stocks to choose from to ensure you’re furnished with the best resources and options to make informed investment decisions.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]