[ad_1]

aydinmutlu

Investment Thesis

Olympic Steel (NASDAQ:ZEUS) is one of the leading US metals service centers focused on the processing of processed carbon steel, coated, aluminum, and plate steel products.

While I don’t believe Olympic Steel’s Q1 2023 results next week will leave much room to dazzle investors, given how much Olympic Steel has already rallied in the past several months, I am nonetheless impressed with Olympic Steel’s prospects.

Furthermore, given that the stock is evidently far from being expensive at approximately 5x EBITDA, I urge readers to see the big picture and stick with this name.

Why Olympic Steel?

In recent years, Olympic Steel has grown its value-added processing products to include carbon flat products, particularly through its acquisition of Metal-Fab. In fact, the Metal-Fab acquisition was a significant move, back in January of this year, costing approximately 30% of Olympic Steel’s market cap.

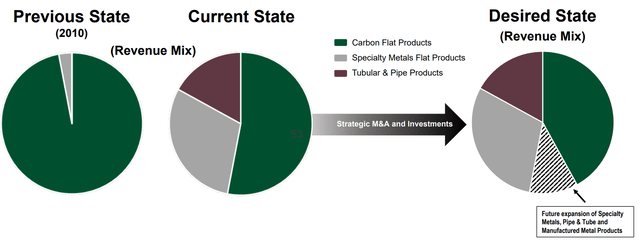

Further, I believe that one distinguishing feature of Olympic Steel is that they do not appear to embrace acquisitions for the sake of acquisitions, but instead, describe their specific operating objectives to include managing inventory turnover and cash turnover rates and end-market diversification, see below.

ZEUS presentation

That being said, if I were to highlight one negative consideration towards this investment thesis, it would be that despite working hard to free up its working capital in 2022 and be highly free cash flow generative and all the while paying down nearly 50% of its debt in 2022, Olympic Steel still carries a fair amount of debt on its balance sheet.

Moreover, while I don’t have the latest figures for Q1 2023, I believe that on the back of its Metal-Fab acquisition subsequent to Q4 2022, Olympic Steel’s net debt profile will probably be higher than $200 million or about a third of its market cap.

Q1 2023 Preview

Olympic Steel is a steel processing company focused on the value-added processing of steel. This means that when steel prices go higher, its working capital requirements go up and its free cash flow goes down.

And when steel prices trend lower, this alleviates its tied-up working capital, which delivers strong free cash flows.

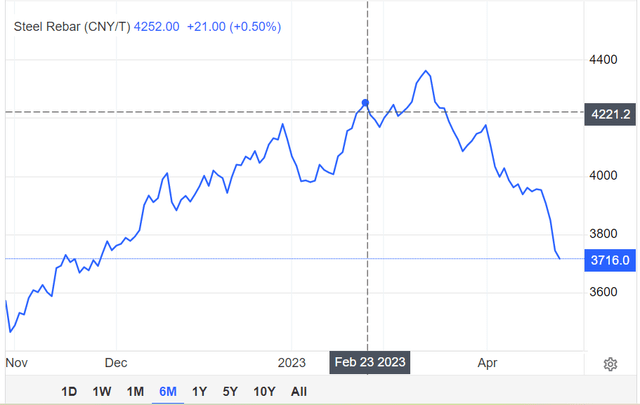

Moving on, at the time of the earnings call, back in February, steel prices were trending higher.

Trading Economics

However, in recent weeks, steel prices have noticeably tumbled. This will mean that Q1 2023 earnings and probably Q2 2023 too, will not be very strong, but Olympic Steel’s free cash flows will optically look impressive.

The Medium-Term Prospects for Steel

The infrastructure of today is constructed with steel. Without steel, it is impossible to produce electric vehicles, bridges, modern homes, and the semiconductor industry.

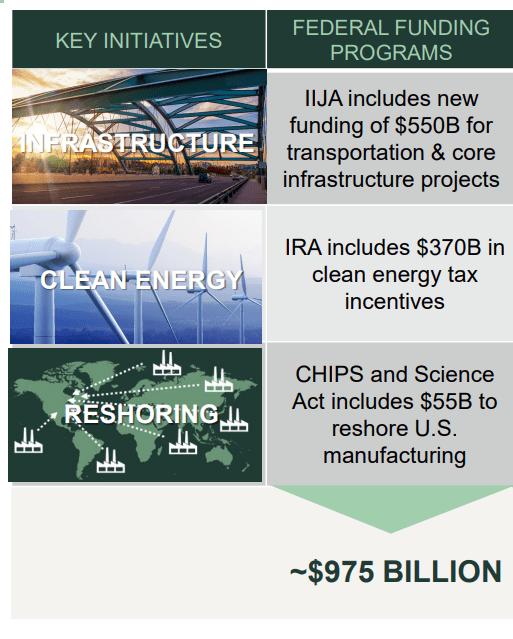

The way to best understand the importance of steel to rebuilding the US is to consider that the Biden administration has no less than 3 different federal funding programs to incentivize the use of steel.

Nucor Presentation 2023

This is my key contention, the world can’t embrace Future Energy without steel. Every aspect of Future Energy has steel at its core, from wind turbines to solar panels to EVs to the reshoring of semiconductor fabs plants.

Altogether with ZEUS priced at very approximately 5x EBITDA, a multiple that I don’t believe is expensive for what’s on offer.

Particularly given that Olympic Steel has demonstrated a tendency to astutely deploy capital towards both capital returns, by increasing its dividend payout by 39% y/y as of Q1 2023, as well as being savvy business acquirers.

What’s more, unlike other steel manufacturers, Olympic Steel is a processor and distributor, which means its capex requirements are only about 10% to 12% of its EBITDA, which means this business oozes free cash flows.

The Bottom Line

Olympic Steel is a cheaply valued steel stock with solid medium-term prospects, even if the very near term may be bumpy.

The more nuanced summary remarks how given that Olympic Steel’s growth has been so reliant on acquisitions to continue diversifying and growing its operations, with its balance sheet carrying a fair amount of debt, it will take some time before Olympic Steel will be able to make further needle-moving acquisitions. Tune back in for its Q1 results next week.

[ad_2]