[ad_1]

Updated on May 19th, 2023 by Bob Ciura

Investors are likely familiar with the standard real estate investment trusts, or REITs. Most REITs own physical real estate, lease the properties to tenants, and derive rental income which is used to pay dividends.

But there is a different set of REITs that investors may not be as familiar with: mortgage REITs. These REITs do not own physical properties, but rather buy mortgage securities.

Mortgage REITs typically have much higher dividend yields than standard REITs, but this does not necessarily make them better investments.

For example, Orchid Island Capital (ORC) is a mortgage REIT, with an extremely high dividend yield of 19%. Orchid Island pays dividends each month, which gives it the compelling combination of a high yield with monthly dividend payments.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

Orchid Island has an exceptionally high dividend yield and is one of the highest-yielding stocks that we cover.

However, the outlook for mortgage REITs is challenged, and Orchid Island’s dividend yield may still not be sustainable even after multiple dividend cuts in the past several years.

This article will discuss why income investors should not be lured by Orchid Island’s extremely high dividend yield.

Business Overview

Whereas traditional REITs own a portfolio of properties, mortgage REITs are purely financial entities. Orchid Island is an externally managed, specialty finance REIT. Orchid Island invests in residential mortgage-backed securities, either pass-through or structured agency RMBSs.

An RMBS is a debt instrument that collects cash flows, based on residential loans such as mortgages, home-equity loans, and subprime mortgages. Mortgage-backed securities are an investment product representing a basket of pooled loans.

As investors saw first-hand during the 2008 financial crisis, mortgage-backed securities can be highly volatile and risky. That said, mortgage REITs were among the biggest winners as interest rates fell during the Great Recession’s aftermath.

Growth Prospects

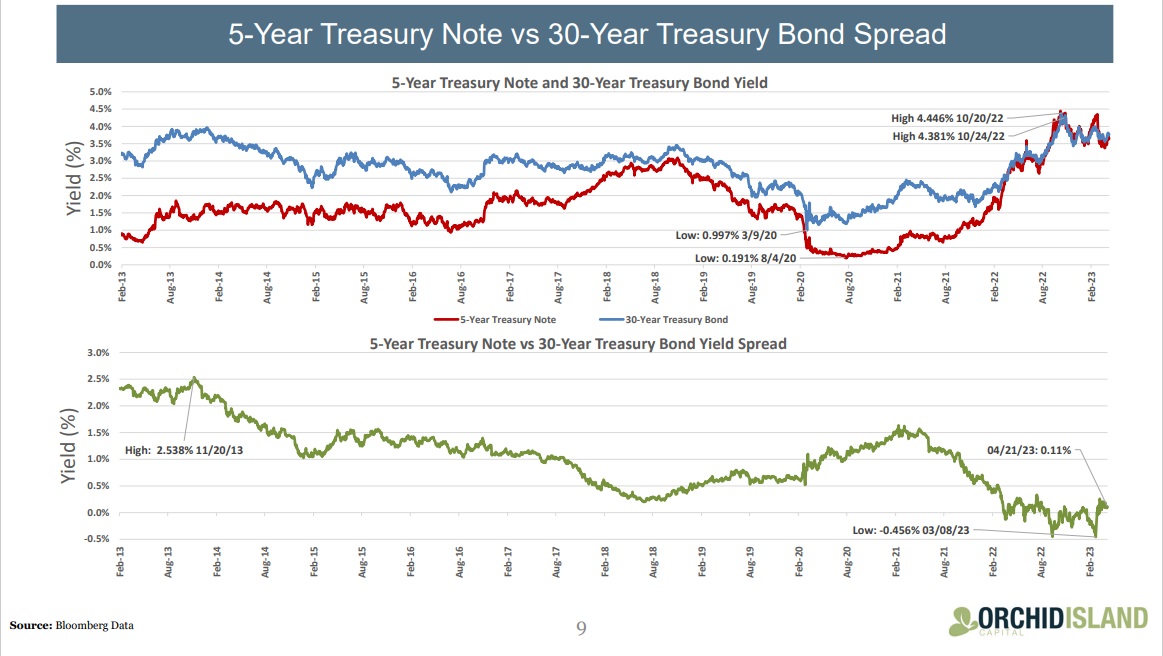

Mortgage REITs make money by borrowing at short-term rates, lending at long-term rates, and pocketing the difference, or the spread between the two.

When the spread between short-term rates and long-term rates compresses, profitability erodes. This is why mortgage REITs can be dangerous if short-term interest rates are about to increase.

Source: Investor Presentation

Interest rates are increasing and likely will continue to rise in the coming year. Short-term bond yields have risen, sometimes offering a higher yield then longer-term bonds. This is known as an inverted yield curve, which can be a precursor to a recession. Because of this, the stock price for ORC has fallen 32% over the past 12 months.

Shares had fallen so much that the trust executed a 1-for-5 reverse stock split on August 30th, 2022.

Orchid Island has not been able to produce meaningful growth in the past several years. The trust has experienced extreme earnings volatility over the past several years, with a net loss in 2013 and 2018 and multiple years in which the trust barely generated a profit.

Orchid Island’s inability to perform well with interest rates at zero makes it unlikely that the trust can regain its footing as interest rates continue to rise.

That said, the company’s most recent quarter showed some signs of strength.

On April 27rd, 2023, Orchid Island Capital reported Q1 results. Orchid reported a net income of $3.5 million, or $0.09 per common share, in the first quarter. This included net interest expense of $4.2 million and total expenses of $5.0 million. However, the company also recorded net realized and unrealized gains of $12.7 million on RMBS and derivative instruments, contributing to earnings.

The first quarter dividends declared and paid amounted to $0.48 per common share. The book value per common share stood at $11.55 as of March 31, 2023. The total return for the quarter was 0.84%, calculated by dividing the dividends per common share and the decrease in book value per common share by the beginning book value per common share.

Orchid maintained a strong liquidity position, with $197.0 million in cash, cash equivalents, and unpledged RMBS, which represented 44% of stockholders’ equity as of March 31, 2023.

The company also had borrowing capacity exceeding its outstanding repurchase agreement balances of $3,769.4 million, spread across 20 active lenders.

Dividend Analysis

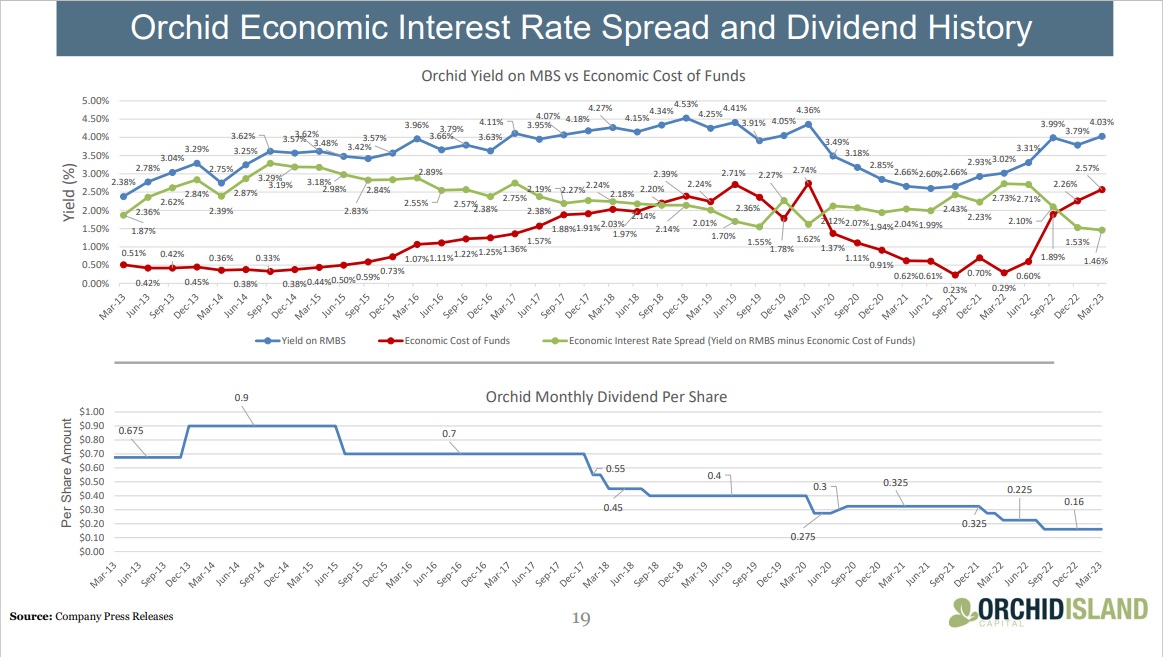

Orchid Island’s eroding fundamentals have caused a significant drop in its dividend payments to shareholders in the past several years.

Orchid Island currently pays a monthly dividend of $0.16 per share. But Orchid Island’s dividend payout still remains below the split-adjusted monthly dividend it was paying before 2021.

Source: Investor Presentation

Looking back further, Orchid Island’s monthly dividend payout has been reduced multiple times since then.

On an annualized basis, the trust has a current dividend payout of $1.92 per share. Based on its recent closing price, the stock offers a 19% dividend yield. This is a huge dividend yield, considering the average dividend yield of the S&P 500 Index is currently 1.6%.

However, there are too many red flags for Orchid Island to be considered an attractive investment, including the trust’s multiple dividend cuts over the past few years and inconsistent profitability in that time.

In addition, Orchid Island has issued shares at a high pace in recent years. Its share count has skyrocketed since 2013. This comes at a steep cost to shareholders in the form of heavy dilution.

With a volatile dividend history, Orchid Island is not an appealing choice for investors looking for steady dividend payouts from year to year.

Orchid Island stock appears to be the definition of a yield trap. The stock has badly lagged behind the S&P 500 Index, and we believe this under-performance is likely to continue.

Final Thoughts

Sky-high dividend yields can be deceiving. Orchid Island’s 19% dividend yield is enticing, but this stock has all the makings of a yield trap.

The trust has a sizable amount of debt on the balance sheet, and is issuing shares at an alarming pace. The outlook for mortgage REITs has deteriorated as the Federal Reserve continues to raise interest rates. The trust’s most recent results for Q4 show a significant decline in net interest income and per-share book value.

Orchid Island cut its dividend several times in the past few years due to poor fundamental performance. Investors should tread very carefully with mortgage REITs like Orchid Island. As a result, income investors would be better served buying higher-quality dividend stocks, with more sustainable payouts.

Don’t miss the resources below for more monthly dividend stock investing research.

And see the resources below for more compelling investment ideas for dividend growth stocks and/or high-yield investment securities.

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.

[ad_2]