[ad_1]

ipopba

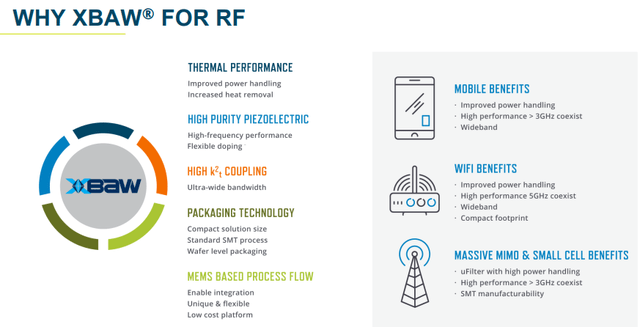

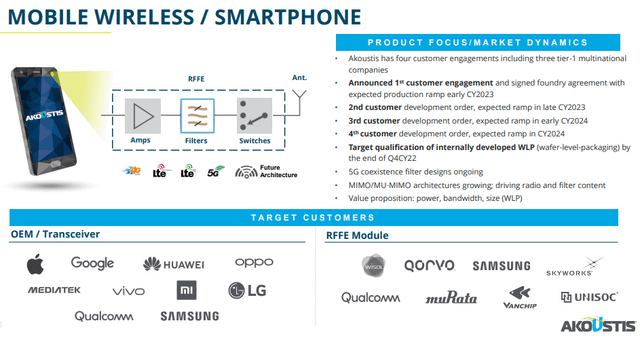

Akoustis Applied sciences (NASDAQ:AKTS) is a designer and producer of cutting-edge RF filters based mostly on its proprietary XBAW expertise (which we described in better element right here and right here), however is summarized in a slide from their December 2022 IR Presentation:

AKTS IR presentation

These filters go into a bunch of units like cellphones, WiFi hotspots, telecom infrastructure, and protection purposes. Just lately two new markets have opened up for the corporate, gaming and the timing and frequency market (the place we have now one other inventory, SiTime (SITM)).

The corporate is beginning to acquire important traction with quite a few design wins and an rising variety of prospects already within the manufacturing part. Two new prospects entered into manufacturing in Q1/23 (the September quarter) for a complete of 15 and one other 4 are anticipated so as to add to this in Q2/23.

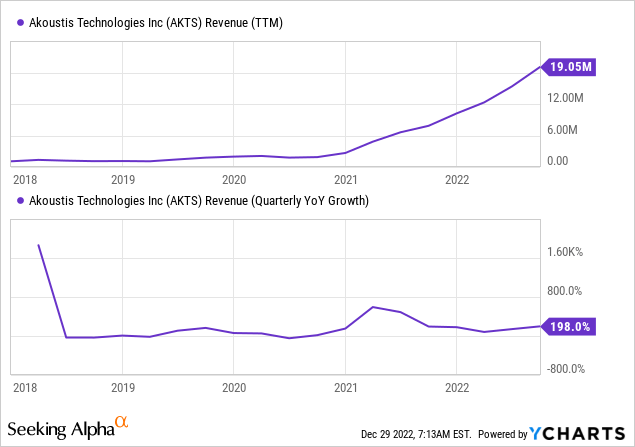

Income progress is effectively in triple-digit territory, though from a small base:

The corporate’s revenues may have grown even sooner if not for some appreciable macro headwinds, largely confined to their WiFi phase the place provide chain issues hold some prospects from totally ramping up manufacturing.

Development

Crucial progress drivers are:

Design wins Repeat prospects Cell Growing content material Personal manufacturing of WLP New markets CHIPS Act

The corporate provides to a lot of completely different segments:

WiFi 5G Cell Community Infrastructure Different

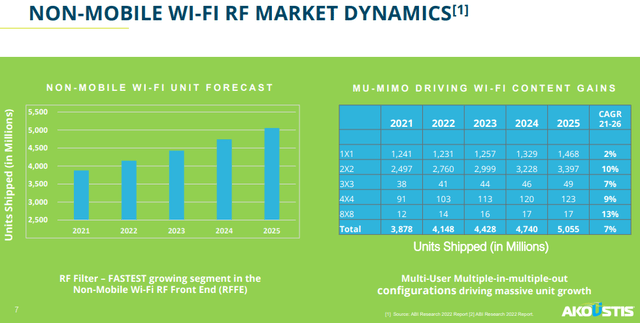

WiFi

AKTS IR presentation

The availability chain issues are concentrated of their largest market, which is unlucky as many of the prospects which can be already in manufacturing come from this phase (10 out of a complete of 15).

The corporate now has 20 design wins right here with three new wins in Q1/23. They had been early entrants in WiFi 6/6E/7, which explains these design wins, aside from the superior XBAW expertise.

Nonetheless, administration argues there are indicators that these provide bottlenecks are beginning to ease and administration expects an accelerated ramp from prospects subsequent 12 months.

The corporate produced 4 new filters, two of which with a considerably decreased type issue (the 5.6 and 6.6 GHz coexistence filters), and now has 16 XBAW Wi-Fi filters, 12 for Wi-Fi 6E and Wi-Fi 7 and 4 for Wi-Fi 6.

The corporate gained three new design wins in Q1/23 (the September quarter) and expects new design wins for the 4 new filters and manufacturing by the June/23 quarter.

There was additionally a improvement order from a Fortune 100 firm for his or her new diplexer merchandise for WiFi 7 purposes which they’re already growing for one of many largest PC chipset makers. Different OEMs additionally expressed an curiosity.

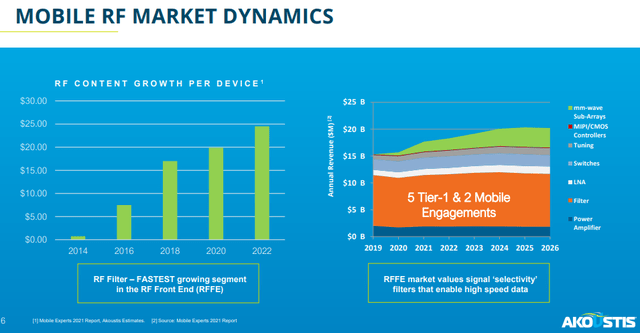

5G Cell

AKTS IR presentation

Whereas WiFi might be their largest phase proper now (there isn’t any income cut up out), the potential for the 5G cell market dwarfs WiFi (given the variety of cellphones).

Aside from making inroads, there’s additionally a sustained enhance in content material per machine (see graph above) as a result of rising complexity of filters and the rise within the variety of filters per machine.

The corporate has a number of customer-funded XBAW filters in design with 4 buyer engagements, together with three Tier 1 prospects. Right here is how they summarized developments within the quarter (Q1CC):

We acquired our first buy order from a Tier 1 RF module maker buyer that we engaged with final December.

We iterated our first RF filter design for a Tier 2 foundry buyer and acquired a purchase order order for 2 further filters.

We acquired a quantity order from a Tier 1 RF part firm for an anticipated manufacturing ramp within the first half of calendar 2023.

And eventually, we have now accomplished the method circulate for our new WLP and chip scale bundle merchandise and have design locked the primary WLP for our Tier 1 RF part firm buyer.

The orders are comparable in dimension to what’s taking place of their WiFi phase, however they’re more likely to enhance an order of magnitude

AKTS IR presentation

And simply as we’re about to publish this text they really transformed a giant deal within the 5G cell house. This is superb information, for the next causes (firm PR):

That is our first design win for the 5G cell market that’s deliberate to ramp manufacturing within the first half of CY2023, supporting selectivity calls for within the 3 to 7GHz 5G/WiFi spectrum. Additional, it’s our first product that leverages our new proprietary wafer-level-package expertise, which is considerably smaller than our present packages and superior in back-end manufacturing price.

The Tier 1 shopper can be contemplating further purposes:

The client is contemplating further purposes for XBAW® in future modules for 5G smartphones, tablets, wearables, and different cell units after the profitable completion of this primary answer.

The corporate is getting into the large league with this.

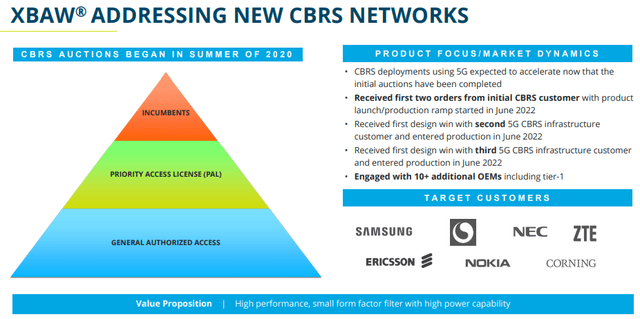

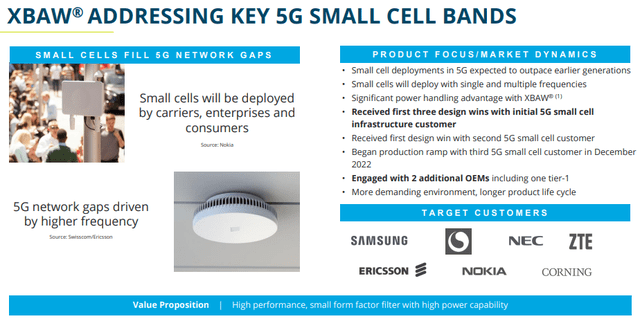

Community Infrastructure

AKTS IR presentation

The corporate has 4 design wins for CBRS (unlicensed Residents Broadband Radio Service) community prospects and 5 design wins in 5G small cell, one among these this quarter which is anticipated to ramp on the finish of this 12 months.

Three CBRS prospects are ramping manufacturing, one on excessive quantity, and the 2 others on low to mid-volume with a number of filters per machine.

AKTS IR presentation

Different enterprise

The corporate has two R&D contracts with DARPA, one among these new this 12 months. The completion of the acquisition of RFMi in July/22 can be producing outcomes with a big design win from a number one IC provider.

New segments

The corporate has entered two new segments:

Within the gaming they received two design wins in Q1, each of which can go into manufacturing mid-next 12 months. The corporate additionally entered the timing and frequency market with their XBAW resonators, working with the producer of timing RF elements and beginning the qualification for his or her first two timing management merchandise with their first buyer, who is anticipated to begin manufacturing in H1/23 and there’s already a improvement order from a second buyer.

Wafer Degree Packaging

The corporate has developed its proprietary WLP answer in its NY fab facility and has accomplished qualification for the 5G cell, Wi-Fi, timing management, and different markets. From the December 21 PR:

The qualification of this new, superior WLP course of and packages allows smaller type elements, decrease price and can open important high-volume markets to Akoustis together with 5G smartphones, tablets and computing, representing the most important income alternatives for our XBAW® expertise.”

The corporate already has a design win for a Tier 1 RF part firm. Some great benefits of taking the manufacturing in-house are (Q1CC):

We consider bringing the WLP course of in-house enhances considerably our means to regulate the standard, price and customization of our superior packages.

CHIPS Act

The corporate will apply early subsequent 12 months for funds from the CHIPS Act for 2 initiatives:

A number of new 8-inch silicon wafer manufacturing traces of their NY web site Construct a complicated packaging heart (restoring).

Funding, which may arrive by mid-2023, would place Akoustis to make a leap in manufacturing capability and manufacture and ship billions of XBAW filter chips yearly.

This could propel them make the leap servicing Tier 1 and Tier 2 cell corporations for 5G smartphones and different multibillion-dollar finish markets, together with 5G networks, high-frequency Wi-Fi units and different wi-fi markets.

Senator Schumer has already visited their NY facility twice just lately and has a blueprint to make NY a worldwide innovation and semiconductor hub. The corporate suits very properly in these plans.

Funds

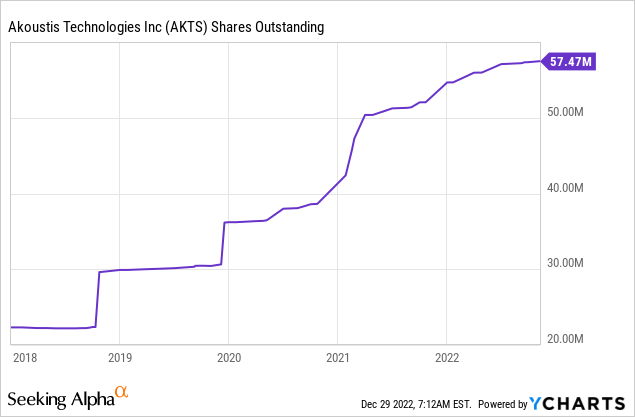

That is the half the place the issues lie. Whereas the corporate is scaling up manufacturing very quick (which depends upon prospects scaling up their manufacturing), the dimensions continues to be not close to sufficient for the corporate to cease the money bleed. Some information:

Revenues +6% q/q and +195% y/y to $5.6M GAAP OpEx loss $18M, non-GAAP $15.6M CapEx $4.8M, down from $5.9M in This fall/22 OpEx money $15M used, up from $11.9M in This fall/22 Money $60.7M, down from $80.5M This fall/22 Q2 steerage, a number of prospects ramping WiFi and community infrastructure, income +5%-10% q/q and +55%-70% y/y with working money burn a minimum of 25% decrease

The corporate goes to tempo some CapEx and guides operational money burn 25% decrease in Q2 so money outflow shall be within the order of $15M. If money burn does not decline additional it offers them three quarters to burn via all of it.

We do count on money burn to maintain reducing on the idea of extra prospects ramping manufacturing and WiFi provide constraints easing. However in any case they might want to go to the markets for the manufacturing line and crops they wish to construct, though these could be vastly helped by CHIPS Act funding.

Valuation

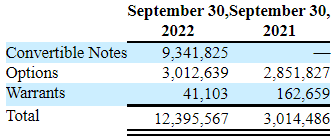

There may be fairly a little bit of dilution on the way in which, from the 10-Q:

AKTS Q3-22 10-Q

So at $2.60 a share the corporate has a market cap of $182M which quantities to six.7x gross sales (The corporate has $43.85M in notes excellent however the conversion of those into shares is already included within the calculations).

On the FY24 (ending in June/24), that is halved to three.35x as income is anticipated to double to $54.1M.

Conclusion

The corporate is raking in design wins and firms that transfer into manufacturing (15 already, over 25 by the tip of subsequent 12 months in response to administration) based mostly on their superior XBAW expertise, which it retains bettering. There are short-term headwinds of their largest phase as a consequence of provide chain issues, however these are easing and administration expects an accelerated ramp subsequent 12 months. It’s also gaining in community infrastructure, protection (two DARPA contracts) The corporate has big potential within the 5G cell market which dwarfs that of WiFi and has now its first large win on this house, propelling the corporate to the large league. The corporate is making inroads in new markets, like gaming and timing. The greenback content material of most of the finish merchandise for his or her filters is rising as a result of rising sophistication of the filters and the rising variety of filters per machine. The corporate is more likely to profit significantly from the CHIPS Act for funding further manufacturing traces and a brand new WLP plant which might propel the corporate on a brand new airplane and allow it to service quantity demand from the most important prospects in addition to design and produce the packaging in-house, which can increase margins. Even with CHIPS Act funding, the corporate is more likely to want new finance someplace subsequent 12 months.

Mainly, the corporate is ready to make a giant leap subsequent 12 months if they’ll finance their enlargement plans because the curiosity from prospects is there, however we first need to cross a funding hobble.

[ad_2]