[ad_1]

Roland Magnusson

Dear readers/followers,

I’ve covered companies in metals and mining, with recent updates on peers and companies like Boliden (OTCPK:BDNNY). Now it’s time for an update on SSAB (OTCPK:SSAAF), which isn’t a company in general mining or metals, but steel. Swedish steel is a classic investment – the only thing more classic would be Swedish timber.

In my latest article, I made it clear that I’d made triple-digit returns on SSAB – more than 4x as much as the S&P500 in the same timeframe. This is my typical M.O. for a company like this – buying it extremely cheap, which I did, then holding it for several years, if needed. Again, I did.

You can’t really say how quickly recoveries happen. It depends on a multitude of factors. All you can usually say when you invest in a business such as SSAB is that “Yeah, I got this cheap on a relative basis”. Sometimes it takes even more than 5-7 years for a company to reach the levels where I would say it’s time to trim or sell it off. Sometimes it might not happen at all.

For SSAB, my first sell came in 2022 – the second not that long ago, though, at that point, my position was down to a very limited amount.

Since that last article when I went “HOLD” on the business, the company has moved, but not much in either direction. We’ll re-review SSAB here, and show you where the company might be going.

SSAB – Review, 1Q23 and the potential downside.

So, to be clear – there’s plenty of potential downside in SSAB. Like most mining/metal or basic materials companies, SSAB is primarily a play on commodities and input pricing. When those trends are favorable, things are working fine – when those trends are really good, those things might even be absolutely spectacular, like we saw in 2022.

However, when those things turn negative, which is the current expectation for the next 3 years, things are going to be awful. We’re talking double-digit loss of capital even with dividends included, per annum.

This is why valuation is key in every investment that you care to exemplify or make. If you buy something safe, and you buy it at a good price, and you’re willing to hold it through thick and thin, I argue that there are very few scenarios where you’re not going to be coming out on top.

If you’re on the other hand buying something great, but expensive, you don’t want to hold it if it drops and you’re liable to make emotional decisions… that’s a setup for absolute disaster, unfortunately.

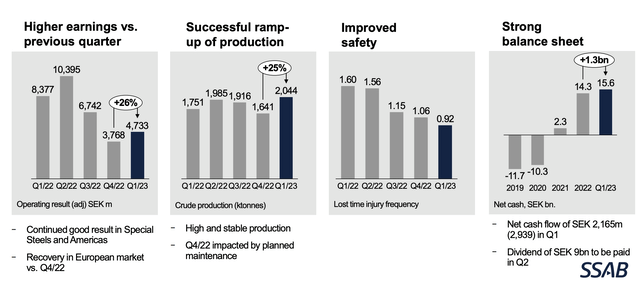

The latest SSAB report confirms the beginning of the downside for the company here. While the company managed to actually improve earnings, this is far, far below the ATH levels seen in the 1Q-2Q22 levels – and that’s with improved production levels.

What’s positive for Boliden and SSAB, and other companies in volatile sectors, is that they’ve taken advantage of the massive influx of cash from ATH’s, to really solve their debt situations. SSAB is a great example. The company now has a net cash position.

SSAB IR (SSAB IR)

Overall, the steel market hasn’t dropped as hard as some of the other commodity markets have been doing – and SSAB also has the advantage of being among the world leaders in ESG-friendly steel, which increases its relative appeal in home markets here.

However, trouble and signs of downturns are starting to appear across the company’s operations. Ruukki Construction was the segment in 1Q23, with a more pronounced downturn and lower revenue, together with weak margins. The sector generated negative operating results overall.

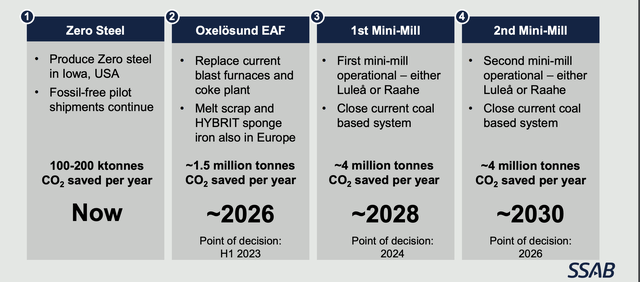

But more on the positives. SSAB managed to launch SSAB Zero, its zero-carbon steel segment, with third-party verification. This steel is based on recycled raw materials, fossil-free electricity, biocarbon, and biogas. No carbon emissions need to be offset – and the company already has significant order amounts from leading customers like Volvo (OTCPK:VOLAF), Epiroc (OTCPK:EPOKY), and PEAB. The transformation to fossil-free is on track as well.

SSAB IR (SSAB IR)

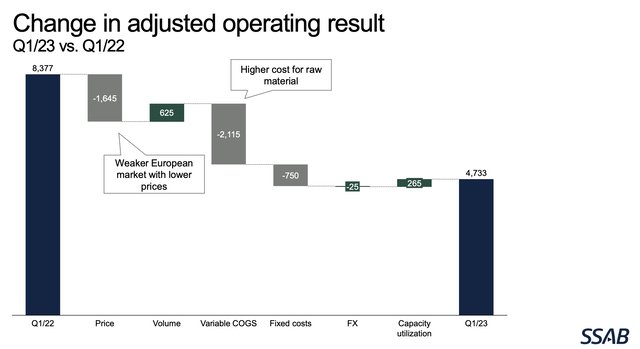

However, none of the changes or pushes here take away from the fact that EBITDA on a per-tonne basis is down from the highs – significantly down, EBITDA is down as well, and revenue is in decline. Even if the company manages to grow slightly here in terms of EBITDA and profit, the company will still see earnings that are significantly below the 2022 levels.

Headwinds hail from input, weaker markets, higher fixed costs, FX, and other headwinds (logistics and other things) with volume and efficiencies only managing to offset these negatives ever-so-slightly.

SSAB IR (SSAB IR)

No company, not SSAB either, can fight the “tide” here – and that tide is turning. And when the tide turns, we can expect that the premiums that were previously paid for companies like SSAB will no longer be paid.

The positives for the company include the rock-solid financial position, with a debt/equity of -22%, meaning we have negative debt, and over 15B SEK of cash on the books as of the quarter’s end. Some will go to dividends – but even net of dividends, that leaves the company with almost 6B SEK of net cash.

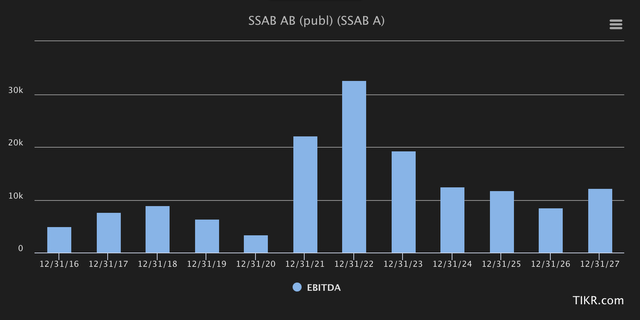

The current maintenance cycle is well in hand, and CapEx will consume about 1.5B SEK worth of capital, with most expected to be carried out in 4Q23. What I am saying, and repeating, is that this paves the way for a massive drop in earnings and EPS. FactSet is expecting a negative 44.7% YoY for 2023, for adjusted EPS. For S&P Global, it looks much the same. Take a look at forecasted EBITDA and the EBITDA development until 2026-2027E.

SSAB EBITDA (TIKR.com/S&P Global)

Again, not a pretty picture – and you can expect what this sort of development will do to the company’s share price and valuation. This is why I sold. Not because SSAB is a bad company, or because I don’t want to own it.

I want to own SSAB – but if I’ve generated over 100% RoR, and I see with a relatively high degree of certainty that things are moving down as opposed to up, I know that I can invest in better companies at better valuation.

But when the company drops (not if – when – that’s how the market works) I will be happy to pick up shares at a discount and start the cycle over again.

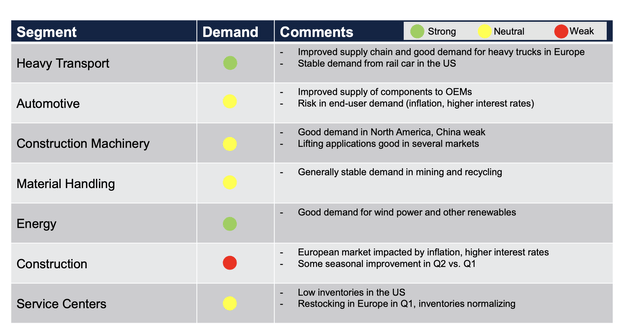

That’s what differentiates me from other investors. I’m not a B&H-forever investor. I’m aware of valuation cycles, especially in these sectors, and I “Play” them. The worsening outlook is confirmed in most of the company’s key segments.

SSAB IR (SSAB IR)

Aside from this, very few fundamental risks exist for SSAB. The company has nearly 40B SEK worth of cash and facilities available, and can “push” what direction it considers necessary. But it cannot control the market – and the market and commodity cycles dictate where these things go.

For now, and for the next few years, I expect we’re going to “brown-town”, and for that reason, I give you my valuation thesis for SSAB – and it’s not a positive one at this price.

SSAB – Still expensive for what it is – I say “Be careful”, and certainly not a buy here.

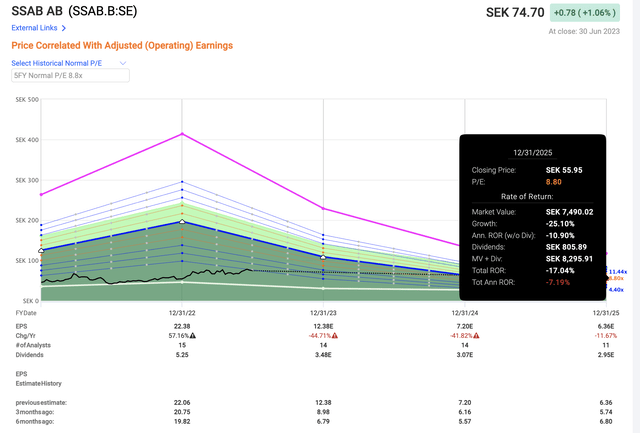

SSAB is simply put, a cyclical commodity play entering a very expected and currently-forecasted downturn. At a normalized P/E for SSAB, this company is expected to generate negative growth even with dividends included for the next few years.

SSAB downside/upside (F.A.S.T graphs)

This is not rocket science – it’s what happens to commodity plays. They go up – then they go down. I believe we’re at a blessing here because you can still actually sell SSAB at an amazing profit. If I still held SSAB, I would not take a chance that the company might reach higher here – I would rotate and reinvest in many other more attractive companies.

In times of volatility, this company’s earnings go negative, and the dividend goes to zero – it requires you to act and invest accordingly. This has been proven again and again by history, and even if the company this time around has the base to actually keep paying a dividend, it cannot move mountains, meaning change the commodity market. If you invest in SSAB today, you’re investing in a company going into a forecasted earnings decline with an expected negative 60% EPS decline for 2023E, another 35% decline in 2024, followed by another 2% in 2025E.

This is dangerous.

I covered in my last article why there are serious issues that aren’t talked about often – with regards to energy supply for SSAB, which is an absolutely crucial piece of their transformation, and why I believe this will initially fail.

The company is priced as though none of these challenges exist. Looking at analyst estimates, you could be excused for thinking me being too negative. 12 analysts cover the company with averages from 65 SEK on the low side to 116 SEK on the high side, with a PT average of 90 SEK. However, before you go placing “BUY” orders based on this data, please note that out of 12 analysts, only 3 are actually at a “BUY” – the absolute majority of analysts are either at “HOLD” or “underperform” here, which makes me question the conviction of these analysts as well as what these expectations are based on. I expect positives from zero-carbon steel and technologies, but I do not expect they will overcome the commodity cycle.

In my last article, I made a case for why I view SSAB as being worth around 50 SEK – and I consider that to be high for a downcycle SSAB. Remember, the lowest PT for SSAB during the downcycle was actually 12 SEK/share (Source: S&P Global) – now people, less than 2 years later, are saying it’s worth at least 60 SEK. Does that make sense?

It does not to me, at least. It shows me that this company is cyclical, and I treat a cyclical in a cyclical manner.

This means I “BUY” it when it’s dirt-cheap, and when analysts are giving it triple-digit share prices, I sell.

Which is what I am rating it here – it’s a rotation target. I won’t go full “SELL”, because I reserve this for companies in trouble, but SSAB is a rotation target for sure.

Here is my thesis.

Thesis

Investing in commodity companies/metal companies such as SSAB is always a tricky thing. They’re volatile and fickle investments, even more so in the Nordics where dividend stability isn’t necessarily a thing. This means that investors need to be prepared for such volatility not only in the share price, but in other metrics as well. SSAB should be viewed as a very long-term investment. When viewed in such a way, investing in SSAB at a forward valuation of below 10X (in terms of a normalized EPS; not the current one) isn’t all that unappealing. However, that also means you need to be an active disposer of the company’s shares when they do go up in valuation. For this reason, and because I recently sold off most of everything I had left, I am at a “HOLD” here. I view SSAB as significantly overvalued, with little left going for it. PT for SSAB is 50 SEK – no more, and I’m not changing this target as of July 2023.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

This company is overall qualitative. This company is fundamentally safe/conservative & well-run. This company pays a well-covered dividend. This company is currently cheap. This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company is a clear “HOLD” to me here – and should be considered a target for rotation.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]