[ad_1]

Sundry Images

Enphase Power, Inc. (NASDAQ:ENPH) is a world power expertise firm. They try to supply a set of built-in photo voltaic expertise which manages photo voltaic technology, storage, and communication on one platform.

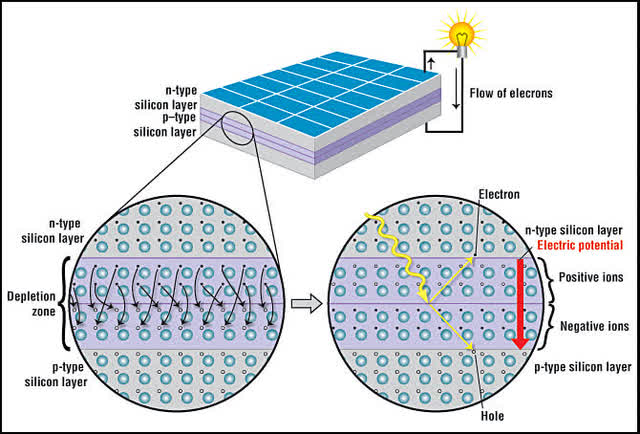

Photo voltaic photovoltaic (PV) set up construction

schematic of a photo voltaic cell (Enphase)

Determine 1: schematic of a photo voltaic cell.

A photo voltaic cell is the singular unit of the photo voltaic PV set up.

Photo voltaic cells include two semiconductors. Semiconductors are supplies which conduct electrical energy extra effectively than an insulator (akin to rubber), however much less effectively than a pure conductor (akin to aluminum). Semiconductors in photo voltaic cells have a tendency to make use of silicon. One semiconductor is known as P-type silicon, while the opposite is known as N-type silicon. P-type semiconductors have a emptiness of electrons, while N-type silicon has an extra of electrons. Determine 1 exhibits the construction of a photo voltaic cell.

When daylight hits the photo voltaic cell, the photo voltaic power triggers the electrons to maneuver from the N-type silicon layer to the P-type silicon layer. Because the N-type and P-type layers are related with a metallic wire, the electrons are replenished on the N-type layer and thus in a position to create a circulate of electrical energy.

A number of photo voltaic cells could be joined collectively to provide a photo voltaic module. A number of photo voltaic modules could be joined collectively to provide a photo voltaic array.

Services and products

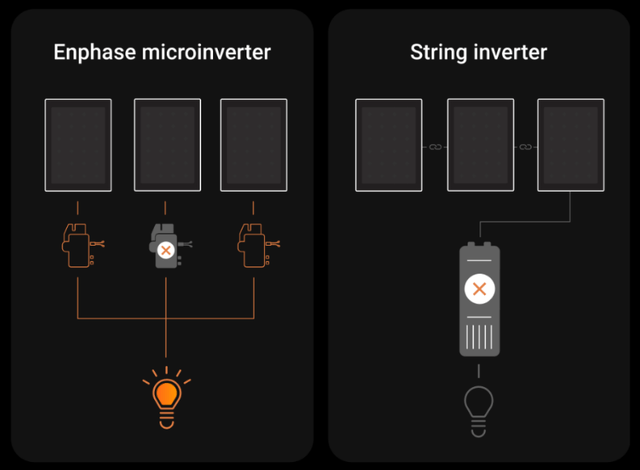

String inverters

As photo voltaic PV installations can solely produce direct present, DC, an inverter is required to transform DC to alternating present, AC, which can be utilized by the grid and home equipment. There are two foremost forms of photo voltaic inverters: string inverters and microinverters. String inverters are essentially the most broadly used. These depend on a centralized strategy, with every photo voltaic module related in sequence. While this makes administration of the photo voltaic PV set up simpler (as if the set up breaks down, it’s probably the inverter), because the inverter’s modules are related in sequence reasonably than parallel, because of this the output of the group of modules is proscribed by the bottom performing module. This will happen when one module turns into shaded. Moreover, string inverters don’t enable for monitoring to the identical extent as microinverters; if power technology is low, it’s going to probably go undiscovered for an extended time period.

Microinverters

microinverter and string inverter (Enphase)

Determine 2: microinverter and string inverter.

Enphase developed the microinverter. Microinverters convert DC to AC at every particular person photo voltaic module. This offers a number of benefits. To start, this ensures that the output of different modules shouldn’t be affected by the output of 1 module. As an illustration, if one module is roofed and due to this fact can not produce electrical energy, this doesn’t imply that different modules are unable to provide electrical energy. This enables for elevated electrical energy technology. This is because of modules being related in parallel reasonably than sequence (see determine 2). Subsequent, superior power monitoring is enabled by means of a microchip being put in in each microinverter. That is utilized by means of their ‘burst mode’ expertise. Burst mode refers back to the photo voltaic module having the ability to generate extra power in low-light circumstances to make sure that there’s at all times a gentle electrical energy manufacturing. Lastly, it’s simpler to broaden the photo voltaic array with microinverters because the inverter shouldn’t be constructed in sequence.

There have been 8 renditions of their microinverter up to now. The most recent rendition, IQ8, has an built-in circuit chip which has its personal micro-grid. Which means IQ8 householders can produce and use their very own energy and may present electrical energy throughout an influence outage with no battery. That is distinctive in the marketplace. Future renditions of the microinverter purpose to make use of gallium nitride, a chemical which will increase the facility out there to semiconductors.

Different services

Enphase makes an attempt to supply an built-in strategy to power options. They’ve a number of apps and companies out there for customers. These embrace the Enphase Installer App, IQ Battery, IQ Combiner, IQ Gateway, and Enphase Enlighten.

Enphase Installer App

The Enphase Installer App is used to arrange the varied Enphase companies.

IQ Battery

The IQ battery is a photo voltaic battery. This enables customers to retailer electrical energy generated through photo voltaic panels to make use of later. The IQ battery has a “load management” perform, which can be utilized by means of the IQ Load Controller. This enables customers to determine which home equipment are powered throughout an electrical energy outage in order that the battery lasts longer.

The following rendition of the IQ Battery, IA9D-BAT Inverter combines battery and energy administration in a single board, changing seven boards beforehand, due to this fact optimizing value.

IQ Combiner

The IQ Combiner consolidates wires and different interconnection gear. This reduces problem and makes administration simpler.

IQ Gateway

The IQ Gateway sends knowledge about photo voltaic power technology and power consumption to the Enphase Installer Platform.

Enphase Enlighten

Enphase Enlighten is a web-based software which permits customers to view system standing, historic manufacturing knowledge, and see easy-to-read charts and trendlines exhibiting solar energy technology, power storage and consumption.

Enphase offers a guaranty with microinverter models lasting 15 years for first and second technology microinverters, and 25 years for subsequent technology microinverters. This implies that the merchandise are more likely to final for this era.

Enphase additionally present varied different companies together with electrical automobile chargers, communication wiring, equipment, and clothes. All of those are outlined beneath a single working and reportable section of their monetary information.

Enterprise mannequin and technique

Technique

Enphase have had a constant technique for the earlier years.

Finest-in-class buyer expertise Develop market share worldwide. Increase product choices.

Enphase need to capitalize on their presence in core markets, in addition to rising market share in Europe, Asia Pacific, and Latin America. They intend to broaden into rising markets.

Enphase differ from their opponents in that they supply a full-service strategy to photo voltaic power installations; they supply all the elements required for power administration.

4. Enhance energy and effectivity and scale back value per watt

5. Enhance storage density, scale back set up time and price per kWh

6. Concentrate on the buyer and installer companions

Badri Kothandaraman, CEO, talked about that fleet analytics are an important instrument to the corporate. As of now, Enphase monitor: power technology per dwelling, power consumption per dwelling, system vitals and occasions, house owner profile, errors and notifications, world climate knowledge, grid efficiency, and installer stats and efficiency.

Income

Income is primarily generated by means of the gross sales of microinverters and storage techniques. The principle value of revenues is because of product prices, guarantee, manufacturing personnel and logistics, freight, and stock write-downs.

General, throughout the earlier three years, the US has represented a smaller portion of income, lowering from 84% in 2019 to 82% in 2020 to 80% in 2021, regardless of complete income rising by $607,624 to $1,382,049 between 2020 and 2021. This probably represents efforts by Enphase to extend worldwide market presence.

Mergers & acquisitions

Enphase have had six acquisitions up to now, all throughout the earlier two years.

Enphase acquired Sofdesk Inc. in January 2021. Sofdesk offers design and proposal software program. Later, in March 2021, Enphase acquired DIN Engineering Providers LLP which give proposal and allowing companies and are significantly targeted on automating the creation of allow plans units to broaden the installer base. In December 2021, Enphase acquired 365 Pronto which match cleantech asset house owners to an area and on-demand workforce of service suppliers utilizing a predictive software program. Enphase expects that this acquisition will provide installers an internet platform to service their upkeep contracts and offers entry to a labour pool that may carry out these companies. Later in December 2021, ClipperCreek Inc. was acquired. ClipperCreek provide electrical automobile charging options. This has allowed Enphase to enter the EV charging market. In 2022, Enphase acquired SolarLeadFactory LLC. SolarLeadFactory is a photo voltaic lead firm who’re trying to speed up the adoption charge of solar energy. Enphase then acquired GreenCom Networks AG, an organization which optimises power administration and consumption to scale back electrical energy off-take from the grid.

Moreover, SunPower, the fourth largest retailer in California’s residential market, made a cope with Enphase in 2018 for Enphase to be the only provider of microinverters for a interval of 5 years. Given SunPower’s massive share within the residential market, this offers Enphase assured gross sales.

Manufacturing, provide chains and clients

Enphase outsource manufacturing to a number of companions. Flex Ltd and Salcomp Manufacturing India Pyt Ltd are the first producers. They’re chargeable for assembling and testing the microinverter AC battery storage techniques and communications merchandise. Hong Kong Sinbon Industrial Restricted manufacture customized AC cables, and Amperex Applied sciences Restricted provide lithium-ion batteries. Enphase declare that this diversification of the provision chain can assist them higher serve clients by means of slicing down on supply instances.

Enphase primarily promote to main photo voltaic and electrical distributors, installers, unique gear producers, strategic companions, and householders. Although, it is very important observe that in 2021, one buyer accounted for an estimated 34% of complete internet income.

Financials

Income and bills

Regardless of internet income rising by 78.5% between 2020 and 2021 (from $774,425,000 to $1,382,049,000), internet earnings solely elevated by 8.5% (from $133,995,000 to $145,449,000). This may be attributed to elevated working bills (analysis and growth, gross sales and advertising, and common and administrative), elevated curiosity expense, and loss on partial settlement of convertible notes.

Analysis and design have marginally elevated in expense as a proportion of income throughout the earlier three years, rising from 6.5% in 2019, to 7.2% in 2020, to 7.6 in 2021. The monetary notes part feedback that analysis and growth expense consist primarily of product growth personnel prices, together with salaries and advantages, stock-based compensation, different skilled prices and allotted amenities prices. Administration goes on to remark that analysis and growth staff are engaged within the design and growth of energy electronics, semiconductors, powerline communications, networking and software program performance, and storage. Substantial assets are offered to enhancing current merchandise and growing new ones.

Administration remark that common and administrative expense embrace personnel-related bills for govt finance, human assets, IT and authorized organizations, amenities prices, and charges for skilled corporations.

Curiosity expense has been rising as a proportion of incomes from operations throughout the earlier three years, rising from 9.4% in 2019, to 11.3% in 2020, to twenty.9% in 2021. This represents elevated ranges of debt throughout the firm.

Debt

Non-current debt elevated from $4,898,000 to $951,594,000 between 2020 and 2021. Administration observe that this might be used to fund working actions, working capital, acquisitions, and buying property and gear. They anticipate that future capital wants from the debt market might be extra restricted.

Dangers

Rivals

Enphase is primarily an organization involved with inverters and power storage. Thus, opponents could be categorized into these two markets.

Inverters

Menace within the inverter market happens from varied corporations together with SolarEdge Applied sciences Inc., Fronius Worldwide GmbH, SMA Photo voltaic Expertise AG, and Tesla. Notably, these corporations produce string inverters reasonably than microinverters as Enphase does, thereby giving Enphase a singular benefit. Nonetheless, SolarEdge’s main product is their “energy optimizer.” That is an inverter which first optimizes the DC present, after which absolutely converts it to AC at a central converter. This has an identical output to Enphase’s microinverter.

Hoymiles, headquartered in Hangzhou in China, is one other competitor. They undertook an IPO in December 2021 through which they raised virtually the equal of $1 billion, the most important Chinese language IPO ever on the time. Importantly, Hoymiles additionally produce microinverters for quite a lot of nations, and may generate electrical energy throughout an influence outage – each of that are USPs of Enphase. This will likely current challenges to Enphase, particularly if Hoymiles are trying to broaden into overseas markets. Although, it is very important observe that as of now, Enphase have a extra holistic strategy in the direction of photo voltaic installations than Hoymiles; Enphase has a wider array of merchandise and apps.

2. Power storage

Enphase record a number of opponents within the storage market, together with Tesla, SolarEdge, LG Chem, Sonnen and Generac. Enphase’s battery capability lies in the direction of the decrease finish of the vary at 3.5 – 10.1kWh (see determine 3).

Firm

Battery capability (kWh)

Enphase Power

3.5 – 10.1

SolarEdge

10.0

Tesla

13.5

Sonnen

5.5 – 22.0

LG Chem

8.6 – 17.2

Generac

18.0

Click on to enlarge

Determine 3: battery producers and battery capability.

Although, all these corporations, aside from SolarEdge, produce merchandise referring to quite a lot of industries. As an illustration, LG Chem produces all kinds of petrochemicals, superior supplies, and gear for the life sciences. This offers Enphase a bonus within the sense that they’ve a distinct segment space throughout the photo voltaic trade through which they’ll deal with. SolarEdge, nevertheless, occupies this space too.

Semiconductor provide chain points

In keeping with S&P International, specialists predict that provide chain challenges throughout the semiconductor trade will final till late 2023 and early 2024. The constraint on the provision chain has already adversely affected Enphase, and will additional have an effect on part availability, lead instances and price, due to this fact rising the chance of surprising delays or cancellations of key elements.

To mitigate these dangers, Enphase has prolonged buy agreements and positioned non-cancellable superior orders. Although, this may increasingly imply that Enphase are unable to make use of newer expertise.

Small variety of outdoors contract producers

As Enphase lack the capabilities to fabricate internally, they depend on exterior contract producers – Flex, Salcomp, Sinbon Industrial Restricted, and ATL. Notably, Enphase lack long-term provide contracts with these producers, which means that they’re beneath no obligation to produce merchandise to Enphase for any interval. Sooner or later, Enphase is weak to produce chain points. Moreover, Enphase constitutes a small portion of the revenues of those producers. Due to this fact, Enphase is probably going not a precedence, and this presents dangers with delays within the provide chain. Diversification of the provision chain would do nicely to mitigate this danger.

Clients

Within the fiscal 12 months ending December thirty first 2021, one buyer accounted for 34% of gross sales. Additional, as of the time of publishing of the latest 10-Q, one buyer accounted for 38% of complete accounts receivable stability. The contracts for these are typically short-term reasonably than long-term. Due to this fact, a single buyer having such a big share of gross sales topics Enphase to a considerable amount of danger; if this buyer stops shopping for, then complete income and shareholders are more likely to endure. Diversifying the client base is the most effective answer. This may be achieved by means of advertising and reaching out to potential business clients who could also be prepared to make a deal.

Discount, elimination, or expiration of presidency subsidies

Authorities subsidies within the type of feed in tariffs, rebates, tax credit and different incentives have meant that there’s an elevated demand for photo voltaic installations. Diminished authorities subsidies might scale back this demand and thus lower income for Enphase.

Current enlargement into new and current markets

Enphase is trying to broaden into different worldwide markets. This presents a number of issues related to worldwide enterprise basically, together with acceptance of microinverters in a brand new market, competing in a brand new market, adapting to new regulatory necessities, unfavorable mental property safety, and others.

Failure to understand advantages from SunPower deal

In 2018, Enphase and SunPower made a deal for Enphase to be the only provider of microinverters for a interval of 5 years. The advantages from this transaction will solely be realized if Enphase abide by the foundations of the SunPower Grasp Provide Settlement, “MSA.” Finishing the phrases beneath the MSA is advanced and time-consuming. Delays or breach of obligation beneath the MSA may have an antagonistic impact on Enphase.

SWOT evaluation

Strengths

Enphase is nicely established as a market chief, is progressive, and has a superb fame amongst customers. Enphase’s USP is microinverters – a product which is generally distinctive to them. Microinverters have higher knowledge analytics compared to string inverters and maximzse electrical output. Photo voltaic power is clear and limitless in daylight circumstances. A holistic strategy to photo voltaic installations implies that customers are probably to purchase multiple product from Enphase. A sequence of acquisitions implies that Enphase is more likely to strengthen its current enterprise and bear market diversification. The SunPower deal implies that Enphase have some assured gross sales throughout the subsequent 5 years. Enphase have over 230 US patents and 75 non-US patents; their expertise is nicely protected. There was little or no authorized motion taken towards the corporate.

Weaknesses

Most clients purchase within the short-term reasonably than the long-term. Which means long-term gross sales are unpredictable. As microinverters work on the stage of every photo voltaic module, they’re extra more likely to fail. Microinverters value greater than string inverters which can push away clients. Restricted suppliers imply that Enphase is weak to produce chain points if issues happen with these suppliers. Worldwide provide chain is liable to delays. Enphase require distributors, installers, and suppliers of photo voltaic financing to assist in promoting merchandise. A breakdown in relations with these corporations may trigger points for Enphase. Potential points with worldwide methods. As a big proportion of future income depends on R&D, funding returns should not assured.

Alternatives

To seize the remaining client base who don’t need to purchase microinverters on account of problem or financial causes, Enphase may promote string inverters. Given the SEC’s approval, a merger between Enphase and SolarEdge, two market leaders on this area, may get rid of competitors and supply profit to each corporations by means of a much bigger set of mental property and higher scale of economies. Elevated R&D funding may present simpler expertise.

Threats

One buyer accounts for 34% of income. Competitors from different photo voltaic expertise corporations. Menace of alleged patent infringement by different photo voltaic expertise corporations. Breach of contract of the MSA with SunPower may lead to litigation. Semiconductor provide chain constraints. Discount of presidency subsidies for photo voltaic installations may scale back demand. Points with worldwide commerce, akin to US tariffs, may trigger provide chain points.

Valuation and conclusion

Enphase has a In search of Alpha Valuation Grade of D- and a Quant rating of three.43 and Quant ranking of “maintain.” In keeping with In search of Alpha, Quant scores beat the market. Since Enphase has a Progress rating of A+ and a Profitability rating of A-, in addition to my fascinating evaluation above implies that I must agree with the Quant ranking of maintain for now. Nonetheless, the inventory will go to the highest of my watchlist, and as quickly because the Valuation Grade or the Quant rating improves, I’ll probably then transfer the ranking to a Purchase. I just like the enterprise mannequin of Enphase Power, Inc. and the agency has many strengths. Clearly, although, this seems to be already factored into the valuation for now.

Vital hyperlinks

Investor day 2021 presentation

2021 10-Okay

Take care of SunPower

MSA between SunPower and Enphase.

[ad_2]