[ad_1]

Alvaro Moreno Perez/iStock via Getty Images

What is one thing you are guaranteed to see outside of every business or public agency regardless of sector, industry, product, or service? Handicapped parking spaces. Why? Because it’s federal law. Since 1990 and the passage of the American’s with Disabilities Act (or ADA for short), this and other measures became a requirement so that people with disabilities could have as unfettered access as possible to all the places non-disabled people do. Non-conformity results in civil penalties.

As early as 1994, digital accessibility started to become part of the conversation. As the internet grew, so too did more formal guidelines and initiatives related to making web pages usable for the disabled. Fast forward to today and the movement is picking up steam. Increasingly, businesses and public agencies are being called upon to have websites that accommodate people with a range of disabilities. Indeed, some are getting sued for NOT making said accommodations.

My intent with this article is to discuss how AudioEye (NASDAQ:AEYE) is at the tip of the spear in this nascent sub-sector, a micro-cap company with massive plans to be a dominant player in helping web properties become accessible to the disabled. I have written about them before, with articles you can check out here. With a few more quarters having transpired since my last publication, some meaningful events have occurred that are worth discussing.

Bottom line-up front: in spite of revenue growth being sluggish lately, the regulatory environment is heating up, and AEYE is poised to capture meaningful market share. With carefully controlled expenses while still investing in meaningful R&D, this debt free enterprise has all the pieces in place to wait for business to come to them for accessibility solutions. Like handicapped parking stalls, I see it as only a matter of time before ALL websites will be required to have reasonable accommodations, which AEYE exists to help build out.

The Law

The European Union has an accessibility law whose deadline for compliance is fast approaching, June of 2025. The law applies to all businesses that are not “microenterprises”, meaning any business with over 10 employees and 2 million euro in revenue.

The United States isn’t so staunch yet, with the Department of Justice only recently proposing a rule that only government agencies would have to comply with as it relates to accessibility. The rule would also apply to “public schools, community colleges, and public universities as well as state and local police departments.” It is projected that the rule will take effect within a few years.

This is another step in the direction of ultimately mandating accessibility requirements for all businesses. After all, handicapped parking stalls and the like were agitated for long before it was ultimately demanded by the ADA. Currently, it is estimated that only 3% of the world’s top 1 million web properties are accessible to the disabled. I don’t imagine that is going to pass scrutiny for much longer.

All that is to say that AEYE is well positioned to realize a boom of revenue from businesses required to seek their services, whereas currently their growth is from business who are forward thinking and want to comply.

Litigation

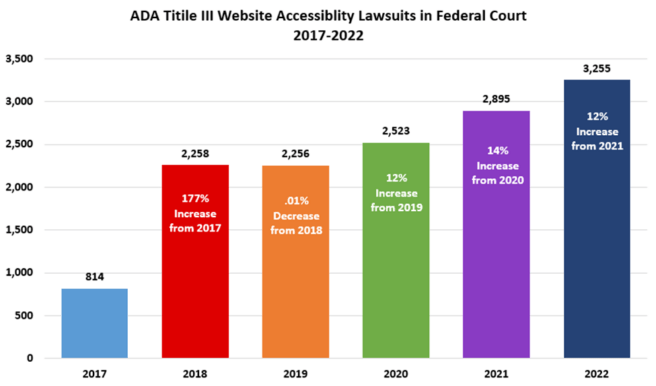

Lawsuits against web properties for accessibility lapses have skyrocketed in recent years:

adatitleiii.com

Increasingly, businesses are going to need compliance solutions to protect themselves. This point was born out recently by AEYE in an important precedent case.

AudioEye has a customer, Babylon Marine, who had a suit brought against them in federal court by a disgruntled customer who alleged website accessibility issues in violation of the ADA. AudioEye rushed to the defense of Babylon Marine which resulted in the case being dismissed for no monetary settlement or relief. Andrew Mirra, a manager at Babylon Marine, said:

When we received the ADA complaint, which came with a large settlement demand and potentially significant legal costs, we were confident there was no merit in the claim because of AudioEye. The AudioEye team determined there were no digital accessibility barriers, and provided documentation which proved that the claims were false. We appreciate how AudioEye stepped in to stand by their solution and customer; and how effective they were in resolving the claim. AudioEye was an invaluable partner throughout the entire process.

Before AudioEye, we really didn’t know which accessibility vendor was right as there are confusing options out there, including ones that make false promises. We were confident that AudioEye could not only solve our accessibility issues but be there as our partner if any issues came up.

David Moradi, CEO of AudioEye had this to say about the case:

We were able to successfully defend Babylon Marine – helping them avoid an unnecessary and costly lawsuit that could have damaged their reputation – through our unique approach of technology and accessibility and legal experts. Being compliant today has never been easier nor more important. We know businesses want to do the right thing and just need the right partner. In this first of its kind case, we were able to stand behind our solution and successfully defend our customer.

As it pertains to this internet sub-sector, this truly is a landmark case. For AudioEye specifically, it bears out the power of their platform and their team in helping businesses avoid costly legal issues. This is the type of thing that of course wins business.

Valuation

Here is the tricky part. I typically rely on DCF analysis to value companies. But DCF analysis relies entirely on informed assumptions. With AEYE, having informed assumptions is ghastly difficult. They are the only publicly traded company in this space, so peer comparison can’t be. They don’t have a long history and they aren’t profitable, so we are without a start point as it relates to trajectory. Therefore, this valuation section could also serve as a risk factors section. How can we calculate the present value of all future cash flows when there is so little with which to surmise those cash flows?

Here is what little we know. Management says that a Q3 non-GAAP profit is likely. Cash burn is decreasing and is expected to inflect positively in Q4. So we can comfortably assume that AEYE isn’t worth $0. Hooray for a starting point.

Management also guided to annual recurring revenue (ARR) increasing sequentially by $1 million in the back half of this year, which would bring the total from $29.7 million currently to $30.7 million by year-end.

They also achieved record gross margins last quarter, up to 77%. 77% on $30.7 million is $23.6 million.

As for operating expenses, they are trending to have $32.3 million annually. However, $6.5 million of that is from depreciation, amortization, and stock based compensation. Let’s call it $25.8 million of cash opex.

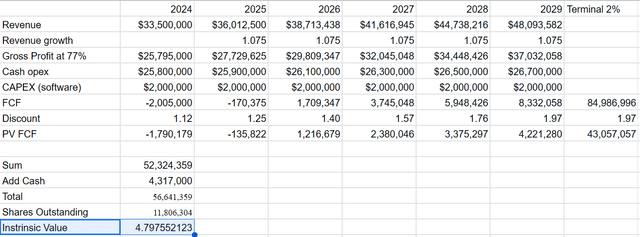

From there we can determine what growth would have to look like at AEYE in order to justify the current share price by running a reverse engineered DCF analysis. In other words, instead of trying to figure out the stock price by assuming inputs, we take the stock price as the known variable and then figure out the inputs that would justify it. If the inputs look easy to achieve or beat, we have an appraisal for fairly or undervalued. If the inputs look out of reach, the stock is over-valued. Here is what I came up with:

Author

As can be seen, under a 12% discount rate (my personal minimum required rate of return), revenues would have to grow 7.5% annually for the next 6 years in order for the stock to be worth what it is currently trading at. That is with gross margins staying at 77%, whereas management has said they might be able to juice that a bit more. I also grew operating expenses a bit every year, showing the investments necessary to support growth. I also put a line item for capitalized software costs. AEYE isn’t a traditional manufacturer, so CAPEX looks a little different for them, but is functionally the same. It is dollars spent on the necessary infrastructure to keep the business going. The infrastructure is simply digital. The $2 million number came from the cash flow statement from the most recent quarter showing $999,000 in “software development costs” for the first six months of 2023 under the “cash flows from investing activities”. I simply annualized that and rounded up.

So the question is, are these results achievable? Can AEYE grow revenue by at least 7.5% every year? If they can do that or better, then buying the stock right now trading around $4.75 is going to lock in a 12% return at least. If they can’t grow by that much, then the stock is over-valued. To be clear, revenue growth from the last quarter was only 4%. A significant acceleration would need to occur, and then they would have to sustain that. Given that larger numbers are difficult to compound, they have their work cut out for them.

It is also perfectly possible for revenues to stop growing. In that case, AEYE would slowly atrophy. Their cash burn rate was only $191,000 for the first six months of this year, and they have $4.3 million of cash on hand. A liquidity crisis isn’t imminent even if revenue stops growing. But, being that they are a micro-cap which are notoriously skittish, and because so much of the overall investment thesis revolves around explosive growth as a tech company, if revenues stagnate then the floor would completely fall out from underneath the stock. There are still plenty of rumblings about an impending recession too. If a recession materializes, companies aren’t going to prioritize website accessibility. Again, that hit to revenues would crater the stock price even if the underlying business is healthy and set up well for the future. As with most companies where the potential reward is out-sized, so is the risk.

Politics

So much of AEYE’s success will come down to which party is in office at any given time. Democrat control is going to see an advancement of accessibility rulings that will favor AEYE. Republican control will likely see any ADA related legislation sidelined. We have already seen this play out, summarized nicely by this article from Seyfarth:

Regulations providing guidance regarding entities’ obligations with respect to websites under the ADA have been long-desired by all interested parties—the disabled community, advocates, governmental entities, and private businesses. The last effort to do this, begun by the Obama Department of Justice in 2010, drew on for years before it was unceremoniously withdrawn by the Trump DOJ at the end of 2017. In March 2022, the Biden DOJ issued Guidance regarding website accessibility, in what many thought was the DOJ’s alternative to any regulatory effort. Apparently rather than being an alternative, it was a warm-up for the main event.

The main event spoken of being the new proposed rules mentioned at the outset of this article. I don’t mean to get into politics here. My only point is that Democrat majority control of congress and or the White House is more likely to result in federal laws being passed that will be a huge boon to AEYE. This issue ought to be kept front of mind when surveying whether or not AudioEye can achieve the growth needed to justify current valuations. Any news related to legislation gaining traction that formally codifies into the ADA website accessibility is a huge buy signal.

Conclusion

I remain bullish on AudioEye. It might take a mighty long time for the investment thesis to play-out, but I believe that eventually website accessibility will be mandated just like handicapped parking stalls are mandatory. The great news is that they will be cash flow positive within a few quarters and they have zero debt. Therefore, they have everything in place necessary to wait as long as they need to for their heyday to come as the regulatory environment evolves. No interest payments and no needs for capital injection. They have proven that their product works. They are growing revenues, albeit slowly, while also reducing expenses. It is this careful control that inspires my confidence in management. While the stock is priced such that I am not pounding the table per se or smashing the buy button, layering into, and building a position over time is advisable for those looking for exposure to a new, potentially super high-growth tech and software niche.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

[ad_2]