[ad_1]

Daniel Balakov

Outperforming stocks have increased in the S&P 500 from the last half of the year to this one.

According to a BMO Capital Markets’ U.S. Strategy Comment report, published on Wednesday, the number of outperforming S&P 500 (NYSEARCA:SPY) stocks rose from 146 to 193 in the second half of the year. That’s nearly 10% of the stocks.

The energy (XLE) and financial (XLF) sectors showed a great increase and the tech (XLK) sector stayed from the first half of 2023 to the second.

“Relatively narrow breadth has been a main characteristic of market performance for much of 2023 and this trend has been a big concern for many investors who believe that it is unsustainable for continued market momentum,” BMO strategists wrote.

BMO continues to see a bull market into 2024 with higher stock prices through the year-end.

Earnings resiliency also continued strong through 2023, they wrote, with “big increases in 2H leadership coming from seemingly forgotten areas of the market.”

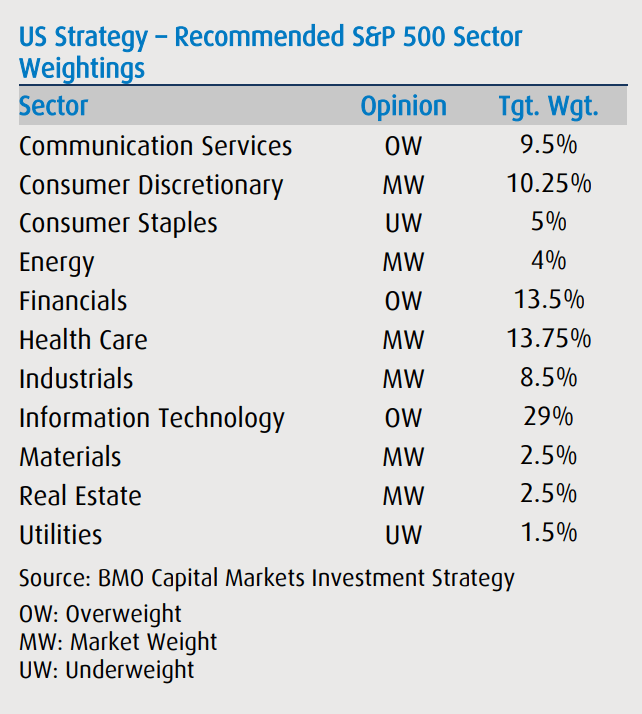

Information Technology (XLK) – continues to be the leader of the S&P 500 (SPY), with 38 stocks outperforming; 57% of its stocks outperformed in the second half of the year, compared to 47% in the first half. Financials (XLF) – although a significant laggard during the first half of the year (15%), in the second half, it had the highest number of outperforming stocks within a sector (38, or 57%). Industrials (XLI) – 32 outperforming stocks in the S&P 500 (SPY); 45% of its stocks outperformed in the second half, compared to 49% in the first half. Energy (XLE) – only one stock outperformed in the first half (4%), and 28 during the second half (78%). Consumer discretionary (XLY) – had two of the largest drops in 2H outperformance. It went from 23 outperforming stocks to 17. Healthcare – the second largest drop in 2H outperformance, going from 18 to 13. Communication Services (XLC) – 48% of its stocks outperformed in the second half, versus 36% in the first.

More on SPDR S&P 500 ETF Trust:

[ad_2]

Source link