[ad_1]

peshkov

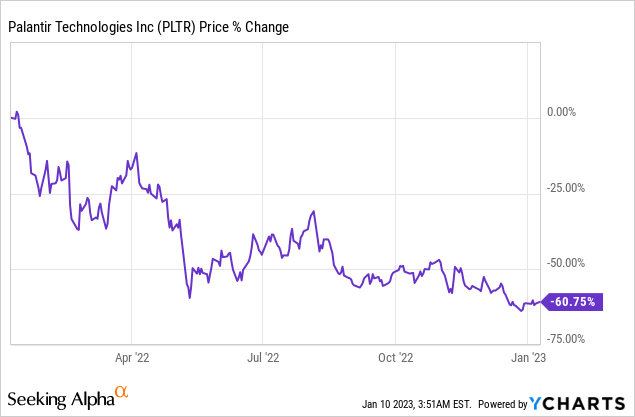

Palantir (NYSE:PLTR) has been brutalized within the final twelve months with shares dropping 61% of their worth resulting from souring investor sentiment and a slowdown within the agency’s prime line development. Though Palantir secured some large contracts with numerous authorities companies final 12 months, together with from the US Military and the US Area Techniques Command, traders appeared to lose curiosity within the firm’s development potential final 12 months. With earnings developing subsequent month, I’m discussing my expectations for Palantir’s This fall’22 and lay out what should occur for shares to revalue increased!

Robust buyer acquisition might drive business and monetary ends in FY 2023

Palantir operates two distinct enterprise segments. The primary is the federal government enterprise which solicits multi-year service contracts from numerous branches, together with legislation enforcement and the navy. Simply on the finish of December, Palantir introduced a £75M contract with the British Ministry of Defence.

Authorities revenues accounted for 56% of Palantir’s revenues within the first 9 months of FY 2022, exhibiting a lower of three PP in comparison with the year-earlier interval. The explanation for the decline within the share of presidency revenues has been Palantir’s success in rolling out its Foundry software program platform to extra clients within the business section, which is the corporate’s second income stream.

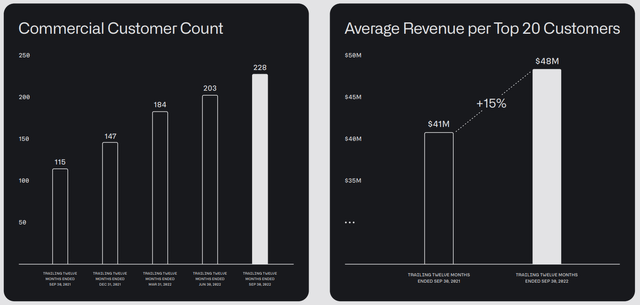

Within the business section, buyer acquisition has been particularly sturdy in FY 2022, partly as a result of Palantir closely invested in its gross sales crew and made it a precedence to signal on new business shoppers. On the finish of the September-quarter, Palantir had 228 business clients in its portfolio, exhibiting a 12 months over improve of 98% 12 months over 12 months.

Supply: Palantir

Regardless of numerous disappointments in FY 2022 (most notably the down-grade of its full-year income steerage), I imagine Palantir general nonetheless had a reasonably respectable 12 months. One space during which Palantir was actually profitable was buyer acquisition: as of the tip of the September-quarter, Palantir had 337 clients utilizing its numerous Foundry and software program merchandise on its books, exhibiting a 12 months over 12 months improve of 66%.

Palantir’s core enterprise has momentum

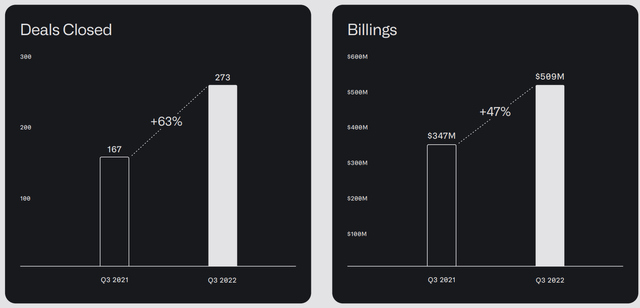

Palantir grew its consolidated revenues 22% 12 months over 12 months to $477.9B in Q3’22 and the software program analytics firm guided for greater than half a billion in This fall’22 revenues for the primary time ever. Palantir additionally closed 106 new offers within the final twelve months (largely with new clients), 78 of which had been closed simply within the third-quarter and nineteen of these had a deal worth in extra of $10M. The agency’s complete deal quantity (as of September 30, 2022) was $4.1B, exhibiting 14% 12 months over development. Clients proceed to flock to Palantir’s Foundry options which assist firm’s centralize, streamline and analyze their giant knowledge units and so long as Palantir continues to develop its buyer base and deal worth, I imagine the software program agency is on a very good path in the direction of profitability.

Supply: Palantir

These are my expectations for Palantir’s This fall’22

Palantir has general executed its enterprise technique effectively within the first 9 months of FY 2022 and the corporate is prone to report continued sturdy buyer acquisition, particularly within the business section, in This fall’22. My expectations for Palantir’s This fall’22 earnings — that are set to be reported subsequent month — are as follows:

1. Palantir will doubtless finish the 12 months with greater than 350 complete clients which might be utilizing Foundry platforms and different companies. The corporate added a mean of greater than 30 new clients per quarter within the final 12 months, so my estimate could also be on the conservative finish.

2. Though there’s a slowdown within the business enterprise, I imagine business clients will proceed to undertake Foundry merchandise because of the apparent worth they provide them in driving effectivity good points. I count on between 15-20% 12 months over 12 months business income development within the fourth-quarter with the same annualized fee of development in FY 2023. Palantir’s business revenues grew 17% in Q3’22, so the corporate ought to have the ability to meet the projection vary for the fourth-quarter simply.

3. Palantir’s business buyer base doubtless grew at charges just like these within the final couple of quarters and the corporate might finish the 12 months with 245-255 paying business clients in its portfolio. Within the business section, Palantir added a mean of 28 clients every quarter within the final 12 months, however development has been slowing down in Q3’22, so I’m a bit extra cautious with my projection right here. If Palantir acquired 28 business clients in This fall’22, the corporate would report a buyer depend on the top-end of my steerage.

4. Palantir guided for $1.9B to $1.902B in revenues in FY 2022, implying a income development fee of 23% 12 months over 12 months. I count on Palantir to fulfill (or barely exceed) this steerage on a full-year foundation resulting from sturdy execution within the business enterprise.

5. Contemplating current contract wins (as indicated above), I imagine Palantir’s deal worth might see development within the low-teens on a full-year foundation.

6. I count on Palantir to report $40-50M in free money movement for This fall’22 which might end in full-year free money movement someplace between $172M and 177M. This implies Palantir might be taking a look at a free money movement margin of 9-10%. Something above this margin degree might be a robust catalyst for Palantir’s shares.

7. Palantir could or could not affirm its long term annual income development goal of 30%. If it does, shares can also revalue increased.

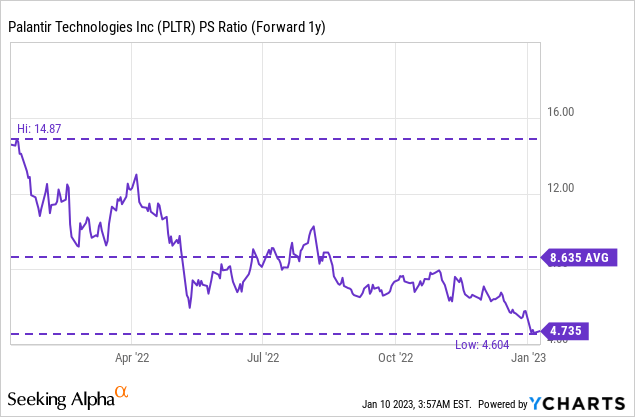

Palantir’s valuation

Palantir’s business income development is decelerating which contributed to rising valuation strain in 2022. Primarily based off of gross sales, Palantir is valued at a P/S ratio of 4.7 X which is 46% beneath the typical agency’s P/S ratio within the final 12 months.

Dangers with Palantir

The massive danger for Palantir, as I see it, is that adoption of Foundry merchandise might weaken in a recession setting which might put Palantir’s long term annual income development goal of 30% in danger. Palantir has lowered its income goal from 30% to 23% in FY 2022 and slowing prime line development in FY 2023 would doubtless be a robust motive for traders to promote their shares. One other danger issue pertains to the corporate’s excessive SBC bills that are stopping the software program analytics firm from reporting constructive web earnings.

Last ideas

So long as buyer acquisition and deal worth development remained sturdy in This fall’22, I imagine the software program analytics agency has a very good likelihood of seeing a valuation rebound in FY 2023. The business companies continues to be rising quickly and the software program firm isn’t that distant from attaining a 50% income share from the business section.

If Palantir executed effectively in This fall’22, which I count on, than traders would have a robust justification to rethink Palantir’s shares in FY 2023. If Palantir fails to fulfill expectations, then the inventory might sharply revalue decrease after earnings. Higher than anticipated free money movement, sturdy deal worth development and robust business buyer acquisition in This fall’22 might be catalysts for Palantir’s shares subsequent month. For these causes, I imagine Palantir stays a maintain for now!

[ad_2]