[ad_1]

Khanchit Khirisutchalual

Workday (NASDAQ:WDAY) is a leader in the human capital management market and is expanding its business into the financial management end-market. During the quarter, they raised both revenue and margin guidance for the full year. Additionally, they provided a stunning outlook for the next fiscal year, projecting 17%-18% subscription revenue growth coupled with margin expansion. Strong early renewal activities have enabled them to grow their backlog and reinforce their confidence in the growth for the next fiscal year. I am initiating a “Buy” rating with a fair value price of $280 per share.

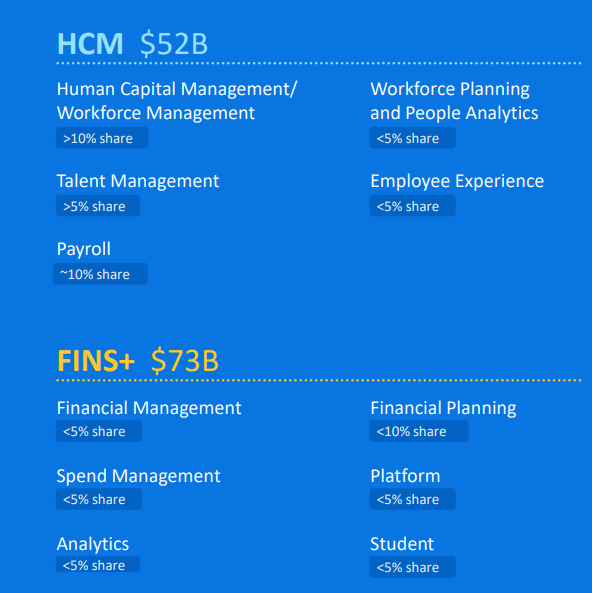

Leader in Human Capital Management

Workday has established a leadership position in the Human Capital Management [HCM] market, offering cloud-based solutions that deliver significant value to enterprise customers. Without requiring substantial initial capital investments, enterprises can subscribe to Workday’s services for talent planning, people analytics, workforce management, employee experience management, and payroll services.

Workday competes with major legacy players, including SAP (SAP) and Oracle (ORCL). I believe Workday’s cloud-based platform possesses several advantages. Firstly, it digitalizes and automates numerous business processes in human capital management. The core CRM system encompasses recruiting, learning, and talent optimization, allowing enterprise customers to manage their workforce on a unified platform with many automated processes.

Secondly, Workday incorporates extensive AI and machine learning functionality into its platform to facilitate the crucial shift to a skill-first approach. With these predictive tools, enterprise leaders gain a much better understanding and can plan for their future leadership and workforce more effectively.

Lastly, Workday’s platform infrastructure is built on a modern cloud environment, making it well-suited for enterprises’ multi-cloud workload environments.

Expansion into Financial Services

Workday has expanded its business into financial management, financial planning, spend management, and data analytics across various industries. This move presents a significant addressable market for Workday, putting them in competition with various vendors in each specific product category. I believe the expansion into financial services is strategically sound.

On one hand, Workday can leverage its existing platform infrastructure to offer more subscription services to enterprises. These cloud-based services are easily deployable for enterprises. On the other hand, Workday can capitalize on its massive client base and sales force to cross-sell various subscription services. The trust established through their HR platform could further strengthen their brand in enterprise software.

During the Q3 FY23 earnings call, the management indicated that their financial services pipeline continues to grow, with sales to both new customers and existing Workday clients. They express confidence that their financial services business will complement their leadership in the HCM market.

Workday 2022 Capital Market Day

Early Renewals Support Their Future Growth

The early renewal activities this year have been robust, as indicated in their quarterly earnings call. According to their disclosures in the 2023 Capital Market Day, their net revenue retention rate surpassed 100%, and the average gross revenue retention rate exceeded 98%.

For a SaaS company, the net retention rate is mission-critical for future growth, serving as a leading indicator of the company’s cross-selling capability, introduction of new products, and customer satisfaction. My key takeaway from their Q3 FY23 earnings is the strength in early renewal activities. I believe these activities not only allowed them to raise their full-year guidance but also provided an early outlook for the next fiscal year, projecting a 17%-18% subscription growth coupled with margin expansion.

During the earnings call, the management emphasized that over the past 12 months, they observed an elevated growth rate in scheduled renewals. This serves as a positive indicator for the growth rate in the upcoming fiscal year. These early renewals cover various services, including Talent Optimization, Accounting Center, and others, offering promising visibility for future growth.

Financial Analysis and Outlook

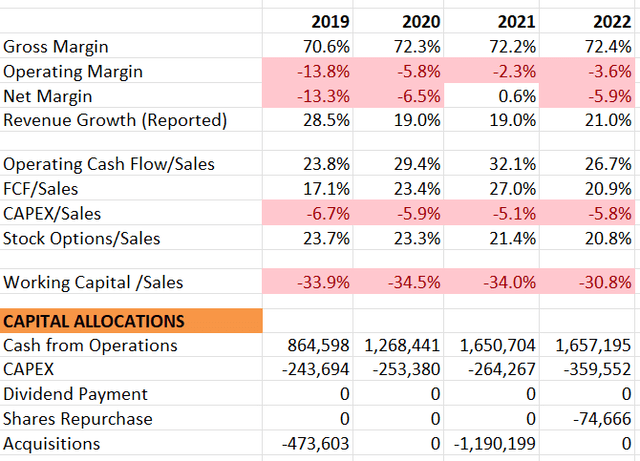

As a SaaS company, they boast a gross margin exceeding 72%, supported by a robust deferred revenue that contributes to a very strong net working capital. With a historical revenue growth rate surpassing 20%, they are guiding for a 17%-19% long-term subscription growth. Their free cash flow margin stands at over 20%, indicating ample room for future expansion. This is driven by the continuous addition of subscriptions, benefiting from operating leverage, and improving margins.

In terms of cash flow management, their focus has been on acquisitions, and since FY22, they have also initiated share repurchases. The balance sheet reflects strength, with a net cash position exceeding $3 billion.

Workday 10Ks

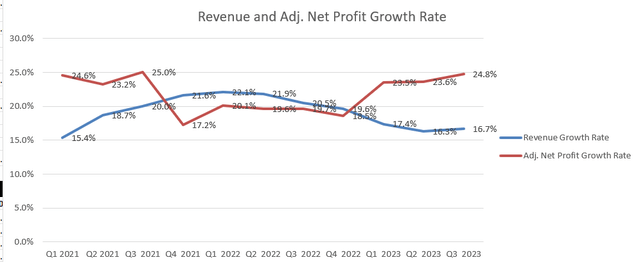

They delivered impressive results in Q3 FY23, achieving a remarkable 16.7% year-over-year revenue growth and a substantial 24.8% growth in adjusted profit. The company raised both its topline and bottom line guidance for the full year, with a noteworthy increase in the FY 2024 subscription revenue guidance to $6.598 billion, reflecting a 19% year-over-year growth. Additionally, the full year operating cash flow guidance was raised to $1.975 billion, marking a 19% year-over-year growth.

Thanks to robust early renewal activities, they anticipate subscription revenue in the range of approximately $7.725 billion to $7.775 billion for the next fiscal year, representing a remarkable growth of 17% to 18%. Overall, the provided guidance is nothing short of stunning.

Workday Quarterly Earnings

I find their guidance to be quite reasonable, given the strong visibility provided by the renewal activities, aligning well with their long-term growth targets. In Q3, they repurchased $148 million of their own shares, with $139 million remaining under the buyback program. With a robust cash position of $6.9 billion, I believe they have ample capacity to continue repurchasing their stocks.

Key Risks

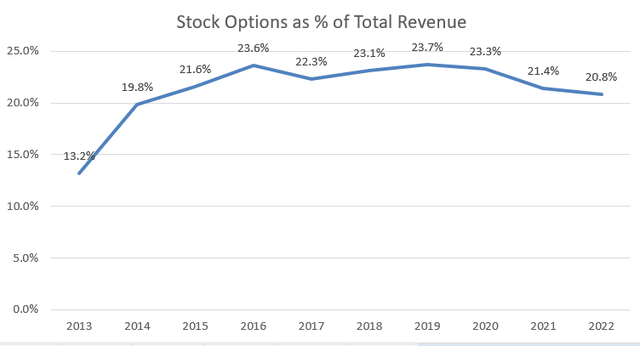

Stock Option Compensation: Their stock option expenses currently account for over 20% of group revenue, although the ratio has been declining over time. During their 2023 Capital Market Day, they set a target of reducing it to 15% by FY27. While this is an improvement, I consider it still relatively high. The reduction in stock options is crucial for reported margin expansion, and I anticipate it may take several years for them to bring this ratio below 10%.

Workday 10Ks

Competition from SAP: While Workday has established leadership in the HCM market, their financial services business faces significant competition. SAP, having acquired several SaaS businesses to enhance its position in the ERP market, poses a substantial challenge. Workday may not be as competitive in these new markets as it is in its core HCM market.

Valuations

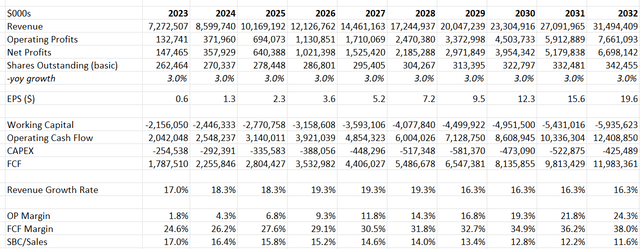

The assumptions for the current year align closely with their official guidance. I assume a normalized revenue growth of 17%, comprising 17% for organic revenue growth and 1.3% for acquisition-related growth. The organic revenue growth aligns with their long-term target and historical trends.

Regarding stock option expenses, I anticipate a gradual decline in the percentage of group revenue over time, reaching 11.6% by FY32. These assumptions align with their long-term targets and are reasonable for a growing SaaS company trajectory. The expected operating margin expansion is driven by both operating leverage and reduced stock option expenses.

Workday DCF – Author’s Calculation

The valuation model utilizes a 10% discount rate, 4% terminal growth rate, and a 19% tax rate. Based on these parameters, the estimated fair value is calculated to be $280 per share.

Verdict

I admire their robust early renewal activities and the proactive guidance for the upcoming fiscal year. Given their evident growth trajectory, I am initiating a ‘Buy’ rating with a fair value price target of $280 per share.

[ad_2]

Source link