[ad_1]

da-kuk

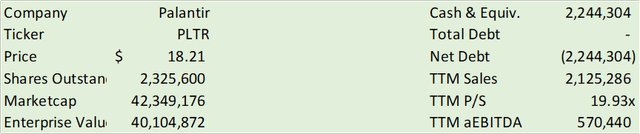

Palantir Technologies (NYSE:PLTR) experienced substantial growth YTD in customer acquisition and revenue growth and has made strides in sustaining profitability. With the fast adoption of its AIP platform, I believe Palantir is positioned to experience further expansion in its land and expand the approach. With revenue growth guidance in the range of 4.25-4.44%, I provide PLTR a BUY recommendation with a price target of $21.76/share.

Operations

Palantir has exhibited strength in expanding operations across commercial customers in a variety of industries. Its software is utilized across 16% of hospital beds across the US in q3’23 vs. 1% this time a year ago. Palantir has also expanded the use of its AIP workflows to over 300 organizations across various industry verticals, including finance, healthcare, industrials, aerospace, automotive, and energy. The firm is increasingly growing its deal size with 80 new deals valued over $1mm, 29 of which are over $5mm, and 12 of which are over $10mm.

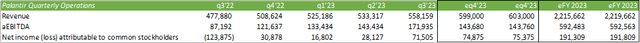

Management expects Palantir to generate $599-603mm in revenue for q4’23, resulting in $2,215-2,220mm for FY23, resulting in 4.25-4.44% growth on a TTM basis. If maintaining a constant 27% aEBITDA margin, this will generate $529-603mm in aEBITDA for FY23. One point to note is that the firm has earned a GAAP net profit for the last 4 consecutive quarters, making it eligible for inclusion in the S&P 500.

My estimates below align with management’s revenue guidance with aEBITDA and net margins consistent with q3’23.

Corporate Reports

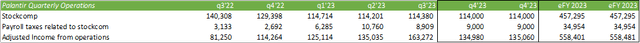

One thing that particularly stands out to me when reviewing Palantir’s operations is the declining stock comp expense. Despite growing headcount by 62% over the last 4 years, stock comp has continued to decline, allowing the firm more flexibility towards profitability.

Corporate Reports

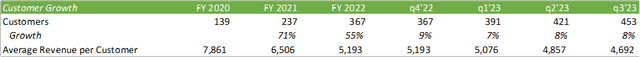

Growth has remained relatively consistent q/q on a TTM basis with an average topline growth rate of 3.70% for the first 3 quarters of 2023. Management anticipates revenue to grow between 4.25-4.44% on a trailing basis for q4’23 as its Artificial Intelligence Platform (“AIP”) adoption accelerates.

Corporate Reports

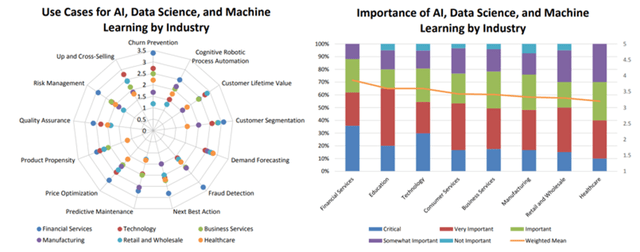

Though AI adoption at the corporate level remains in the early innings, adoption may accelerate as organizations look to optimize business operations as inflation remains relatively high. From an industrial perspective, I believe this level of data analysis can make strides in inventory management and/or regionalizing warehousing to help cut down on transportation costs and product spoilage. AI may also be leveraged in energy transmission as faster power cutover from intermittent sources to reliable sources will be necessary as utilities shift the power mix more heavily into renewables. Please see my article covering Quanta Services (PWR).

According to data provided by Dresner Advisory Services through Palantir, AI adoption is gaining interest while not yet being heavily utilized.

Dresner Advisory Services, LLC

Given that Palantir has expanded its AIP footprint across more than 300 customers in the 5 months since launch, further adoption of this tool is only a matter of time. In my view, using generative AI in the workplace will allow firms to better optimize operations, effectively cut costs, and reduce inventory build.

Other updates

Palantir announced on 12/15/23 a one-year extension of the Army Vantage program with a total contract value of $115.04mm. According to the press release, the partnership has saved the US Army $700mm/year for cumulative savings of $4b since the program’s initiation.

Translating this into commercial use cases, I believe businesses are realizing the benefits of data analytical platforms like Palantir’s and that the benefits can far outweigh the costs.

Valuation

Corporate Reports

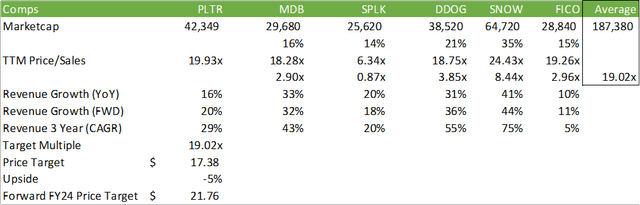

PLTR is priced to the market in terms of its price/sales valuation.

Seeking Alpha

Considering consensus revenue growth across the selected cohort, as provided by Seeking Alpha, I believe PLTR is priced appropriately, and I provide a BUY recommendation. Using a weighted average price/sales multiple across this cohort, the average price/sales multiple comes out to 19.02x for a price of $17.38/share.

Seeking Alpha

Considering the historical multiple for PLTR shares, this price multiple should hold as the firm grows. Looking out to FY24 consensus estimates as provided by Seeking Alpha, PLTR shares should reflect a price of $21.76/share.

Seeking Alpha

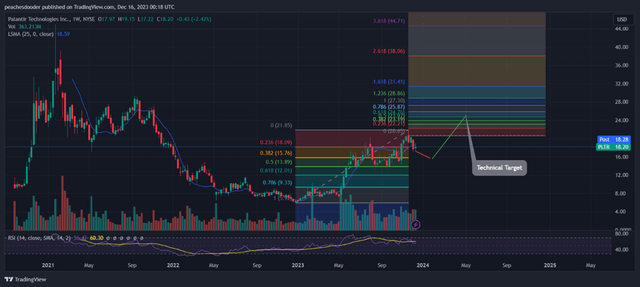

On a technical basis, PLTR shares are in overbought territory and may decline in the near term before following through to the next wave of advancement.

TradingView

[ad_2]

Source link