[ad_1]

Capital One Bank is one of the 20 largest banks by assets in the United States. To be precise, it’s #10 as of September 30, 2022.

It makes a lot of money too. In 2021, the most recent year for which we have full data, Capital One Bank reported more than $12 billion in profit before taxes.

Where does all that money come from? The big picture actually isn’t that complicated. Capital One earns the vast majority of its income from interest on credit cards, consumer loans, and commercial loans, and from debit and credit card transaction fees. Here’s how it all fits together.

How Much Money Does Capital One Make?

Capital One Bank earned $12.39 billion in 2021.

Chime offers an online checking account without monthly fees. Get paid two days early when you sign up for direct deposit and watch your savings grow automatically with their 1.00% APY savings account. Sign Up for Chime

Chime offers an online checking account without monthly fees. Get paid two days early when you sign up for direct deposit and watch your savings grow automatically with their 1.00% APY savings account. Sign Up for ChimeThe bank’s income and expenses fall into two major categories: interest and noninterest.

Capital One’s Interest Income Sources

Capital One earned $25.77 billion in gross interest income in 2021.

Most of that interest income comes from funds lent to customers. That includes:

Capital One also treats income it earns from investment securities as interest income. Finally, it earns a very small amount of interest on operating cash held in its own accounts as well.

Capital One’s Interest Expenses

Capital One had $1.6 billion in interest expenses in 2021.

Capital One’s interest income dwarfs its interest expenses, but those expenses do still cut into its profit. After accounting for them, Capital One netted $24.2 billion in interest income in 2021.

Capital One’s biggest interest expense is the interest it pays on customer deposit accounts, like savings accounts and certificates of deposit. (It is a bank, after all.) The rest goes to Capital One’s own debt service — that is, the interest it pays on previously borrowed funds.

Capital One’s Noninterest Income

Capital One earned $6.26 billion in noninterest income in 2021.

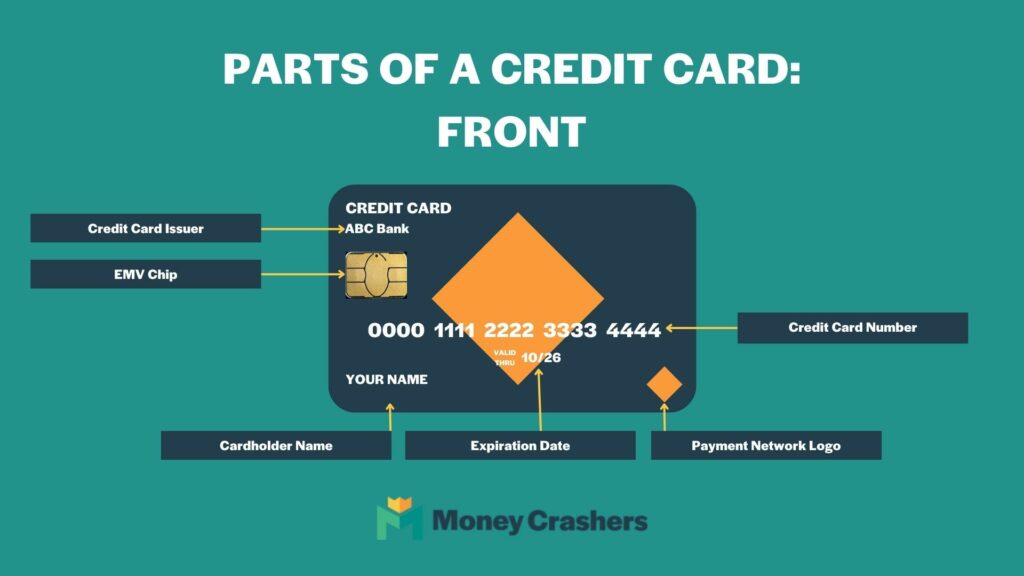

Most of that (62%) comes from interchange fees, also known as swipe fees. Interchange fees are transaction processing fees paid by merchants to credit card issuers like Capital One. Every time you use your Capital One credit card, Capital One gets a small cut of the amount paid — typically 1.5% to 3.5%, depending on the payment network and whether the transaction occurs online or in person.

Most of the rest of Capital One’s noninterest income comes from service charges and other fees charged to customers. As banks and credit card issuers go, Capital One isn’t known for charging excessive fees, and it doesn’t charge overdraft fees at all on consumer checking accounts. But the fees it does charge still add up:

Credit card annual feesInstallment loan origination feesWire transfer feesBank check feesPaper statement fees

Capital One’s Noninterest Expenses

Capital One had $16.57 billion in noninterest expenses in 2021.

This expense category encompasses all the expenses Capital One incurs to run its business:

Salaries, wages, and benefitsReal estate, known as “occupancy” in accounting parlanceOffice equipmentMarketing activitiesTelecommunications and data processingProfessional servicesVarious overhead expenses

The sheer size of Capital One’s noninterest expenses shows just how important the bank’s interest income is for its bottom line. Were it not for interest income, Capital One’s noninterest expenses would leave it deep in the red — interchange fees and service charges simply aren’t enough to keep pace.

Capital One’s 2021 Provision Credit

Capital One had one other significant source of noninterest income in 2021: a provision credit.

A provision credit is an accounting artifact that offsets bad debt from previous years. Each year, banks like Capital One keep track of unpaid debts — past-due credit card balances and loans, mostly — and make their best guess as to how much money they’ll actually lose on those debts. They write off the amount as a loss.

Those losses don’t always materialize. When the bank determines they’ve written off too much for phantom future losses, they use a provision credit to recover the difference.

In 2021, Capital One took a provision credit of $1.94 billion. That credit accounted for 6% of its total income.

Where Did We Get This Data?

We got all the data for this report from Capital One’s 2021 Annual Report, which covers the fiscal year that ended on December 31, 2021.

As a publicly traded company, Capital One is required by law to file a detailed annual financial statement with the Securities and Exchange Commission. The statement, known as a 10-K, runs more than 200 pages and breaks down Capital One’s assets, liabilities, and revenues in excruciating detail.

The 10-K makes up the bulk of Capital One’s annual reports. You can find the 2021 version at the link above, beginning on page 19.

If you don’t have time to pore over hundreds of pages of numbers and legal jargon, we have the highlights for you here.

Final Word

It’s impressive that Capital One earned over $12 billion in 2021, a year marked by historically low interest rates and relatively low rates of credit card utilization.

In 2022, interest rates were much higher and consumers leaned on credit cards more than they have in years. Despite a more challenging economic environment overall, it stands to reason that Capital One took advantage of the favorable interest rate environment and continued printing money.

Or maybe not. We’ll have to wait for the bank’s next annual report to be sure.

[ad_2]