[ad_1]

jetcityimage

Angi (NASDAQ:ANGI), more commonly known as Angie’s List, hasn’t been able to deliver strong enough top-line metrics to keep investors excited, and user level metrics paired with competitive threats and macro softness has sent the stock lower through much of 2022. We don’t anticipate the stock to perform so poorly going into 2023, as we anticipate that on a pure valuation basis the stock is cheap, and should be valued at $5 per share. But given how cheap the entire sector has gotten, we think investors can find better opportunities in other names. It’s why we have a Hold or Neutral stance on the stock, because the investment thesis isn’t all that great when compared to alternatives, despite being a very cheap stock when compared to other peers.

Can ANGI stock recover?

Over the past 5-years, ANGI’s stock price peaked in September of 2018, where the stock traded at $24 per share. A bit inconceivable given the low $2-$3 range the stock has been bouncing around in. Much of the hype in 2018 was tied to the HomeAdvisor and Handy acquisition, which drove the stock price from $10 to the $24 peak in 2018. Handy was originally acquired by Angi in February of 2018 for a modest sum of $164 million. The CEO/founder of Handy, Oisin Hanrahan was later promoted to CEO of ANGI in 2021 given his track-record and execution as a key member of the management team.

As of October 2022, Oisin Hanrahan stepped down as CEO of ANGI, and Joey Levin took over the CEO position. Keep in mind, Joey Levin serves as a dual-role CEO to parent company Interactive Media (IAC), which owns 90% of ANGI. Given the added decision making authority between both entities, it might give Angi shareholders much of the old black magic that made the stock relevant back in 2018, today.

With Joey Levin taking back control over the company there’s the prospect for spin-outs, acquisitions, and mergers, which could create unexpected surprises, which is something investors have been in dire need of. Some strategic miss-steps, and softening of the economic environment may have necessitated the change in leadership, and while we appreciate all the effort Hanrahan has put into running the company, we’re crossing our fingers for another accretive M&A miracle with IAC and Barry Diller’s blessing adding more cash to the pot upon a defined change in strategy.

Some brief history and refresh

All was rosy and beautiful, with a strong economic environment in real estate, and a more well-rounded portfolio to take share away from competing platforms. In 2017, ANGI merged with HomeAdvisor, thus creating what is now referred to as “Angi Leads.”

Follow along with us here, as it’s a bit confusing to understand the core business, but basically the business has three differentiated products: a lead generating platform, which came from the Home Advisor acquisition; a direct service offering from the Handy acquisition; and the conventional digital ad-based model with the original Angie’s List.

So, when approaching ANGI from the perspective of a home service contractor provider, the key market that ANGI is trying to monetize basically has three on-ramps. ANGI markets its Angi Ads, which generates in-bound leads primarily to your phone or website for a fixed monthly contract. The second product, Angi Leads generates traffic to your Angi/HomeAdvisor profile, which creates outbound leads for a fixed dollar amount per lead. Basically, ANGI might charge $20 per cleaning lead, $40 for bigger houses, and so forth. The pricing on leads varies by category generally, and the pricier the category (home renovation) the more expensive the lead price. Finally, ANGI has a third product called Angi Services, which operates like a sort of middle-man taking a fixed percentage of transactions upon the completion of a service visit, as opposed to charging for advertising up-front like the other two services.

The ANGI rebranding occurred in Q1’2021, and we think some of the negative drivers to the stock has been the confusion around the front-end and back-end experience of the corresponding apps, and how they all sound so similar to each other, but have vastly different functionality from an ad-purchasing perspective. Do I want to take out ads across all of Angie’s properties, or do I want to buy leads from Angi Leads? Should I just work as a contractor on behalf of Angi Services? Again, these things aren’t all that obvious to more novice entrepreneurs hoping to leverage the company’s ad products.

It’s why we think the PR and M&A flurry of 2017 and 2018 that generated all the hype didn’t materialize into a bigger more efficient company. Some of it has to do with the difficulty of organizing the three separate products/divisions. Joey Levin inherited a very difficult job, and perhaps a very different organization than what he imagined when doing all the M&A. However, upon organizing the divisions and making them more efficient we think there is room for even more M&A activity, which could bring some hype back into the stock, and some growth acceleration to keep the stock interesting.

Addressing the negative factors to our report

Overall platform activity implies ANGI saw a reduction in home services professionals throughout the course of the year. We looked deeper into the channel, and came up with a variety of reasons for why professionals are dropping from ANGI:

marketing/conversion cost too high to effectively generate a profit from leveraging the platform difficult environment led to an aggregate reduction in home service contractors in the United States ANGI’s products face stiffer competition, suggesting turnover in the form of competitors gaining share.

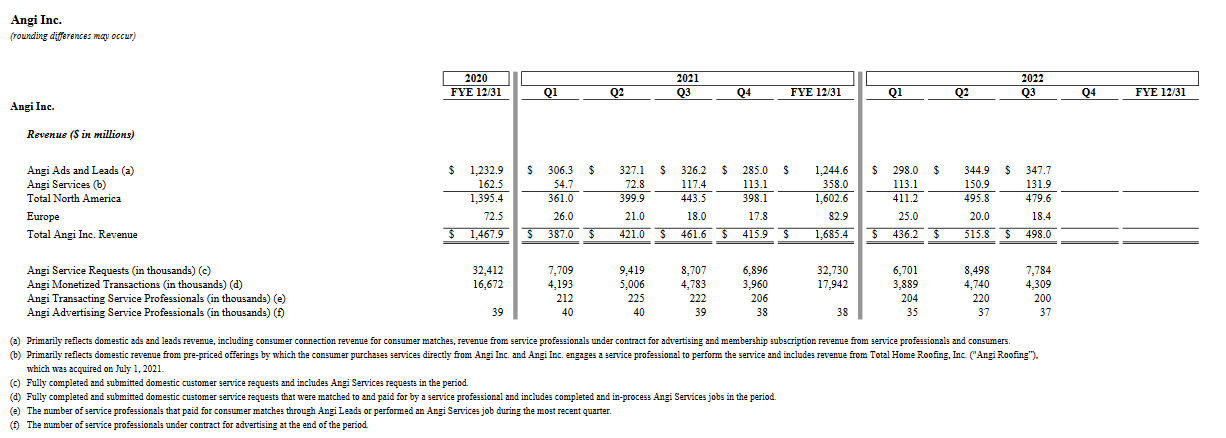

Figure 1. Angi Core Business Metrics

Angi (Angi)

Angi Service Professionals declined for much of the year with monthly transacting professionals declining from 222 thousand in Q3 ’21 to 200 thousand in Q3 ’22 representing a 9.9% drop in total service professionals paying for the Angi Lead product.

However, trends have been mostly stable in Advertising Service professionals with the number of professionals declining from 39 thousand to 37 thousand representing a 51 bpp (basis percentage point) drop in total users. Again, the reason why the Ads product is more sticky has to do with the 1-year service contract that service professionals sign, which is why there’s much less churn in the Angi Ads segment. Angi monetized transactions also declined Q3 ’21 by 9% y/y and we think most of that was attributed to the drop-off in service professionals from the prior year.

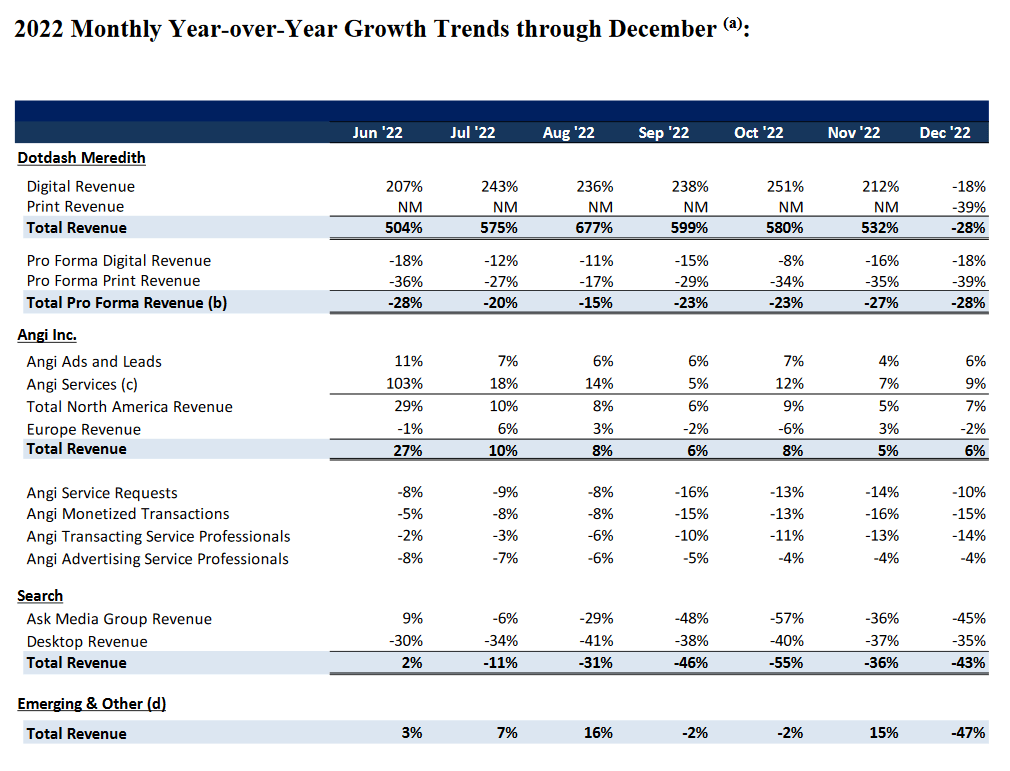

Figure 2. ANGI & IAC Business Metrics 2022

Interactive Media (Interactive Media)

Despite what has already been a relatively unremarkable year in terms of user level metrics and revenue. We find some additional negatives from the most recently released December IAC data report where revenue metrics may have slowed, but not completely ground to a halt.

July-September months implying 8% revenue growth for Q3 ’22 versus Q4’22 average revenue growth of 6.33%, which compares to consensus estimates of 7.1% y/y growth for Q4 ’22. So, based on just preliminary data alone, which was released on January 11th, 2023, we believe the company is either in-line with revenue, or misses Q4 ’22 revenue estimates by a narrow margin based on the average sales growth per month.

But if the number of both transactions and users are dropping, you’ve gotta wonder how they’re growing sales. And it’s because they’ve substantially increased the price of advertising on the platform in the form of higher leads costs, and higher ads costs as well. This explains how the company was able to offset a -15% revenue headwind from a reduction in transaction volume, the company had to adjust pricing dynamically by 22%, basically an incremental 7%-8% added price increase on-top of the demand loss to ensure revenue grew in-line with estimates.

The increase in price makes the value proposition weaker when compared to alternatives that may have opted to keep lead pricing lower in order to remain competitive with ANGI. As such, the loss of some of its service professionals could have a more devastating effect, assuming they find cheaper alternatives.

But what about the positives?

Some of the weakness in metrics is tied to the poor economy or the softness in the housing market. Again, we acknowledge that it’s a difficult environment for a more mature business to generate growth against more difficult comps. However, leaning on that reason alone isn’t sufficient enough to drive a solid investment thesis, as we become more economically dependent on economic metrics improving as opposed to any strategic shift internally by ANGI to generate some positive headline figures against analyst consensus estimates.

Even though we’re grumbling about the lack of strong metrics in response to a weak environment, it’s worth noting that interest rates for mortgages have started to trend lower in recent months. Assuming markets are pricing-in a slower more dovish federal reserve, there could be an argument for why there’s a modest recovery in demand for housing next year, which is also reflected in the bump in mortgage applications. Any increase in house transactional volume in the United States would have a major impact on results, as people make service requests following a move-in, or move-out of a property.

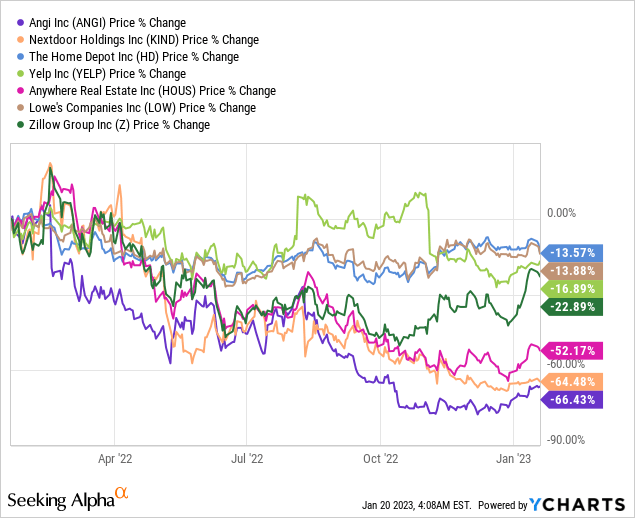

Figure 3. Stock performance dismal across the entire housing sector

YCharts (YCharts)

As a group, home services have done remarkably poorly for the past year. The stalwarts have been the conventional retailers like Home Depot and Lowe’s (LOW), which declined -13% year-to-date as opposed to the even more substantial drop-off of the tech-enabled cohort such as ANGI, Nextdoor (KIND) and Anywhere Real Estate Inc (HOUS), which have declined by -66%, -64%, and -52%, respectively. So while the metrics are weak on an individual basis, the broad softness can be felt across any service provider tied to housing – Zillow (Z) and Yelp (YELP) being the medium-sized tech equivalents who have managed to lose less value even when compared to ANGI.

Competitively ANGI has growth opportunities

Currently, we’re grappling with the competitiveness of the features and products Angi offers. For example, Handy, which is now rebranded as Angi Services, could become a significant growth driver, but being dependent on that singular growth opportunity tied to a commission marketplace that primarily competes head to head with its rival TaskRabbit in the segment doesn’t do enough to justify a meaningful improvement to revenue – at least not in the near-term, as services revenue has slowed to low-teen growth rates.

We’d have to see a more aggressive attempt at scaling the Handy/Angi Services model to be more competitive and to take share from its rival whenever possible. Currently, ANGI reports that it has 237 thousand professionals on its platform whereas TaskRabbit reports that it has a comparable 200 thousand tasker professionals. In other words, Angi Services may have hit that wall where customer acquisition becomes more difficult and it has to compete in order to sustain higher growth rates.

Also, it’s worth noting that the Angi Ads product compares to Google Local Ads, Nextdoor Ads and Yelp. Whereas the lead generation product, ANGI leads, compares most closely to Thumbtack. So, any effort to expand may involve some M&A. If ANGI does pursue M&A we hope they buyout Thumbtack, as its lead based business model seems the most compatible, and strengthening the lead business could keep competition at bay even if it’s a marriage of circumstance. Other alternatives could be earlier stage home services start-ups that have a uniquely differentiated user experience.

One of the company’s greatest complaints from investors is the heightened spend on advertising, which we also think is in response to heightened pricing for ad units across the industry. The more they have to increase their average user acquisition cost leveraging Google Ads (GOOG) (GOOGL) the more likely they are to pass costs onto their ad buyers as well.

Getting out of this pervasive cycle, ANGI needs to build a stronger moat around its business model and focus more on retaining existing service professionals. The wall of execution challenges and the poor environment paired with the weak numbers have triggered the stock to sell-off on repeated occasions throughout the year. While we do empathize with the poor business environment, we’d get more optimistic about the company if numbers could justify a surprise on near-term results, which seems highly unlikely given the monthly data release.

Why our expectations remain limited on ANGI

With the backdrop of weak metrics for the duration of the year, and softness in near-term results based on preliminary data, we’re backing-off on our assumptions of an immediate turnaround. The scope of competitive risks, and the need to tackle different competitors with a stronger more robust product offering will take time. Not to mention, we anticipate that it will be a while longer before Joey Levin can suddenly pull a rabbit out of a hat. It will take him time to find the right types of deals that can offer some immediate accretive potential to ANGI and IAC.

There’s also the possibility that we are due for a more immediate housing bounce, and efforts to clamp down on inflation start to cool throughout the course of 2023. Ideally, that would be the most optimistic scenario, albeit macro dependent. We’re not certain how the economy will perform. We don’t have that kind of crystal ball, but we are aware that some metrics tied to housing are bound to improve, which is what’s likely to cause various housing sector stocks to buck the trend.

Bottom line – the stock is cheap but cheap for a reason

So even with all the negative data tied to FY ’22 we think softer comps, and a strengthening housing market could be the driver that causes the stock to trend higher assuming gross marketplace volume also gets an uptick in activity. It’s certainly enough to keep us away from shorting the stock or encouraging bears to take positions. The situation is bad, but not so dire that the prospective upside from betting against the stock is necessarily all that attractive. The market has already priced the stock at such a steep discount that any material surprise could cause a short squeeze and trigger an immediate bounce back rally.

In terms of valuation, we find a very low possibility of the firm delivering a material beat on revenue or earnings in FY ‘23. Though ANGI could prove us wrong by surprising us on FY ’23 outlook. We feel like expectations have already adjusted to a point where meeting estimates has become difficult.

When arriving at a valuation we estimate the company will report revenue of $2.05 billion for FY ’23 representing 7.8% y/y sales growth. We then apply a forward sales multiple of 1.25x (industry average among peers) to arrive at a valuation of $2.56 billion, or $5.07 per share, which compares to the consensus price target of $5.33 per share.

Based on the price target alone, the stock has +89% upside from current levels, but the back-drop of weak earnings results, and poor macro keeps us nervous. We’re not all that certain that our estimate is all that achievable if the company has to keep raising pricing on leads in order to offset the drop-off in active service professionals. With user level metrics looking shaky at best, we’d need to see more solid data before getting optimistic on sales/earnings multiple expansion, hence we believe the stock is a hold/market perform.

ANGI is going to do about as well as the other housing stocks, and if the sector doesn’t show signs of meaningful recovery through 2023 then pretty much all bets are off the table even for cheaper value stocks like ANGI in the segment.

[ad_2]