[ad_1]

Jaiz Anuar

Skyworks Solutions, Inc. (NASDAQ:SWKS) is a top producer of semiconductors used in wireless devices such as handsets, medical equipment, vehicles, and routers. SWKS is a leading player in the non-silicon radio frequency market, with a focus on design, manufacturing, and packaging of products like SAW filters, power amplifiers, and integrated front-end modules. SWKS’s key offerings include power amplifiers, filters, switches, and integrated frontend modules that enhance wireless connectivity. The majority of its clientele consists of big smartphone manufacturers, with a growing presence in non-handset applications.

Q1 Results & Outlook

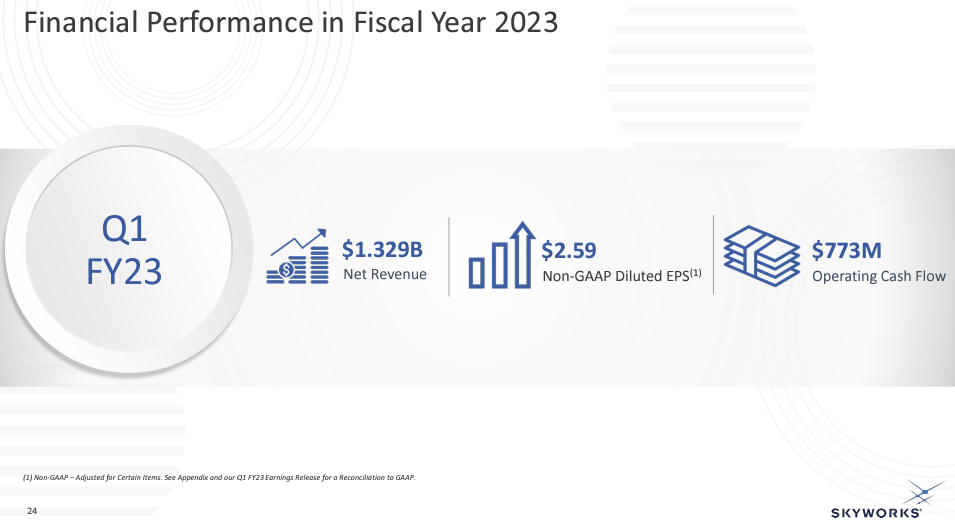

SWKS reported impressive results for the first quarter of the fiscal year, despite a challenging economic environment and a soft demand for smartphones. Despite these factors, SWKS remains a leader in the radio frequency (RF) chip space. SWKS has announced a $2 billion stock buyback, indicating management’s belief that shares are undervalued.

In the December quarter, revenue was $1.329 billion, a 5.5% decrease from the previous quarter and a 12% decrease from the previous year. Mobile revenue was $864 million, a 4% decrease from the previous quarter and a 16% decrease from the previous year. SWKS faced challenges due to iPhone supply issues and inventory corrections among Android-based smartphone customers. However, SWKS saw positive demand for automotive and Wi-Fi chipsets.

Company presentation

For Q2 of fiscal 2023, SWKS expects revenue to be in the range of $1.125 billion-$1.175 billion, a 13.5% decrease from the previous quarter. The adjusted gross margin is expected to dip to 50.0%-50.5%. The decrease in revenue is due to seasonal headwinds and Android inventory adjustments.

Despite these challenges, SWKS is well positioned to succeed in the long term, with potential for growth from 5G RF content gains and design wins in other types of non-smartphone devices.

A Leading Supplier in the Radio Frequency Market

SWKS boasts a strong advantage in the radio frequency (RF) industry with its extensive knowledge and experience in RF design, manufacturing, and integration. As 5G technology advances, SWKS is poised for growth and a larger market share.

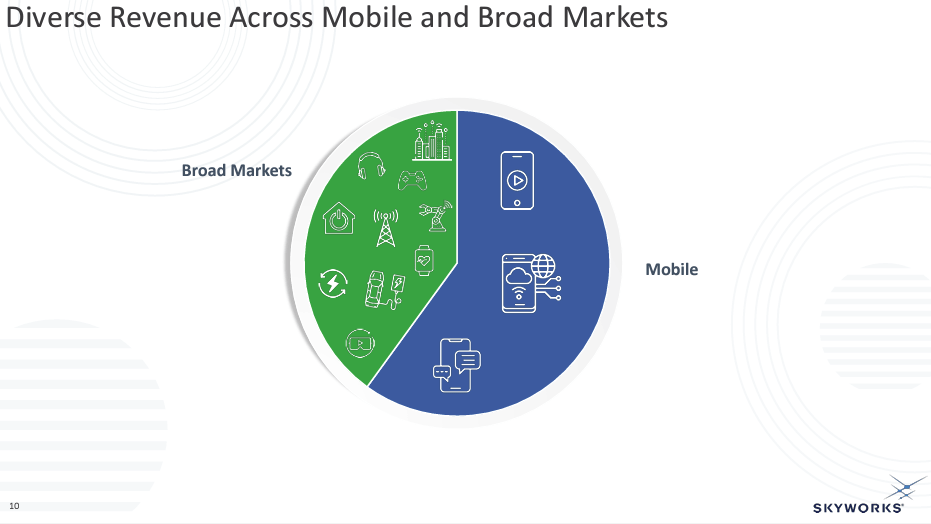

Most of SWKS’s revenue comes from mobile products, particularly RF components that enhance, switch, and filter wireless signals in smartphones. The increasing demand for 5G-enabled devices is leading to exponential growth in RF content per phone, benefiting SWKS and its competitors. With 5G rollouts continuing and 5G devices becoming more complex, SWKS’s expertise in RF components will become even more valuable to device manufacturers. With the increasing number of connected devices, the potential for SWKS to find new industries that require RF chip content also grows.

SWKS is one of the few RF companies capable of supplying hundreds of millions of RF products each year, giving it an edge over new entrants. However, the RF market is highly competitive, and SWKS faces the risk of pricing pressure with Apple (AAPL), accounting for almost two-thirds of its revenue, as a major customer.

Company presentation

SWKS’s expansion into non-handset markets, such as the automotive industry, is positive, but the company’s fortunes are still tied to the wireless industry for the time being. Despite these challenges, SWKS is well-positioned in the RF market and is expected to maintain its growth in the coming years.

The Growth of Semiconductor Demand

The semiconductor industry is expected to experience growth in the medium term due to advancements in technology and the increasing demand for electronic devices, such as mobile devices, IoT devices, and AI technology. The growth of 5G networks, cloud computing, IoT devices, and EVs are expected to drive demand for semiconductors, as well as the expansion of data centers and cloud computing. However, the industry faces challenges such as trade tensions and intense competition, and the impact of pandemic-related disruptions could also impact growth in the medium term. Despite these challenges, the outlook for the semiconductor industry remains positive.

Valuation

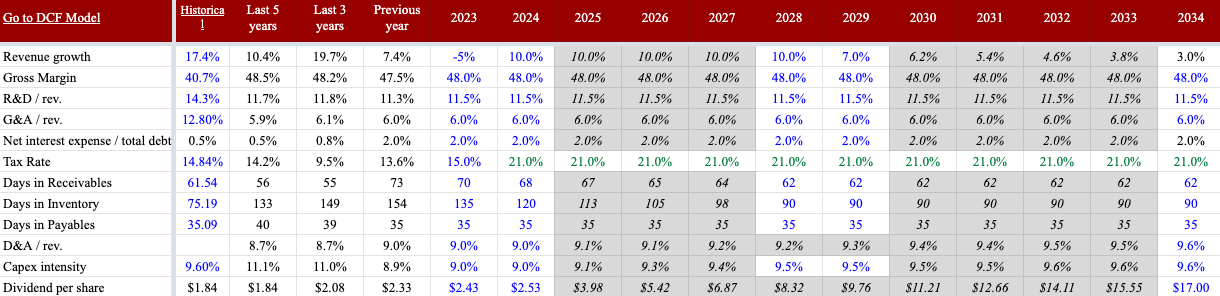

My estimated fair value for SWKS’s stock is $133 per share. My projection shows a 5% decline in sales for fiscal 2023, followed by an annual growth rate of 10% until fiscal 2028, and long-term growth eventually converging to 3%.

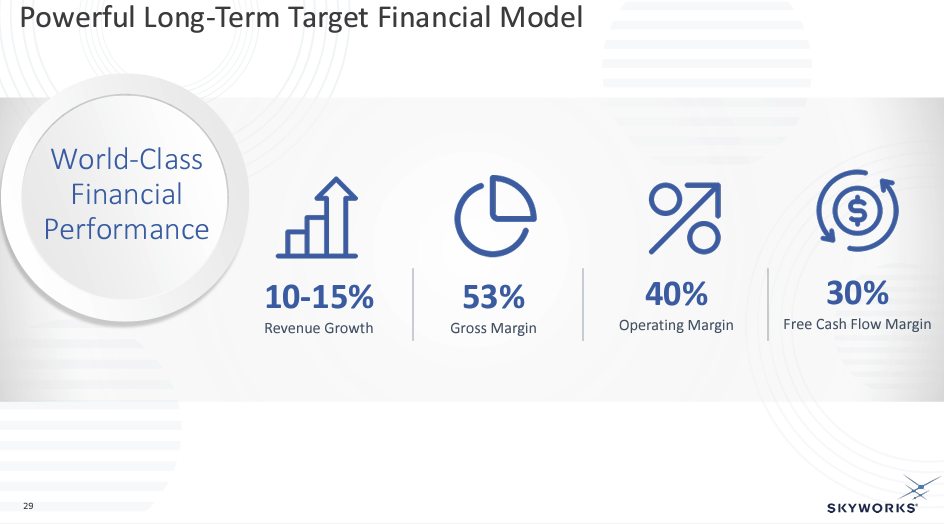

I have considered the following financial assumptions and long-term targets in my analysis. It is worth noting that my projections differ from the high growth expectations outlined by SWKS.

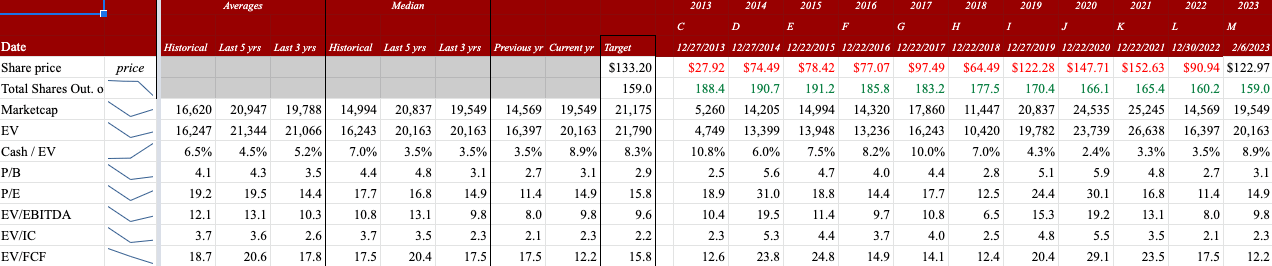

Author estimates & company 10-K filings

Company presentation

At $133 per share, the multiples are within historical ranges as demonstrated below.

Author estimates, company 10-K filings & Seeking Alpha

Risks and Challenges in the Semiconductor Industry

SWKS, like other companies in the semiconductor industry, experiences cyclical changes and relies heavily on a concentrated customer base. Its primary risk lies in its heavy dependence on Apple. A loss of business with Apple could have significant consequences for SWKS.

Moreover, SWKS faces fierce competition in the wireless sector from radio frequency specialists such as Qorvo (QRVO), Broadcom (AVGO), and Qualcomm (QCOM). Even if SWKS maintains its share of design wins, its clients, including Apple and Samsung (OTCPK:SSNNF) (OTCPK:SSNLF), may have significant pricing power that could reduce the profitability of these wins in the long run.

Debt-Free with Strong Financials, Committed to Shareholder Value

SWKS boasts a strong financial status, with a debt-free balance sheet, before acquiring the infrastructure and automotive chip businesses from Silicon Labs in 2021 for $2.75 billion. Despite adding $2.2 billion in debt, SWKS still holds $0.6 billion in cash and is expected to easily cover the debt obligations through its strong free cash flow.

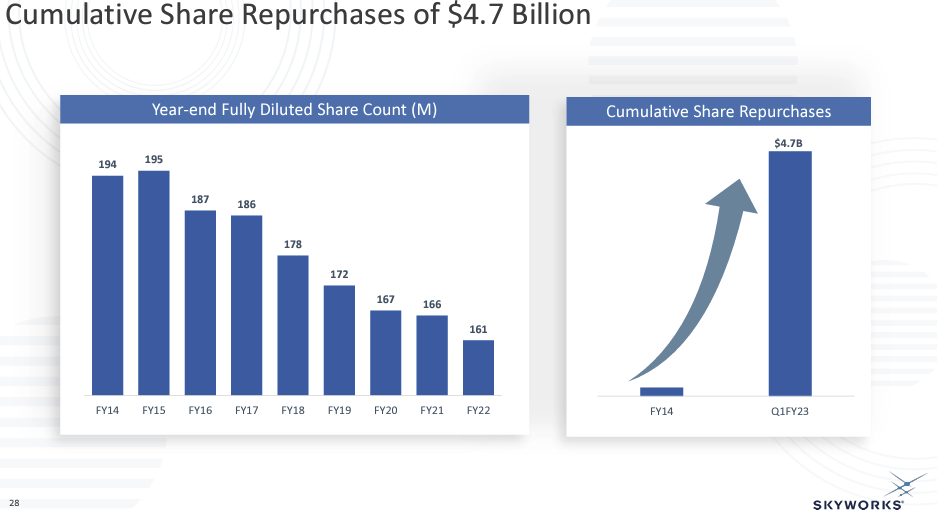

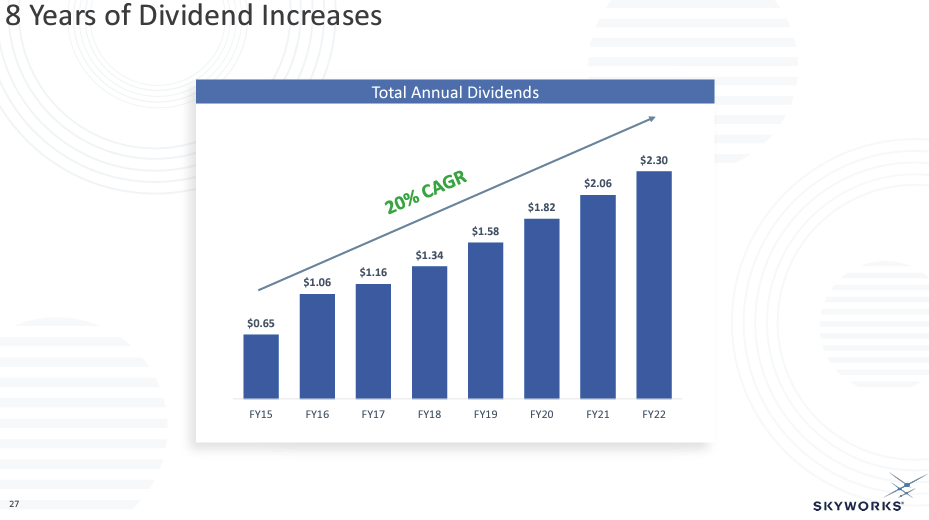

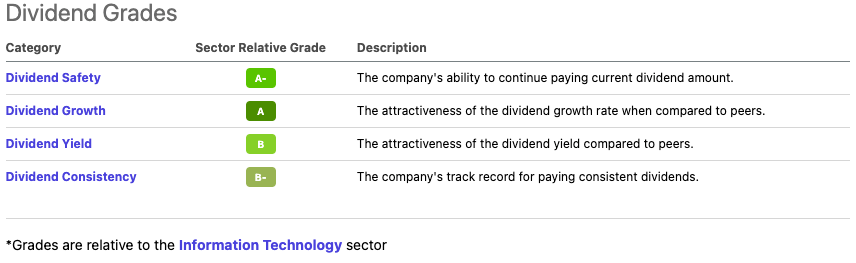

Since 2015, SWKS has reduced its share count by 17% and has shown a consistent commitment to returning value to shareholders through both share buybacks and increasing dividends by 20% annually. This commitment has earned SWKS an excellent dividend score and a 2.16% yield, as evaluated by Seeking Alpha’s Quant Ratings.

Company presentation Company presentation Seeking Alpha

Conclusion

SWKS is a leading player in the non-silicon radio frequency market, with a focus on the design, manufacturing, and packaging of products for wireless devices. Despite facing challenges in the first quarter of the fiscal year due to iPhone supply issues and inventory corrections among Android-based smartphone customers, SWKS remains well-positioned in the RF market and is expected to maintain its growth in the coming years. The growth of 4G and 5G networks, which use a wider range of spectrum frequencies, presents opportunities for SWKS to expand its offerings. The semiconductor industry is expected to experience growth in the medium term due to advancements in technology and increasing demand for electronic devices, such as mobile devices, IoT devices, and AI technology.

After the earnings release, the share price increased from $109 to almost $123. However, my fair price of $133 still offers an 8% upside. I would recommend exposure to such a high-quality company with slightly undervalued shares.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]