[ad_1]

Rasi Bhadramani/iStock via Getty Images

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on February 14th, 2023.

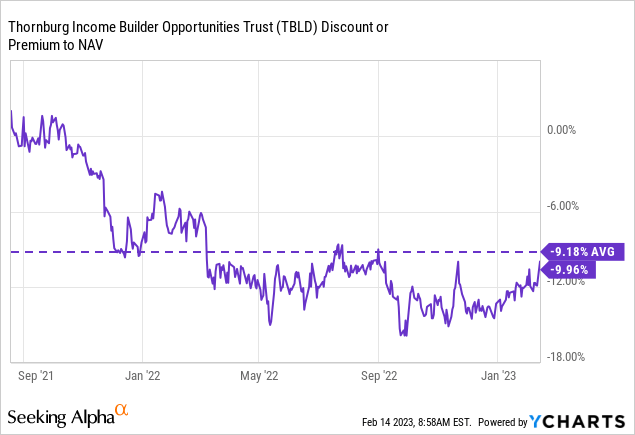

Thornburg Income Builder Opportunities Trust (NASDAQ:TBLD) launched in the middle of 2021. Despite the broader declines we’ve seen across asset classes, the fund has held up relatively well in terms of its portfolio. However, as we often see with new closed-end funds coming to market, they move to large discounts. TBLD is no different. In fact, most CEF discounts widened out during 2022 after being historically narrow through 2021. For TBLD, it could present an attractive entry for investors considering a hybrid fund with significant flexibility in its investment.

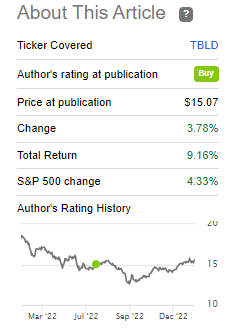

Since our last update, the fund has performed quite well. The S&P 500 Index isn’t a direct benchmark, but it can give us a broader idea of how the market overall has performed. In this case, TBLD’s total returns have exceeded that of the broader market since the update.

TBLD Performance Since Prior Update (Seeking Alpha)

Some of this came from a slight narrowing of the fund’s discount, but overall recovery in the underlying portfolio was a driving factor. Due to still being at an attractive discount, I believe it’s still worth taking a look at despite the recovery.

The Basics

1-Year Z-score: 0.91 Discount: 9.96% Distribution Yield: 7.99% Expense Ratio: 1.65% Leverage: N/A Managed Assets: $557.3 million Structure: Term (anticipated liquidation date August 2nd, 2033)

TBLD’s investment objective is “to provide current income and additional total return.” To achieve this, the fund will invest “in a broad range of income-producing securities to include both equity and debt securities of companies located in the U.S. and around the globe. The Trust additionally expects to employ an options strategy to generate current income from options premiums and to improve risk-adjusted returns.”

This leaves the fund entirely flexible to invest in just about anything income-related. 80% of the fund will be invested in income-producing securities “directly or indirectly.” They aren’t restricted to a certain market cap to invest in a company either but lean heavily toward large caps. At this time, those make up 98.3% of the portfolio.

They then mention that the global equity allocation should vary between 50-90% – leaving the debt allocation with the remainder of the portfolio. The fund will typically be more tilted towards equity positions, given the general weightings. The options strategy “will be approximately 10% to 40%” of the notional value of the portfolio.

Being at 10.8% overwritten with the latest options overlay would suggest they are less bearish, as covered calls can be a slightly defensive strategy. Then again, as an income-focused investment, generating option premiums for distributions will be one way to achieve that.

The fund continues to employ no leverage but maintains the flexibility to utilize leverage if they feel there is an opportunity.

While I’m generally positive about the fund, the fund’s expense ratio would initially appear high. The management fee is 1.25%, meaning that’s a large part of the problem. Total expenses of 1.65% include an expense waiver of 0.10%, too, so it would be even worse. They’ve capped themselves for the first two years at 1.65%, meaning this will increase in the future.

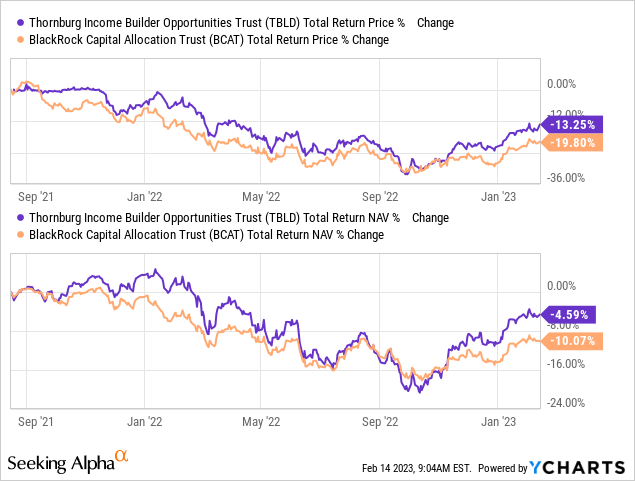

That being said, it isn’t out of the ordinary for these types of flexible funds. BlackRock (BLK), which offers a similar flexible fund through BlackRock Capital Allocation Trust (BCAT), has an expense ratio of 1.63% and also sports a 1.25% management fee.

Performance – Strong Results, Attractive Discount

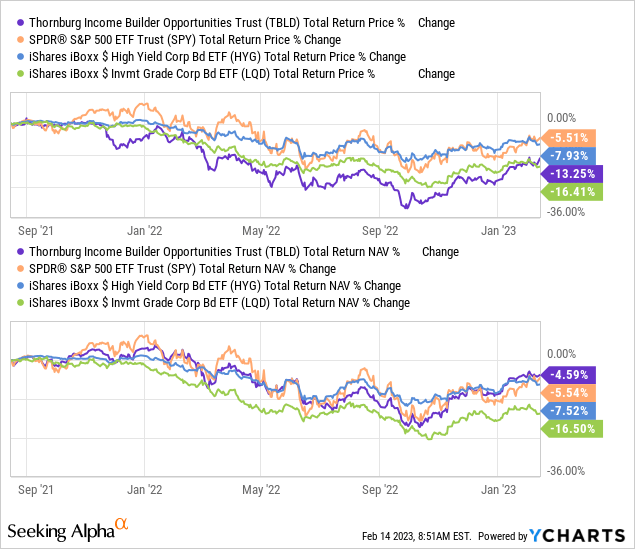

Despite the high fees, the fund’s results have still been fairly strong at the end of the day. On a total NAV return basis, at the time of writing, it has bested the SPDR S&P 500 (SPY), iShares iBoxx High Yield Corporate Bond (HYG) and iShares iBoxx Investment Grade Corporate Bond (LQD).

Being a hybrid fund, some sort of combination of these investments would be appropriate. One of the main differentiating factors here could be the utilization of a call-writing strategy. As a slightly defensive strategy, that could have limited some of the downside. Since the fund came at a time when stocks and bonds took a hit, this could have helped soften the blow.

Ycharts

On the other hand, the total share price returns have fallen well short of its portfolio. It has only topped LQD results on that basis. For CEF investors, that’s precisely where opportunities come from, as that has translated into an attractive discount for the fund. This often happens with newer funds, but as the rest of the market recovers, the fund’s discount has already narrowed.

Ycharts

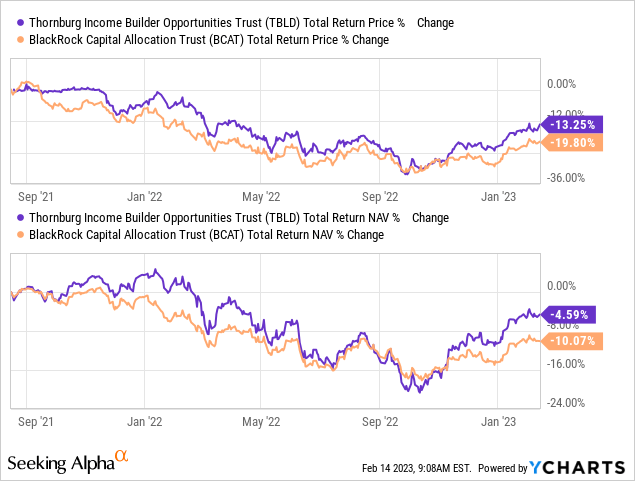

One fund that could be quite similar to the same flexibility that comes to mind is BlackRock Capital Allocation Trust (BCAT).

Ycharts

When comparing the fund to BCAT, TBLD has come out on top. BCAT had been carrying a relatively higher amount in fixed income. BCAT is split about 50/50 at the moment between fixed income and equity. TBLD has favored equity positioning. BCAT was also carrying leverage through 2022, but they have since taken that down to nothing.

Ycharts

Distribution – Income Focus

The fund launched with a monthly distribution of $0.1042 – that’s currently where it is maintained today. It works out to an attractive 7.99% distribution rate. Thanks to the fund’s discount, the underlying portfolio actually only has to earn 7.20% to cover that for shareholders.

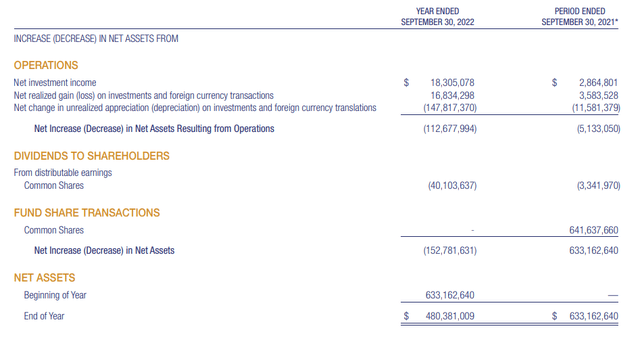

Net investment income coverage came to 45.6% in its first full fiscal year report. This seems to be about right for a hybrid fund that incorporates roughly 33% of its capital in fixed income. We often want to see fixed-income funds cover their distributions by 100%+. With their coverage above the allocation to fixed-income, I see that as a positive.

TBLD Annual Report (Thornburg)

That being said, this is where the higher expense ratio comes to bite as that directly reduces NII left for shareholders. A lower expense ratio would provide both better distribution coverage and better returns over time.

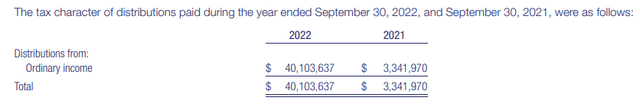

For tax purposes, we have another example of why you need to view distribution coverage and tax classifications as two separate categories. TBLD has identified the entire distribution as ordinary income despite NII above not showing 100% coverage.

TBLD Distribution Tax Classification (Thornburg)

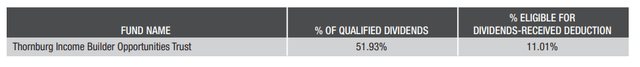

Some good news on this front is that just over 50% of the ordinary income was considered to be qualified dividends. That means more tax-favorable treatment for shareholders. Reducing tax obligations directly impacts investors’ end results. The less you give up to Uncle Sam, the more that is left in your pocket.

TBLD Qualified Distribution Classification (Thornburg)

TBLD’s Portfolio

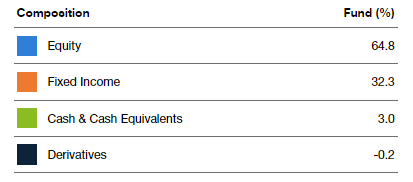

Portfolio turnover in the last year came to 58.30%. That means they are fairly active in buying and selling underlying positions. Broadly speaking, the fund has leaned towards equity positions over fixed-income. This is consistent with what we saw previously when the split was 67.2/29.8%. So we haven’t seen a significant shift since.

TBLD Asset Allocation (Thornburg)

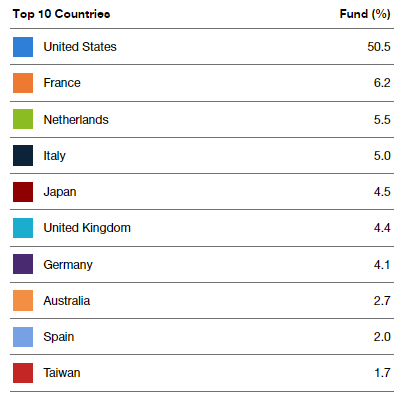

The fund also isn’t afraid to go global. Only around 50% is invested in the U.S.

TBLD Geographic Allocation (Thornburg)

As we mentioned above, the overwhelming majority is also allocated to large-cap companies. This isn’t necessarily a bad thing, and I’d say it’s even expected. As an income-focused fund, they should naturally gravitate towards larger names that are generally more mature and financially stable to offer dividends. The weighted average market cap of the underlying holdings comes to $184.7 billion.

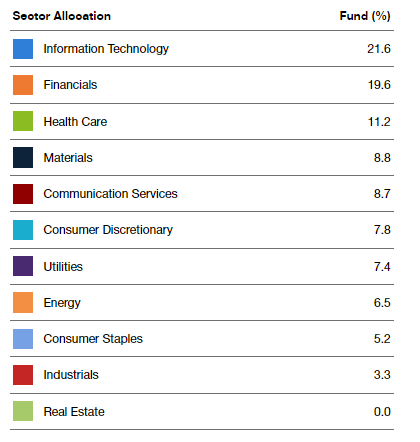

The forward P/E comes to 9.3x, while the trailing P/E comes in at 10.8x. This would indicate they take a value approach. When looking at the sector allocation of the fund, I think that’s a fair assumption. They carry the highest allocation to tech, but following right behind that is a sizeable position in financials. We then see healthcare, materials and communication services.

TBLD Sector Allocation (Thornburg)

However, being a globally focused fund, I believe that explains some of the impacts too. In general, global investments are cheaper than in the U.S. on a P/E basis. Historically, U.S. stocks haven’t always outperformed, but it has been a main theme now for the last decade. At some point, international positions could start outperforming, and a lower valuation could help propel that trend.

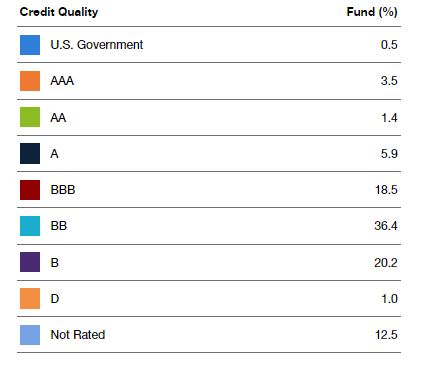

In terms of the fund’s credit quality for the fixed-income sleeve, the fund has favored lower-rated debt. Again, this isn’t anything shocking, as it has really been one of the only ways to generate higher yields for a while now. While rates are rising, it offers another benefit as it generally means lower maturity. Lower maturity means lower duration – a measure of interest rate sensitivity. TBLD’s effective duration comes to 4.6 years.

TBLD Fixed-Income Credit Quality (Thornburg)

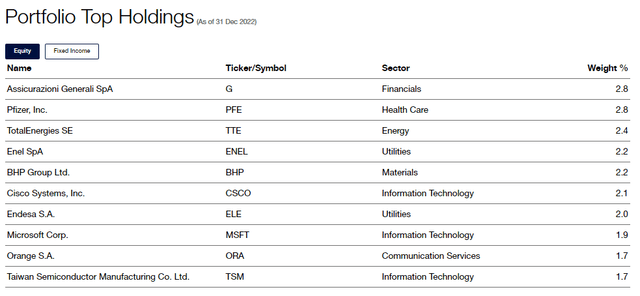

The fund helps reduce risks through diversification. We’ve seen a diversification in the asset class weightings, geographic exposure, sector exposure and credit quality exposure. In total, there are 199 holdings in the fund. With that, the top exposures are fairly small. The top ten equity positions make up 21.8%. We also see a number of global positions that are held within these top holdings.

TBLD Top Equity Holdings (Thornburg)

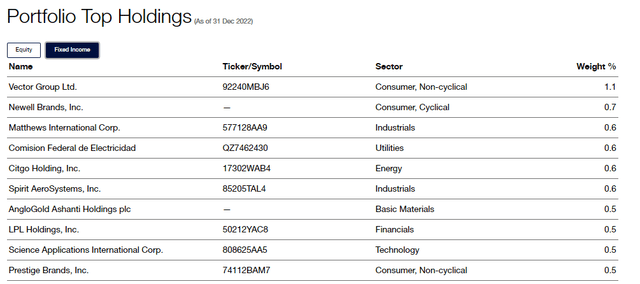

For the fixed-income sleeve, we see even less concentration. I would say this is naturally the case as fixed-income funds tend to diversify out further than equity funds. The fact sheet is a bit dated as it was updated last in Q3 2022, but the split at that time showed 59 equity positions while bonds/others made up 115. The top ten fixed-income positions only comprise 6.2% of the portfolio.

TBLD Fixed-Income Top Holdings (Thornburg)

Conclusion

TBLD continues to trade at an attractive discount, though it may still be too new for some investors. Being a newer fund, it’s hard to try to find where its longer-term range could be. That being said, with the market recovering, TBLD has seen its discount narrow from some of the deepest depths we saw in 2022. The fund is highly flexible, offering exposure to stocks and bonds, as well as a diversified portfolio of sectors, credit qualities and geography.

[ad_2]