[ad_1]

spxChrome/iStock via Getty Images

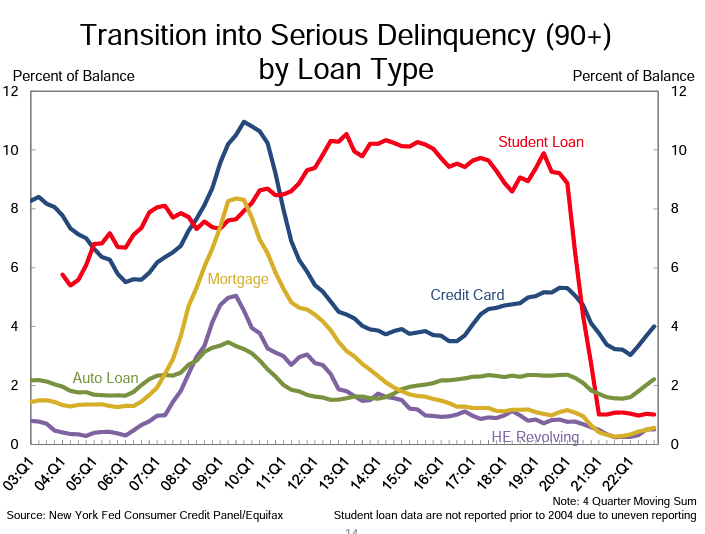

January’s credit card metrics generally show some deterioration in credit quality as consumers deal with the realities of their holiday spending. That means the month’s data are often skewed by seasonal trends. Taking the broader view, yes, the credit quality is trending down as pandemic era stimulus programs have long expired (except for the pause on federal student loan payments).

Baird analyst David George, who covers six of the seven stocks in the table below, summed up January’s credit card metrics, saying net charge-offs were worse than the typical seasonality, seasonal loan balance run-off rate was higher than expected, and delinquencies increased M/M in line with seasonal expectations. The only stock that George doesn’t cover in the Seeking Alpha table is Bread Finanancial (NYSE:BFH).

In the broader picture, card losses continue to approach the “normal” range, that is prepandemic level, which he expects to occur during FY2023, George said. His recommendation on stocks is to wait until American Express (NYSE:AXP) and Capital One (NYSE:COF) pull back before adding to positions.

Discover Financial (NYSE:DFS) saw its January delinquency rate of 2.67% meet the prepandemic level of 2.65%; its net charge-off rate of 2.81% still stays well below 3.45% in January 2020.

Wolfe Research analyst Bill Carcache points out that Discover (DFS) and Bread Financial (BFH) both broke above their 2019 levels. For the five credit card stocks he covers (AXP, COF, DFS, SYF, and BFH), delinquency rates on average rose 99 basis points Y/Y and remain 44 bps below 2019.

He reiterates his Underweight stance in card issuers as Wolfe Research macro strategist Chris Senyek believes the Federal Reserve will trigger a recession as it seeks to cool labor markets.

“We expect delinquency rate formations to continue to rise over the coming months before accelerating later in the year as the long and variable lags associated with monetary policy” eventually drive an increase in initial jobless claims, Carcache said in a recent note. As a result, he expects “modest degradation in credit and higher net charge-offs (30% above 2019 levels, aided by denominator effects as loan growth ultimately slows).”

2023 2022 2020 Company Ticker Type January December November 3-month average January Change in bps Capital One COF delinquency 3.65% 3.43% 3.32% 3.47% 4.10% -45 charge-off 3.81% 3.57% 3.14% 3.51% 4.31% -50 American Express AXP delinquency 1.00% 1.00% 0.90% 0.97% 1.60% -60 charge-off 1.50% 1.20% 1.00% 1.23% 2.30% -80 JPMorgan NYSE:JPM delinquency 0.83% 0.76% 0.73% 0.77% 1.14% -31 charge-off 1.17% 1.24% 1.64% 1.35% 2.19% -102 Synchrony NYSE:SYF delinquency 3.80% 3.70% 3.60% 3.70% 4.50% -70 adjusted charge-off 4.30% 3.40% 3.70% 3.80% 5.20% -90 Discover DFS delinquency 2.67% 2.53% 2.36% 2.00% 2.65% 2 charge-off 2.81% 2.54% 2.46% 2.60% 3.45% -64 Bread Financial BFH delinquency 5.80% 5.50% 5.40% 5.57% 6.00% -20 charge-off 6.70% 6.70% 6.10% 6.50% 7.20% -50 Citigroup NYSE:C delinquency 1.04% 1.01% 0.98% 1.01% 1.58% -54 charge-off 1.50% 1.34% 1.33% 1.39% 2.49% -99 Bank of America NYSE:BAC delinquency 1.09% 1.03% 1.02% 1.05% 1.61% -52 charge-off 1.50% 1.43% 1.33% 1.42% 2.54% -104 Avg. delinquency 2.49% 2.35% 2.29% 2.37% 2.90% -41 Avg. charge-off 2.91% 2.68% 2.59% 2.73% 3.71% -80

The Federal Reserve Bank of New York’s Q4 Household Debt and Credit Report showed that credit card balances reached a new series high at $986B. That spells trouble for when the next recession hits. “It’s triple trouble for credit card borrowers. Balances are up, rates are up and more people are carrying credit card debt (46 percent of credit cardholders, up from 39 percent a year ago),” said Ted Rossman, senior industry analyst at Bankrate.

SA contributor Lance Roberts explains why the consumer is likely to be the biggest loser when recession hits.

[ad_2]