[ad_1]

Brandon Bell/Getty Images News

It took just two days for the whole fallout on SVB Financial Group (SIVB) to go from fundraising announcement to falling into receivership, as its efforts to raise funds went into flames.

According to the Wall Street Journal or WSJ, its book-running manager Goldman Sachs (GS), had lined up a deal worth $95 per share on Thursday afternoon before SIVB fell from grace due to a classic bank run.

Its VC- and startup-focused customers lost confidence in the bank’s ability to remain solvent. Portfolio companies were also advised by VCs to flee, urging them to withdraw their funds and move away from SIVB in a hurry.

In the era of digital banking, customers no longer need to go to the bank to run with their money. As such, the speed of collapse was not seen in modern times, as SIVB called off its fundraising attempt as it sought a buyout.

Not long later, Californian state regulators took control of the bank, appointing the Federal Deposit Insurance Corporation or FDIC as the receiver on Friday. SIVB didn’t have the chance to start Friday’s regular trading session due to a trading halt. As such, the collapse of SIVB has been nothing short of spectacular, as the contagion fears spread to other regional banks, including First Republic Bank (FRC).

Even Wall Street’s leading bank, Bank of America or BofA (NYSE:BAC), wasn’t spared. Market operators were in a broad risk-off mode across financial names. The Financial Select Sector SPDR ETF (XLF) and the KBW Nasdaq Bank Index (BKX) were battered, suffering their worst weekly performance in recent memory.

But why BAC? Notably, BAC fell 16% from its weekly highs to lows before recovering slightly to close the week. It continued the pullback from its February highs as investors assessed the extent of the fallout.

With a reported $2.42T in total assets for the year ended 2022, BAC is in second place behind JPMorgan’s (JPM) $3.2T asset base.

Why were investors so worried about a leading, highly-regulated, well-diversified bank led by a competent management team?

Let’s see. According to BofA’s 10-K, the bank had about $1.2T in commercial credit exposure at the end of 2022. Moreover, that exposure was well-diversified, with only “asset managers and funds” accounting for more than 10% of its $1.2T exposure.

It was also well-diversified across multiple sectors and industries, helping to reduce its concentration risks, as BofA emphasized: “[Our] risk management framework is in place to manage industry concentrations and provide ongoing monitoring.”

We gleaned that software and services accounted for just 2.14% of its exposure. Tech hardware and equipment took up another 2.49%. Pharma and biotech accounted for another 2.18%. Adding these three industries gives us a total exposure of 6.81%.

Hence, BofA didn’t have the inherent concentration risks seen in SIVB’s framework.

Now, onto that available-for-sale or AFS and held-to-maturity or HTM securities. Raging Capital Ventures discussed this in a series of tweets in January 2023, indicating how risky SIVB’s portfolio was laden with low-yield, long-duration portfolios bought at the “generational top in the bond market.”

However, as the Fed’s unprecedented hiking rampage unfolded, SIVB was caught off-guard, taking huge unrealized losses against its holdings.

However, SIVB wasn’t the only bank that faced the challenge of “[aligning] its deposits with their investments.” Notably, banks are now laden with $620B in unrealized losses on AFS and HTM securities in Q4’22.

Hence, we believe the critical concerns investors have, as they sold off bank stocks last week, were likely whether “there may be other banks with looming issues if their deposits go down.”

It’s a valid concern; even BAC suffered losses in its AFS and HTM portfolio. Accordingly, BofA took an accumulated net unrealized loss of $3.5B on its AFS securities.

However, based on its amortized cost of $225.49B, the loss ratio of 1.55% is relatively manageable. Notwithstanding, it took a $108.6B gross unrealized loss on its HTM securities in 2022, compared to just $12.96B in 2021. Hence, it’s clear that even BAC wasn’t immune to the Fed’s rapid rate hikes.

Yet, BofA was confident in its earnings potential, as we highlighted in our previous article.

Hence, it doesn’t appear that BofA is facing an impending risk of being forced to realize those losses. UBS Chief Investment Officer Americas Solita Marcelli also articulated:

The SIVB situation is unique. While there are significant unrealized losses in “available for sale” and “held to maturity” securities portfolios across the banking industry due to higher interest rates, the pressure to sell these securities and realize the losses appears to be unique to SIVB—at least for now. – Marcelli’s LinkedIn

As such, the contagion seems limited to SIVB for now. Of course, no one can predict who’s next in line, but BofA doesn’t seem to be on the chopping block.

Yet, with the market in a risk-off mood, BAC will unlikely escape from the line of fire unscathed, as investors toggle on their “sell first, ask questions later” fearful mentality again.

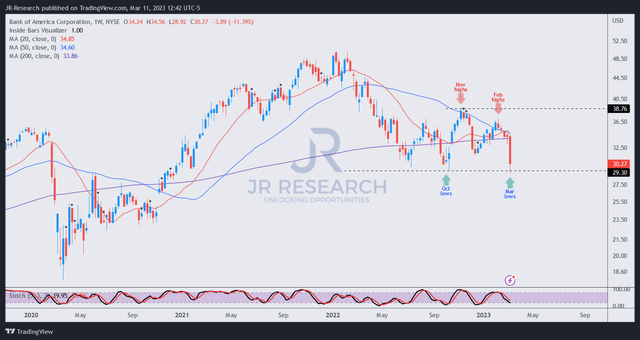

BAC price chart (weekly) (TradingView)

BAC NTM earnings multiple has dropped to 8.8x after last week’s selloff, just ahead of the two standard deviation zone under its 10Y average.

In other words, BAC looks attractive again.

Also, it re-tested its October lows and appears to be supported by buyers who returned late last week.

Hence, a buying opportunity is possible, coupled with an attractive valuation. With BAC, we consider it a core buying opportunity rather than a speculative one. Despite that, the price action for a timely entry has not been validated.

However, investors can still consider buying ahead of price action validation, anticipating a recovery from these levels. But, we must remind investors about the potential contagion from the SIVB collapse could spread if the Fed and the FDIC do not arrive at a viable solution to contain the fallout. Pershing Square founder Bill Ackman expects more bank runs to happen on Monday, leading to more potential failures. At this point in time, Bloomberg reported that a government bailout is in discussion as a backstop against more bank failures.

The risk of further financial instability is increasing, and BAC will not likely not be spared from such an event.

Hence, investors must carefully assess the opportunity in BAC, even though we think it looks attractive relative to its market leadership and diversification.

Rating: Buy (Reiterated).

Note: Investors are reminded to do their own due diligence and not rely on the information provided as financial advice.

[ad_2]