[ad_1]

Published on March 15th, 2023 by Aristofanis Papadatos

A few days ago, the stock of Silicon Valley Bank (SVB) collapsed. Due to fast-rising interest rates, the bank incurred material losses in the bonds it had purchased when interest rates were depressed. In order to cover its losses, the bank issued new shares. Under normal conditions, the bank would easily cover its paper losses and retrieve them upon the maturity of its bonds. However, most of its depositors were venture capitalists and technology startups, who panicked on the news, and thus they withdrew excessive amounts from the bank. They essentially triggered a bank run, and hence Silicon Valley Bank failed.

The collapse of Silicon Valley Bank caused a massive sell-off of the entire financial sector, as investors feared that most banks have incurred paper losses due to rising interest rates and thus they may follow the path of Silicon Valley Bank. Regional banks were particularly hit, as they were considered more vulnerable to a potential bank run.

However, the Federal Deposit Insurance Corporation (FDIC) will not allow panic to prevail in the entire financial system. This means that the stocks of banks with solid fundamentals have been punished to the extreme by the market. This is the definition of the emergence of rare investing opportunities. This article will discuss the prospects of 10 regional banks, which have solid business fundamentals and have become exceptionally attractive after the recent sell-off. We have ranked the banks in order of expected 5-year annual total return, from lowest to highest.

You can download your free copy of the Dividend Champions list, along with relevant financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the link below:

Table of Contents

You can instantly jump to any specific section of the article by using the links below:

Regional Bank #10: Cullen/Frost Bankers (CFR)

The roots of Cullen/Frost Bankers go back to 1868 when Frost Bank was established in San Antonio, Texas, where T.C. Frost provided Texans with the supplies they needed to prosper on the frontier. In 1977, Frost merged with Houston-based Cullen Bankers to become Cullen/Frost Bankers. The company operates over 170 branches and 1,700 ATMs in Texas metropolitan areas, where the community-oriented bank serves individuals and local businesses. The Bank offers consumer and commercial loans, investment management services, mutual funds, insurance, brokerage, and leasing.

Cullen/Frost has been consistently growing its earnings per share over the last decade, with just slight declines in 2013, 2015, and 2019. The company has grown its earnings per share by 9.8% per year on average over the last decade. Its earnings per share decreased by 25% in 2020 due to the pandemic but recovered strongly in 2021.

Cullen/Frost generates most of its revenue from net interest income. Depressed interest rates have provided a headwind for years, but the Fed has been raising them aggressively since last year. We thus expect blowout earnings per share this year and 1% average annual growth beyond this year due to a high comparison base.

Thanks to its disciplined business model, Cullen/Frost has proved resilient to downturns, including the Great Recession. The bank incurred just a 14% decrease in its earnings per share in 2009 and kept growing its dividend, in contrast to most banks.

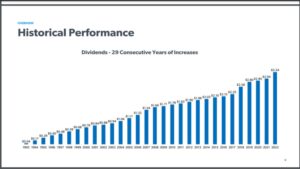

Cullen/Frost has raised its dividend for 29 consecutive years.

Source: Investor Presentation

The stock is currently offering a 3.1% dividend yield. Given the healthy payout ratio of 32% of the stock and its defensive business model, its dividend has a wide margin of safety.

Based on expected earnings per share of $11.00 this year, Cullen/Frost is trading at a 10-year low forward price-to-earnings ratio of 10.1, which is lower than our assumed fair earnings multiple of 14.0 of the stock. If the stock trades at its average valuation level in five years, it will enjoy a 6.7% annualized gain in its returns. Given also the 3.1% dividend of the stock and 1.0% growth of earnings per share, Cullen/Frost can offer a 10.3% average annual total return over the next five years.

Click here to download our most recent Sure Analysis report on Cullen/Frost Bankers (CFR) (preview of page 1 of 3 shown below):

Regional Bank #9: Farmers & Merchants Bancorp (FMCB)

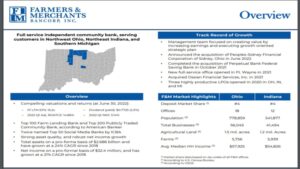

Founded in 1916, Farmers & Merchants Bancorp is a locally owned and operated community bank with 32 locations in California. Due to its small market cap ($773 million) and its low trading volume, it passes under the radar of most investors. Nevertheless, F&M Bank has paid uninterrupted dividends for 87 consecutive years and has raised its dividend for 58 consecutive years. As a result, it is a Dividend King.

The company is conservatively managed and, until seven years ago, had not made an acquisition since 1985. However, in the last seven years, it has aggressively pursued growth.

Source: Investor Presentation

It acquired Delta National Bancorp in 2016 and increased its locations by 4. Moreover, in late 2018, it acquired Bank of Rio Vista, which has helped F&M Bank to further expand in the San Francisco East Bay Area.

Before 2018, F&M Bank grew its earnings per share at a 10-year average annual rate of 2.2%. As the Fed has raised interest rates aggressively since last year and the bank has only recently begun to pursue growth more aggressively, we expect a 9% growth of earnings per share this year and a 5.0% annual growth of earnings per share beyond this year. The new branch in Oakland will be a contributor to growth, which opened in the fourth quarter of 2021.

F&M Bank is a prudently managed bank that has always targeted a conservative capital ratio. The bank currently has a total capital ratio of 13.1%, which results in the highest regulatory classification of “well capitalized.” Moreover, its credit quality remains exceptionally strong, as its portfolio has extremely few non-performing loans and leases.

The merits of this strategy were on display during the Great Recession. While most banks incurred a collapse in their earnings, F&M Bank reported a modest 9% decrease in its earnings per share and kept raising its dividend. The stock is currently offering a 1.6% dividend yield, with a payout ratio of only 16%. Thus, its dividend will remain on the rise for many more years.

Based on expected earnings per share of $105.00 this year, F&M Bank is trading at a forward price-to-earnings ratio of 9.8, which is lower than our assumed fair earnings multiple of 12.0 of the stock. If the stock trades at its fair valuation level in five years, it will enjoy a 4.2% annualized gain in its returns. Given also the 1.6% dividend of the stock and 5.0% growth of earnings per share, F&M Bank can offer a 10.7% average annual total return over the next five years.

Click here to download our most recent Sure Analysis report on Farmers & Merchants Bancorp (FMCB) (preview of page 1 of 3 shown below):

Regional Bank #8: Republic Bancorp (RBCAA)

Republic Bancorp is a financial holding company headquartered in Louisville, Kentucky, providing traditional and non-traditional banking products to its customers. It has 42 full-service banking centers in five states, with most of the centers in Kentucky. The bank offers savings, checking and money market accounts while it also originates residential mortgage loans, home equity loans, commercial real estate loans, credit lines and offers personal and business banking services.

Republic Bancorp is characterized by conservative management focused on maintaining pristine credit quality metrics. Non-performing loans are only 0.37% of total loans, while net loan charge-offs are only 0.01% of total loans. Thanks to its prudent strategy, the company has proved resilient to recessions. In the Great Recession, Republic Bancorp continued growing its earnings and dividend, in sharp contrast to most banks. The bank has proved resilient throughout the pandemic as well.

The conservative strategy of Republic Bancorp results in slower growth during boom times but much more reliable performance during downturns. This is the key behind the strong dividend growth record of Republic Bancorp, which has raised its dividend for 22 consecutive years. The stock is currently offering a 10-year high dividend yield of 3.7%. Given its solid payout ratio of 33% and its defensive business model, the bank can keep raising its dividend for many more years.

Republic Bancorp has exhibited a solid performance record over the last decade. It has grown its earnings per share at a 15.9% average annual rate over the last decade and at a 12.9% average annual rate over the last five years. The bank is trying to grow by expanding its reach via digital channels and acquiring smaller peers, while it is also doing its best to reduce its operating costs. Nevertheless, due to a somewhat high comparison base formed this year amid high-interest rates, we prefer to assume just a 3.0% growth of earnings per share over the next five years, in order to be on the safe side.

Based on expected earnings per share of $5.95 this year, Republic Bancorp is trading at a nearly 10-year low forward price-to-earnings ratio of 9.0, which is lower than the 7-year average earnings multiple of 11.5 of the stock. If the stock trades at its average valuation level in five years, it will enjoy a 5.0% annualized gain in its returns. Given also the 3.7% dividend of the stock and 3.0% growth of earnings per share, Republic Bancorp can offer an 11.1% average annual total return over the next five years.

Click here to download our most recent Sure Analysis report on Republic Bancorp (RBCAA) (preview of page 1 of 3 shown below):

Regional Bank #7: Community Trust Bancorp (CTBI)

Community Trust Bancorp is a regional bank with 84 branch locations in 35 counties in Kentucky, Tennessee, and West Virginia. It is Kentucky’s second-largest bank holding company, with a $5.5 billion balance sheet. Due to its small market capitalization, it does not belong to the S&P 500 index and hence it is not considered a Dividend Aristocrat even though it has raised its dividend for 42 consecutive years.

The key competitive advantage of Community Trust Bancorp is its disciplined and conservative management. Its business model results in slower growth during boom times but in resilient performance during recessions. In the Great Recession, Community Trust Bancorp remained profitable and kept raising its dividend.

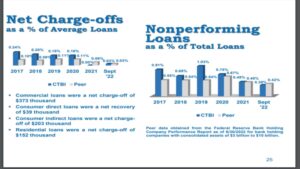

The recession from the pandemic in 2020 caused an 8% decrease in the earnings per share of Community Trust Bancorp, but this business performance is superior to that of most other banks thanks to the conservative loan portfolio. To provide a perspective, the bank has reported average net loan charge-offs of only 0.03% in the last four quarters.

Source: Investor Presentation

Thanks to the recent sell-off, the stock is offering a nearly 10-year high dividend yield of 4.5%. Given its solid payout ratio of 39% and its defensive business model, the company is likely to continue raising its dividend for many more years.

Moreover, Community Trust Bancorp has grown its earnings per share at a 6.4% average annual rate over the last decade and at a 9.5% average annual rate over the last five years. The economy has recovered from the pandemic, and the Fed has raised interest rates aggressively in recent quarters. Higher interest rates have enhanced the net interest margin of the bank, but they have caused deceleration of the economy, as intended. Moreover, the non-recurring decreases in the bank’s tax rate, which fueled a great portion of the bottom-line growth in 2018 and 2019, will no longer be growth drivers. As a result, we expect slower growth in the upcoming years. We expect Community Trust Bancorp to grow its earnings per share at a 2.0% average annual rate over the next five years.

Based on expected earnings per share of $4.55 this year, Community Trust Bancorp is trading at a forward price-to-earnings ratio of 8.6, which is much lower than our assumed fair earnings multiple of 12.0 of the stock. If the stock trades at its fair valuation level in five years, it will enjoy a 7.0% annualized gain in its returns. Given also the 4.5% dividend of the stock and 2.0% growth of earnings per share, Community Trust Bancorp can offer a 12.5% average annual total return over the next five years.

Click here to download our most recent Sure Analysis report on Community Trust Bancorp (CTBI) (preview of page 1 of 3 shown below):

Regional Bank #6: Enterprise Bancorp (EBTC)

Enterprise Bancorp was formed in 1996 as the parent holding company of Enterprise Bank and Trust Company, referred to as Enterprise Bank. Enterprise has 27 full-service branches in the North Central region of Massachusetts and Southern New Hampshire. The company’s primary business operation is gathering deposits from the general public and investing in commercial loans and investment securities.

Enterprise has an outstanding performance record, as it has remained profitable for 133 consecutive quarters. This is a testament to its prudent management and its focus on sustainable long-term growth. The bank has grown its earnings per share at an 11.1% average annual rate over the last decade and has grown its earnings per share in all but two years throughout this period.

Enterprise opened a new branch in North Andover in January 2021 and its 27th branch in Londonderry, New Hampshire, in May 2022. While opening two new branches is not significant for most banks, it is important for Enterprise, as it has increased its branch count by 8%. Moreover, the Fed is raising interest rates aggressively in an effort to keep inflation under control. It will thus enhance the net interest margin of Enterprise. Thanks to these tailwinds, we expect Enterprise to grow its earnings per share by 8% this year and by 3% per year beyond this year.

Thanks to its disciplined management, Enterprise has grown its dividend for 29 consecutive years. During the last decade, the bank has grown its dividend at a 6.6% average annual rate. The stock is currently offering a nearly 10-year high dividend yield of 2.9%, with a healthy payout ratio of 24%. It is thus likely to keep raising its dividend for many more years.

Based on expected earnings per share of $3.80 this year, Enterprise is trading at a forward price-to-earnings ratio of 8.4, which is much lower than our assumed fair earnings multiple of 12.0 of the stock. If the stock trades at its fair valuation level in five years, it will enjoy a 7.3% annualized gain in its returns. Given also the 2.9% dividend of the stock and 3.0% growth of earnings per share, Enterprise can offer a 12.8% average annual total return over the next five years.

Click here to download our most recent Sure Analysis report on Enterprise Bancorp (EBTC) (preview of page 1 of 3 shown below):

Regional Bank #5: Prosperity Bancshares (PB)

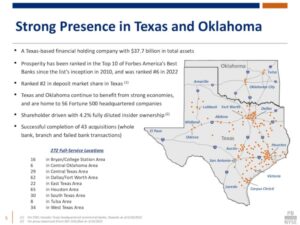

Prosperity Bancshares was formed in 1983 to acquire the former Allied Bank – chartered in 1949 as the First National Bank of Edna, Texas, now known as Prosperity Bank. The bank’s main operation is receiving deposits from the general public and using the capital to originate commercial and consumer loans. Prosperity Bancshares operates 261 branches in the greater Houston area, some neighboring counties in Texas, and 14 more branches in Oklahoma.

Prosperity Bancshares has grown its earnings per share at a 5.1% average annual rate over the last decade, primary thanks to strong economic activity in Texas and Oklahoma. Texas has the fastest-growing population and one of the highest economic growth rates in the nation.

Source: Investor Presentation

It is also expected to outperform most other states in economic growth in the upcoming years. Prosperity Bancshares stalled from 2014 to 2017, but it has reignited growth in the last five years.

In addition, the pandemic has not disrupted the bank’s growth trajectory. Moreover, the Fed has been raising interest rates aggressively since last year, and thus, it will provide a tailwind to the bank’s net interest income. Due to the all-time high expected earnings this year, we expect the bank to grow its earnings per share by 4.0% per year on average over the next five years.

Prosperity Bancshares initiated a quarterly dividend of $0.025 per share in early 1999 and has grown it at a fast clip to $0.55 per quarter. In the last five years, the bank has raised its dividend by 8% per year on average, and it is currently offering a 10-year high dividend yield of 3.5%. Thanks to its low payout ratio (37%) and its promising growth prospects, it should be able to continue raising its dividend meaningfully for many more years.

Based on expected earnings per share of $5.95 this year, Prosperity Bancshares is trading at a 10-year low forward price-to-earnings ratio of 10.4, which is lower than the 10-year average earnings multiple of 14.3 of the stock. If the stock trades at its historical valuation level in five years, it will enjoy a 6.5% annualized gain in its returns. Given also the 3.5% dividend of the stock and 4.0% growth of earnings per share, Prosperity Bancshares can offer a 13.5% average annual total return over the next five years.

Click here to download our most recent Sure Analysis report on Prosperity Bancshares (PB) (preview of page 1 of 3 shown below):

Regional Bank #4: Bank OZK (OZK)

Bank OZK, previously Bank of the Ozarks, is a regional bank that offers services such as checking, business banking, commercial loans and mortgages to its customers in Arkansas, Florida, North Carolina, Texas, Alabama, South Carolina, New York and California. Bank OZK is the largest bank in its home state of Arkansas.

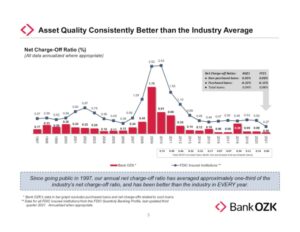

The key competitive advantage of Bank OZK is its exemplary management. The company has proved exceptionally resilient to recessions thanks to its rock-solid business execution, which results in superior asset quality.

Source: Investor Presentation

Thanks to its high asset quality and strong business execution, Bank OZK has raised its dividend for 27 consecutive years. When most banks incurred excessive losses and cut their dividends in the Great Recession, Bank OZK continued raising its dividend. Notably, the bank has raised its dividend in every single quarter since 2010. It is also offering a 3.6% dividend, with an exceptionally low payout ratio of 25%. Therefore, the bank is likely to keep raising its dividend for many more years.

Bank OZK had grown its earnings per share in almost every year since the financial crisis. During the last decade, the company has grown its average earnings per share by 16% per year. Bank OZK has not only been growing organically, but it has repeatedly performed high-return acquisitions. Nevertheless, due to the high comparison base formed by its all-time high expected earnings per share of $5.40 this year, we expect just 3.0% growth of earnings per share going forward.

Based on expected earnings per share of $5.40 this year, Bank OZK is trading at a forward price-to-earnings ratio of 7.0, which is much lower than a typical earnings multiple of 11.0 for a bank. If the stock trades at its fair valuation level in five years, it will enjoy a 9.3% annualized gain in its returns. Given also the 3.6% dividend of the stock and 3.0% growth of earnings per share, Bank OZK can offer a 15.2% average annual total return over the next five years.

Click here to download our most recent Sure Analysis report on Bank OZK (OZK) (preview of page 1 of 3 shown below):

Regional Bank #3: Huntington Bancshares (HBAN)

Founded in 1866 and headquartered in Columbus, Ohio, Huntington Bancshares is a regional bank holding company with $183 billion in assets. The company offers full-service commercial, small business, and consumer banking services through more than 1,100 branches in 11 states.

In contrast to most of the banks discussed in this article, Huntington has exhibited a much more volatile performance record and has proved highly vulnerable to economic downturns. In the Great Recession, Huntington lost significant money and had to take drastic actions. It nearly eliminated its dividend and essentially doubled its share count while its stock price collapsed from $25 to just $1. Earnings per share have not yet reached the pre-recession peak due to the hefty issuance of new shares.

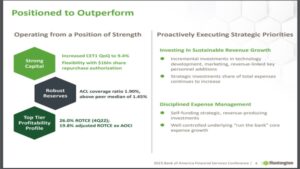

Huntington has grown its earnings per share by 8.5% per year on average over the last decade, partly thanks to a catch up from a terrible performance during the Great Recession. The bank was hurt by the fierce recession caused by the pandemic in 2020, but it has fully recovered from that downturn.

It has also recently improved its credit metrics.

Source: Investor Presentation

As a result, the bank is now well positioned to take advantage of the hikes of interest rates implemented by the Fed. Overall, given the high comparison base formed by the 10-year high earnings expected this year and the vulnerability of Huntington to downturns, we expect the bank to grow its earnings per share at a 2.0% average annual rate over the next five years.

Huntington kept its dividend flat in 2020-2021, so it does not have a dividend growth record. Due to its recent sell-off, the stock is currently offering a 10-year high dividend yield of 5.6%. Huntington has a healthy payout ratio of 39%, but its business performance is somewhat unreliable. As a result, its dividend is not entirely safe. On the other hand, the stock has become markedly cheap.

Based on expected earnings per share of $1.60 this year, Huntington is trading at a 10-year low forward price-to-earnings ratio of 6.9, which is far lower than our assumed fair earnings multiple of 11.0 of the stock. If the stock trades at its fair valuation level in five years, it will enjoy a 9.9% annualized gain in its returns. Given also the 5.6% dividend of the stock and 2.0% growth of earnings per share, Huntington can offer a 15.7% average annual total return over the next five years.

Click here to download our most recent Sure Analysis report on Huntington Bancshares (HBAN) (preview of page 1 of 3 shown below):

Regional Bank #2: M&T Bank (MTB)

M&T Bank is a regional bank with branches in New York, Maryland, Pennsylvania, and West Virginia. It has more than 800 total branches spread out amongst these four states. Almost half of the loan book of the bank is composed of commercial real estate (47% of portfolio), with the remainder of loans consisting of consumer real estate (8%), commercial loans (29%), and consumer loans (16%).

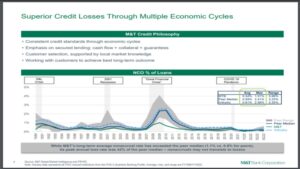

M&T Bank incurred a 43% plunge in its earnings per share in the Great Recession but recovered swiftly in the ensuing years. Since 2009, there have been only two other years (2014, 2020) in which the company did not grow its earnings. This consistent performance is a testament to the disciplined business model of the bank, which is also confirmed by the superior record of the bank with respect to credit losses.

Source: Investor Presentation

M&T Bank has compounded its earnings per share by 7% per year on average over the last decade. Given the somewhat high comparison base formed this year, we expect a 6.0% growth going forward.

Due to its recent sell-off, M&T Bank is currently offering a 10-year high dividend yield of 4.1%. M&T Bank has a healthy payout ratio of 28% and a fairly reliable business model. As a result, its dividend has a wide margin of safety. In addition, the stock has become markedly cheap.

Based on expected earnings per share of $18.30 this year, M&T Bank is trading at a 10-year low forward price-to-earnings ratio of 6.9, which is much lower than our assumed fair earnings multiple of 10.0 of the stock. If the stock trades at its fair valuation level in five years, it will enjoy a 7.6% annualized gain in its returns. Given also the 4.1% dividend of the stock and 6.0% growth of earnings per share, M&T Bank could offer a 16.5% average annual total return over the next five years.

Click here to download our most recent Sure Analysis report on M&T Bank (MTB) (preview of page 1 of 3 shown below):

Regional Bank #1: KeyCorp (KEY)

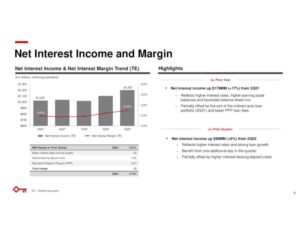

Headquartered in Cleveland, Ohio, KeyCorp has been in business for over 190 years and is now one of the largest bank-based financial services companies in the U.S., with $190 billion in assets. The company operates in 15 states with approximately 1,300 ATMs and 1,000 full-service branches.

KeyCorp has grown its earnings per share by 8.4% per year on average over the last decade. It is also likely to benefit from the aggressive interest rate hikes implemented by the Fed, as its net interest margin seems to be in a sustained uptrend.

Source: Investor Presentation

Nevertheless, due to the high comparison base formed this year, we expect the bank to grow its bottom line by only 4.0% per year on average over the next five years.

It is also important to note that KeyCorp has a much less reliable business model than most of the banks discussed in this article. In the Great Recession, its shareholders incurred devastating losses due to the excessive losses of the company. This is a major reason behind the 33% slump of the stock in the recent sell-off, in just a few days.

Due to its massive sell-off, KeyCorp is currently offering a 10-year high dividend yield of 6.8%. KeyCorp has a decent payout ratio of 41%, but its business performance is unreliable. As a result, its dividend is not safe. On the other hand, the stock has become markedly cheap.

Based on expected earnings per share of $2.00 this year, KeyCorp is trading at a 10-year low forward price-to-earnings ratio of 6.0, which is half the 10-year average earnings multiple of 12.0 of the stock. If the stock trades at its average valuation level in five years, it will enjoy a 14.9% annualized gain in its returns. Given also the 6.8% dividend of the stock and 4.0% growth of earnings per share, KeyCorp could offer a 23.1% average annual total return over the next five years.

Click here to download our most recent Sure Analysis report on KeyCorp (KEY) (preview of page 1 of 3 shown below):

Final Thoughts

The above 10 regional banks have become exceptionally cheap due to the brutal sell-off of the entire financial sector in the last few days. KeyCorp has the highest expected return, but it also has elevated risk due to its inconsistent business performance. We thus believe that the two most attractive stocks are M&T Bank and Bank OZK. These two high-quality companies have proved resilient to downturns thanks to their exemplary managements. We have a strong conviction that these two stocks will offer excessive returns to patient investors off their current levels. We also expect double-digit total annual returns with negligible risk from Prosperity Bancshares, Enterprise Bancorp, Community Trust Bancorp, F&M Bank, all of which have disciplined managements and a high-quality business model in place.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.

[ad_2]