[ad_1]

There was an growing demand for efficient options to handle human assets and preserve enterprise payroll. It has turn out to be extra vital in at the moment’s world the place enterprise leaders are struggling to seek out and retain expertise resulting from unfavorable labor market circumstances and inflationary pressures.

Paychex Inc. (NASDAQ: PAYX), a number one supplier of human capital administration options, is an organization that’s on a mission to make the job of HR managers and CEOs simpler. It helps companies recruit the proper workers and tackle complicated human useful resource points, utilizing superior expertise.

In Development Mode

The New York-based firm maintained secure earnings and income efficiency throughout the pandemic, aided by the demand created by widespread digital transformation. The corporate has enhanced its market worth prior to now few years — till the latest market selloff performed spoilsport. In 2022, the inventory skilled excessive volatility, although it reached an all-time excessive mid-year. However PAYX outperformed the broad market very often throughout that interval.

Learn administration/analysts’ feedback on quarterly outcomes

The shares dropped this week regardless of the corporate reporting optimistic second-quarter outcomes, an indication that the market was anticipating a good higher final result. Nonetheless, they bounced again rapidly from the short-lived dip and maintained the uptrend since then. However that doesn’t make Paychex a dependable funding choice as a result of the excessive valuation is a dampener in the case of creating significant shareholder worth.

Time to Purchase?

That stated, returning money to stockholders has been a precedence for the administration – it repurchased inventory frequently after initiating this system a number of years in the past and raised dividends virtually yearly. Whereas the inventory’s prospects as a long-term funding are encouraging even now, a greater method to method it’s to purchase when the value drops.

The persevering with volatility within the job market and muted enterprise confidence, as a result of financial slowdown, is anticipated to weigh on Paychex’s funds within the foreseeable future, although the latest enchancment on the employment entrance is encouraging. The continued hiring freeze in some sectors and rising situations of company layoffs don’t bode properly for the corporate. Additionally, it’s estimated that enterprises would stay cautious of their spending, involved concerning the Fed’s hawkish stance and looming rate of interest hikes.

From Paychex’s Q2 2023 earnings launch:

“We posted strong monetary outcomes for the second quarter, with development of seven% in complete income and 9% in diluted earnings per share, pushed by our sturdy execution and complete suite of options… We proceed to leverage our modern HR expertise and advisory options to assist employers navigate this difficult setting. We’ve helped greater than 50,000 of our shoppers safe out there authorities funding by way of the Worker Retention Tax Credit score program.”

Q2 Final result

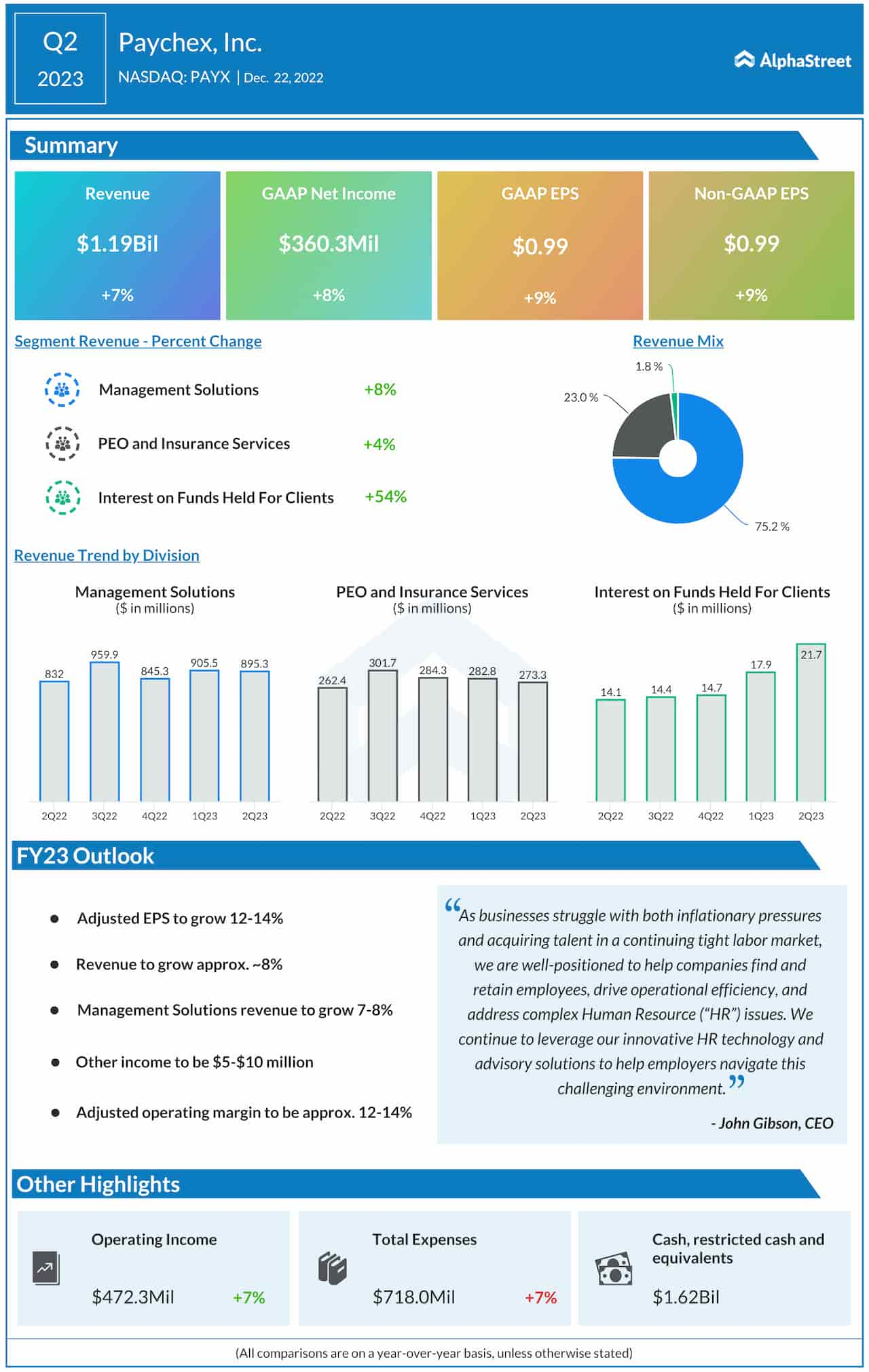

Within the second quarter of 2023, Paychex’s revenues elevated 7% yearly to $1.19 billion, which is according to analysts’ forecasts. All three working segments registered development, driving up adjusted revenue to $0.99 per share. The underside line additionally topped expectations. The administration expects full-year revenues to develop by about 8%.

ACN Earnings: Key quarterly highlights from Accenture’s Q1 2023 monetary outcomes

Shares of Paychex traded barely above $115 throughout Friday’s session, after shedding about 12% this 12 months. It has stayed under the 52-week common for many of this month.

[ad_2]

Source link