[ad_1]

Galeanu Mihai

From Bloated to Purchase

With a possible recession looming, industrial big ABB Ltd. (NYSE:ABB) would possibly appear to be a inventory finest averted. Counter-intuitively, I suggest the precise reverse and counsel ABB as a high decide for lengthy buyers in 2023.

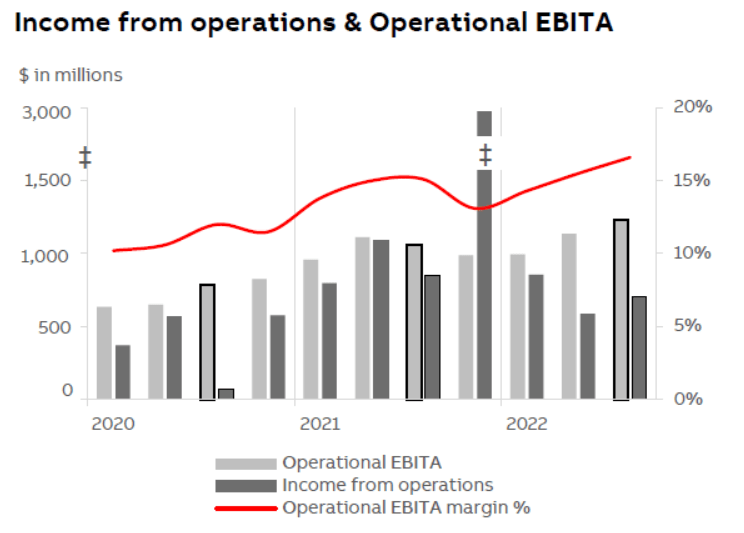

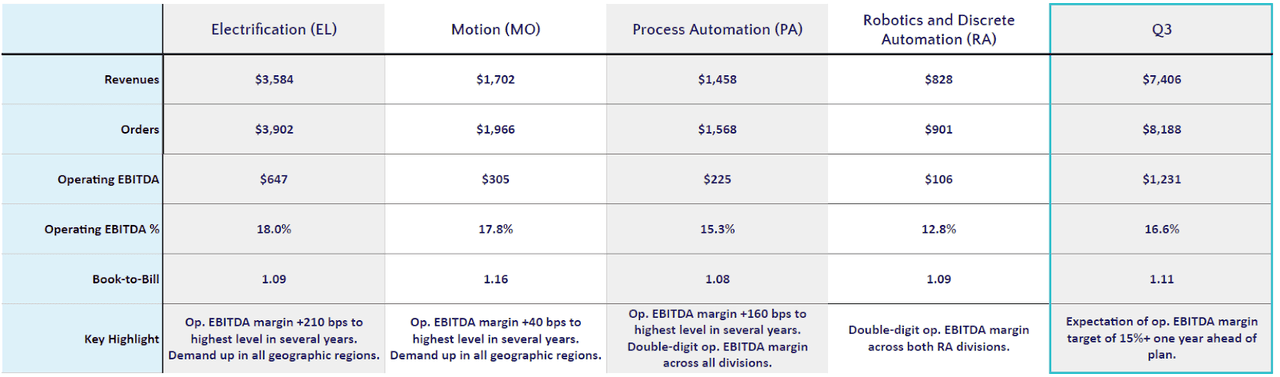

After struggling for years (arguably) with a bloated portfolio of companies and depressed demand through the pandemic, a newly streamlined ABB noticed its working EBITDA margin lately hit a excessive of 16.6% in Q3 FY ‘22.

Determine 1: ABB Working EBITDA Margin (ABB Earnings Launch Q3 FY ’22)

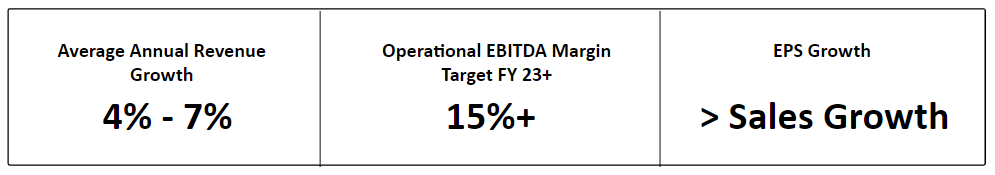

Granted that is merely one, remoted information level, but it surely’s worthwhile noting right here within the introduction that it places administration on monitor to succeed in their long-term EBITDA profitability objective of 15%+ one 12 months early.

Determine 2: ABB Progress Algorithm (Yves Sukhu/ABB Annual Report FY ’21)

And mentioning this reality helps set the stage on this report back to argue that:

1. Administration’s turnaround plan is working.

2. The agency’s product and geographic range, coupled with its positioning to sort out the megatrends of electrification, renewable vitality, and automation, might show resilient even beneath recessionary situations.

3. Shares could also be undervalued on a “sum of the elements” foundation.

Towards the Grain

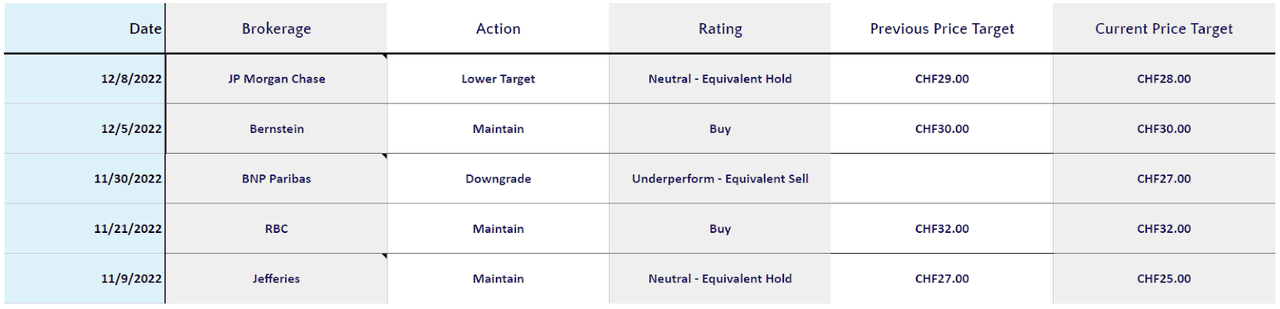

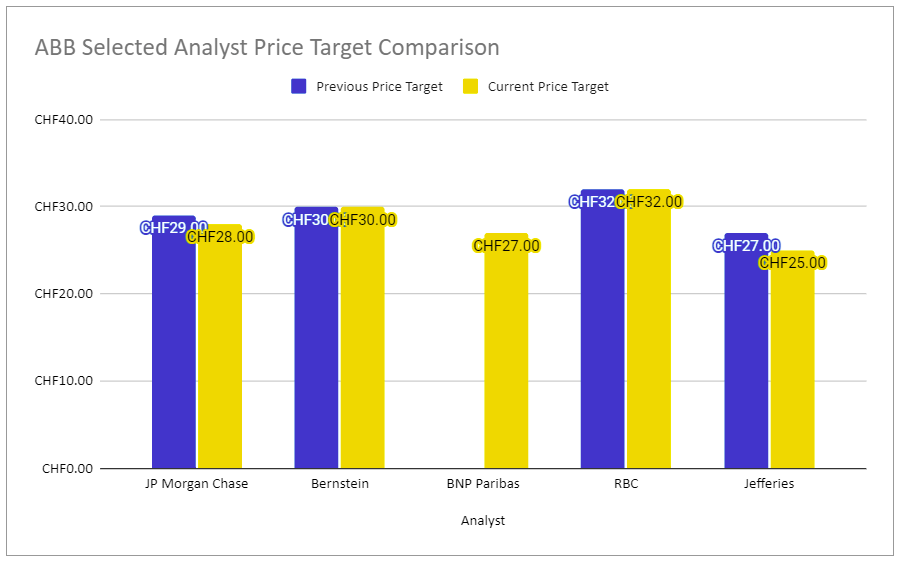

To be clear, my pitch of ABB as a “purchase” heading into the brand new 12 months goes towards the grain of some latest essential evaluation, together with a late November downgrade issued by BNP Paribas to promote shares.

Determine 3: ABB Chosen Analyst Rankings (Yves Sukhu/MarketScreener)

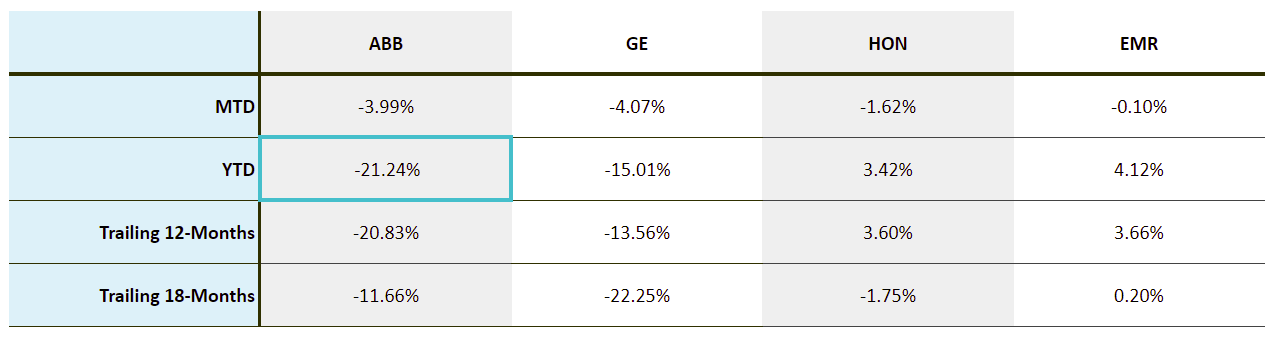

Buyers additionally appear a bit skittish of what might lie forward in 2023, regardless of the rally in shares following the announcement of Q3 outcomes.

Determine 4: ABB and Chosen Competitor Efficiency (Yves Sukhu)

Notes:

Information as of market shut December 23, 2022.

These sentiments are to be anticipated given the overhang of a possible recession, even when I don’t agree.

Indicators of a Turnaround: Diving Into Q3 FY ‘22 Outcomes and Trying Out to This fall

As readers know, 1H FY ‘22 was a turbulent interval for ABB, with the agency battling supply-chain bottlenecks and strict COVID-19 lockdowns in China. Issues in China had been felt throughout ABB’s 4 working segments of Electrification (“EL”), Movement (“MO”), Course of Automation (“PA”), and Robotics and Discrete Automation (“RA”); however they hit RA particularly exhausting. Nonetheless, with supply-chain shortages easing and China re-opening its financial system, Q3 efficiency was usually wonderful (with quotes under from ABB’s Earnings Launch Q3 FY ‘22):

Group income of $7.4B was up 18% year-over-year (“YoY”) on a comparable foundation. Americas and Europe geographic areas “led the way in which”, rising 23% and 18% respectively on a comparable foundation; with robust sequential progress in the US, Spain, Italy, and the UK. Whole gross sales of $21.6B for the 9 month interval ending September 30 mirrored comparable progress of 10%.

Orders of $8.2B grew 16% on a comparable foundation. EL and MO order progress outpaced PA and MO, rising 20% and 24% respectively on a comparable foundation. “[PA] was hampered by a excessive [prior period] comparable and timing of [new orders]. [“RA”] noticed protracted lead occasions in clients’ resolution making.” Even so, PA and RA orders grew 3% and seven% respectively on a comparable foundation. On the entire, administration famous “…buyer exercise was sturdy for each the short-cycle stream enterprise and the methods enterprise.”

Order backlog of $19.4B on the finish of Q3 mirrored 35% YoY progress on a comparable foundation.

Group book-to-bill ratio of 1.11. The agency’s book-to-bill ratio mirrored the seventh straight quarter with the metric above 1 signaling continued, wholesome market demand.

Document 16.6% working EBITDA margin. EL, MO, and PA drove the robust group working EBITDA margin efficiency with 18.0%, 17.8%, and 15.3% phase margins respectively – the best outcomes seen in these segments in a number of years. Even RA, which, as talked about, has struggled in FY ‘22, achieved double-digit working margin through the quarter of 12.8%. Administration famous working EBITDA efficiency was pushed by greater volumes, pricing execution, and different operational enhancements which offset uncooked supplies, labor, and freight value inflation.

As ABB’s 2 largest segments, each EL and MO noticed comparable gross sales progress above 20% through the quarter. As evidenced by FY ‘21 and Q3 FY ‘22 information as two examples, EL and MO account for greater than 2/3 of whole gross sales and ~75% of working EBITDA. Each segments posted a robust efficiency, with EL and MO gross sales leaping 22% and 23% YoY respectively on a comparable foundation. MO noticed robust progress in China – a very massive marketplace for the phase – and was the one working phase to understand constructive progress in China throughout Q3.

Adjusted EPS of $0.36/share versus $0.33 within the prior interval. GAAP EPS declined (41%) YoY to $0.19 through the quarter. Nonetheless, web earnings had been impacted by a ($325M) non-operating cost associated to ABB’s settlement of bribery allegations associated to the Kusile Energy Station challenge in South Africa. Including again the cost utilizing ~1.9B shares excellent, adjusted EPS was ~$0.36/share, as in contrast with $0.33 within the prior interval.

Notice: Comparable figures above account for portfolio modifications and forex results. Administration famous the robust greenback launched a (9%) to (10%) headwind through the quarter.

Determine 5 under summarizes Q3 efficiency throughout working segments and for the group.

Determine 5: Abstract of ABB Working Phase Efficiency Q3 FY ‘22 (Yves Sukhu/ABB Earnings Launch Q3 FY ’22)

Notes:

Consolidated group outcomes for Q3 embody intersegment eliminations.

Q3 efficiency, after all, solely displays a cut-off date. Nonetheless, robust orders progress throughout the group, feeding into the practically ~$20B backlog, indicators the “leaner and meaner” ABB – which shed itself of its Energy Grids, Dodge, and turbocharger companies during the last handful of years – is progressing with its turnaround by doubling-down on electrification and automation applied sciences. Furthermore, steering signifies the corporate will exit This fall FY ‘22 in a robust place with administration anticipating:

Low double-digit comparable income progress. Gross sales progress will come towards a troublesome This fall FY ‘21 comparability.

Strongest quarter when it comes to money. ABB exited Q3 with ~$3.5B in money and marketable securities. The agency’s money place can be bolstered in This fall by administration’s resolution on the finish of Q3 to exit the corporate’s remaining 19.9% stake in Hitachi Power for $1.4B. Moreover, administration famous that the largest tie-up in money throughout 1H FY ‘22 was in stock; nevertheless, CFO Timo Ihamuotila famous that stock ranges have normalized. Accordingly, buyers can anticipate the enterprise to complete FY ‘22 with a robust money place.

No further provisions to be made relative to the Kusile Energy Station challenge. CEO Bjorn Rosengren instructed through the Q3 FY ‘22 Earnings Name that the Kusile “matter” is successfully resolved. Nonetheless, Mr. Ihamuotila appeared to trace that the settlement isn’t completely finalized and that there might be future money stream impacts. Maybe an inexpensive investor inference is that the majority of a last settlement quantity was recorded in Q3. Thus, any further impacts in This fall and/or 2023 could also be restricted.

Sequentially decrease working EBITDA margin, however robust sufficient to assist full-year goal of 15%+. Administration famous its historic enterprise sample sees decrease profitability within the fourth quarter. Nonetheless, to reiterate, the group’s robust Q3 efficiency places the enterprise able to hit its full-year goal of 15%+ working EBITDA margin in FY ‘22 – one 12 months forward of plan (see Determine 2).

Whereas ABB’s turnaround journey is much from over, Q3 outcomes and the outlook for This fall counsel the group is “on-the-right-track”, with Mr. Rosengren providing that he thinks “..[ABB has] taken an enormous step…[and thinks the business is]…now coming as much as the proper ranges [of financial performance].”

A Counter-Intuitive Play for 2023

Even when a recession hits subsequent 12 months, that doesn’t essentially indicate all industries can be equally affected, nor that every one geographies can be equally affected. Certainly, ABB’s geographic range, together with its product range, might show resilient even beneath recessionary situations.

On this level, think about EL and MO. As talked about within the final part, EL and MO make up the majority of ABB’s working EBITDA (see Determine 5). Each segments have vital publicity to the buildings and transportation/infrastructure end-markets; and every of those two end-markets is being pushed by sticky traits in “greener” design, vitality effectivity, electrification, and many others. Progressive governments (technologically-speaking) in EL and MO’s largest geographies – specifically Europe, the US, and China – appear “dead-set” on re-architecting their infrastructures and transport methods, regardless of financial situations to a sure extent. For instance, following a lackluster 2022, infrastructure spending in China could also be set to develop considerably in 2023 with the Chinese language authorities seemingly abandoning their long-standing zero-COVID coverage. With the Russia-Ukraine struggle exposing the European Union’s (“EU”) weak spot with respect to vitality, EU governments are set to extend funding for strategic infrastructure tasks to maneuver the continent towards vitality independence. And, after all, local weather change considerations are driving elevated electrification of not solely vehicles, however heavy autos as effectively. It goes with out saying that EL and MO are well-positioned to use these dynamics; and, clearly, a robust efficiency from each companies within the new 12 months will assist the general group.

It appears to me the outlook for PA and RA in 2023 is extra unsure, albeit maybe with room for optimism. Administration indicated they anticipate a greater PA efficiency in This fall, though headwinds emerged in Q3 within the metals end-market on account of excessive vitality costs. But, with good demand in refining, mining, marine, and gasoline throughout the latest quarter, PA might have extra to sit up for within the new 12 months, particularly with respect to energy-related tasks. RA, which cited decrease order progress in Q3 partly on account of longer gross sales cycles, might be set to rebound in This fall and 2023 as clients pull the set off on new orders, significantly with the easing of semiconductor and electronics part shortages. Furthermore, administration is anticipating a stronger RA margin efficiency in This fall, pushed partly by robust improvement within the meals and beverage (F&B) end-market. Logically, the huge F&B market is more likely to proceed pushing extra into automation – even throughout less-than-ideal financial situations – to counteract inflationary results and drive efficiencies.

All in all, it’s cheap to suppose that ABB’s working segments will provide buyers sure countercyclical dynamics throughout a possible 2023 recession. That’s not to say that the enterprise can be proof against macroeconomic headwinds. However, I imagine, utilizing the argumentation above, that the group might show way more resilient than some might imagine.

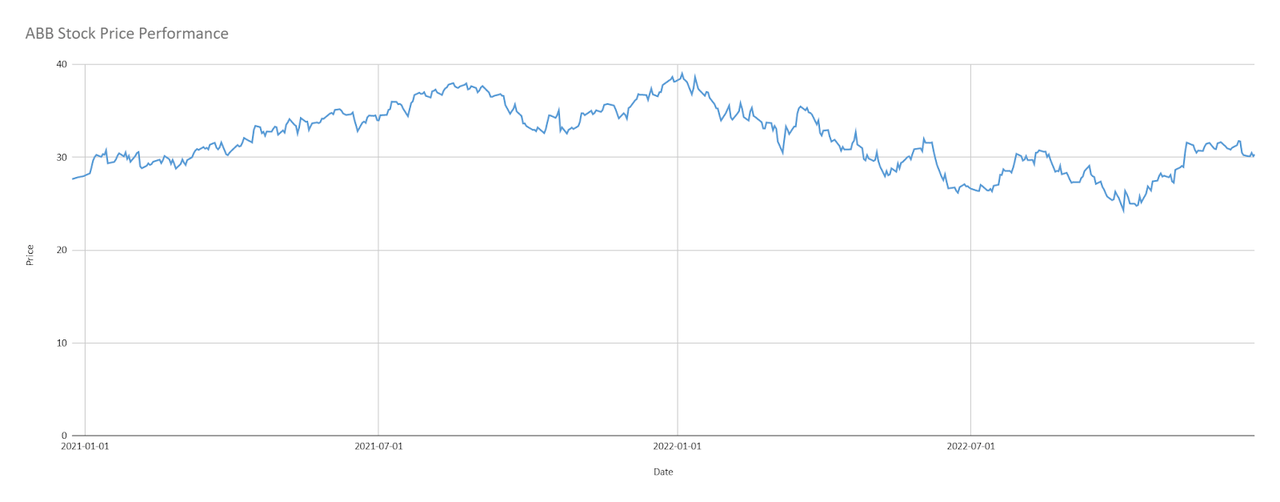

Room to Run

As mentioned earlier, ABB shares rallied following Q3 outcomes and closed at $30.30 on December 23, 2022.

Determine 6: ABB Inventory Value Efficiency (Yves Sukhu)

I famous in my final article on ABB that activist investor Cevian Capital had instructed some time in the past that shares needs to be buying and selling nearer to CHF 35; though that decision got here pre-pandemic, throughout very totally different market situations than proper now. Actually, if the analysts listed in Determine 3 are in the proper ballpark, shares could also be pretty valued proper now based mostly on the typical of CHF 28.40, or $30.44 utilizing a conversion charge of 1 CHF/$1.07 USD.

Determine 7: ABB Chosen Analyst Value Targets (Yves Sukhu/MarketScreener)

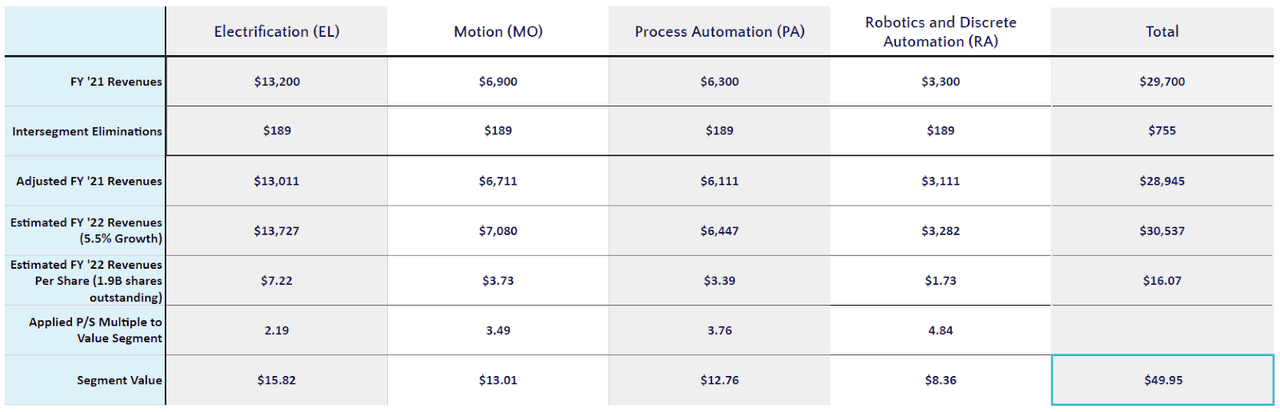

Nonetheless, it does appear that the valuation the market locations on the “entire” of ABB might not pretty mirror the sum of the elements – i.e. a situation the place every working phase was buying and selling as an impartial firm. For instance, let’s think about a easy train the place we assume that Schneider Electrical S.A. (OTCPK:SBGSY), Rockwell Automation (ROK), Emerson (EMR), and Fanuc (OTCPK:FANUY) are proxies for ABB’s EL, MO, PA, and RA companies respectively. Now, let’s take a guess at whole FY ‘22 revenues for every ABB working phase by:

Beginning with whole FY ‘21 gross sales for every phase.

Subtracting an equal quantity from every phase to account for FY ‘21 intersegment eliminations.

Assuming every phase will develop this 12 months by the midpoint income progress goal of 5.5%, implied by the corporate’s progress algorithm in Determine 2, to reach at an estimate of whole FY ‘22 income for every phase.

Subsequent, let’s estimate the worth of every working phase as if it had been an independently traded enterprise utilizing the ahead P/S multiples for every proxy enterprise talked about above and ~1.9B shares excellent. The mannequin seems to be like this:

Determine 8: “Sum of the Elements” Valuation Mannequin (Yves Sukhu)

Notes

“Proxy” ahead P/S multiples utilized to every phase as follows: SBGSY P/S of two.19 utilized to EL; ROK P/S of three.49 utilized to MO; EMR P/S of three.76 utilized to PA; FANUY P/S of 4.84 utilized to RA.

Ahead P/S information for proxy firms from In search of Alpha.

Now, I’m not saying ABB is value ~$50/share as calculated by this simplistic mannequin; and the proxy firms that I chosen are removed from good analogues for every of ABB’s working segments. Slightly, to reiterate, I’m merely saying – and attempting for example through Determine 8 – that it appears to me the market is undervaluing the conglomerate. Furthermore, if ABB’s companies do exhibit countercyclical results in 2023 towards the drag of a downturn, maybe shares do have extra room to run regardless of what the analysts “say” in Determine 7. How far can they go? I can’t say for certain after all. However, Cevian Capital’s earlier name for CHF 35, or ~$37.45/share, doesn’t appear unrealistic to me, particularly provided that shares had been buying and selling north of $38/share at first of the 12 months. Accordingly, it is probably not unreasonable to suppose ABB shares may respect ~25% within the new 12 months as they retrace floor misplaced in FY ‘22.

A Smarter Method to Creating Shareholder Worth

The “previous” ABB mannequin of shopping for companies left and proper, which led to the unwieldy mess that present administration has been working to streamline, has fallen by the wayside. Mr. Rosengren has dedicated the agency to stability and profitability earlier than progress. That is evidenced by administration’s clever concentrate on small, bolt-on acquisitions, such because the latest buy of vitality administration platform supplier ASKI Power, versus massive, high-risk acquisitions.

Furthermore, buyers can anticipate administration to proceed their efforts to unlock shareholder worth, pushed partly by activist shareholders like Cevian Capital talked about earlier. Notably, administration:

Launched a brand new share buyback program of as much as $3B at first of Q2 FY ‘22.

Stays dedicated to listing the E-mobility division (electrical car charging).

Believes the agency is already “right-sized” to climate any potential near-term downturns.

As I provided within the introduction, latest efficiency and the outlook for This fall FY ‘22 counsel administration’s turnaround technique is working; and the group’s play on electrification and automation megatrends, mixed with their product and geographic range, might show resilient within the coming 12 months, even beneath recessionary situations. As I argued, shares appear undervalued when contemplating the potential worth of the person “elements” of the enterprise.

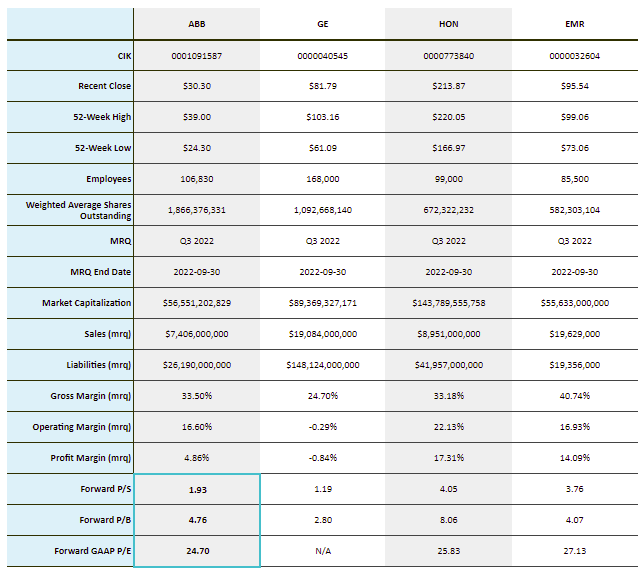

Determine 9: ABB and Chosen Competitor Statistics (Yves Sukhu)

Notes:

Information as of market shut December 23, 2022.

Ahead P/S, P/B, and GAAP P/E information from In search of Alpha besides ABB ahead P/B.

I do not know precisely what to anticipate with 2023 across the nook. However, if the world falls aside, I feel ABB shares might unexpectedly provide lengthy buyers sanctuary.

Editor’s Notice: This text was submitted as a part of In search of Alpha’s High 2023 Choose competitors, which runs via December 25. This competitors is open to all customers and contributors; click on right here to search out out extra and submit your article in the present day!

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please concentrate on the dangers related to these shares.

[ad_2]

Source link