[ad_1]

Tesla is one of the most popular stocks among both investors and day traders. It is highly volatile and liquid, which makes it easy to buy and sell. Also, the shares are offered by most online brokers, including those that offer CFD products.

However, It would be wrong to reduce Tesla to just a stock in the electric vehicle category. As we will see in the article, the company’s fields of influence are various. There are also many catalysts that move stock value.

In this article, we will explain the best strategies to day trade Tesla stock (and why they are risky for long-term investment).

What is Tesla?

Tesla has grown from a small and unprofitable car manufacturing company to the biggest one in the industry by market cap. At the time of writing (March 2023), Tesla had a market cap of over $602 billion.

In contrast, Ford has a market cap of $42 billion while General Motors was valued at about $47 billion. In all, Tesla is more valuable than other automakers, combined.

There are three main reasons why Tesla is such a valuable company. First, the firm has a strong market share in the electric vehicle (EV) industry. It has a commanding share compared to all EV companies globally because of its first-mover advantage.

Second, Tesla has a strong market share in the charging industry. In the United States, the company owns thousands of supercharging infrastructure. As such, since range anxiety is a major concern among EV buyers, the presence of this infrastructure makes Tesla more attractive.

Third, Tesla’s technology, such as autopilot is more advanced than that of other companies like GM and Ford. Further, Tesla is the only company that is manufacturing and selling EVs profitably.

The importance of Tesla in the EV sector

Tesla is widely seen as one of the most important companies of the last few decades. That’s because the firm was able to disrupt one of the most important industries in the world. While electric vehicles have always been around, Tesla made them more attractive to the masses.

Further, Tesla helped to disrupt an industry that leads in global carbon emissions. As the world continues battling ways to reduce these emissions, Tesla has become a key part of the ecosystem.

Day trade or invest in Tesla?

A common question is whether one should day trade or invest in Tesla shares. Historically, both options have been highly profitable.

For investors, Tesla has been a highly profitable company to invest in. For one, its stock has soared from about $1 in 2010 to about $190 in February 2022. At its peak, the stock was trading at $415.

However, as an investment, Tesla is a risky company because of the industry it operates in.

For one, while Tesla has a leading market share in the industry, the company is facing stiff competition from companies like Porsche, GM, and Ford. It is also competing against pure-play companies like Rivian, Lucid, and Nio. This partially explains why Tesla shares have plunged by over 40% from their all-time high.

Our suggest: day trade tesla stocks

There are several reasons why we recommend day trading Tesla shares. First, the stock is highly liquid, with millions of shares being exchanged every day. This volatility means that all types of day traders can benefit from its movements.

Second, Tesla is always making headlines, which is a good thing for people who day trade the stock. Some of the popular headlines come from Elon Musk and Wall Street analysts.

Further, there are too many catalysts for Tesla shares. Some of them are the company’s earnings, analyst ratings, Elon Musk’s tweets, and even monetary policy.

How to analyze Tesla stock

There are several ways to analyze Tesla. First, you should look at the company’s vehicle deliveries. Like other companies in the EV industry, Tesla publishes its monthly vehicle deliveries. As such, you should always watch these numbers and see whether the company’s business is improving or not.

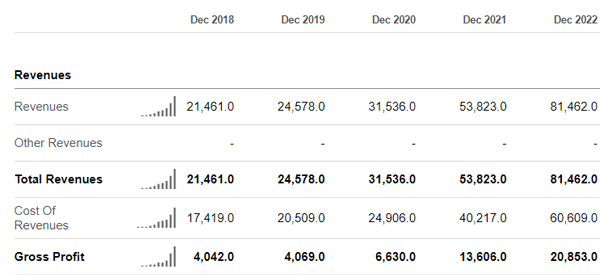

Second, look at the company’s revenue and profitability growth. As shown below, the company’s revenue has jumped from over $21 billion in 2018 (2 billion in 2013) to over $81 billion in 2022. Its gross profit has also jumped to over $20 billion.

Third, look at the company’s profits and profitability growth. The company moved from an $862 million loss in 2018 to over $12 billion in 2022.

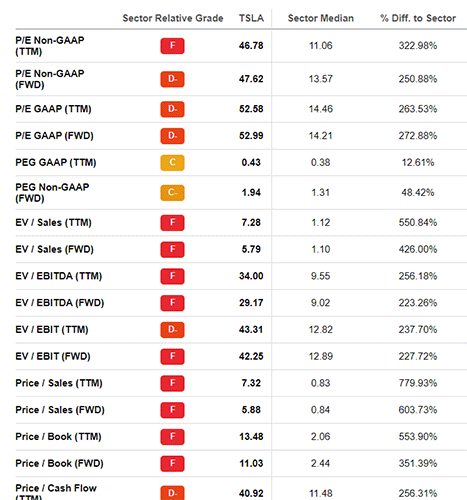

Further, look at its key multiples like price-to-earnings (PE), price-to-sales (PS), and Enterprise value to EBITDA (EV to EBITDA) multiples.

Related » What EBITDA is?

These multiples are important because they show how investors are valuing the company. However, as shown below, Tesla is one of the most expensive companies to invest in.

Key catalysts for Tesla stock

There are several catalysts that move Tesla stock prices. Some of the most popular ones are:

Earnings – Like all stocks, Tesla shares react to the company’s earnings. In most periods, the stock jumps or slides by double-digits after the company publishes its earnings.Analysts’ ratings – The other key catalyst for the stock is analysts’ ratings. An upgrade from a key analyst tends to move the stock higher and vice versa.Elon Musk tweets – At times, the stock reacts to tweets and other statements by Elon Musk. He is one of the most followed people on Twitter.New product launches – Tesla shares tend to react to new product launches. For example, it rose after the company made a presentation of the cyber truck.Monetary policy – The stock tends to react to monetary policy. In most cases, the stock tends to do well in periods of low-interest rates.Deliveries – As mentioned, Tesla reacts to vehicle deliveries numbers that are published every month.

Strategies to day trade Tesla stock

There are several strategies you can use to day trade Tesla stock. Some of the top approaches that are common with traders are:

Scalping – Scalping is a trading strategy that involves buying or shorting stocks and holding them for a few minutes. The goal is to exit a trade with a small profit many times a day.Arbitrage – This strategy involves buying Tesla and shorting correlated stocks and vice versa. The idea is that Tesla moves in the same direction with other large tech stocks. As such, you can benefit from the difference between the profit and loss.Momentum – Also known as trend-following, this strategy involves buying the stock when it is rising and vice versa. This strategy is better used with trend indicators like moving averages and Bollinger Bands.VWAP strategy – A key strategy is known as the VWAP strategy. It involves buying the stock when it crosses the VWAP and vice versa.Fading – This is a strategy that seeks to take advantage of pullbacks that happen after the market opens. If Tesla shares open much higher, you can fade the move or wait for a pullback.

Reasons to avoid Tesla stock

As mentioned, there are several reasons why you should avoid Tesla as a long-term investment. They include:

Valuation – Tesla is one of the most overvalued stocks in the world. It has a PE ratio of 52 and a forward EV to EBITDA multiple of 20.China exposure – The company has a strong exposure to China. With tensions rising, the company is at risk if the situation escalates.Elon Musk risks – Tesla is fully associated with Elon Musk. As such, there are risks because of his cult following.Competition – The company is facing major competition from the likes of Rivian, Lucid, Nio, and Xpeng.Demand – There are signs that demand for electric vehicles is falling, which explains why the company has slashed its prices recently.

Summary

In this article, we have looked at what Tesla is and whether you should invest or trade the stock. In our view, we believe that trading Tesla is much better than investing in it because of the substantial risks involved.

Some of these risks are its valuation, competition, and the fact that demand seems to be falling.

External useful resources

[ad_2]