[ad_1]

franckreporter

Investment updates

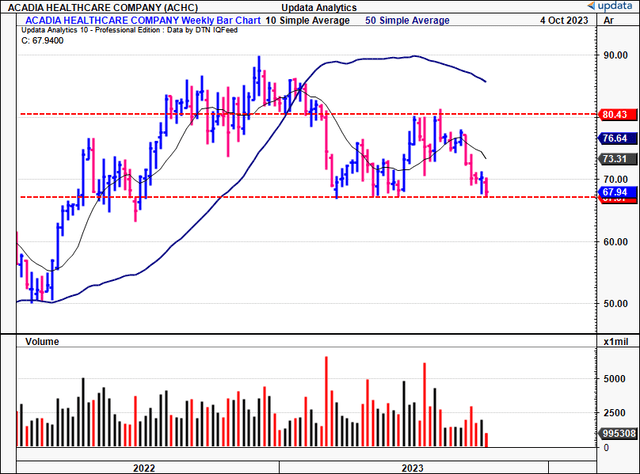

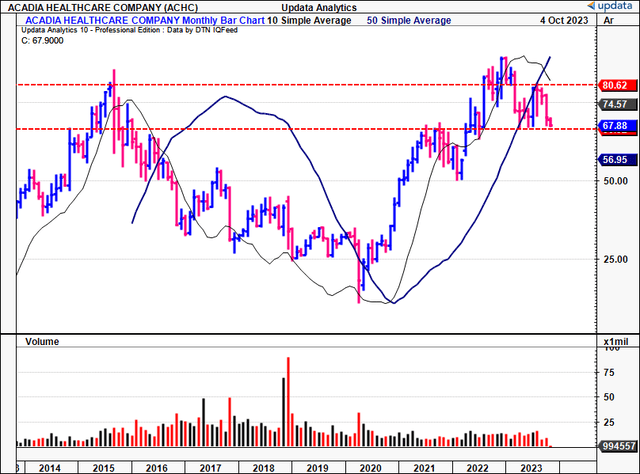

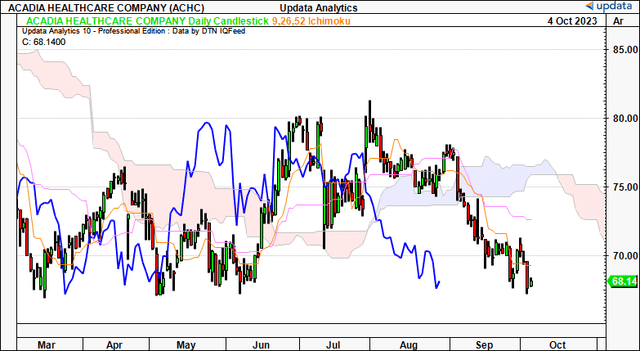

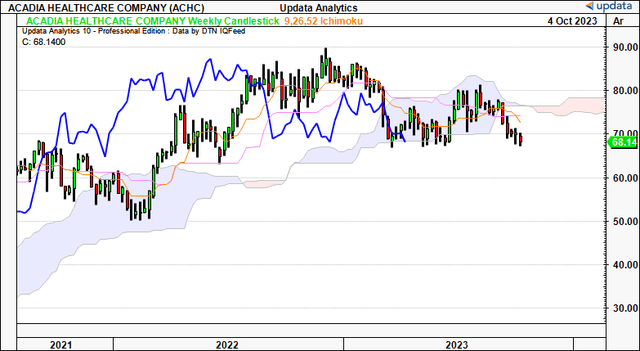

Investors continue to sell Acadia Healthcare Company, Inc. (NASDAQ:NASDAQ:ACHC) in the back end of 2023. The stock has reversed course from its mid-year rally, and now tests the bottom of its ’23 trading range, as seen in Figure 1. It has sold beneath its 50DMA for the last 5 weeks to date. Looking back across the years, ACHC is back in-line with its 2015 ranging highs, as noted in Figure 1(a). Since my last publication, shares are down 4%.

There is a lot to think about in the ACHC investment debate. Many positives, a few powerful negatives. For instance—

Positives:

The firm is investing heavily into growth initiatives and pulling in decent rates of return on these new investments. Net working capital efficiencies, recycling each $1 invested in NWC to cash at a reasonable pace. FCF positive, whilst leaning up in capital intensity and growing NOPAT. Trading around estimates of fair value.

Negatives:

Slack returns on existing capital, presenting as a low-margin, low capital turnover business. Post-tax earnings therefore not economically valuable, leading to losses above our threshold margin of 12%. Unsupportive technicals, with price structure indicative of potential future downside. Pessimistic expectations from the market, corroborating the repricing of ACHC’s equity to the downside in ’23.

The very last point is important. Any company’s stock price is a set of discounted expectations. When expectations change, so does the stock price. The questions we have to uncover here are, (i) Is there a reason to deviate from the market’s expectations, and (ii) what would the differing expectations be?

This report will seek to answer these questions and more using sound economic principles to do so. Net-net, I estimate the market could be under-reflecting ACHC’s incremental investment and profit growth, which adds to the company’s intrinsic valuation. Reiterate buy for long-term positioning.

Figure 1. ACHC trading back within a range across ’23. Trading below 50DMA for last 5 weeks, testing support line of channel.

Data: Updata

Figure 1(a). Covid-era was tremendously beneficial to ACHC stockholders. It now trades back in line with its previous highs of 2015. Note: Monthly bars shown.

Data: Updata

Critical findings in support of reiterate buy thesis

1. Price implied expectations

What’s useful is a gauge of the market’s expectations to understand what is currently priced into ACHC’s market value.

In short, by my estimation, the market’s implied expectations (based on calculus presented here) are:

A 6.8% growth in FY’23 earnings, 17% YoY growth in pre-tax income. Around $2.97Bn in sales, ahead of management’s expectations of $2.9Bn. Implied ROIC expectations of 4.5%, expected reinvestment rate of ~28%. I’d also point out, there’s been 11 upward revisions to sales and earnings estimates from Wall St analysts in the last 3 months. Earnings + sales expectations

ACHC currently sells at 19.9x forward earnings and 15.2x forward EBIT. At the current market value of $6.41Bn and EV of $7.93Bn, implies an expected $3.40/share in earnings and $521.7mm in pre-tax income (7,930/15.2=521.7). The market therefore expects a c.6.8% growth in earnings and 17% YoY growth pre-tax on these assumptions. Using the same logic it expects $2.97Bn in sales (6,410/2.16 = 2,967).

ROIC + investment expectations

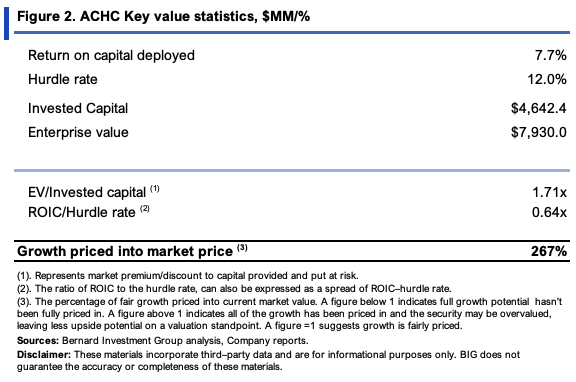

Investors have also priced the company at 1.71x EV/invested capital. In other words, it has valued ACHC’s investments at a 0.71x premium, corresponding to a relatively flat market return on invested capital. Comparing its business returns on investment of 7.7% (discussed later) to our 12% required rate of return (call this the threshold margin), the economic value of the firm’s investments is a ~0.64x multiple.

Comparing 1) the market’s appraisal of 1.71x (market returns) to 2) the business returns as a ‘no growth’ multiple, it appears the firm’s earnings power on current investments is well reflected in its market value (Figure 2). As to the market-implied ROIC (1/(EV/IC)xROIC), it appears the expectations are 4.5% ROIC going forward (1/(1.71×7.7%) = 4.5%).

Finally, we can obtain the reinvestment rates the market expects, looking at the function of growth, ROIC and investment (RI = g/ROIC). At a 15.7% pre-tax growth rate, and 4.5% expected ROIC, it would imply the market expects ACHC to reinvest 28.6% of its pre-tax earnings over the coming 12-24 months, or ~$146mm.

BIG Insights

2. Economic value drivers

Thinking in first principles, the question now is what, if any, reasons ACHC’s economic performance gives us to differ from the market’s view.

But why?

(i). It matters explicitly in the investment context. ACHC should be investing at rates above a long-term market return on capital to create outsized shareholder value.

(ii). It has implications to both FCF and owner earnings farther downstream. Sub-standard investments, measured by the rate of cash flows they produce, jeopardize the growth/value axis. Low rates on capital abort any situation of sustainable growth and high/growing FCF. One will eventually have to give. This compresses intrinsic value. Not all growth is created equally, as they say. Whereas high returns on capital = high FCF without jeopardizing growth, and vice versa.

(iii). It serves as the bedrock to compare internal vs. market expectations.

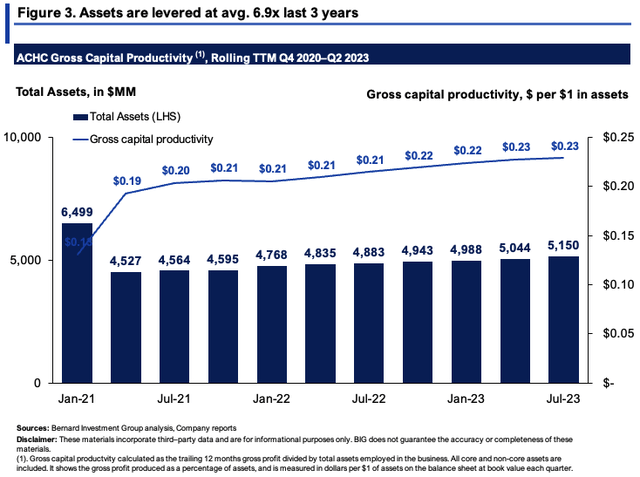

For ACHC, you can see it has been investing heavily over the past 2-3 years. Assets employed into the business have grown by $623mm since 2021, producing $0.23 in gross per $1 of assets in Q2 (Figure 3). Productivity has been increasing too–off $0.19 on the dollar in ’21 (TTM values).

As to its value drivers, in the last 3 years, the company’s sales have compounded at ~3% each period, on avg. operating margins of 17%. Each new $1 in sales growth required $0.042 in NWC and a $0.70 investment to fixed capital, $0.17 on the dollar to M&A. This means every $1 of new sales required $0.92 of investment [note: call these the steady-state expectations, to be utilized later].

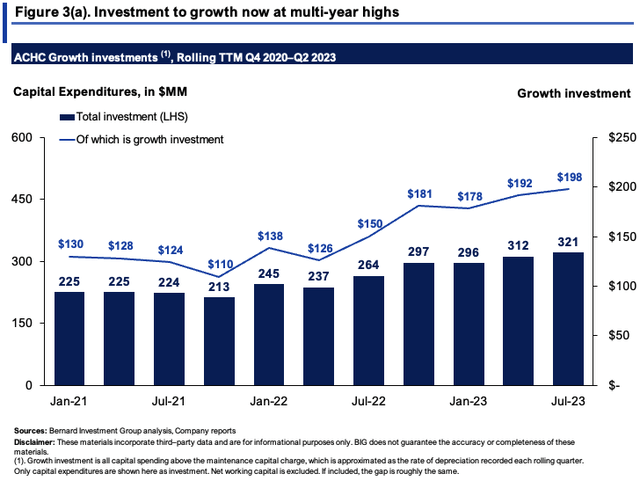

Meanwhile ACHC’s investments to growing its future revenues are noteworthy, as seen in Figure 3(a). Growth capital is measured as all investments above the capital charge, approximated as the rate of depreciation, at $321mm in the TTM to Q2 FY’23. In the last 12 months, it had allocated $198mm to growth initiatives under this convention, up from $130mm in 2020.

And where has it been investing exactly?

Specifically, its 5-pathway investment strategy encapsulates the capital allocations well:

Facility Expansions Added 98 beds to existing facilities in Q2, totaling 204 bed additions so far in 2023. Expected total bed additions for 2023: ~300 beds, in line with previous years. Wholly-owned de novo hospitals Scheduled opening of a 101-bed adult hospital and outpatient facility in Illinois. Anticipated opening of an 80-bed inpatient hospital in California. JVs (Pathway 3 and 4): Partnership with SolutionHealth for a 144-bed behavioral health hospital in New Hampshire. Partnership with Nebraska Methodist Health System for a 96-bed hospital serving the Omaha, and Iowa metro area. Acquisitions (Pathway 5):Recent announcement to acquire Turning Point Centers in Utah, a 76-bed specialty provider of substance use disorder and primary mental health treatment.

BIG Insights

Capital efficiency and profitability

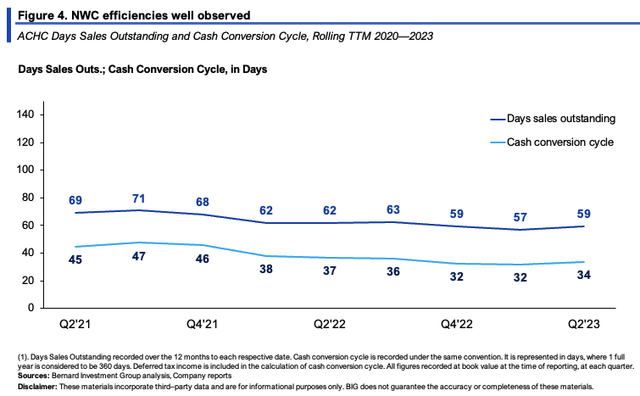

ACHC is recycling investments to NWC back to cash at a reasonable pace. Its cash conversion cycle was 34 days last period, down from 45 days in 2020, and 37 days last year. It can turn over its NWC 10.7x each at this pace, a little over 1x per month.

BIG Insights

The most critical data in this report in my view is seen below:

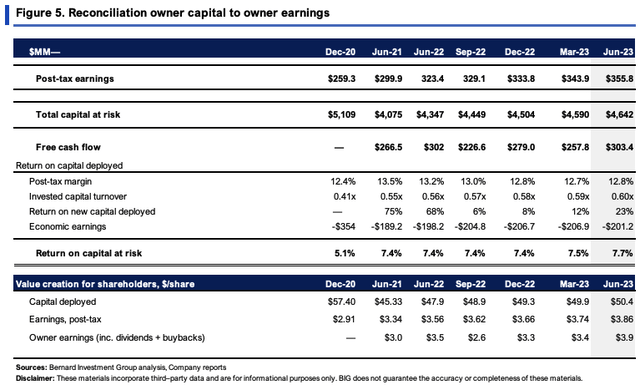

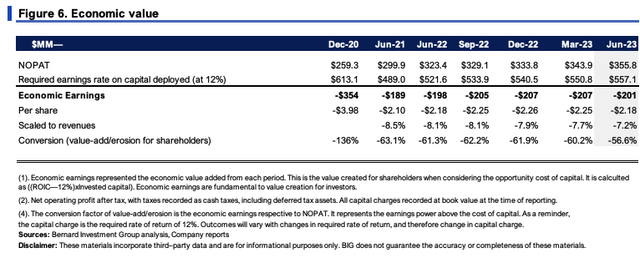

ACHC had $50.40/share invested at risk in Q2. This produced $3.86/share in TTM post-tax earnings, 7.7% return on investment. These rates are not economically valuable for long-term investors who employ a 12% required rate of return, as we do. Figure 6 outlines this in granular detail, depicting the economic losses produced since 2020 vs. a 12% hurdle, at $2.18/share last period. ACHC’s is a low-margin, low capital turnover business, with 12.8% after-tax on sales and 0.6x capital turns. This is troubling, as you’d expect capital turnover to be high if ACHC was using its ‘real estate’ efficiently and effectively.

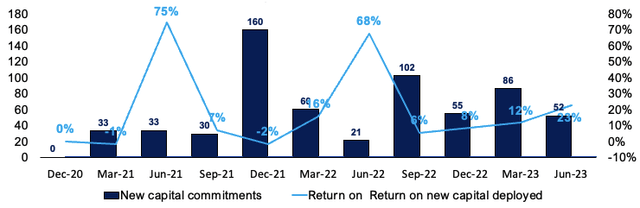

But what’s most interesting is the returns on incremental investments, charted below. These show the firm investing anywhere from 8%–75% of earnings in the last 3 years, to produce consistently positive returns on new capital deployed, 23% last period.

Critically, if incremental ROIC > historical ROIC, it implies the firm’s new investments are more profitable than its legacy capital.

It should be investing as much as it can at these rates, and it is, as already outlined. This cannot be overlooked, and feeds into the firm’s intrinsic value, and ability to unlock further value downstream.

BIG Insights

BIG Insights

Technicals = unsupportive

The technicals shown below link to the price implied expectations from earlier. On the daily cloud chart, both price and lagging lines are beneath the cloud, well away from bullish territory. It suggests resistance at $71 by November, and corroborates a neutral view over the coming weeks.

Figure 7. Daily Cloud chart

Data: Updata

The weekly cloud chart is more intriguing. You can see the price line crossed the cloud last month, and the lagging line is currently testing the cloud base. This is a critical juncture for the company. A break lower would see the lagging line cross to the downside, corroborating the neutral view over the coming months.

Figure 8. Weekly cloud chart

Data: Updata

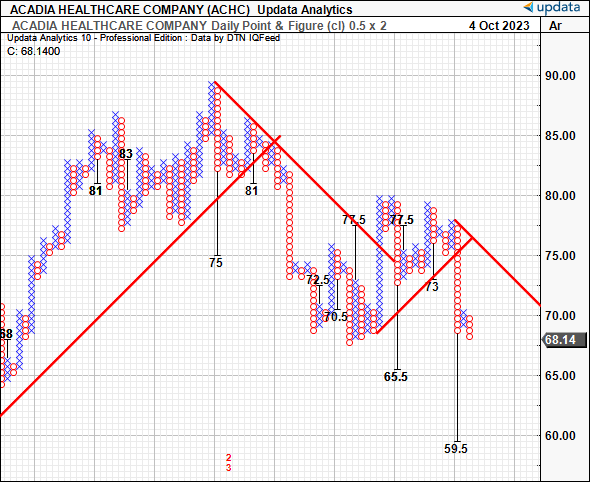

As a result, we have downside targets to $59.50 on the point and figure studies below. These are superb uses of data to (i) remove intra-trend volatilities and get a cleaner view, and (ii) remove the noise of time to get an accurate view of price action. It has caught each of the moves with reasonable accuracy to date, so $59.50 might be the next level to watch out for.

Figure 9. Downsides to $59.50 on daily 0.5×2 box reversal

Data: Updata

Valuation—looks fair

The stock sells at 19.9x forward earnings and 15.2x forward EBIT, as mentioned earlier. It also sells at 18x NOPAT. Consider ACHC’s return on new capital was 23% in Q2, warranting $437.6mm in forward NOPAT. At the same 18x multiple, this derives an implied value of $7.87Bn or $85/share, 22% value gap from the current market value (18×437.6 = 7,870).

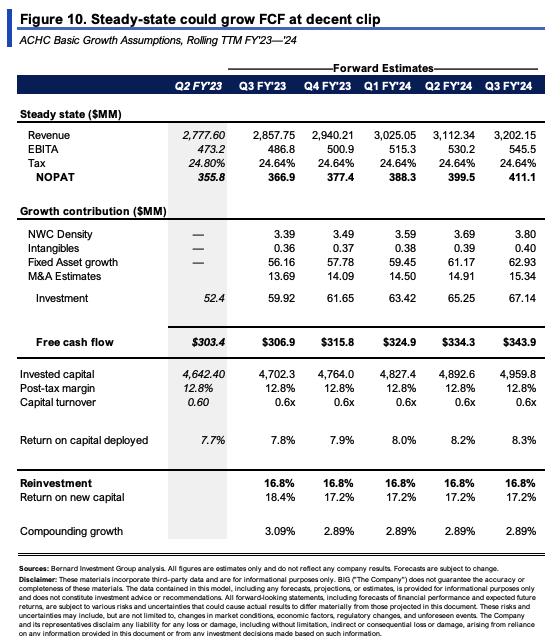

Moreover, extending the steady-state numbers outlined earlier implies the company can throw off $306–$344mm in cash to its shareholders into the coming periods (Figure 10). Given the incremental returns on investment, this could be accretive to its intrinsic value.

BIG Insights

Additional factors for consideration:

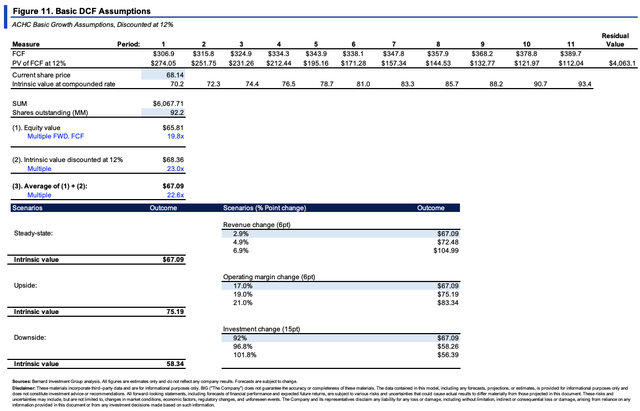

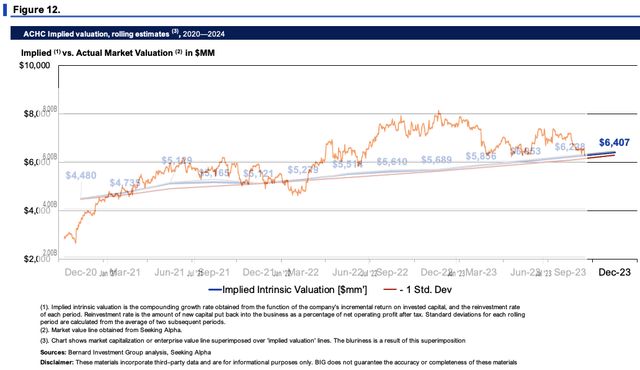

Extending the above estimates out to FY’28, then discounting at the 12% threshold margin, arrives at an implied value of $67/share, 22x FCF multiple. Compounding ACHC’s intrinsic value at the function of its ROIC and reinvestment rate (inc. FY’23 estimates) it appears the company is trading around fair value as we speak at $6.4Bn. The market looks to have been an accurate judge of fair value over the last 3 years as well.

BIG Insights

Discussion of facts pattern

This opens up an interesting debate. On the one hand, the market’s implied expectations are for reasonable ~7% earnings growth and 15.7% growth in pre-tax income, flat ROIC, and a reinvestment rate of 28%. ACHC is investing heavily to its growth operations, and its incremental investments are also achieving attractive rates of return once the cash is deployed. But returns on existing capital, not so much. The existing economics of the business aren’t conducive to a long-term compounder, being a low-margin, low capital turnover operation.

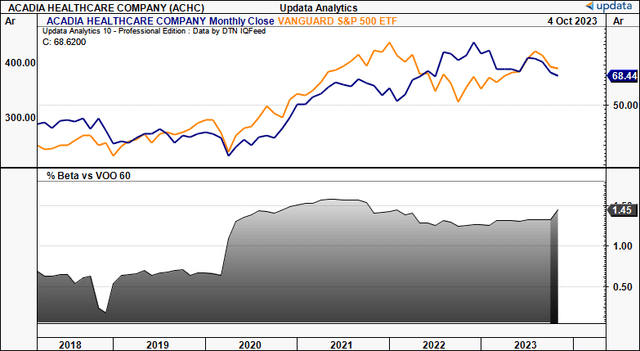

The second thing to consider is ACHC is compounding its intrinsic value at a steady pace. But how much of this is truly idiosyncratic, versus beta-related? Figure 13 shows ACHC is a high-beta name, displaying equally high correlation to the U.S. equity benchmark, both are high. Still, the valuation band outlined in this report calls for $6.4–$7.87Bn in market value, otherwise $68–$85.40 per share, in line with my previous analysis on the company.

What I believe the market could be under-reflecting is ACHC’s incremental investments and profit growth. This cannot be overlooked. All else equal, this is the major factor that deviates from the market’s appraisal of the company, based on this analysis. In that vein, I am retaining a buy on ACHC, noting this is a contrarian view to the market.

Net-net, reiterate buy, with a long-term upside target of $85/share. The key risks to consider are a further revision in market expectations to the downside, which could see ACHC trade lower.

Figure 13.

Data: Updata

[ad_2]