[ad_1]

Andrii Yalanskyi/iStock via Getty Images

In my last article on AerCap Holdings N.V. (NYSE:AER), I advised readers to avoid the airlines (represented by the U.S. Global Jets ETF (JETS)) and just buy AerCap.

The key part of the thesis was the stability of the business model compared to airlines. AerCap revenue is secured by long-term contracts with airlines and collateralized by valuable assets (e.g. aircraft, engines, helicopters, etc.).

As such, the valuation metric the market typically looks at for such companies is the book value. In other words, provided the company can grow its book value the share price should be able to rise in tandem (albeit with some volatility due to macro and industry macro settings).

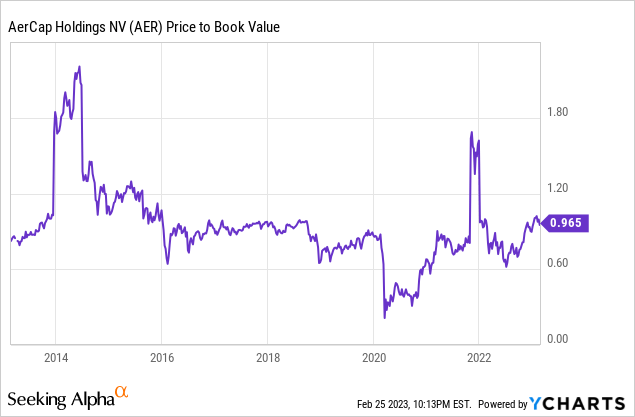

The below chart highlights the price-to-book value for AerCap in the last 10 years.

A few observations on the above chart:

AerCap tends to trade at a slight discount to book value and historically in the range of 0.8x to 0.9x book value (outside of turbulent macro times) Currently, the book value is understated due to purchase accounting arising from the acquisition of GE Capital Aviation Services. The adjusted book value is currently ~$75 and therefore AerCap is trading at ~0.8x adjusted book value. The impact of purchase accounting on book value will dissipate over time. The temporary spikes in 2014 and 2021 in the above chart are due to the transformative acquisitions The dips in 2016, 2018, and 2020 are due to general market declines (China fears in 2016, market dip in 2018 due to the Fed, and of course the recent pandemic in 2020).

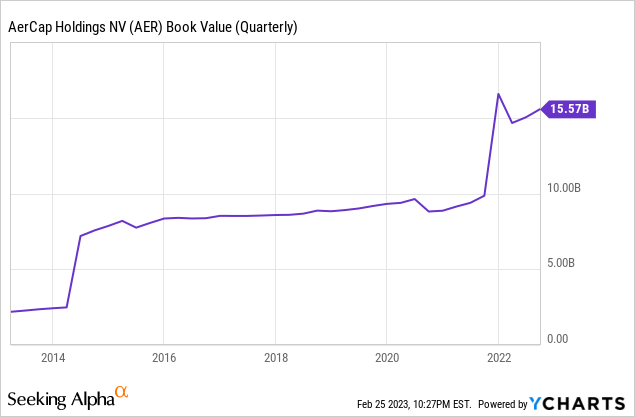

It is also interesting to see the growth in book value over the last 10 years:

As can see above, the book value has grown by over 600% in the last 10 years primarily driven by the transformative acquisitions noted above. The dip in 2022 in the book value reflects the write-off (~$3 billion) of the Russian portfolio for accounting purposes. Although, some or all of it may be recovered through insurance proceeds that are currently being litigated.

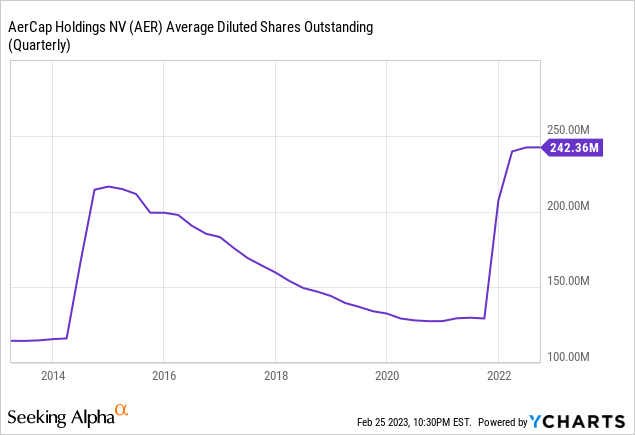

To pay for these acquisitions, AerCap had to raise capital and thus issue a large number of shares. However, as can be seen below, in subsequent years to these acquisitions, AerCap has quite aggressively bought back shares in the market and reduced the average diluted shares outstanding.

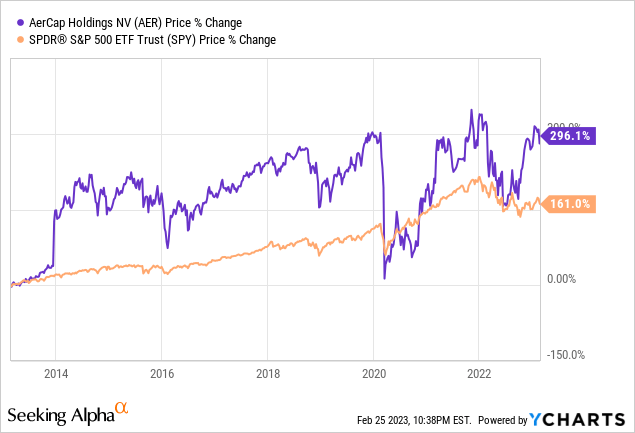

So putting this all together, the share price returns have been impressive over the last 10 years compared with the S&P.

I attribute AerCap’s outperformance to two key reasons:

The transformative acquisitions were made at a significant discount to the targets’ book value at opportune times. Capital structure arbitrage (i.e. selling assets at a premium to book value and buying back shares at a discount to book).

The Capital Arbitrage Playbook Is Back

It is very clear that the AerCap playbook of large share buybacks is back on.

AerCap is arbitraging its capital structure by selling assets at a premium to book value and utilizing the proceeds to buy back shares at well below book. This is exceptionally accretive and helps to grow the book value per share rapidly.

Following the acquisition of GECAS, AerCap has reached its target leverage ratio of ~2.7x in Q3’2022 earlier than expected. I expect it to restart its share buyback program imminently.

However, this time around, the capital arbitrage playbook is much more attractive. Historically, AerCap used to sell assets at an average premium to book high-single-digits. However, in the current favorable market conditions and shortage of aircraft, AerCap was able to sell assets at a 23% premium in Q3’2022.

AerCap seems to be pressing the pedal on selling assets. It sold 97 aircraft in Q4’2022 out of a total of 207 in the whole of 2022. This suggests that AerCap will use the proceeds for these sales (likely at a high premium to book) to retire a large number of shares in 2023 and beyond.

Final thoughts

I have been following the aircraft leasing industry for over 10 years and have been holding AerCap for just as long. The tailwinds for AerCap currently are very strong in spite of inflation and fears of an upcoming recession.

AerCap is clearly benefiting from the scale of its platform, being the largest global lessor of aircraft. Additional cost synergies from the GECAS acquisition are to be expected in the next 12 to 24 months (AerCap has guided for $150m annual synergies over time).

There is evidently a strong demand for and shortage of aircraft and engines. The recent reopening of China is certainly an incremental tailwind. The above-noted market conditions translate to higher lease rates and exceptionally strong gains on the sale of assets. AerCap is booking very accretive long-term business on the books right now as well as likely opportunistically redeploying capital to share buybacks. As such, in the post-pandemic environment, I expect AerCap to generate strong returns on equity in the mid-teens from ~10%-12% ROE previously.

Mr. Market has still not fully digested the benefits for the aircraft lessor industry given the post-pandemic dynamics. Nor is it giving AerCap credit for cost and other qualitative synergies that AerCap is deriving from the GECAS acquisition.

At the moment, continuing with the capital structure arbitrage and share buybacks is exceptionally attractive and makes absolute sense. At some point, I also expect AerCap to institute a dividend that should attract income-orientated advisors.

Finally, additional upside may be generated if AerCap gets compensated (insurance proceeds or otherwise) for the ~$3 billion of losses tied to the Russian assets.

I remain very bullish on AER stock and my 12 months target is $80 on the basis of continued growth in book value powered by share buybacks and re-rating of multiples due to higher ROE compared with past decade. Additional upside remain should AerCap recover insurance proceeds due on the Russia portfolio.

[ad_2]