[ad_1]

Spreadsheet data updated daily

Updated on January 20th, 2023 by Bob Ciura

Individual products, businesses, and even entire industries (newspapers, typewriters, horse and buggy) go out of style and become obsolete.

Perhaps more than any other industry, agriculture is here to stay. Agriculture started around 14,000 years ago. It’s a safe bet we will be practicing agriculture far into the future.

And, the growth of the global population is tied to increasing agricultural efficiency. The agricultural revolution allowed greater population growth (and led to the industrial revolution).

As the global population grows, so does the need for improved agricultural production. This creates a long-term demand driver for agriculture stocks.

You can download the complete list of all 40+ agriculture stocks (along with important financial metrics such as price-to-earnings ratios, dividend yields, and dividend payout ratios) by clicking on the link below:

The agriculture stocks list was derived from two major exchange-traded funds. These are the AgTech & Food Innovation ETF (KROP) and the iShares Global Agriculture Index ETF (COW).

Investing in farm and agriculture stocks means investing in an industry that:

Has stable long-term demand

Has withstood the test of time, and is extremely likely to be around far into the future

Benefits from advancing technology

This article analyzes 7 of the best agriculture stocks in detail. You can quickly navigate the article using the table of contents below.

Table of Contents

We have ranked our 7 favorite agriculture stocks below. The stocks are ranked according to expected returns over the next five years, in order of lowest to highest.

Even better, all 7 agriculture stocks pay dividends to shareholders, making them attractive for income investors. Interested investors should view this as a starting off point to more research.

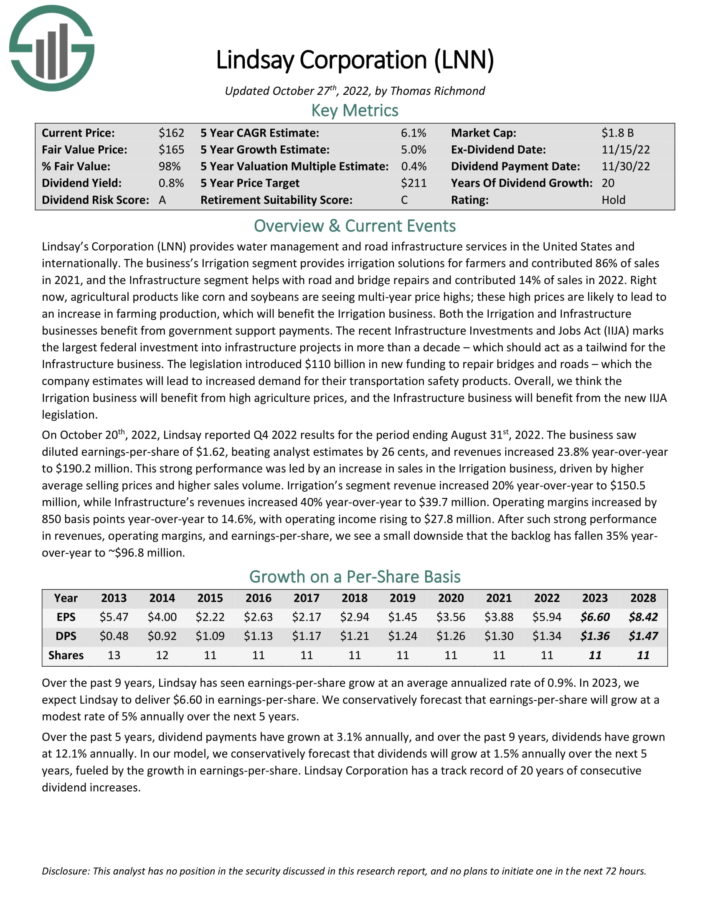

Agriculture Stock #7: Lindsay Corporation (LNN)

5-year expected annual returns: 8.6%

Lindsay’s Corporation provides water management and road infrastructure services in the United States and internationally. The business’s Irrigation segment provides irrigation solutions for farmers and contributed 86% of sales in 2021, and the Infrastructure segment helps with road and bridge repairs and contributed 14% of sales in 2022.

The recent Infrastructure Investments and Jobs Act (IIJA) marks the largest federal investment into infrastructure projects in more than a decade – which should act as a tailwind for the Infrastructure business. The legislation introduced $110 billion in new funding to repair bridges and roads – which the company estimates will lead to increased demand for their transportation safety products. Overall, we think the Irrigation business will benefit from high agriculture prices, and the Infrastructure business will benefit from the new IIJA legislation.

You can see an overview of the company’s first-quarter results in the image below:

Source: Investor Presentation

Lindsay has averaged a payout ratio of 39.6% over the past 9 years. We project that the dividend will be safe since thelow payout ratio signifies that the dividend is adequately backed by strong earnings-per-share.

We expect annual returns of 8.6% per year over the next five years, driven by 5% EPS growth, the 0.9% dividend yield, and a small boost boost from an expanding P/E multiple.

Click here to download our most recent Sure Analysis report on Lindsay (preview of page 1 of 3 shown below):

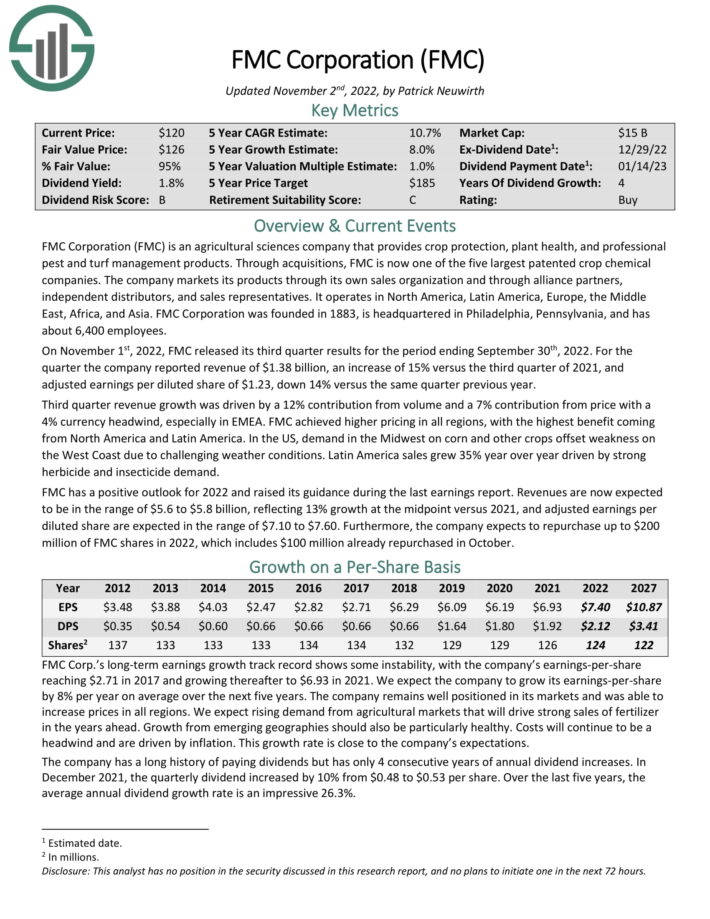

Agriculture Stock #6: Scotts Miracle-Gro (SMG)

5-year expected annual returns: 9.0%

The Scotts Miracle-Gro Company is one of the world’s leading marketers of branded consumer lawn and garden as well as hydroponic and indoor growing products. The company offers fertilizers, grass seed products, spreaders, outdoor cleaners, and any lawn-related weed, pest, and disease control products.

Source: Investor Presentation

On November 2nd, 2022, Scotts Miracle-Gro reported its Q4-2022 and full-year results. The company recorded sales of $493.6 million during the quarter, a 33% decline compared to Q4-2021, primarily driven by a 49% sales decline in the Hawthorne division and an 18% decline in the U.S. Consumer division. The decline in Hawthorne’s sales was due to oversupply issues in the cannabis industry amid record sales last year.

The company is currently being pressured by higher commodity prices that have led to a significant margin decline despite multiple pricing actions. Consequently, adjusted losses-per-share came in at ($2.04) compared to adjusted losses-per-share of ($0.82) in the same period of last year. Accordingly, adjusted earnings-per-share for the year equaled $4.10 compared to $9.23.

We expect annual returns of 11.9% per year, driven by expected EPS growth of 7%, the 5.2% dividend yield and a small decline from a lower P/E multiple.

Click here to download our most recent Sure Analysis report on Scotts Miracle-Gro (preview of page 1 of 3 shown below):

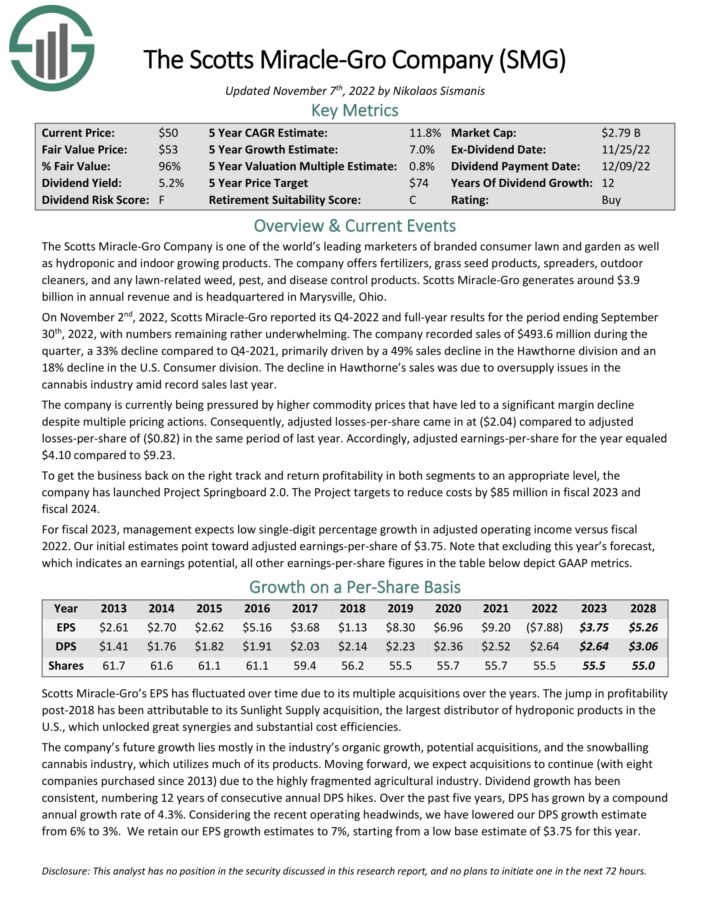

Agriculture Stock #5: FMC Corporation (FMC)

5-year expected annual returns: 9.6%

FMC Corporation is an agricultural sciences company that provides crop protection, plant health, and professional pest and turf management products. Through acquisitions, FMC is now one of the five largest patented crop chemical companies.

The company markets its products through its own sales organization and through alliance partners, independent distributors, and sales representatives. It operates in North America, Latin America, Europe, the Middle East, Africa, and Asia.

On November 1st, 2022, FMC released its third quarter results. The company reported revenue of $1.38 billion, an increase of 15% versus the third quarter of 2021, and adjusted earnings per diluted share of $1.23, down 14% versus the same quarter the previous year.

Third quarter revenue growth was driven by a 12% contribution from volume and a 7% contribution from price with a 4% currency headwind, especially in EMEA. FMC achieved higher pricing in all regions, with the highest benefit coming from North America and Latin America.

FMC has a positive outlook for 2022. Revenues are now expected to be in the range of $5.6 to $5.8 billion, reflecting 13% growth at the midpoint versus 2021, and adjusted earnings per diluted share are expected in the range of $7.10 to $7.60.

We expect annual returns of 9.5% per year, driven by 8% expected EPS growth and the 1.7% dividend yield, partially offset by a small decline from a lower valuation multiple.

Click here to download our most recent Sure Analysis report on FMC (preview of page 1 of 3 shown below):

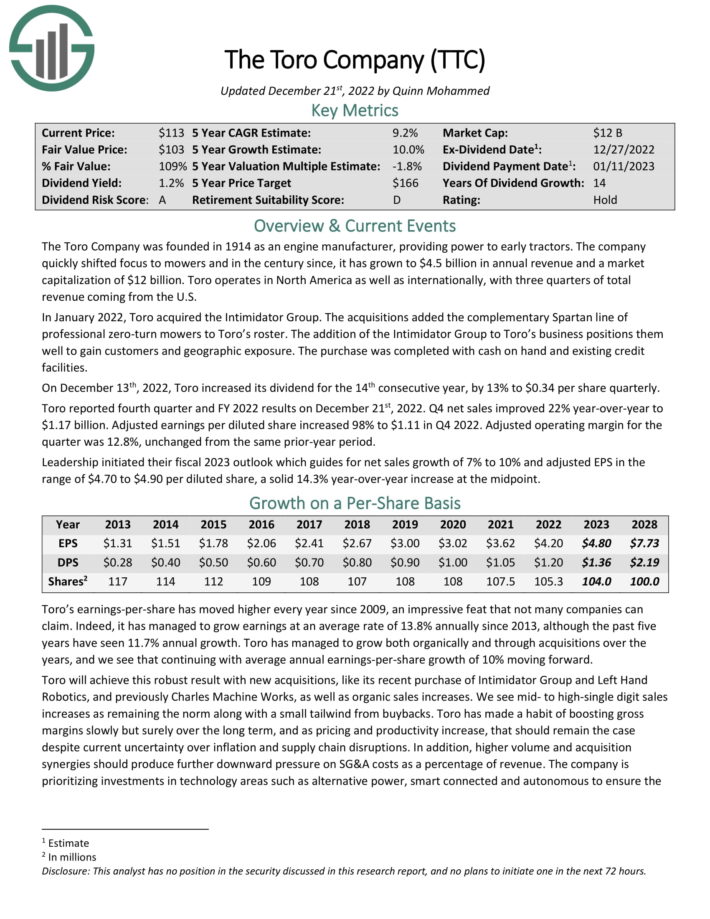

Agriculture Stock #4: Toro Co. (TTC)

5-year expected annual returns: 9.8%

The Toro Company was founded in 1914 as an engine manufacturer, providing power to early tractors. The company quickly shifted focus to mowers and in the century since, it has grown to $4.5 billion in annual revenue and a market capitalization of $12 billion. Toro operates in North America as well as internationally, with three quarters of total revenue coming from the U.S.

In January 2022, Toro acquired the Intimidator Group. The acquisitions added the complementary Spartan line of professional zero-turn mowers to Toro’s roster. The addition of the Intimidator Group to Toro’s business positions them well to gain customers and geographic exposure. The purchase was completed with cash on hand and existing credit facilities.

Source: Investor Presentation

On December 13th, 2022, Toro increased its dividend for the 14th consecutive year, by 13% to $0.34 per share quarterly. Toro reported fourth quarter and FY 2022 results on December 21st, 2022. Q4 net sales improved 22% year-over-year to $1.17 billion. Adjusted earnings per diluted share increased 98% to $1.11 in Q4 2022. Adjusted operating margin for the quarter was 12.8%, unchanged from the same prior-year period.

Leadership initiated their fiscal 2023 outlook which guides for net sales growth of 7% to 10% and adjusted EPS in the range of $4.70 to $4.90 per diluted share, a solid 14.3% year-over-year increase at the midpoint.

We expect annual returns of 9.8% per year, consisting of 10% expected EPS growth and the 1.2% dividend yield, partially offset by a small negative annual return from a declining P/E multiple.

Click here to download our most recent Sure Analysis report on TTC (preview of page 1 of 3 shown below):

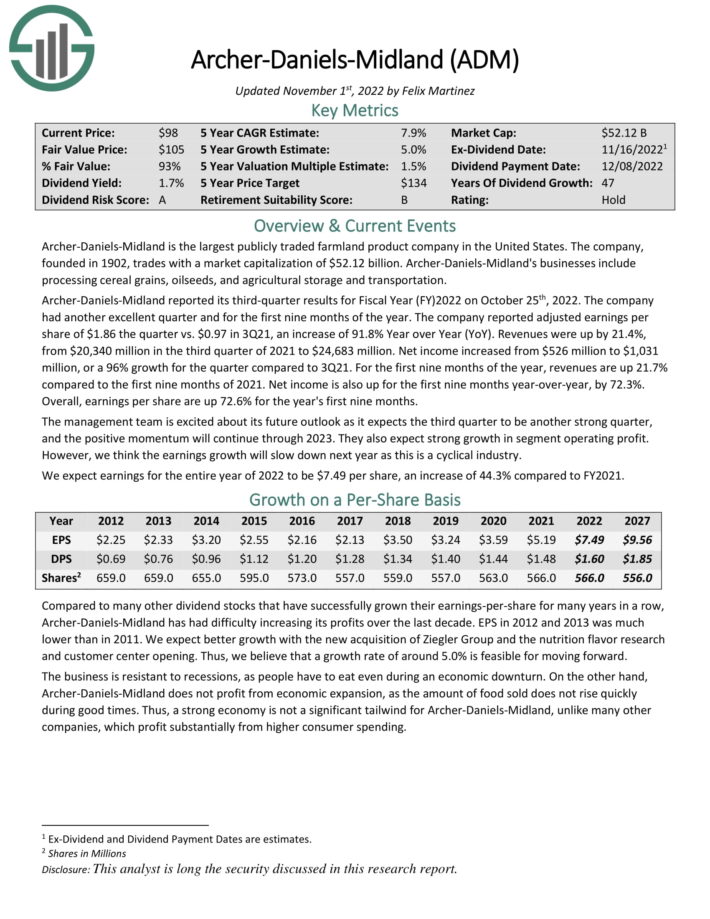

Agriculture Stock #3: Archer-Daniels-Midland (ADM)

5-year expected annual returns: 10.8%

Archer-Daniels-Midland is the largest publicly traded farmland product company in the United States. Its businesses include processing cereal grains, oil seeds, and agricultural storage and transportation.

Archer-Daniels-Midland reported its third-quarter results for Fiscal Year (FY) 2022 on October 25th, 2022. The company had another excellent quarter and for the first nine months of the year. The company reported adjusted earnings per share of $1.86 the quarter vs. $0.97 in 3Q21, an increase of 91.8% Year over Year (YoY).

Revenues were up by 21.4%, from $20,340 million in the third quarter of 2021 to $24,683 million. Net income increased from $526 million to $1,031 million, or a 96% growth for the quarter compared to 3Q21. For the first nine months of the year, revenues are up 21.7% compared to the first nine months of 2021. Net income is also up for the first nine months year-over-year, by 72.3%. Overall, earnings per share are up 72.6% for the year’s first nine months.

We expect annual returns of 10.8% per year, due to 5% expected EPS growth, the 1.9% dividend yield, and a 3.9% annual return from an expanding P/E multiple.

Click here to download our most recent Sure Analysis report on ADM (preview of page 1 of 3 shown below):

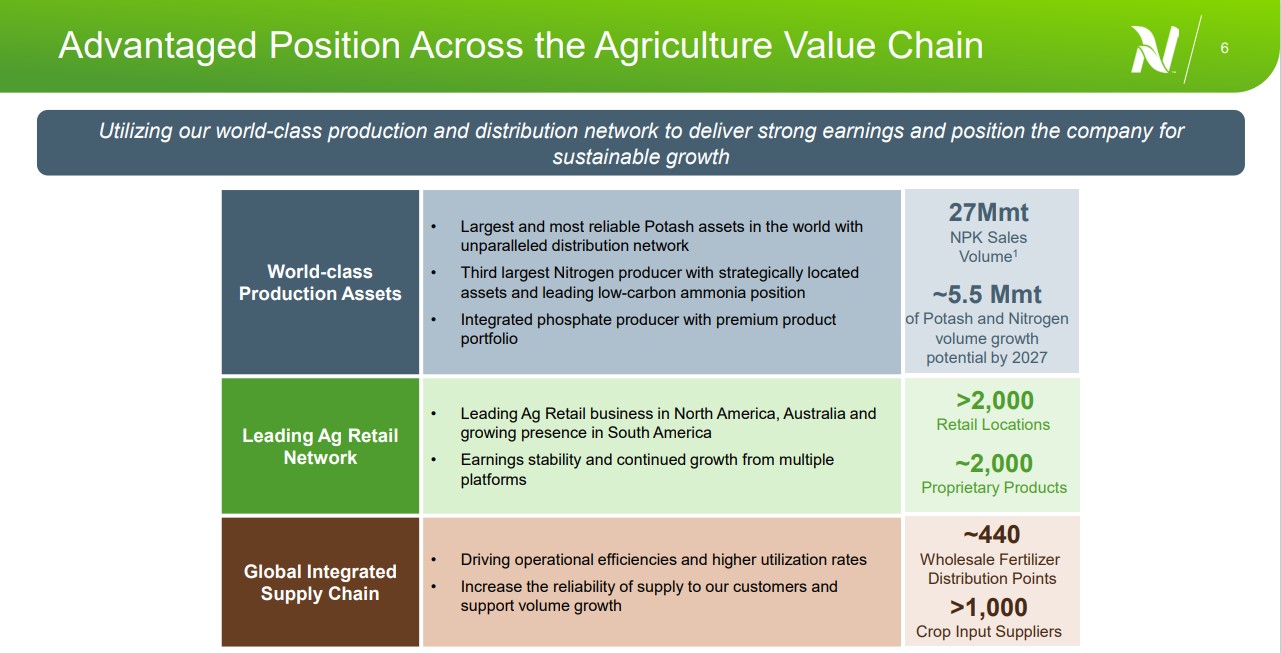

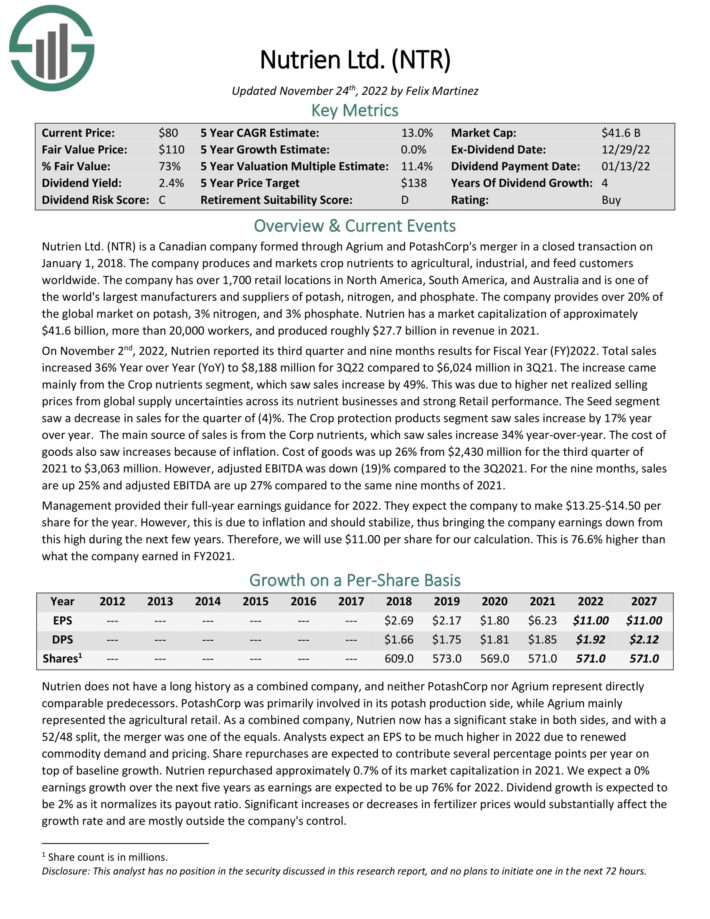

Agriculture Stock #2: Nutrien Ltd. (NTR)

5-year expected annual returns: 14.2%

Nutrien Ltd. is a Canadian company formed through Agrium and PotashCorp’s merger in a closed transaction on January 1, 2018. The company produces and markets crop nutrients to agricultural, industrial, and feed customers worldwide.

The company has over 1,700 retail locations in North America, South America, and Australia and is one of the world’s largest manufacturers and suppliers of potash, nitrogen, and phosphate.

Source: Investor Presentation

The company provides over 20% of the global market on potash, 3% nitrogen, and 3% phosphate. Nutrien produced roughly $27.7 billion in revenue in 2021.

On November 2nd, 2022, Nutrien reported its third quarter and nine months results for Fiscal Year (FY)2022. Total sales increased 36% Year over Year (YoY) to $8,188 million for 3Q22 compared to $6,024 million in 3Q21. The increase came mainly from the Crop nutrients segment, which saw sales increase by 49%.

This was due to higher net realized selling prices from global supply uncertainties across its nutrient businesses and strong Retail performance. The Seed segment saw a decrease in sales for the quarter of (4)%. The Crop protection products segment saw sales increase by 17% year over year.

The cost of goods also saw increases because of inflation. Cost of goods was up 26% from $2,430 million for the third quarter of 2021 to $3,063 million. However, adjusted EBITDA was down 19% compared to the 3Q2021. For the nine months, sales are up 25% and adjusted EBITDA are up 27% compared to the same nine months of 2021.

Total returns are estimated at 14.2% per year. While we expect no EPS growth, the 2.5% dividend yield and 11.7% annual returns from an expanding P/E multiple will fuel future returns.

Click here to download our most recent Sure Analysis report on NTR (preview of page 1 of 3 shown below):

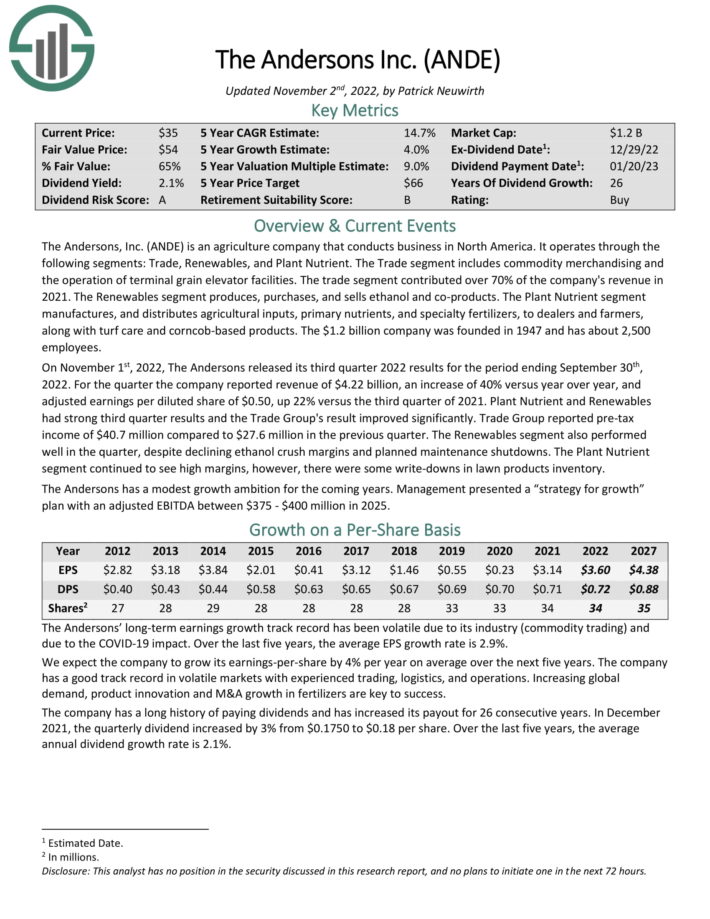

Agriculture Stock #1: The Andersons Inc. (ANDE)

5-year expected annual returns: 14.3%

The Andersons, Inc. operates through the following segments: Trade, Renewables, and Plant Nutrient. The Trade segment includes commodity merchandising and the operation of terminal grain elevator facilities. The trade segment contributed over 70% of the company’s revenue in 2021.

On November 1st, 2022, The Andersons released its third quarter 2022 results for the period ending September 30th, 2022. For the quarter the company reported revenue of $4.22 billion, an increase of 40% versus year over year, and adjusted earnings per diluted share of $0.50, up 22% versus the third quarter of 2021.

Plant Nutrient and Renewables had strong third quarter results and the Trade Group’s result improved significantly. Trade Group reported pre-tax income of $40.7 million compared to $27.6 million in the previous quarter. The Renewables segment also performed well in the quarter, despite declining ethanol crush margins and planned maintenance shutdowns. The Plant Nutrient segment continued to see high margins, however, there were some write-downs in lawn products inventory.

The Andersons has a modest growth ambition for the coming years. Management presented a “strategy for growth” plan with an adjusted EBITDA between $375 – $400 million in 2025.

The company has a long history of paying dividends and has increased its payout for 26 consecutive years. Shares currently yield 2.1%. We expect 4% annual EPS growth, while the stock also appears to be undervalued. Total returns are estimated at 14.3% per year.

Click here to download our most recent Sure Analysis report on ANDE (preview of page 1 of 3 shown below):

Final Thoughts

Agriculture stocks are a compelling place to look for long-term stock investments. That’s because the demand drivers of the industry make it extremely likely to be around far into the future.

We believe the 7 agriculture stocks examined in this article are the best within the industry.

At Sure Dividend, we often advocate for investing in companies with a high probability of increasing their dividends each and every year.

If that strategy appeals to you, it may be useful to browse through the following databases of dividend growth stocks:

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.

[ad_2]