[ad_1]

Spencer Platt/Getty Images News

Recap

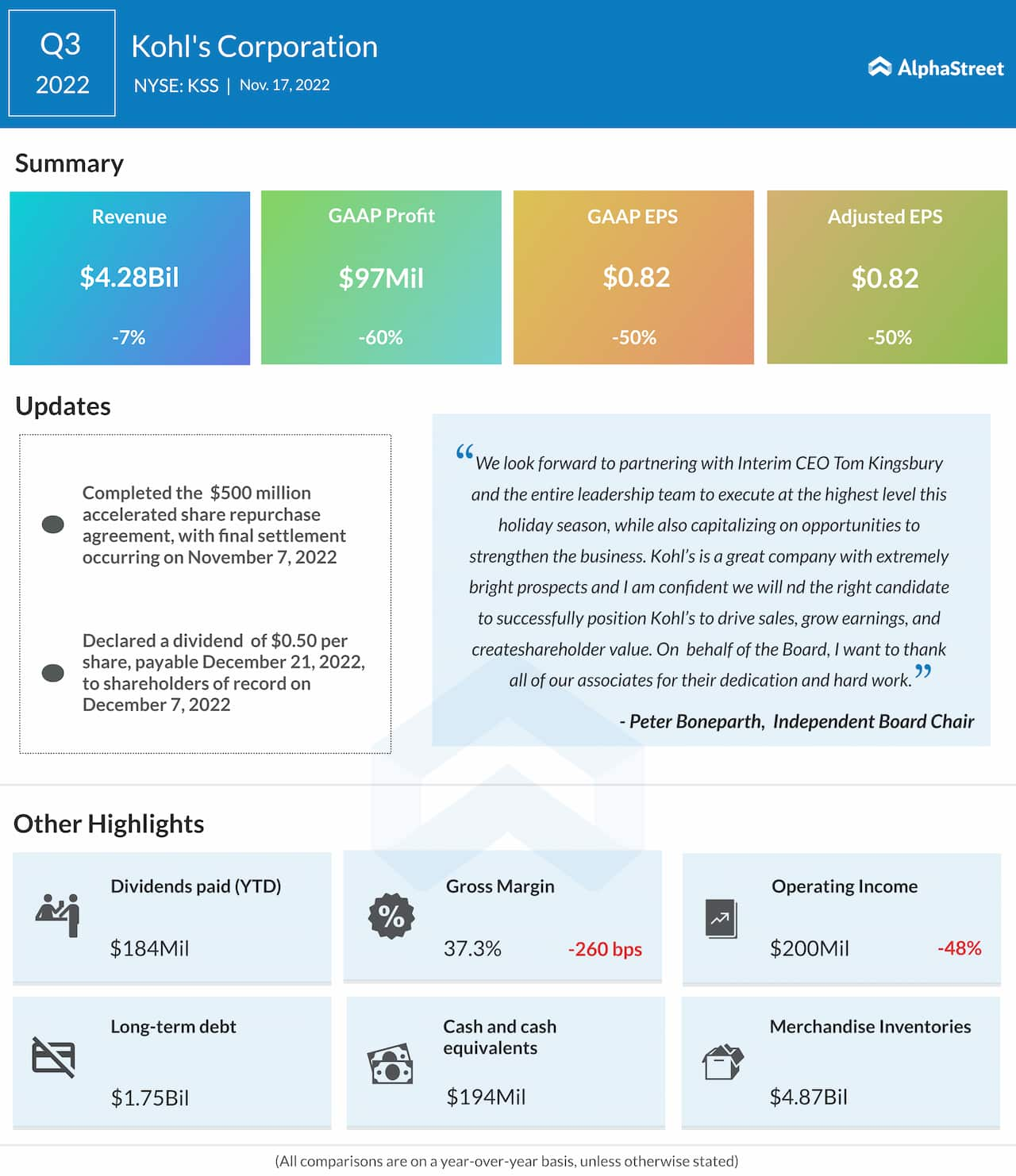

We initiated coverage of Allbirds (NASDAQ:BIRD) on October 20th, 2022, with a “SELL” rating based on the company’s revenue deceleration, increased losses, and elevated balance sheet risks. Since then, the company has lost another -15.63% in market capitalization despite the S&P 500 returning 8.21% in that same time frame. Based on recent news, evolving market conditions, and Allbirds Q3 earnings announcement, we believe now is a good time to update investors on our thesis on Allbirds. In short, we remain firm on our bearish thesis and reiterate a “SELL” rating.

Company Updates

Q3 Earnings

Allbirds had a mixed earnings in light of the company’s one year anniversary since the IPO. The company posted net revenue of $72.7 million in Q3 2022 which represented a 16% YoY increase. The revenue came in higher than street expectations. The company also announced an adjusted net loss of -$22.4 million which was less than Q2’s net loss of -$29.4 million. However, the net loss remains much more elevated compared to the previous year where the company only lost -$6.3 million. Furthermore, the net loss margin has increased YoY, and now stands at 35.0% compared to 22.0% the year before. As seen below, the increased net loss trends hold true, and there’s not yet any evidence of a turnaround in this negative momentum.

Balance Sheet

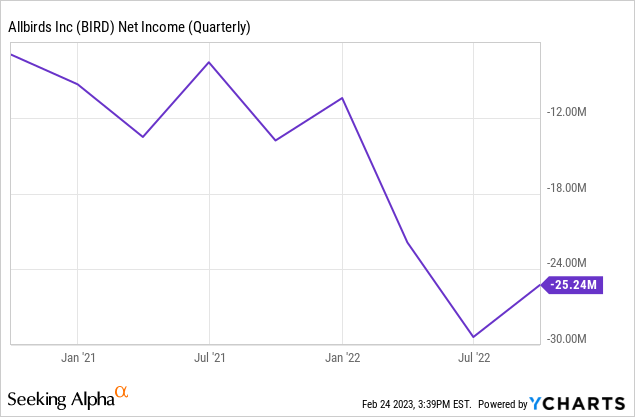

In our coverage article, we noted our fears of liquidity risks given the higher losses and decline in liquidity position. The declining cash balance has maintained its downward trend, as the company ended Q3 with $180.7 million in cash compared to $207.3 million in cash balance in Q3. Though the company stated that it has another $40 million in revolving credit agreement, our fears about the balance sheet continued as losses continue to mount quarter-over-quarter. Though the company has signaled initiatives to streamline its business, we have yet seen major shifts in the negative trends though we will remain vigilant for any signs of a substantial turnaround.

Economic Risks

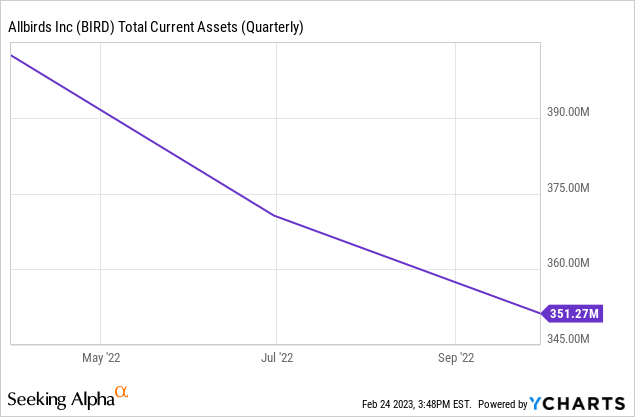

The near-term future of the U.S. economy remains uncertain. With unfavorable inflationary data and higher expectations of higher interest rates and for longer durations of time, our base case scenario assumes a recession that will impact U.S. consumption negatively. As a consumer discretionary company with focus on apparel and shoes, Allbirds will likely be directly impacted by a recession, and its financial performance could be worse as revenue contracts and losses increase. Such pressures will provide even greater risk to its weakening financial position and would present a further downside to the company’s share price and valuation multiples.

Thoughts on Valuation

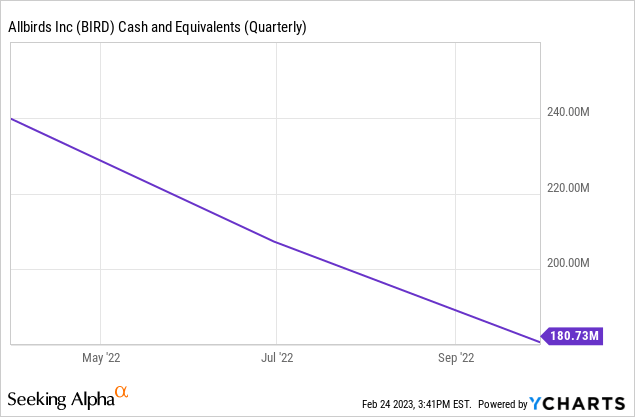

The company is difficult to value due to its lack of profitability, short history of financial performance, and lack of comparable public competitors. As mentioned in the coverage article, these multiples below don’t shed too much color on our thesis. Rather, we find it more important to look at the declining cash balances and the continued net losses on a quarterly basis. As seen below, the company’s current assets are in a steady downward trend, and with a market capitalization of ~$400 million, the company is valued more than its total current assets. Given the risks and negative trends identified in this article, we find that the valuation doesn’t provide a good risk/reward basis for investors.

Conclusion

We reiterate our “SELL” rating on Allbirds due to mixed Q3 results, continuation of liquidity risks, and large exposure to recession risks. The company’s balance sheet continues to deteriorate and its financial performance has deteriorated on a YoY basis despite a fairly robust U.S. consumer environment. Though some upside risks remain with potential Federal Reserve pivot or a soft-landing, we believe there is greater downside risk than potential upside given the economic conditions and the negative trend that the company has yet to break out of.

[ad_2]