[ad_1]

The stock market is likely to see record highs in early 2024 after an “extremely rare” signal just flashed.

That’s according to Carson Group chief market strategist Ryan Detrick, who highlighted another sign that breadth is improving.

“We continue to expect stocks to do quite well and we remain overweight equities,” Detrick said.

An “extremely rare” signal just flashed in the stock market, suggesting to Carson Group chief market strategist Ryan Detrick that record highs are imminent.

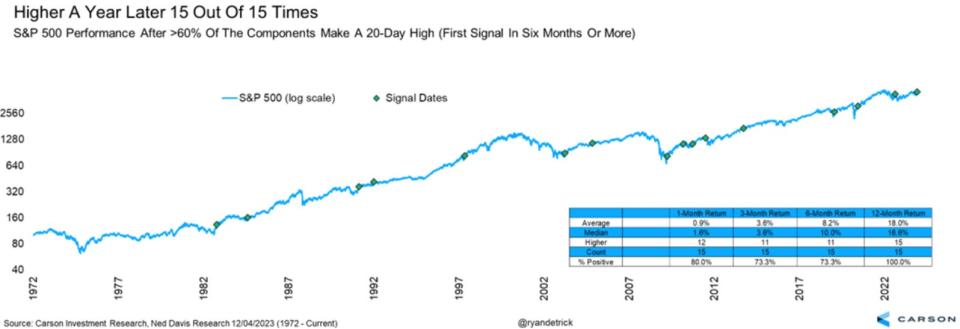

Detrick highlighted in a Thursday note that more than 60% of all components in the S&P 500 hit a new 20-day high last week. This runs counter to the idea that mega-cap tech companies are driving the bulk of the gains in the stock market.

“Last week, we saw a very rare breadth thrust, which suggested many stocks were surging, which tends to be a signal of impending strength,” Detrick said. “This is extremely rare and showed a lot of buying has taken place recently, not just in a few large stocks.”

Since 1972, this rare signal has flashed 15 times, not counting last week’s signal. The S&P 500 was higher a year later 100% of the time after the signal flashed, generating an average return of 18%.

If a similar gain occurs over the next year, the S&P 500 would trade at just above 5,400, which exceeds even the most bullish stock market forecasts.

Detrick highlighted that there have been other bullish signs in the stock market in recent weeks, including the S&P 500 surging 8.9% in November, representing its 18th best month ever.

When measuring the S&P 500’s 20 best months of performance, stocks were higher 80% of the time a year later, with an average gain of 13%. And when counting the 30 months in the S&P 500’s history when gains were at least 8%, stocks went on to rise 90% of the time in the following year.

“Once again, this signals the strength we just saw was likely the beginning to more strength, not the end,” Detrick said.

Story continues

Finally, he noted that the S&P 500 hasn’t hit a record high since January 2, 2022, nearly two years ago. With stocks less than 5% away from new highs, Detrick said he expects a record high to be hit in early 2024, and if that happens, it would be one more bullish signal.

“Previous times stocks went at least one full year without new highs and then hit one, the future returns were very solid. In fact, stocks were up 13 out of 14 times a year later and up 14.9% on average after long streaks without a new high and then finally making one,” Detrick explained.

When combined with the “extremely rare” technical breadth thrust signal that flashed last week, all signs are pointing for a continued bull market in 2024.

“Any one of these signals by themselves could be argued to be random, but when you start stacking them all on top of each other, we continue to expect stocks to do quite well and we remain overweight equities,” he said.

Read the original article on Business Insider

[ad_2]

Source link