[ad_1]

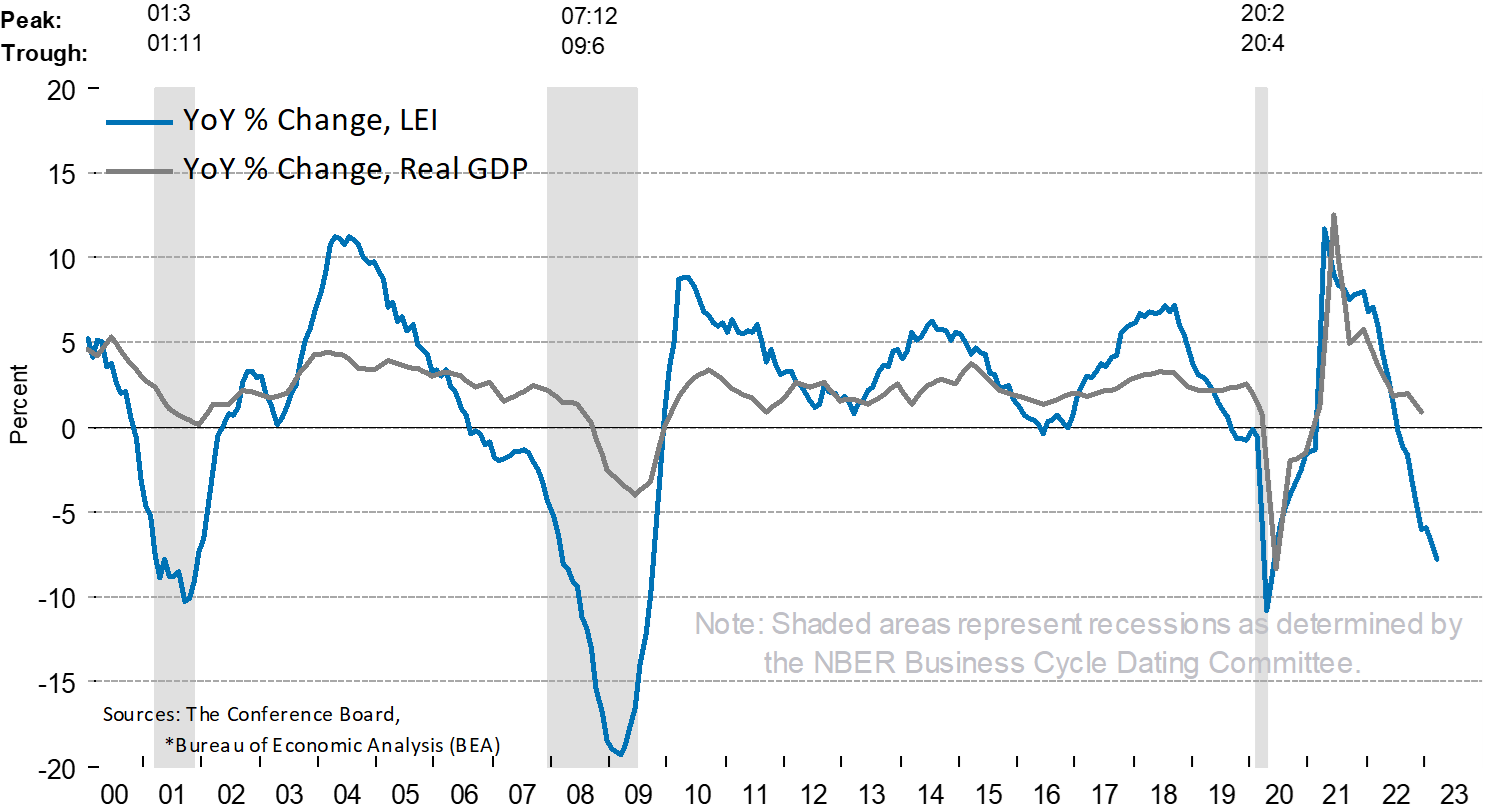

The Conference Board Leading Economic Index (LEI) for the US fell by 1.2% in March. It was the 12th straight month of declines in the LEI.

The drop in the LEI was steeper than the 0.7% projection and follows on the heels of a 0.5% decline in February. A conference board spokesperson pointed out that the LEI has hit the lowest level since November 2020 and is “consistent with worsening economic conditions ahead.”

The weaknesses among the index’s components were widespread in March and have been so over the past six months, which pushed the growth rate of the LEI deeper into negative territory. Only stock prices and manufacturers’ new orders for consumer goods and materials contributed positively over the last six months. The Conference Board forecasts that economic weakness will intensify and spread more widely throughout the US economy over the coming months, leading to a recession starting in mid-2023.”

In fact, the Leading Economic Index is now lower than in the early stages of the 2008 recession.

Longview Economics CEO Chris Watling told CNBC that a recession is coming, citing what he described as “pretty compelling” and “brutally bad” leading economic indicators.

Even the Federal Reserve now concedes that the economy is heading toward a recession. But Powell and Company insist the downturn will be “mild.”

Keep in mind that in early 2008, then-Fed Chairman Ben Bernanke was predicting a “mild” recession.

In his podcast, Peter Schiff pointed out that one of the lone bright spots in the Leading Economic Indicators — the stock market — is actually a negative, but it’s not being counted as a negative in the LEI.

In the past, the strong stock market generally signaled that investors were bullish about the economic future and confident company earnings would increase.

But that’s not how it works anymore.

“It’s actually the opposite,” Schiff said. “The stock market goes up when the economic data is bad. Bad news is good news for the stock market.”

Why does it work that way now?

When investors think the economy is bad, they get bullish on stocks because the Fed is going to be easier. Maybe they’re going to start cutting rates sooner. Maybe they’re going to go back to quantitative easing. So, when the stock market goes up, that’s actually a bad sign. Investors think the economy is weak. Conversely, when the stock market is going down, it’s because of good news. When investors think the economy is going to be strong, they want to sell stocks because they think the Fed is going to have to hike rates more or leave rates higher for longer.”

Watling told CNBC that the stock market wouldn’t likely make it through the recession unscathed.

The reality is if you look at profit margins, they went to record highs in 2021 and a bit of 2022, and of course, when you have a lot of inflation around, you can get very good operating leverage so you can get record high profit margins. When you get into recession, we’ve got to do a double hit on profit margins. You’ve got to normalize them back to normal levels, and then you’ve got to price in a recession. So, I think the expectations for earnings are way too optimistic and therefore the stock market will have to contend with that at some point.”

The mainstream generally believes a recession will put the final nail in inflation’s coffin. But in reality, the Federal Reserve will almost certainly go back to creating inflation in order to prop up the economy. That means we’re likely heading toward a stagflation scenario.

In a recent interview, Schiff said we would be lucky to escape with just a recession.

I think this is a depression. We’re probably already in it. It’s just going to get worse.”

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

[ad_2]