[ad_1]

Abu Hanifah/iStock via Getty Images

As profitable as Apple Inc. (NASDAQ:AAPL) is as a company, the tech giant is highly reliant on a key deal with Alphabet Inc./Google (GOOG, GOOGL) to generate a large portion of those profits. Regulators don’t want these default monopolistic relationships to exist, creating risk to the current business model. My investment thesis remains ultra-Bearish on the stock, which is trading at a premium valuation with several business models at risk.

Financial Risk

Advertising is the biggest risk and potentially a great opportunity for Apple. As much as the tech giant continues to push into new Services such as Apple TV+, the company obtains a large portion of revenues from the search engine deal with Google.

Apple will obtain an estimated $18 billion this year from the deal for Google to be the default search engine on Safari. This business has an estimated 90% gross margin, providing for a large portion of overall profits with over $16 billion in estimated gross profits in 2023 alone.

Barclays analyst Tim Long estimates pure advertising-related revenue to hit $7.5 billion this year, up from just $5.0 billion in 2022. The tech giant obtains ad revenues from the App Store and could move to obtain more ad revenues from Apple Maps, TV+ and other services.

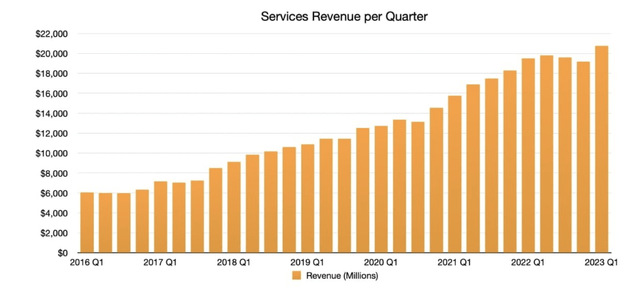

The Services revenue topped $20 billion in quarterly revenue during FQ1’23. While revenues have slowed as App Store revenue growth paused from the covid boost during 2021, Apple still generated $78 billion worth of revenues from Services in FY22.

Source: AppleInsider

Barclays has the advertising portion of Services revenues counting for 28% of overall revenues and contributing 12% of overall EPS. For FY23, analysts have Apple producing an EPS of $6 for net income of $96 billion based on 16 billion shares outstanding.

The prime risk is that Google finally gets tired of paying these traffic acquisition costs to Apple due to assuming iOS users find their way to Google search without the default. Google has 90% market share in search, and consumers prefer the search engine regardless of default settings.

So far, Google hasn’t wanted to risk Apple making subversive moves to steer people away from Google search. The new ChatGPT threat from Open AI and Microsoft Corporation’s (MSFT) Bing could be the threat to keep Google paying Apple.

Regulators in the U.S. and elsewhere are already lining up against these exclusive arrangements. The UK’s Competition and Markets Authority has been investigating the relationship for a while and along with the U.S. Department of Justice has clear concerns about competitive threats.

Donald Polden, Dean Emeritus and professor of law at California’s Santa Clara University made this statement to The Register about the cozy relationship:

A couple of years ago, some of my antitrust students were quizzing me about why Apple didn’t build out its Safari mobile search platform to take on Google search and this is a pretty good explanation – it is just too beneficial to maintain each others’ dominance.

The Google default deal appears to fit the very definition of anti-competitive behavior. The big question is whether Apple blocks other search engines from have easy access to Safari users. The DOJ is definitely probing these questions and the end result could definitely be a move to break the default relationship.

Reputation Risk

While the loss of Google revenue could be quickly offset by Apple instituting a default search engine where the tech giant directly collects the ad revenues is an option, the biggest issue for Apple is the repetitional harm of being heavily in the ad business. Right now, the company just collects fees from Google and doesn’t face any of the reputational harm.

Apple already faces antitrust issues with the App Tracking Transparency move. In addition, the ads shown on the App Store constantly run into issues not necessarily worth the risk according to 9to5 Mac considering the small portion of the nearly $400 billion revenue base.

CEO Tim Cook has long pointed out the desire to serve the interests of customers, not advertisers. This claim quickly shifts as Apple reaches a $7.5 billion ad business in 2023 and targets higher revenues in the future.

Again, the problem lies in Apple being priced for perfection. Despite the gains in advertising revenues, analysts forecast revenues to decline slightly over 1% this year, or the equivalent of $5 billion.

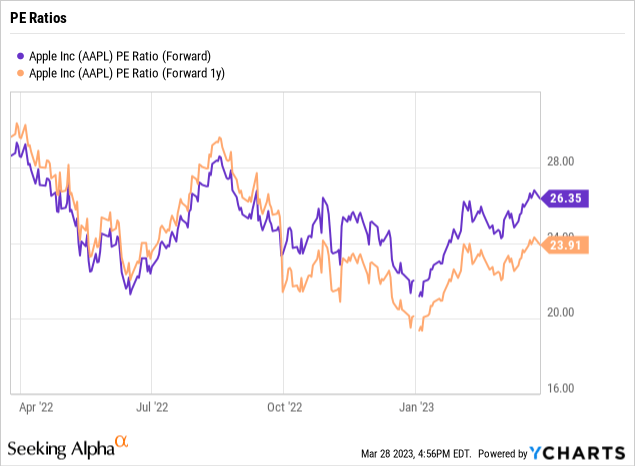

The stock already trades at 26.5x FY23 EPS estimates just shy of $6 and analysts have Apple trading at 24.0x FY24 EPS targets. The market wants to value the stock at even higher multiples to reach the average analyst price target of $169.

In our view, the whole problem with the stock is that investors aren’t properly factoring in the above risks. Investors see the upside potential from ever growing default search engine revenues from Google and the potential for more ad revenues from other sources.

The risk is that the Google revenue disappears and the ad revenue causes reputational harm to the Apple brand. Consumers pay premium prices for Apple products in order to avoid the security and transparency issues from other brands while the tech giant appears to be inching closer to the problems other brands face.

Analysts already factor in the upside from these sources of additional ad revenues. Apple isn’t forecast to generate much in the way of growth while the risks aren’t factored into the stock price.

Our base case isn’t for Apple to lose the Google default search engine revenues, but the risk is that regulators force an end to this relationship. Apple stock is already priced for the best case scenario while investors aren’t accurately factoring in regulator risk, even if small.

Takeaway

The key investor takeaway is that a big risk to Apple Inc. is the financial and reputational harm of running full speed into the advertising sector. The Google search engine deal is fraught with anti-competitive risks, and Apple stock isn’t priced for a large gross profit business to disappear overnight.

Even without this risk, investors should not pay 26x FY23 EPS estimates for Apple Inc.

[ad_2]