[ad_1]

PhonlamaiPhoto

Investment Thesis:

ASML Holding N.V. (NASDAQ:ASML) is a major provider of lithography systems to the semiconductor industry. The company’s technology is essential for the production and use of advanced semiconductors in a variety of electronic devices, including smartphones, laptops and data centers. As such, the future growth prospects of the company are positive because of the increasing demand for these devices. Nonetheless, there are risks to the stock, including a possible slowdown in the semiconductor sector, significant volatility in the share price in short periods of time and export controls on the most advanced machines to China. Although the company’s long-term performance may remain strong, it might be wise to hold for an attractive entry point before investing.

Understanding the Semiconductor Industry:

The semiconductor industry is quite difficult to understand. There are many moving pieces and players across this complex ecosystem. This presents challenges in assessing the relative position of each industry player. I will provide a small overview so that you are able to follow the reading.

We will start with the basics. What are semiconductors? Semiconductors are chips that process digital information and they are in almost every device you can think of. For example, smartphones, cars, computers, etc.

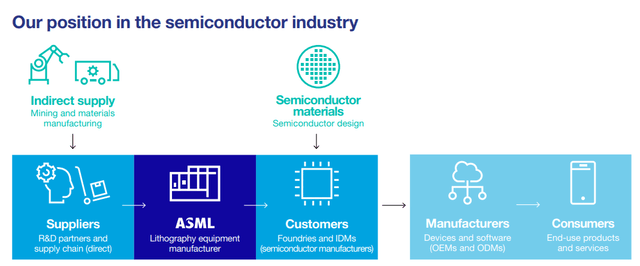

To think about the role of semiconductors and the players in the industry let´s deconstruct the value chain and work backwards from the end use of the product, for example, a smartphone. A smartphone has many chips inside of it, these chips are designed by companies such as Apple (AAPL), Nvidia (NVDA), Qualcomm (QCOM), etc. Once designed, the semiconductor chips are made at fabrication plants from companies such as TSMC (TSM), Intel (INTC) or Samsung (OTCPK:SSNLF). The fabrication plants use high-tech machinery to manufacture the semiconductor chips, this high-tech manchinery is sold by ASML.

It is important to note that as semiconductors become smaller the more efficient they become. This is where ASML’s competitive advantage lies. ASML manufactures the machinery needed to produce the smallest and most advanced semiconductor chips. ASML sells equipment to “Foundries”, and “Integrated Device Manufacturers” so that they can make the chips their customers need. In the business overview, I’ll give more insights into where ASML is in the ecosystem.

Business Overview:

ASML is a leading Lithography Equipment Manufacturer in the semiconductor industry, selling to Foundries and Integrated Device Manufacturers. The company’s customers are among the world’s leading microchip manufacturers, and ASML’s success is very closely tied to the success of its customers. For reference two of the company’s biggest customers are TSMC and Samsung. ASML has a truly dominant position in the industry, essentially holding a monopolistic position.

Why does ASML hold a monopolistic position in the industry? Well, ASML lithography technology is considered to be at the forefront of the industry thanks to its extreme ultraviolet (EUV) technology. Its competitors are not able to manufacture EUV technology yet. In fact, ASML is the only company in the world that can manufacture EUV technology. Before this technology came out, the most advanced technology to manufacture semiconductors was Deep ultraviolet (DUV) technology. It is for good reason that ASML holds this position, as the company invested more than €6 billion in EUV R&D over 17 years.

What is the difference between DUV and EUV? EUV technology uses a wavelength that is significantly smaller than DUV. DUV light used in chip production has wavelengths of 248 and 193nm, whereas the light used in EUV lithography has a wavelength of 13.5nm. It is important to keep in mind that the smaller the semiconductor, the more efficient it is! Now this does not mean ASML only focuses in EUV, the company still has a strong focus on DUV, but EUV is really the competitive advantage it has against its peers.

As a final recall, in essence, ASML sells the equipment to companies like TSMC, Samsung, Intel, etc. Then TSMC and Samsung use the equipment and raw materials in order to produce the end product that goes inside their customers’ products (smartphones, computers, etc.).

ASML Position in the Semiconductor Industry (ASML Annual Report)

Financial Overview:

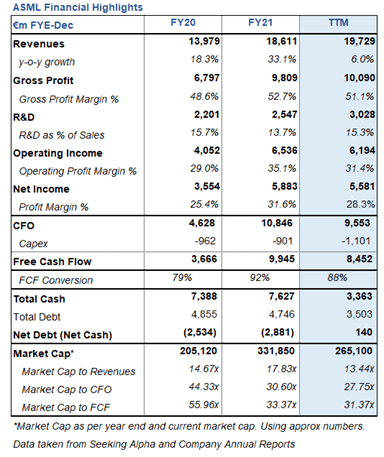

ASML Financial Highlights (Seeking Alpha and ASML Annual Reports)

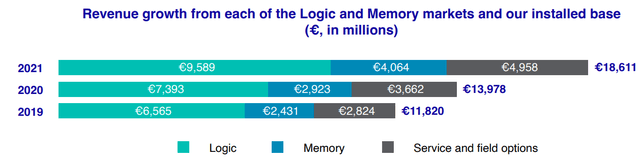

During FYE 2021 ASML generated revenues totalling €18.6 billion. ASML reports revenues through two segments: System sales and Service and Field options. The bulk of the revenues was generated by System Sales which accounted for €13.7 billion. This segment operates in two markets: the Logic, and Memory markets. The rest of the revenues came from Service and Field options accounting for €4.9 billion.

ASML Revenue Growth (ASML Annual Report)

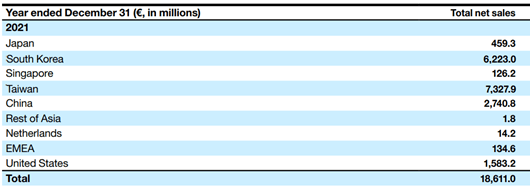

According to ASML during 2021, two customers exceeded more than 10% of total sales, accounting for €12.5 billion of total sales. From the geographical revenue breakdown in the table below, we can derive that these two customers are TSMC (Taiwan) and Samsung (South Korea). It should be noted that Intel also accounts for a significant amount of revenues however this has decreased below 10%.

ASML Geographical Revenue Breakdown (ASML Annual Report)

The reason why ASML technology is years ahead of its competitors and why the company reached EUV technology is largely thanks to the spending on R&D. ASML spends around 15% of total sales in R&D every year. During 2021, ASML spent €2.6 billion in R&D, which is highly focused on enhancing EUV high-volume manufacturing. ASML is already working in the development of the next generation of EUV machines. Despite this significant expense, ASML is able to generate very attractive net profits of €5.9 billion which translates into an outstanding 31.6% net profit margin. ASML free cash flow is also noteworthy to mention standing at €9.9 billion during FYE 2021. The company has consistently demonstrated a strong cash flow from operations, resulting in a cash conversion rate of 80% or higher. Notably, this percentage has been even higher in recent years, as the company has grown in size and efficiency.

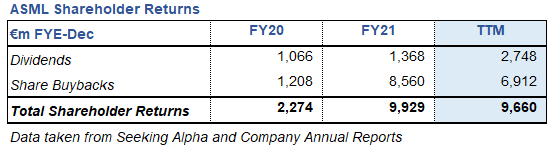

Shareholder Returns:

The company has a strong track record of returning value to shareholders. During 2021, it distributed €10 billion to shareholders through dividends and share buybacks. Share buybacks are clearly working as the outstanding shares have decreased by 20 million shares or 5% since 2019. ASML management recently announced a €12 billion share buyback program with a timeframe of 3 years. The company is able to pursue this new program thanks to its robust financial fundamentals, bolstered by its strong balance sheet.

ASML Shareholder Returns (Seeking Alpha and ASML Annual Reports)

Competition and Growth Opportunities:

The reason why competition and growth opportunities go hand in hand is because ASML is the owner of its own future. ASML faces competition in the industry however its technology is far more advanced than its competitors due to its EUV lithography technology. ASML technology is years ahead of everyone else, which gives the company a dominant position. ASML is also not slowing down, as previously mentioned the company is spending approximately €2.6 billion in R&D. This spending is highly focused on enhancing EUV high-volume manufacturing, as well as the development of the next generation EUV machines.

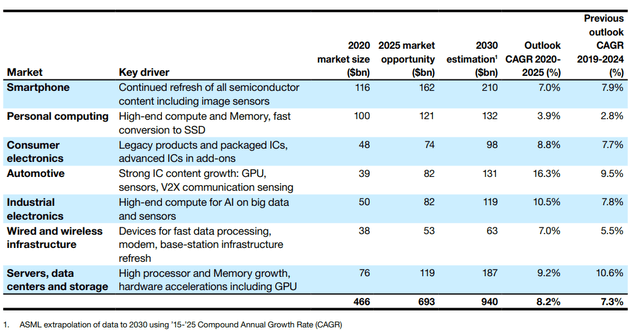

The key area for growth for ASML is the increased annual manufacturing capacity of EUV and DUV systems. The semiconductor industry is expected to grow significantly in the coming years, projected to reach $940 billion by 2030 (Please see table below). This growth is driven by the increasing demand for electronic devices and the need for faster and more efficient chips. ASML EUV technology is well-positioned to benefit from this, as it allows for the production of smaller and more complex chips. Management has been vocal and expects annual revenue during 2025 between approximately €30 billion and €40 billion. Management also presented the 2030 forecast with annual revenue between approximately €44 billion and €60 billion.

Market Overview and Forecast (ASML Annual Report)

Valuation:

The market valuation of ASML has experienced substantial volatility with significant appreciations and depreciations over the past two years. To give a quick summary, at the beginning of 2021, ASML had a market capitalization of $205 billion, later that year it reached a peak of $360 billion. However, one year later the company experienced a significant decline in its market valuation dropping by almost 60% to $149 billion. Jump ahead three months to its current market valuation and it has risen to $263 billion. It is worth noting that these fluctuations have resulted in high double-digit increases and decreases within a short period of time. This volatility risk should be noted by investors. Nonetheless, such volatility also presents opportunities for investors to potentially invest at attractive points.

With the current market valuation, ASML multiples stand at price to cash flow of 27.8x and price to sales of 13.4x. I would argue this is not as attractive as for example 3 months ago when multiples stood at price to cash flow of 15.6x and price to sales of 7.6x

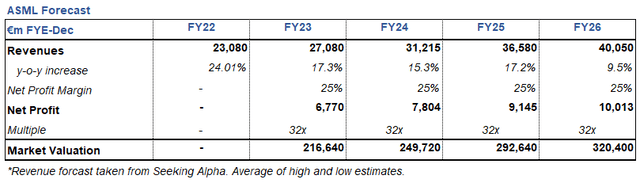

For the valuation of the company, I have used the market multiple method, using future forecasted earnings to a 32x multiple. This is a high multiple but due to ASML dominant position in the market and previous 3 years’ multiple being constantly above 30x, I believe it is reasonable. I have obtained the analysts’ revenue forecast from Seeking Alpha data and have applied net profit margin of 25%. This net profit margin is in line with the previous 3 years’ average. The numbers presented in the table below are largely in line with ASML’s management forecast, with annual revenue during 2025 between €30 billion and €40 billion.

ASML Forecast (Seeking Alpha and Author´s Estimates)

Risks:

Dependence on a few key customers: ASML financial performance is closely tied to the success of its customers, with TSMC and Samsung being its two largest customers. Any loss of business from these key customers could have a significant impact on the company’s revenues and profitability. Management is trying to minimize this risk by diversifying revenues away from its top customers. They have somewhat achieved this during 2021 as in 2020 and 2019, three customers exceeded more than 10% of total net sales. Currently, only two customers exceed more than 10% of total sales.

Geopolitical Agendas: The world has entered a chip war in recent years and ASML has been caught in the middle of this war. The imposition of stricter export controls, specifically targeting China, presents a risk to the company’s potential revenue growth in the world’s second-largest economy. It is likely that Chinese companies will seek to increase their purchases of EUV and DUV machines in order to manufacture their own semiconductors. As it stands ASML will be limited to take advantage of this opportunity. Additionally, the ongoing tensions between China and Taiwan pose a risk to the company’s revenues, as TSMC is one of ASML’s two largest customers. Any military action in the region could have a significant impact on both companies’ top and bottom lines. It is important to note that all countries rely on semiconductors for economic and technological advancement. This presents a consequential downside of any potential conflict for all parties involved. This somewhat provides ASML with protection against these risks.

Bottom Line:

In conclusion, ASML is well-positioned to remain as the leading provider of lithography systems for the semiconductor industry. ASML management has projected for the semiconductor industry to grow to $940 billion. This of course provides a significant growth opportunity. However, as mentioned earlier, the stock has shown significant volatility and this is a risk for investors to take notice of. Furthermore, the semiconductor industry is likely to experience a near-term slowdown as the semiconductor shortage eases. To top it off, ASML is facing strict export controls on its most advanced machines to China. This will certainly hinder the prospects of growth in the second-largest economy in the world. As such, while ASML may continue to perform well in the long term, it may be more prudent for investors to wait for a more attractive entry point before investing in the company’s stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]