[ad_1]

krystiannawrocki/E+ via Getty Images

Overview

ASML Holding N.V. (NASDAQ:ASML) is the preeminent provider of semiconductor production machines. The company produces and distributes the most advanced semiconductor lithography products in the market, continuing to be the only company globally that sells machines for producing chips at the 3nm and 5nm scale.

While this is an important element of the company’s differentiation, I would like to focus on the company’s secular positioning more generally within this article. To sum up my previous position on ASML, I found that this was a company that provides what is genuinely the most advanced technology in the space while also having an extensive operating track record and excellent long-term returns for shareholders.

It is clear that ASML is positioned to continue benefitting from secular growth in the semiconductor industry, a market which is expected to grow at a compound annual growth rate of 12.2% through 2029. The firm’s position in the value chain ensures exposure to this market as it continues to grow and foundries continue to produce more chips.

This secular trend in semiconductors, as well as the high compound growth rate that we get as a result, is made even more interesting by recent developments in generative artificial intelligence computing. The well-known release of ChatGPT has kicked off a rush of B2B offerings that make use of this technology, both from numerous new startups as well as established cloud players. All this new software and associated investment in hardware means that generative AI technology has quickly become a newfound accelerant for the semiconductor industry as a whole.

This means that presently expected rates of growth in certain segments of the semiconductor space may very well be exceeded over the next decade. Already, NVIDIA’s (NASDAQ:NVDA) revenue revisions are showing that this trend is real. Going forward it’s sensible to believe that this should selectively improve the performance of other companies with exposure to generative AI, be it through selling software or hardware.

I certainly consider ASML to be one of these companies, albeit in a less direct way than many others. Essentially the firm stands to benefit from the growth in the market as a whole as well as accelerated marginal investment in more advanced chip production. This should percolate upstream through the value chain and ultimately create more investment in the semiconductor production machines that the company sells, pushing revenue growth beyond current expectations. The rising tide within which it has been operating now appears to be rising even more so.

This is the case both because the company’s business stands to benefit from rising levels of chip demand overall, which are set to increase due to investments associated with AI, but also because of the AI use case in particular. Indeed, cutting-edge 3 nanometer and 5 nanometer chips are already being designed and developed for AI-optimized processing across both mobile and personal desktop computing contexts. Apple (NASDAQ:AAPL) has ordered large amounts of 3nm chips for its latest generation of processors, which come with parallel coprocessors. Microsoft (NASDAQ:MSFT) is working on a proprietary AI chip that is designed around 5nm chip architecture. While early, these signs bode well and indicate that the latest generation of chips are distinctly useful for AI computing. This is good for ASML because, as mentioned, it is still the only firm that sells machines for manufacturing chips at the 3 and 5 nanometer scale.

As such, I think that now is a good juncture to review ASML’s stock and valuation in particular. These elements, along with its present trendline as to fundamentals, will ultimately ensure how further developments in the market and the company’s business will get priced in to its stock. Through this we can determine if the market is already pricing some level of benefit or if this stock’s valuation has not yet begun to reflect what I perceive to be a material future tailwind.

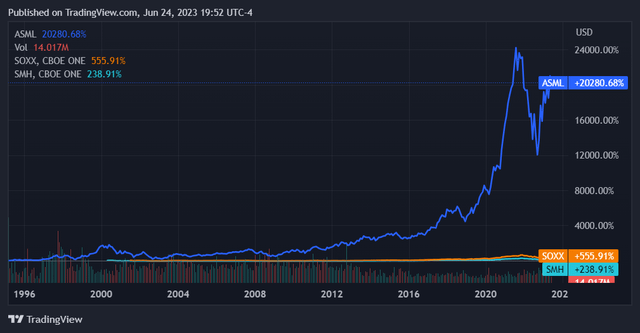

Year-to-date ASML is underperforming the semiconductor space as a whole, the price performance of which I estimate here by using the prominent semi ETF’s SOXX and SMH.

Seeking Alpha

Of course, we must remember that ASML is still a significant outperformer over the long-term, having greatly outperformed these instruments since its 1995 IPO.

Seeking Alpha

These two charts make it clear that this is a highly successful stock that is nonetheless not experiencing price performance at par with its peers overall, this year. This relative effect can partly be chalked up to the significant and concentrated appreciation in NVIDIA driving the performance of the sector at large. It can also be due to a heavy premium already priced in for ASML’s forward prospects, creating an elevated valuation. I will evaluate the latter of these in the next section while also investigating the stock’s momentum.

Valuation and Momentum

ASML is already the largest company in the Semiconductor Equipment subsector by market capitalization. At its current market cap of $275.4B it is more than twice as large as the next largest firm, which is Applied Materials (NASDAQ:AMAT) at $114.3B.

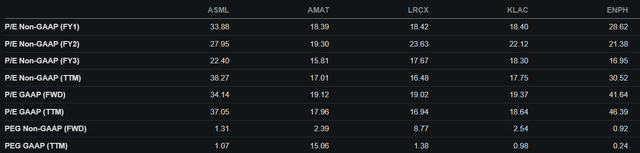

This large market cap is the result of the size of ASML’s business as well as its premium price/earnings ratio. At its current share price of $696.91, ASML trades at a 1-year trailing GAAP P/E of 37.05 and a 1-year forward GAAP P/E of 34.14. We can also consider its GAAP PEG (price earnings to growth) ratio, which multiples in the company’s current expected long-term EPS growth rate; this is 1.07 at the moment. We can then compare these numbers to that of the largest 5 companies in the Semiconductor Equipment subsector to see how it stacks up.

Through this we can see that ASML is the most expensive stock of the bunch on a P/E GAAP basis.

Looking over at GAAP PEG, however, this does not turn out to be the case. ASML’s current PEG ratio of 1.07 actually puts it right in the middle of these 5. While the distribution here is wide, this indicates that ASML is not actually carrying a particularly heavy growth premium at its current valuation.

Seeking Alpha

This leads me to conclude that there could still be buying room here if ASML’s revenue results start coming above expectations.

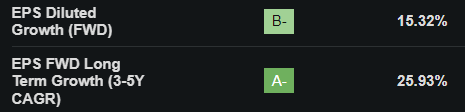

I’ll caveat this by saying that forward growth expectations are already quite high, at over 15% for the year ahead and nearly 26% compounded annually over the next 3-5 years. These are rosy expectations to say the least.

Seeking Alpha

Yet, these expectations do not yet reflect changes from generative AI demand over this time span. This is sensible as the trend was only proven in earnest with NVIDIA’s historic stock surge in late May, exactly one month ago.

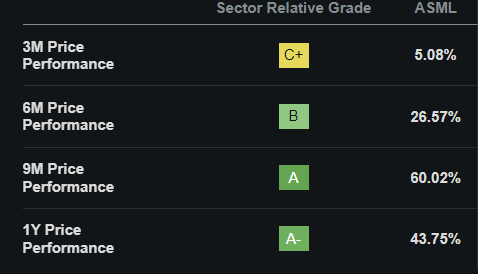

The company’s stock has also not begun to move in advance of these expectations changing. In the last 3 months ASML stock has actually been moving roughly in-line with the IT sector as a whole, appreciating 5.1% as the sector as a whole moved up 4.7% throughout this time.

Seeking Alpha

Overall the picture here indicates to me that ASML stock has room to run if and when its prospects are further buoyed by marginal revenue from the generative AI trend. This means that investors optimistic about improvements to the company’s forward prospects as a result of generative AI buying should stand to benefit from buying the stock at current prices.

Risks and Conclusion

The risk here appears fairly clear-cut. ASML stock trades at a significant growth premium and is a company that already has high growth expectations baked in to its share price. If it fails to live up to these over the next 1-5 years, its stock will likely sell off and not continue to maintain its current GAAP P/E premium.

On the other hand, it appears that ASML stock does not yet reflect what could be even greater growth in its business in the years ahead. While I think it will take some time for the effects of generative AI investment to percolate upwards to the part of the value chain at which ASML sits, I am still expecting this to happen within a 5 year span. I further expect that this will result in further upgrades to revenue growth expectations for the company, which should further elevate the growth premium at which its shares trade. Considering all of this, I will call ASML stock a buy for a 5-10 year investment horizon.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]