[ad_1]

CreativaStudio

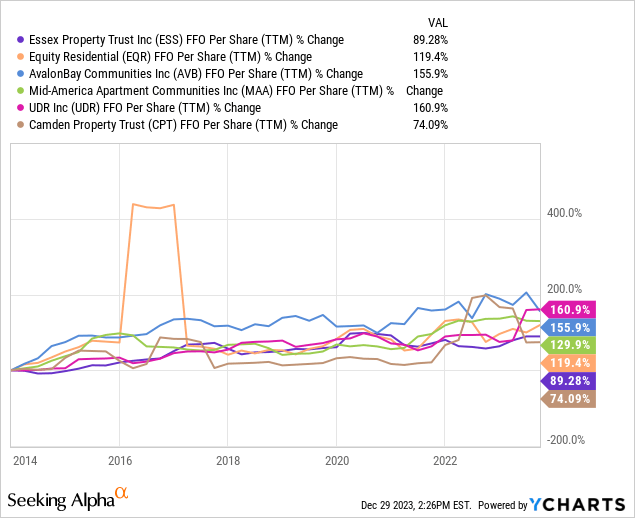

We have been looking at multi-family high-quality residential REITs, as we believe it is one of the sectors that currently offers better value in the real estate sector, especially when one considers its more defensive nature. There are many options to consider, but we decided to focus on six of the biggest and best known ones. This group includes Essex Property Trust (ESS), Equity Residential (EQR), AvalonBay Communities (NYSE:AVB), Mid-America Apartment Communities (MAA), UDR, Inc. (UDR), and Camden Property Trust (CPT). One of the first things we wanted to look at was how much they have grown their funds from operations per share in the last ten years.

Most of them more than doubled FFO per share, with the exceptions of Essex Property Trust and Camden Property Trust. So our top two candidates were UDR Inc and AvalonBay Communities, however, once we looked at things like portfolio diversification, operating margins, and leverage, we decided to focus our efforts on analyzing AvalonBay Communities.

Portfolio

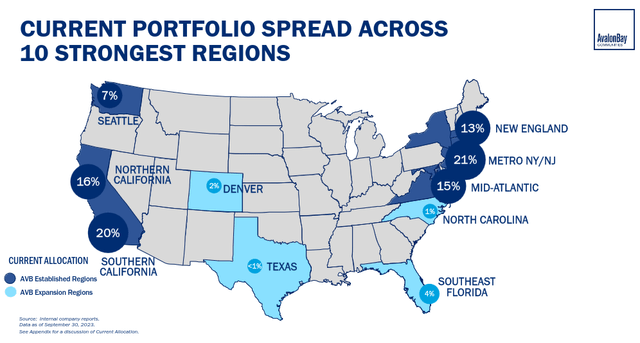

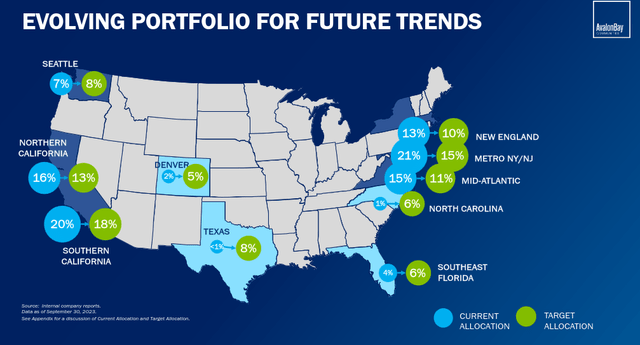

Currently AVB is mostly focused on the coastal markets, but it is working on diversifying in what it calls “expansion regions”, these include Texas, Colorado, Florida, and North Carolina. At the moment they represent a small fraction of the net asset value of the company, but the target is for them to eventually represent about a quarter of the value of the portfolio.

AvalonBay Communities Investor Presentation

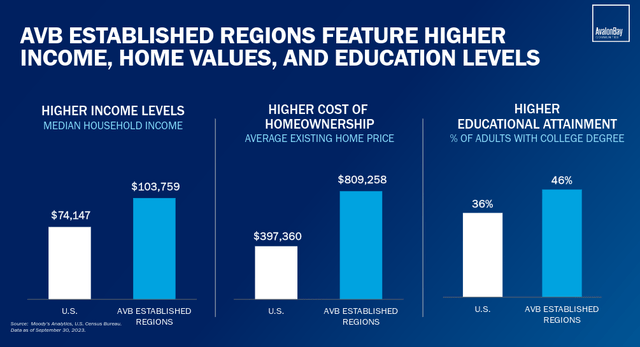

It is going to take some time for the portfolio to reach the company’s target, but we are not too worried, as their current markets have some very attractive characteristics. These include higher median household incomes, higher cost of home-ownership, and a higher percentage of college graduates. These factors have allowed the company to raise rents at a relatively fast pace, especially given that developing new assets in these regions is particularly complicated. This is one of the reasons AVB is now focusing its development efforts in the expansion regions, as well as the higher-than-average population growth these regions are experiencing.

AvalonBay Communities Investor Presentation

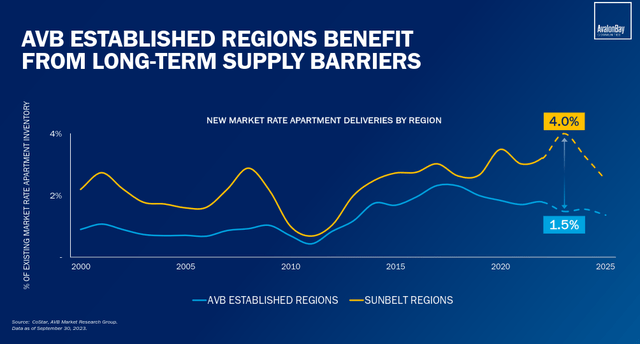

While it might not be in the best interest of society, the complications in some of these states to develop new residential units has resulted in a competitive moat for companies like AVB. This can be seen in the low supply being added as a percentage of existing inventory, with only ~1.5% supply growth in AVB’s established regions, compared to ~4% in Sunbelt Regions.

AvalonBay Communities Investor Presentation

Growth in the expansion regions is going to be done over time, mostly through self-funding and capital recycling. In fact, the company recently shared that since Q3 2017 it has made ~$5.7 billion in dispositions at a weighted average cap rate of 4.4%, and has acquired $2.4 billion in assets with a weighted average cap rate of 4.2%. While the acquisition cap rate is slightly lower, the average age of the acquired assets is only about six years, while the assets being disposed are much older having an average of 21 years.

While AvalonBay Communities plans to continue owning and operating high-quality multifamily buildings in urban and suburban coastal markets, its portfolio will look more balanced if it reaches its targets with respect to the expansion markets. The slide below shows how it should evolve, with places like Texas going from less than 1% to about 8%. If done opportunistically, and recycling assets at good prices, we think this is a good strategy and increases the options the company will have as to where to invest its available capital and free cash flow.

AvalonBay Communities Investor Presentation

The reasons behind this new portfolio allocation were discussed during the last earnings call where CEO Ben Schall gave several reasons when responding to a question from an analyst.

Let me make a couple of comments. First in terms of our long-term framework of moving 25% of our portfolio to our expansion markets that remains. Primary drivers of that; one the recognition that our core customer our knowledge-based worker is in a more dispersed set of markets. And second we can take what we do well bring it to those markets in order to generate incremental value for shareholders.

In terms of pacing and timing, we are seeing softness. We’re starting to see some dislocation in our expansion regions and we see it as a potential opportunity. It’s an opportunity to potentially be buying assets below replacement cost which we have started to do and in a development market that maybe has less players in it or players that don’t have the same access to capital or the same cost of capital that we do to be able to selectively step into some attractive development opportunities there.

Financials

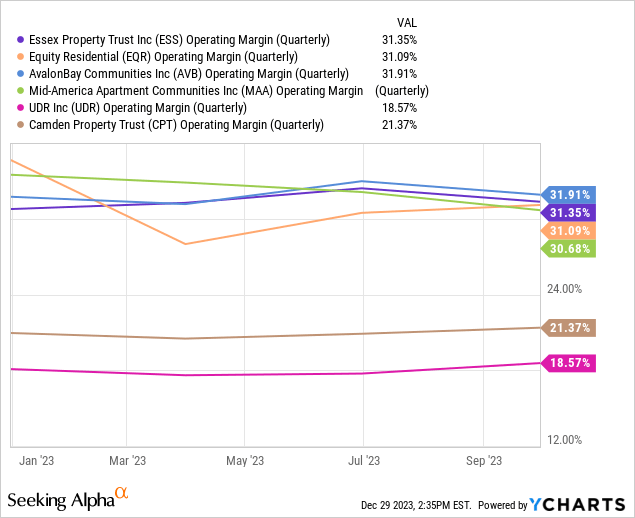

We can see that AVB is effectively leveraging its scale to deliver the best operating margin in the group. The difference is relatively small with its other large peers, it is really UDR Inc and Camden Property Trust that underperform by more than ten percent.

Growth

We believe the outstanding historical FFO per share growth that AVB has delivered in the past decade is in large part a result of its development capabilities. Since 2012, the company has completed more than $10 billion of development assets, more than its REIT peers combined, and created $4.4 billion in value in the process. This is one of the main reasons it has been able to deliver above-average per share growth.

AvalonBay Communities Investor Presentation

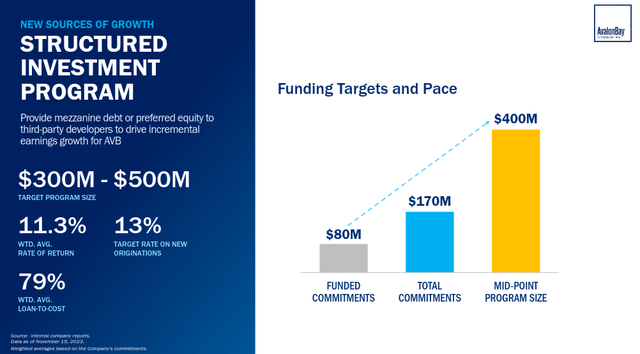

Going forward, it plans to continue developing new assets, and it has added a new growth vector, lending to third-party developers at attractive rates. The target interest rate on these loans is 13%, and it plans to reach between $300 million and $500 million in total loans in the next couple of years. The funds the company is lending are backed by assets the company says would not mind owning if the developer defaults. In the third quarter the company made $50 million of commitments under these program.

While it is not its plan to end up with these assets, at least the company says that it is comfortable even if it were to end up having to own and manage them. It is using its data and experience advantage to properly evaluate the lending decisions, and probably has a better idea of the real value of the collateral compared to other lenders.

AvalonBay Communities Investor Presentation

Balance Sheet

AVB has one of the strongest balance sheets among all public REITs, with an A3 credit rating from Moody’s (MCO) and A- from S&P Global (SPGI). The company has $1.6 billion in excess liquidity after considering its investment commitments. The strength of the balance sheet and diversified portfolio enable the company to borrow money with a roughly 20 bps average spread in its favor compared to peers.

Impressively, the company can invest more than $1 billion per year from retained cash flow, asset sales, and incremental debt supported by growth. It could also invest considerably more it there was a market dislocation that provided great investment opportunities, as its leverage ratio is currently considerably below its target.

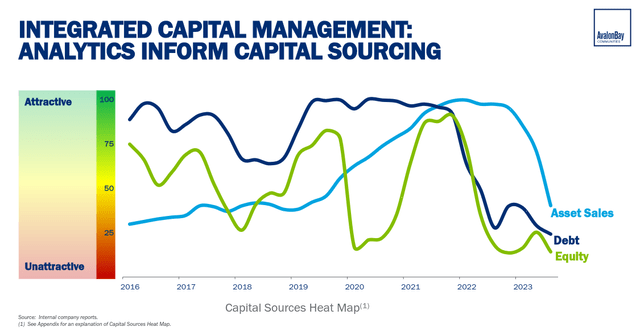

We think every company should make use of a capital sources heat map, as AVB does, which helps it make decisions on how to source capital for growth, or repurchase shares.

When its shares were arguably overvalued in 2022, it issued significant equity at a $250 average per share. Conversely, when it saw its shares undervalued in 2020, in repurchased shares at an average of $150 per share. Looking at the overall picture also helped guide the decision of making multiple asset dispositions when asset sales looked as an attractive option compared to debt and equity issuance.

AvalonBay Communities Investor Presentation

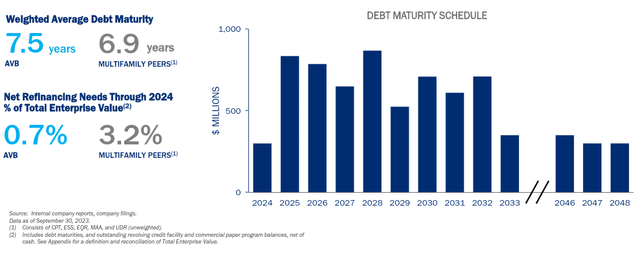

AvalonBay Communities has a very healthy debt maturity schedule, which is well laddered and has a weighted average maturity of 7.5 years. Even with the current higher interest rate environment, the company has been able to issue debt at favorable terms. A few weeks ago it issued $400 million in ten year senior notes at an interest rate of ~5%.

AvalonBay Communities Investor Presentation

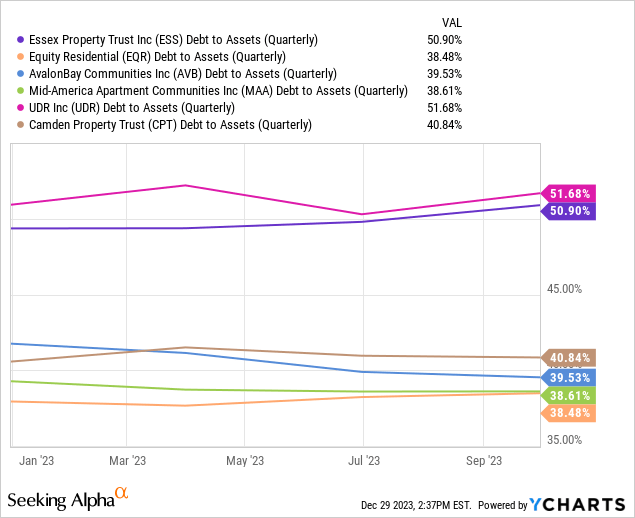

The company’s debt to asset percentage is currently around 39%, not too different to that of most peers, with the exception of UDR Inc. and Essex Property Trust that are more than ten percentage points higher.

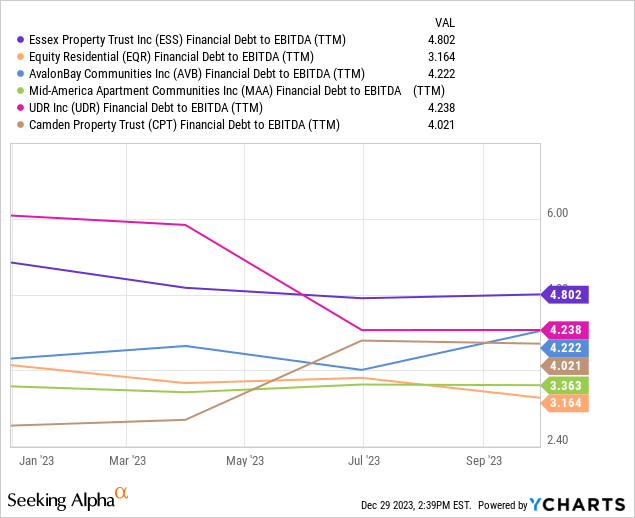

In terms of financial debt to EBITDA, the whole group is under 5x, but things could quickly change if the economy enters a severe recession or there is some other type of economic dislocation as happened with Covid. We think AVB is right in maintaining a below-target leverage for the moment, just in case there is a market dislocation in the future. This would allow it to survive without having to issue equity at unfavorable prices, and might even allow the company to make acquisitions at excellent values.

ESG

AVB has the highest CDP Climate Score, with an A- grade, and the company has shared that it believes this increases the company’s resiliency, provides operating cost savings, aligns with rapidly changing codes and regulations, and reduces residents’ utility costs.

For example, the company has committed more than $75 million to solar energy projects since 2018, with an unlevered IRR of 14%.

AvalonBay Communities Investor Presentation

Mid-America Apartment Communities and Equity Residential have decent climate scores too, and UDR Inc. has a failing grade.

REIT CDP Climate Score AvalonBay Communities A- Essex Property Trust C Camden Property Trust D Equity Residential B UDR Inc. F Mid-America Apartment Communities B Click to enlarge

Source: CDP

Outlook

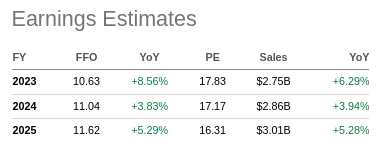

AVB grew core FFO by 6.4% in the third quarter, and is expected to grow core FFO 8.6% in 2023. Economic occupancy is high, but has room for improvement, currently around 95.7%. While the company expects a softer 2024 compared to the current year due to the macroeconomic environment, there are several headwinds and tailwind to take into consideration. Headwinds include dispositions the company has made, higher refinancing costs, and a decline in interest income from above average cash balances. Tailwinds include NIO growth from the stabilized portfolio, NOI from 3,000 units new development deliveries (~2.1x compared to 2023), and earnings from its new SIP lending program. The company also expects a modest decrease in bad debt costs. Other tailwinds include higher than expected stabilized yields, like the one recent completed development in Miami that reached a 7.2% stabilized yield. Two projects started this quarter have projected yields in the mid-6% range.

While some are pessimistic that a weaker job market will significantly affect rents, the company expects them to continue increasing even if at a slower pace. It recently sent renewal offers with a 6% increase proposal, and it expects that after negotiations they will probably end ~4% higher. An interesting fact that the company shared during the last earnings call was that affordability has actually increased in their established regions compared to pre-pandemic levels, as a result of strong wage growth over the last few years. It was also very interesting to learn that the percentage of move-outs to purchase a home is now below 10%, considerably below the mid-teens long-term average. This is likely the result of extremely high home ownership costs from high mortgage rates and elevated house prices.

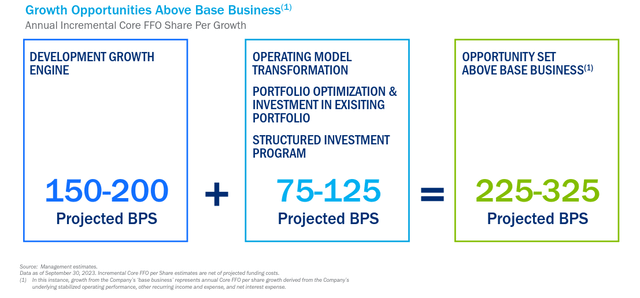

Looking further ahead, we believe the company can potentially deliver base core FFO per share growth of 3% to 5%, with an additional 2% to 3% boost from development and other initiatives. This would potentially result in total core FFO growth of 5% to 8%, and adding a ~3.5% dividend yield could result in 10%+ total returns.

AvalonBay Communities Investor Presentation

Valuation

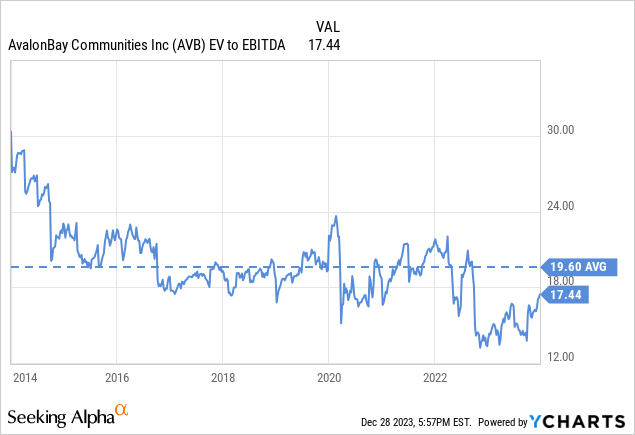

While shares have meaningfully increased in price in the last couple of months as investors have grown increasingly convinced that the FED is about to pivot into lowering rates next year, they are still trading at an attractive valuation. The EV to EBITDA multiple is below the ten year average, although forward EV/EBITDA is close to the average.

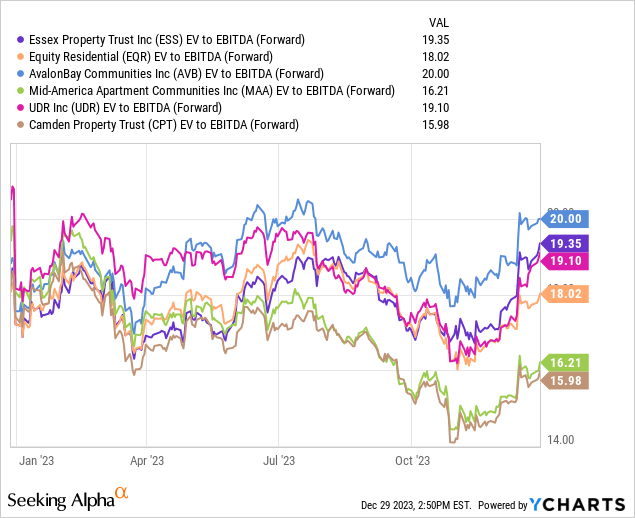

On a forward EV/EBITDA basis, it is the most expensive in the group, but we are willing to pay a premium for its strong competitive advantages, and multiple growth vectors.

Based on average analyst estimates as compiled by Seeking Alpha, shares are currently trading with a FY24 P/FFO of ~17x. For a defensive REIT with decent long-term growth prospects we think this is a very reasonable multiple.

SeekingAlpha

We calculate a net present value of our estimates for future funds from operations of ~$195 per share. Meaning we see the current share price as just slightly undervalued, but priced to deliver close to 10% returns if FFO growth meets expectations.

FFO Discounted @ 10% FY 24E 11.04 10.04 FY 25E 11.62 9.60 FY 26E 12.76 9.59 FY 27E 13.66 9.33 FY 28E 14.29 8.87 FY 29E 15.15 8.55 FY 30E 16.06 8.24 FY 31E 17.02 7.94 FY 32E 18.04 7.65 FY 33E 19.12 7.37 FY 34E 20.27 7.10 Terminal Value @ 4% terminal growth 318.72 101.55 NPV $195.84 Click to enlarge

Risks

One of the attractions of the high-end multi-family residential REIT sector is its defensive nature. It is usually more stable, although certainly not immune, to economic recessions. Still, results can be significantly affected by rising unemployment, new supply added beyond a regions growth in supply needs, and changes to taxes and regulations. Higher interest rates and inflation can also cause issues, as higher interest rates increase financing costs and make dividend paying stocks comparatively less appealing. Inflation can significantly increase development costs, as well as operating costs. These risks are mitigated by the company’s high-quality assets, low supply growth in its established regions, and a very strong balance sheet with long average duration debt.

Conclusion

With the market near all-time highs, it is getting harder to find reasonably valued investing options. One sector that still looks compelling is high-quality multi-family residential REITs. They tend to be more defensive in nature, can deliver decent growth through rent increases and new developments, and are trading at reasonable prices. We particularly like AvalonBay Communities, as it has historically demonstrated a great ability to generate value through new developments, has high-quality assets, and a very strong balance sheet. It has also proven that it can be very smart with respect to capital allocation, buying back shares when they thought they were undervalued, and issuing equity when they considered them over valued. Similarly, they have been smart with respect to asset recycling strategies, and debt issuance. We are starting coverage with a ‘Buy’ rating, as we see shares slightly undervalued, but with real potential of exceeding 10% total returns if they execute well on their growth strategy and the economy stays reasonably strong.

[ad_2]

Source link