[ad_1]

Lux Blue

Banco Santander-Chile (NYSE:BSAC), the leading bank in Chile by loan market share, recently posted a weaker-than-expected quarterly update for Q4, as the bottom line continued to suffer from declining net interest income. While some of the drivers are transitory (e.g., the negative impact from accounting hedges), the headwinds from a higher funding cost and cost of risk could extend into FY23, given current projections for an economic slowdown this year. Policy uncertainty is also a risk, not only from the ongoing constitutional reform process but also from a new consumer provisions model for Chilean banks to be implemented in April. Net, after a strong FY20/FY21, earnings momentum has likely peaked, and ROEs should continue to revert to pre-COVID levels going forward. At ~1.8x book for a mid to high-teens ROE bank with elevated macro and regulatory risks, the risk/reward isn’t compelling here.

A Disappointing Q4 Update as NII Declines Further

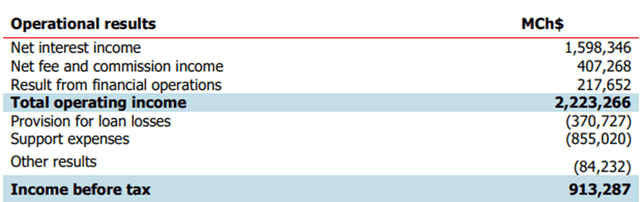

Santander Chile’s preliminary Q4 update, headlined by net income down >50% YoY, was disappointing across all key metrics. In particular, the pace of the ROE contraction is concerning – the implied quarterly ROE of ~10% (down ~10%pts QoQ) is now running at the lowest point since FY20 and well below the 18.5% FY23 ROE guidance. The key driver of the P&L decline was the lower net interest income (NII) at -45% YoY, while the negative impact of accounting hedges and higher funding costs exacerbated the deterioration. The implied cost of risk (i.e., provisions as a % of the loan portfolio) was also up >20bps QoQ, more than offsetting any relief from the lower expenses and one-off income tax benefit.

Banco Santander-Chile

Digging deeper into the NII drop, the December loan growth appears to be the main culprit – the +6% YoY print marks a steep deceleration from recent months (November came in at +8%, and October was +9%). With most of the weakness concentrated in corporate and consumer (consistent with October/November trends), Santander Chile likely lost further market share in these segments. While mortgages have been relatively resilient, a pending slowdown in credit growth across Chile, alongside lower economic growth, should continue to weigh on the overall lending outlook. Also posing headwinds are expected disinflation throughout the year and ‘higher for longer’ rates, which will impact Santander Chile via its cost of funds. In sum, all signs indicate a potential downward revision to FY23 guidance at the upcoming Q4 result call in February.

Capital Position Remains Strong

Despite taking on additional provisions in Q4, capital ratios likely remained well above regulatory requirements. As of Q3 (the latest available data), the CET1 stood at 10.1%, ~160bps above the targeted 8.5% for FY25, so there is ample cushion. A key reason for this buffer is the $700m perpetual bond placement in December 2021, funded by parentco Santander (SAN), which also moved the total capital ratio well above the 11% regulatory limit for FY25. As a result, the 50%-60% payout guidance is well-supported, in my view. Still, investors will want to keep a close eye on the negative funding mix trend. Both time and demand deposits decreased during Q4, with time deposits contracting at a faster -6% QoQ vs. demand deposits at -3% QoQ. This should drive additional pressure on funding costs and, by extension, margins in the coming quarters.

Keep an Eye on the Provisions

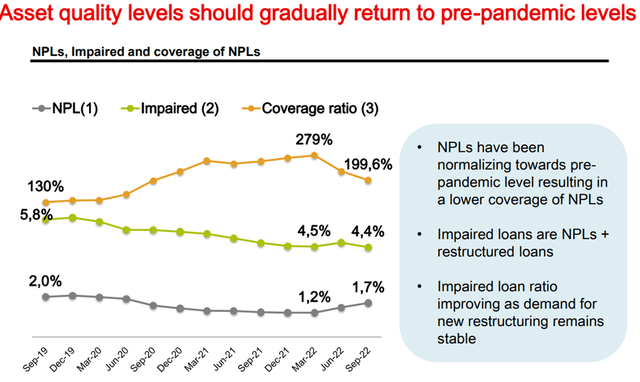

Alongside ROEs, asset quality should also continue reverting lower to pre-COVID levels as the positive impact of the one-off pensions saving withdrawals and government aid gradually fade. Santander Chile hasn’t been too badly affected, but recent months have seen the asset quality deterioration trend picking up. Recall that in Q3, the bank reclassified MCh120bn of additional provisions from the corporate book to the consumer in four installments to be recognized over the next few quarters. Management followed up on this disclosure with an additional MCh35bn of additional provisions, comprising MCh8bn for the consumer portfolio. All in all, this brought provisions for the consumer and mortgage books up ~85% QoQ in anticipation of more asset quality headwinds ahead.

Banco Santander-Chile

The silver lining from these additional provisions is that Santander Chile now has robust coverage levels, which should buffer the cost of risk at ~1% (in line with management guidance) for the coming quarters. Beyond the asset quality risks, further downside could come from the new proposal from Chile’s banking regulator for a new consumer provisions model. While the standard remains in its early stages, the target implementation date in April 2023 creates uncertainty around the potential impact on provisions going forward.

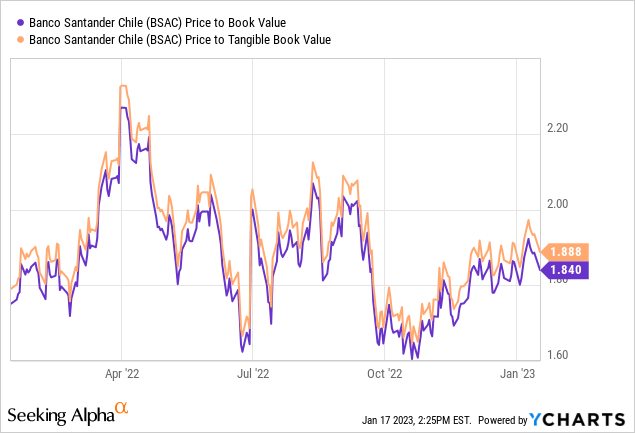

A Less Compelling Risk/Reward as the ROE Reverts Lower

Santander Chile has been buoyed by economic tailwinds in FY20/FY21, but operating conditions will get tougher from here amid projections for a macro slowdown in FY23. So even with the bank’s success in expanding its product offerings and growing its digital presence to drive long-term profitability improvements, earnings momentum has likely peaked for now, and I expect softer ROE trends going forward. While this is a bank capable of mid to high-teens ROE on a normalized basis (vs. ~10% ROE based on Q4 numbers), the ~1.8x P/Book valuation isn’t cheap. Given the regulatory risks that come with investing in Chile as well, I would hold off on the stock at these levels.

[ad_2]