[ad_1]

PhonlamaiPhoto

The Amplify Lithium & Battery Technology ETF (NYSEARCA:BATT) invests in companies that generate a significant amount of revenue from the development, manufacture and use of lithium battery technology: these include EVs, battery metals & materials, and battery storage solutions. As such, the ETF invests globally – which is one reason the expense ratio is relatively high (0.59%). BATT has returned a negative 6.7% over the past year, but is up 22.8% YTD. While I expect a pullback on the shares after a wicked-strong rally last week, I am changing my rating on BATT from HOLD to BUY based on better valuation, an attractive list of top-10 companies, and its relatively strong 3.4% yield – which is primarily due to a relatively large position in BHP (an 8.4% allocation) and its very attractive 10% yield. In last April, I gave a sell rating on BATT.

Investment Thesis

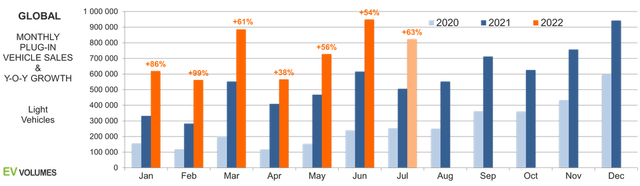

The investment thesis here is relatively straight-forward: EV sales are booming:

EV-Volumes.com

As mentioned in the bullets, over the 1H of 2022 global EV sales grew 62% yoy. When full-year 2022 number are in, EV-Volumes.com expects:

… (global) sales of 10.6 million EVs, a growth of 57 % over 2021, with BEVs reaching 8 million units and PHEVs 2,6 million units.

Each EV obviously has a substantial battery pack. Each battery pack requires raw materials, processed materials, and manufacturing for form, fit, and function.

That being the case, today I will look at how the BATT has positioned investors for success going forward.

Top-10 Holdings

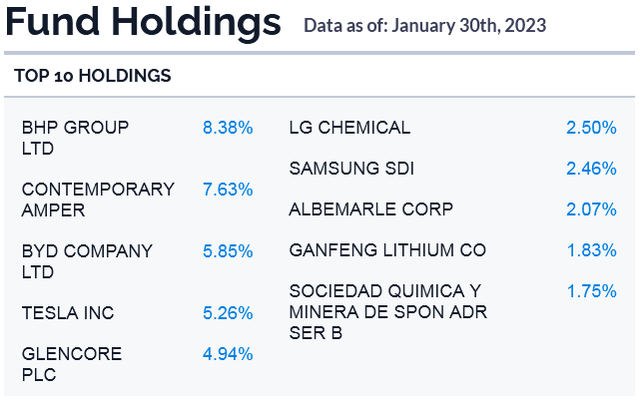

The top-10 holdings in the BATT ETF are shown below and were taken directly from the Amplify ETF’s BATT webpage, where investors can find more detailed information on the fund. The top-10 holdings equate to what I consider to be a relatively well-diversified 42.7% of the entire 88 company portfolio:

Amplify ETFs

I say relatively well-diversified, because the top-3 holding equate to 25%+ of the entire portfolio. However, I like those three holdings very much.

The #1 holding is diversified global miner BHP Group (BHP) with a 8.4% weight. BHP mines copper, silver, zinc, molybdenum, uranium, gold, and iron-ore – among other materials. The stock is up 19% over the past year, and the company is expected to be a primary beneficiary of China’s re-opening. BHP currently trades with a forward P/E of only 13.4x. As mentioned earlier, BHP currently throws off a 10% yield.

Contemporary Amperex, commonly referred to as “CATL”, is the “Battery King” of China and therefore arguably the leading battery maker on the planet. Click on that link and you will read about CATL’s new battery plant in Germany and that CATL:

… had already struck deals to supply batteries to Volkswagen and BMW as the auto manufacturers sought to reinvent themselves and move away from internal combustion engines. CATL also had an agreement to supply batteries for Daimler’s electric buses and trucks.

China-based BYD (OTCPK:BYDDY) is the #3 holding with 5.9% weight. As I reported in July of last year, BYD has over-taken Tesla in terms of global EV sales (see BYD Stock: Outselling & Outperforming Tesla). BYD is up only 4.6% over the past year, but is up 241% over the past 5-years. Berkshire Hathaway (BRK.A) continues to trim its stake in BYD even though the company had record new energy vehicle sales in December (235,197 up 150% yoy) as well as 2022 full-year NEV sales of 1.86 million units – up a whopping 209% yoy.

The BATT ETF has a 5.3% weight in #4 holding Tesla (TSLA). Tesla stock has had a meteoric 64.5% rise YTD after a massive bear-market and Twitter related sell-off last year. Tesla delivered a strong Q4 beat, but margins are falling as the company was forced to cut prices due to strong competition and the need to move inventory. Automotive gross margin in Q4 was 25.9% vs $27.9% in the prior quarter.

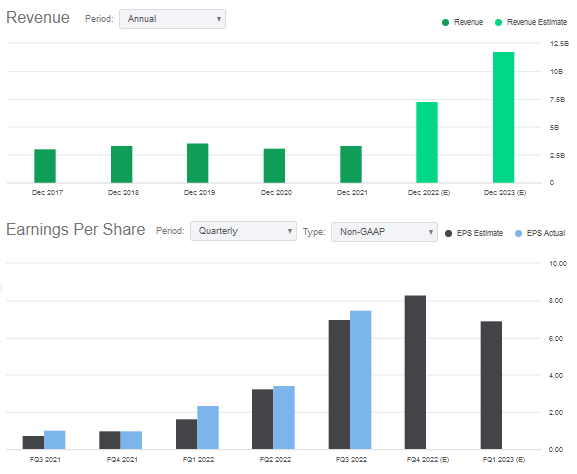

Albemarle (ALB) is the #8 holding with a 2.1% weight. ALB is a global leader in the production of lithium – a critical material required for lithium-ion based EV batteries. ALB is experiencing very strong demand and is expected to grow revenue to $11.8 billion this year, up 60%+ yoy. Earnings growth is expected to follow:

Seeking Alpha

ALB is the #1 holding in the First Trust NASDAQ Clean Edge Green Energy Index ETF (QCLN) – see my recent Seeking Alpha article QCLN: Follow the Money ($1 Trillion+) Into Green Energy & EVs. Shares are up 37% over the past 12-month and currently trade with a forward P/E of only 13x.

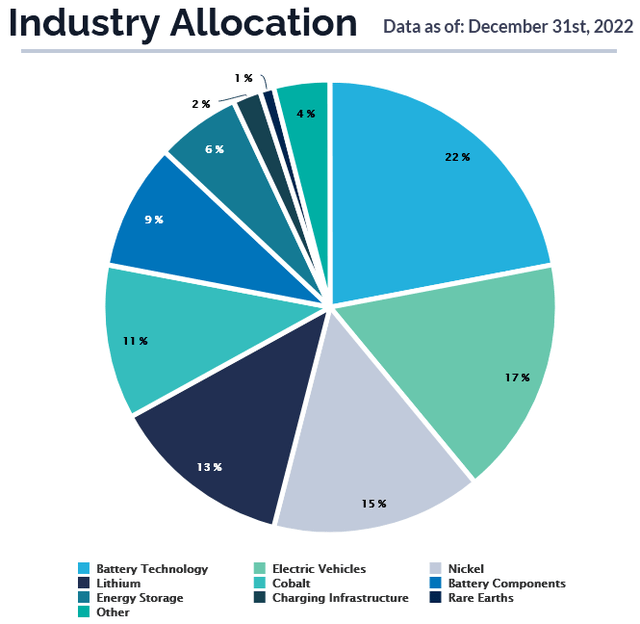

For the portfolio as a whole, the BATT ETF is most highly exposed to the battery-technology, EV, Nickel, and lithium sub-sectors:

Amplify

Performance

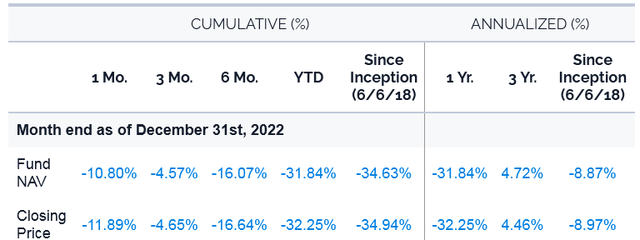

The BATT ETF has a very poor performance track record:

Amplify

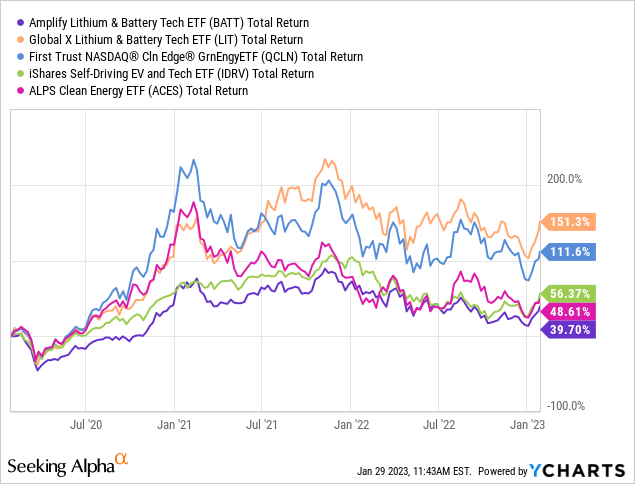

The following graphic compares BATT’s 3-year total-return performance against some competitors like the Global X Lithium & Battery Tech ETF (LIT), the First Trust Green-Energy ETF (QCLN), the iShares Self-Driving EV and Tech ETF (IDRV), and the ALPS Clean Energy ETF (ACES):

As can be seen, the BATT ETF is at the bottom of the list – with its direct competitor, the LIT ETF, outperforming it by over 3.5x over the past 3-years. That is despite the fact that LIT’s expense ratio is 0.75% – 16 basis points higher than BATT’s.

Risks

The BATT ETF is a global fund, and as such it has – as you might expect – a large exposure to China (31%) and relatively small exposure to the U.S. (15%). That being the case, there is above average risks with respect to the Chinese government potentially making – at its whim and potentially at any time – decisions with respect to its rare-earth and battery producing companies that could negatively impact the BATT fund.

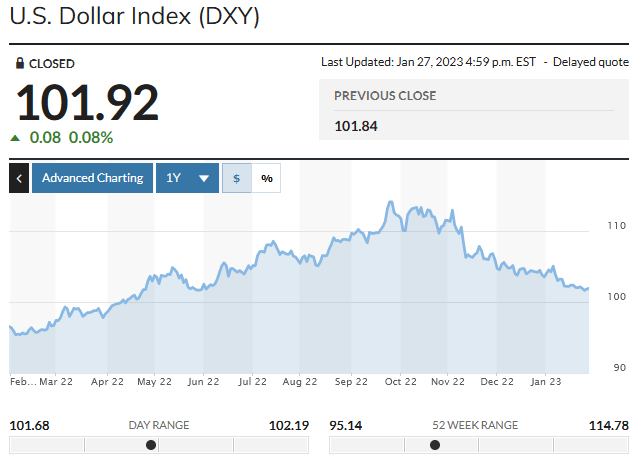

In addition, the large percentage of foreign holdings means the BATT ETF has large foreign currency exposure. However, the U.S. dollar appears to have peaked last September and – in my view – has established a down-trend that likely will take it back below 100 sooner rather than later:

MarketWatch

Summary & Conclusion

While I still highly favor the LIT and QCLN ETFs over BATT, I am raising my rating on the ETF from HOLD to BUY. Based on the ETFs past performance, this is definitely a contrarian call on my part. However, with China re-opening, EV sales booming, and in light of the attractive holdings in the BATT ETF’s top-10 holdings, I believe BATT is positioned to outperform the broad market averages over the next 12-months.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]