[ad_1]

Bitcoin has plunged below $42,000 as on-chain data shows the miners have continued their recent selloff, distributing another 1,000 BTC.

Bitcoin Miners Continue To Make Outflows From Their Reserve

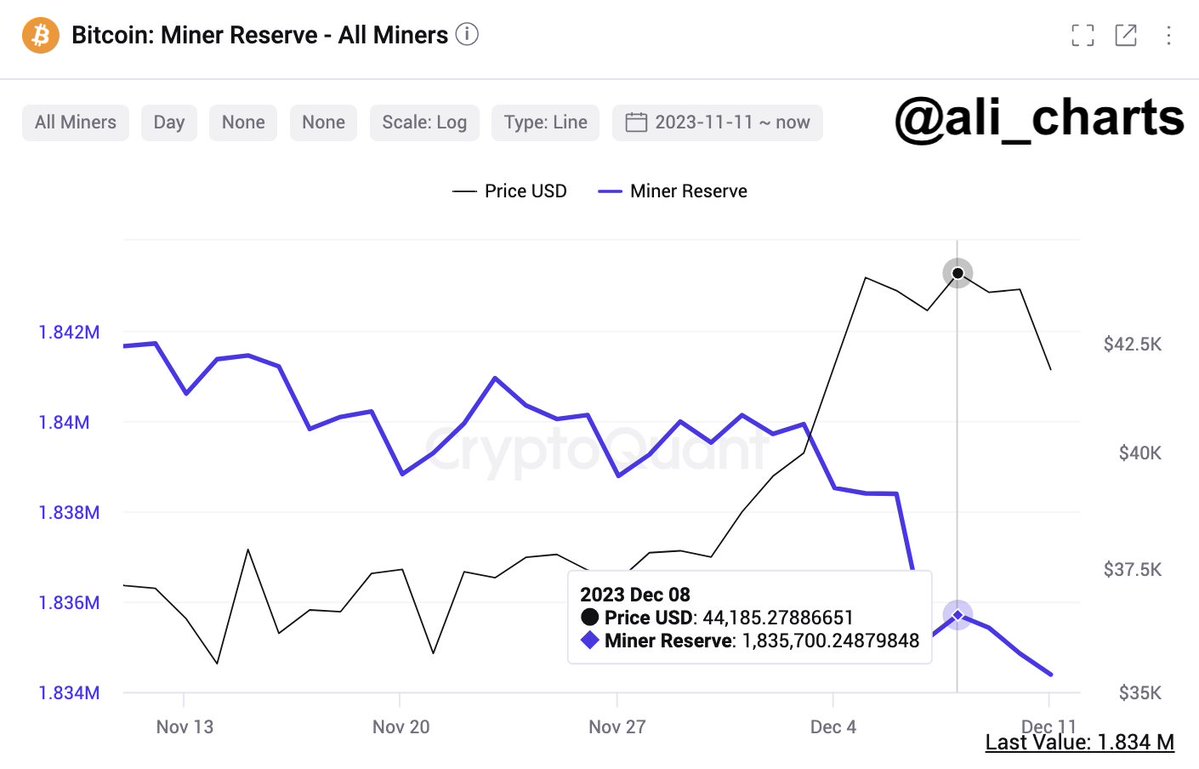

As pointed out by analyst Ali in a post on X, miners have participated in some additional selling since Friday. The indicator of interest here is the “miner reserve,” which keeps track of the total amount of Bitcoin that miners are carrying in their wallets.

When the value of this metric goes up, it means that these chain validators are adding more coins to their supply currently. Such accumulation from this group can naturally positively impact the BTC price.

On the other hand, a decline in the indicator implies the miners are withdrawing a net amount of the cryptocurrency from their wallets right now. Since one of the main reasons why this cohort would transfer their coins out is for selling, this kind of trend may have bearish implications for the asset.

Now, here is a chart that shows the trend in the Bitcoin miner reserve over the past month:

The value of the metric appears to have been sliding down in recent days | Source: @ali_charts on X

As displayed in the above graph, the Bitcoin miner reserve started observing a sharp decline earlier this month when the cryptocurrency first broke past the $44,000 mark.

The miners had participated in a notable amount of selling around these highs, but it would appear that their appetite for distribution wasn’t satiated with this selloff alone as they have participated in some more selling during the last few days.

Since Friday, these chain validators have made net withdrawals of about 1,000 BTC. This stack of coins would be worth almost $42 million at the current asset price.

It’s not certain if these withdrawals have been made for selling purposes. Still, given the rally, it isn’t hard to guess that this cohort has been jumping at the profit-taking opportunity with both these withdrawals and the ones they made earlier.

Bitcoin stagnated when the last selloff from this group took place, and it appears that the cryptocurrency has registered a large decline as this latest one has occurred.

Though, while the miners would have played a part in this plunge, they are still unlikely to be the sole instigator behind it, as the scale of their selling isn’t too great in the grand scheme of things.

Miners are a group who have to do selloffs on the regular to sustain themselves, as they have constant running costs like electricity bills associated with their operations.

As such, they are a source of constant selling pressure in the Bitcoin market, although the scale of their selling isn’t anything the sector can’t readily absorb most of the time.

BTC Price

At the time of writing, Bitcoin is trading around $41,700, up 1% in the past week.

The price of the coin appears to have registered a large drawdown during the last 24 hours | Source: BTCUSD on TradingView

Featured image from Brian Wangenheim on Unsplash.com, charts from TradingView.com, CryptoQuant.com

[ad_2]

Source link