[ad_1]

monsitj

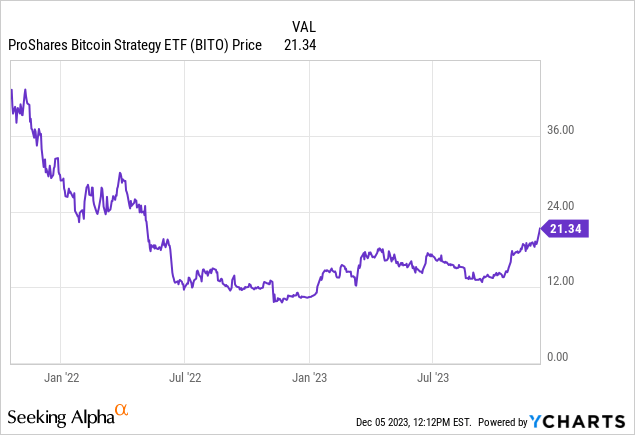

Since my last publication on the ProShares Bitcoin Strategy ETF (NYSEARCA:BITO) entitled “Opportunities with Bitcoin Vs Gold as a Safe Haven” on June 5 this year, it has gained 38.6%. At that time, with memories of the banking turmoil still fresh, I had a hold position while highlighting that a pause by the Federal Reserve would constitute a catalyst. This has effectively been the case with giant asset manager BlackRock’s (BLK) CEO Larry Fink’s comments that “crypto is digitalizing gold” in July also contributing to propping up this asset class. The shares now trade at around $21, which is still below the previous highs attained in 2021-2022.

With this thesis, my objective is to show that Bitcoin’s (BTC-USD) upside could continue based on the demand-supply dynamics and the resiliency it has demonstrated amid extreme volatility since 2021.

High Demand Vs. Low Supply

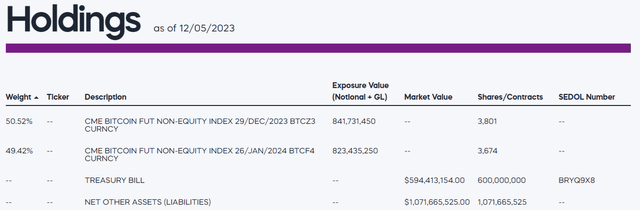

First, as shown below, BITO holds CME’s Bitcoin futures contracts, regulated by the CFTC or Commodities Futures Trading Commission. As such, a digital currency, like Bitcoin is determined to be a commodity.

www.proshares.com

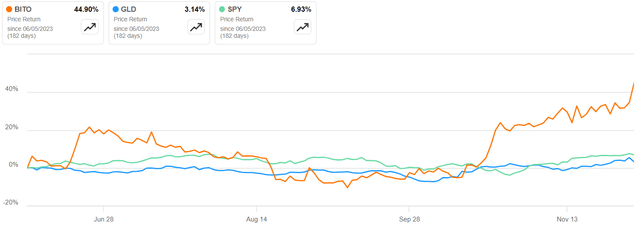

Second, coming back to the Fed, any signs of dovishness or likelihood of interest rate rise not rising reduces support for the greenback which is generally good for commodities. This is one of the reasons why, as per the chart below which dates back from June 5, both gold and Bitcoin have seen their downward path leveling off around September 20 and reversing around October 31 since during each occasion the FOMC meeting called for a pause. Risk assets like equities held by the SPDR S&P 500 ETF (SPY) also benefited.

Comparison between Gold, SPY, and BITO (www.seekingalpha.com)

However, the degree by which BITO outperformed the broader market, tellingly by over 35% shows that there is something else at play. The reason according to JPMorgan (JPM) has to do with the asset class garnering more enthusiasm from institutional investors, following the application for a Spot Bitcoin ETF by BlackRock, Invesco, and Wisdom Tree, while not forgetting Bank of America (BAC).

These collectively manage millions of dollars of client assets, and, such big players entering the crypto space has resulted in creating high expectations for the SEC to approve a Spot Bitcoin ETF by the first quarter of 2024 potentially as early as January. Needless to say, such approval would be a big boost to the cryptocurrency ecosystem as it will allow investors to buy digital currency directly through the same mechanism that they used to buy stocks and bonds.

Now, coupled with higher demand, lower supply has contributed to higher prices.

This is about the supply of Bitcoin available for buying and selling on crypto exchanges, and, according to Coin Metrics, only 58.58% of the total amount available has been exchanged in the past three years compared to the peak of 73% in 2019. This has been caused by a relatively higher number of investors and even miners are HODLing or holding on to their crypto assets as I recently detailed in a thesis, with the motivating factor being the Bitcoin halving event to occur in April next year which will decrease the reward obtained for producing each coin by half.

Going into details, halving kicks in about every four years and explains why miners who were obtaining 50 Bitcoins for each block mined or added to the blockchain before 2009 now get only 6.25 BTC. This number will further drop to 3.125 BTC after April. Now given miners have to compete before obtaining rewards, the less efficient ones will likely not survive given escalating production costs due to higher wage inflation and energy costs (to power mining equipment). This will in turn reduce the supply.

BITO Deserves Better

Therefore, at the time of writing, the combination of higher demand and lower supply drove BTC to reach a new high of $42.4K, a level not seen since April 2022. At that time, it was on its way down from its peak of $64.8K signifying that this time around, if market conditions continue to be favorable, it recoup all its losses, probably by April next year. This would imply about 50% ((64.8-42.4)/42.4)) upside. Applying this multiplier to BITO currently trading around $21, I obtain a target of around $31.

To justify such a high target, there are three factors.

First, the digital asset hit records after each of the last three halving events according to Bloomberg which is still some four months away. Second, by automatically limiting the number of coins in circulation, the halving event contributes to raising the intrinsic value of Bitcoin. This is in contrast to fiat currencies like the dollar or the euro whose value depends on variables like monetary policy by the Central Banks issuing them, economic growth, and creditworthiness of the host country.

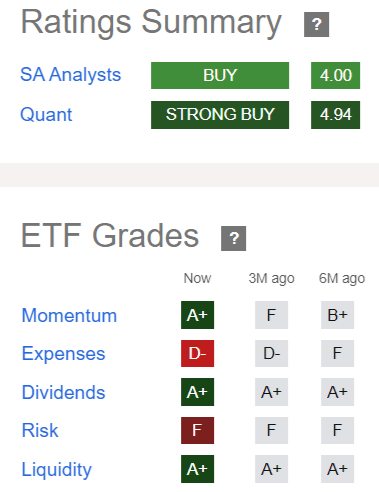

Third, Quant rates BITO as a Strong Buy, based on superior momentum, dividends, and liquidity factors as pictured below. Focusing on liquidity, this ETF has an AUM (assets under management) of $1.6 billion which is way above the VanEck Bitcoin Strategy ETF’s (XBTF) figure of $70.25 million despite the two being incepted around the same time or in October 2021. Additionally, BITO’s assets are above the average for all other ETFs, by over 600% despite being around for only three years.

Rating Summary (www.seekingalpha.com)

Therefore, the ProShares ETF has scaled up rapidly and, in addition to providing exposure to the price movement of BTC without actually owning the digital asset, investors seem to also be attracted by its double-digit dividend yield.

For this purpose, the future contracts it holds provide exposure to BTC without the need to store it and has worked well as evidenced by both the capital gains and distributions. However, there are risks and things may be different in the case of a prolonged downside or a crypto bear market.

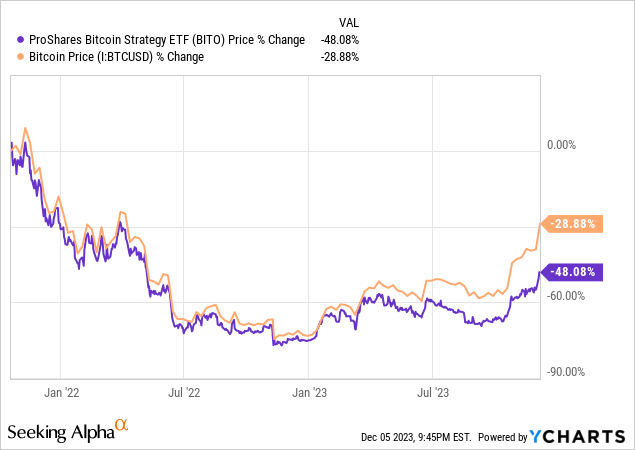

The Risks and Looking for Alternative Exposure

These pertain mostly to the use of futures contracts that carry their own set of risks like the possibility of default in case of a liquidity crunch or inability to meet margin requirements. Detailing further, holding futures means an agreement to trade (buy and sell) at an agreed price in the future. In consequence, the issuers have to sell the contracts before they expire to be able to roll on or spend the money earned on new ones to continually provide exposure to Bitcoin. However, this can give rise to the negative roll yield problem whereby holdings purchased at a certain price need to be sold at a discount before the contract ends, which results in a loss. This loss explains why BITO has not been able to replicate the performance of Bitcoin since its inception and is illustrated by the slight difference of around 2% between the performance of the orange and blue charts below.

ycharts.com

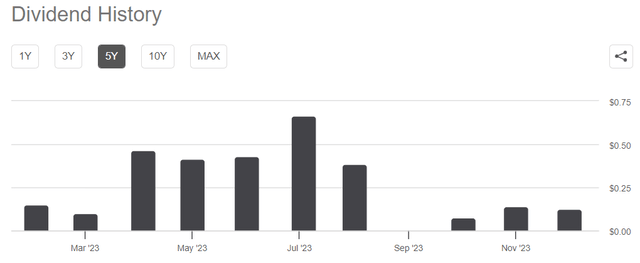

Nonetheless, the roll yield-related loss is acceptable as it still allows BITO to profit from BTC, namely by posting positive returns, and also permitting the issuers to sacrifice part of the capital gains to pay dividends as of February 2023. This has caused the difference between the orange and blue charts to widen from around 2% to 19.2% currently.

Still, shareholders are reminded that the distributions made vary with time as charted below.

Dividends History (seekingalpha.com)

Pursuing on a cautious tone, it is a combination of factors namely a dovish Fed, and high institutional demand in expectation of a potential SEC approval with a reduction in supply which are driving up BTC’s value, which implies volatility in case regulators drag their feet or the Fed having to shift to a hawkish tone in case inflation suddenly raises its ugly head.

Furthermore, compared to equities, Bitcoin is a rather complicated asset class that cuts across different technological areas, involving software coding, mining hardware equipment, and an elaborate blockchain network implying many sources of vulnerability for BITO’s value. Therefore, more risk-averse investors also prepared to forego some capital gains, can look to BTC exposure through the Amplify Transformational Data Sharing ETF (BLOK) which holds shares of miners and crypto exchanges. In this respect, it has appreciated by 56% during the last year, or nearly 50% less than BITO while displaying a lower degree of price fluctuations with its issuers charging 0.75%, or lower than BITO’s 0.95%, but it does not pay dividends.

BITO is a Strong Buy Amid Crypto’s Resilience

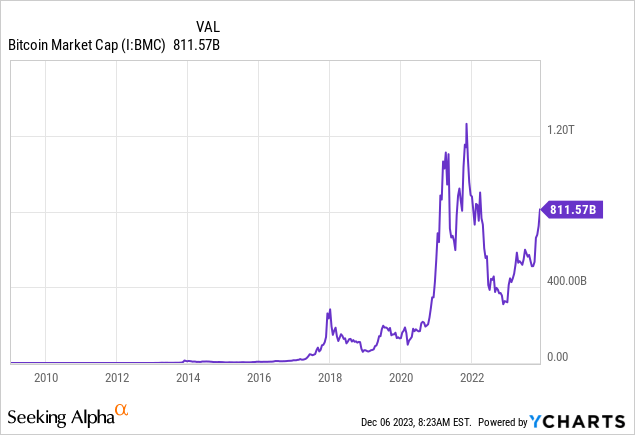

Consequently, for those who favor income, the ProShares ETF is a strong buy based on the appeal of its strategy to capitalize on Bitcoin futures and the upside should be sustained, but amid a volatile path. Talking risks, Bitcoin has proven to be a resilient asset class considering that despite an unprecedented number of setbacks it has risen time and time again and is back to the $811.57 billion market cap.

This resiliency has prevailed despite painful episodes including the collapse of the FTX crypto exchange back in November 2022, after which the total value of the world’s largest cryptocurrency by market cap went down to under $400 billion prompting a major publication to wonder if it was the end of crypto.

However, this has not happened and BTC’s market cap has doubled since.

Moreover, with the present momentum and since a substantial portion of the downside coincided with the aggressive tightening of monetary policy since March 2022, a return to the peak market cap of $1.22 trillion has become a reasonable possibility given the Fed being in “pause” mode and the market pricing in a higher probability of a rate cut in 2024.

Finally, as a test of Bitcoin’s resilience, even the latest salvo fired by regulators, this time on Binance, the world’s largest crypto exchange, by fining it $4 billion for violating U.S. laws has failed to quell enthusiasm for the coin.

[ad_2]

Source link