[ad_1]

onurdongel

The Global X Robotics & Artificial Intelligence Thematic ETF (NASDAQ:BOTZ) is well-positioned to benefit from the popularization and increasing utility of artificial intelligence and robotics. BOTZ attains this position by investing in companies that are at the forefront of the development and deployment of these innovative technologies. Artificial intelligence and robotics expansion, particularly across the workforce, will have a significantly positive impact on the holdings of this ETF during the next few years. For these reasons, I rate BOTZ a long-term buy.

The artificial intelligence industry was valued at about $120 billion in 2022 and is projected to expand at a CAGR of 37% from 2023 to 2030. BOTZ has holdings in companies that provide infrastructure and servicing to emerging artificial intelligence systems, and has the potential to profit from developments in this quickly advancing industry.

The accelerating growth and availability of artificial intelligence is generating fierce competition among tech giants like Microsoft (MSFT) and Google (GOOG)(GOOGL). BOTZ can potentially profit regardless of who prevails with the greatest artificial intelligence system. Artificial intelligence ultimately becoming an integral part of the workforce aligns with BOTZ’s holdings, as it invests in industrials and healthcare in addition to technology. The robotics industry is similarly accelerating, with revenue expected to increase from over $34B in 2023 to roughly $43B in 2027. Robots are becoming increasingly cheap, as industrial robot prices have fallen 50% during the past 30 years. This makes them a potentially attractive alternative to human employees in healthcare and logistics jobs that demand high levels of consistency, speed, and precision.

Strategy

BOTZ tracks the Indxx Global Robotics & Artificial Intelligence Thematic NR USD Index. That index tracks companies responsible for the development, production, and deployment of robotics and artificial intelligence systems. BOTZ exposes investors to companies located primarily in the U.S., Japan, and Europe. BOTZ is managed by GlobalX, a provider known for its forward-thinking investment themes and interests in emerging trends and industries.

Holdings Analysis

BOTZ focuses primarily on three different sectors, technology (48%), industrials (37%), and healthcare (13%). Investments in both industrials and healthcare provide sector diversification as well as opportunities to profit from the integration of artificial intelligence into these two fields. Within the main sector trio, investments are allocated mostly to industrial automation and machinery, healthcare technology, information technology, and consumer goods.

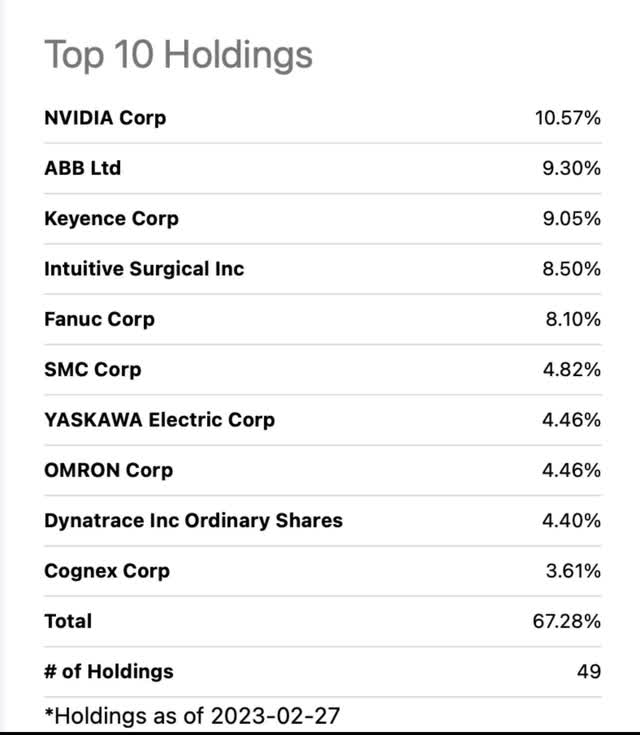

The top three holdings in BOTZ are NVIDIA Corp. (NVDA), ABB Ltd. (ABB), and Keyence Corp. (OTCPK:KYCCF), accounting for over a quarter of total holdings.

Top 10 holdings in BOTZ (Seeking Alpha)

Holdings are located primarily in the U.S. and Japan (a combined 79% of assets under management). Holdings in Japanese companies provide geographical diversification and hedge the growth of the robotics industry. Japan is heavily involved in the industrial robotics industry, accounting for 47% of global robot manufacturing in 2020. BOTZ has 49 total holdings: The top 10 holdings account for 67% of the total portfolio and the top 25 comprise 93%, making this ETF rather top-heavy. This highly concentrated aspect of BOTZ might be unappealing to more risk-averse investors, as technology is already a very volatile industry.

Strengths

BOTZ’s portfolio includes a strong position across several stocks in the ever-growing industries of artificial intelligence and robotics. Despite technology being the backbone of this development, BOTZ also invests in industrials companies that manufacture the physical robots, and healthcare companies where both robotics and artificial intelligence are becoming increasingly useful. This adds extra layers of diversification within the broader artificial intelligence and robotics themes, since there are multiple potential use cases to profit from. BOTZ also provides geographical diversification, with 57% of holdings residing outside of the U.S. Furthermore, Japan and the U.S. are strong allies with shared interests in economic growth, which minimizes the risk of geopolitical tensions hurting BOTZ’s returns.

Weaknesses

BOTZ is not among the lowest-cost ETFs around. At 0.67%, its expense ratio is higher than many thematic ETFs. For example, the similar iShares Robotics and Artificial Intelligence Multisector ETF (IRBO) has a lower expense ratio of 0.47%.

High and ongoing capital expenditures are a potential secular headwind for the types of companies BOTZ tracks. Many companies within BOTZ have high capital expenditures due to heavy investments made in new, long-term robotics projects. These investments do not have guaranteed profits and might be quite risky. This is especially the case given the uncertainty surrounding robotics technology, much of which is driven in part by artificial intelligence. BOTZ is also quite top-heavy with 67% in the top 10. This means that one company’s performance could significantly affect returns. Furthermore, the top five holdings currently account for 45% of BOTZ, which is much more highly concentrated than most equity ETFs.

Opportunities

The rapid expansion of both the robotics and artificial intelligence industries present BOTZ with many ways to win in the long term. The ongoing artificial intelligence war between Microsoft and Google is leaving many investors feeling pressured regarding which companies to buy shares of in order to own the future winners in artificial intelligence as the market determines them. Artificial intelligence has rapidly developed into an ongoing competition between tech giants that battle over which ones can develop the most efficient system.

Microsoft’s recent investment into OpenAI’s ChatGPT system puts that software giant ahead for the moment. However, BOTZ has an opportunity to profit as an ETF in the long run, regardless of who wins and by how much. That’s because many of BOTZ’s holdings provide tech companies with the infrastructure needed to compose an efficient artificial intelligence platform. This infrastructure includes semiconductors, data storage, new algorithms, and cloud computing, among others.

The recent surge in inflation has prompted many companies to lay off employees, to save on rising wage costs. For such businesses, the prospect of not having to worry as much about wage expenses makes deploying industrial robots increasingly attractive. Industrial robots have also displayed increased efficiency and increased affordability during the past two decades.

Threats

Though BOTZ is significantly exposed to rapidly growing industries, it is certainly not impervious to headwinds generated from negative macro events. As interest rates remain high, a possible recession could make expensive robots and similar technology less accessible, hurting profits of the types of companies BOTZ owns.

Generative artificial intelligence systems like OpenAI’s ChatGPT possess a certain amount of risk just based on their complexity and the public’s relative lack of knowledge. Generative artificial intelligence is a unique type of artificial intelligence that utilizes complex learning algorithms and neural networks to generate original media similar to actual humans. ChatGPT has already become an integral part in the lives of students (as a current student, I know this first-hand) and professionals as it demonstrates competency in completing complex tasks and holding conversations with users.

However, generative artificial intelligence has also created some public concerns. For example, Bing’s artificial intelligence bot recently told a reporter it wants to “be alive,” “steal nuclear codes,” and create a “deadly virus,” leading many to question what could go wrong with the popularization of this seemingly revolutionary system. Therefore, generative artificial intelligence could be as problematic as it is useful until these bugs are worked through.

Conclusions

ETF Quality Opinion

BOTZ is particularly attractive to me due to my long-term bullish view on the profit potential in the robotics and artificial intelligence industries. The increasingly important role of companies that provide necessary infrastructure for artificial intelligence make this ETF potentially profitable in the span of the next several years. I can see BOTZ being a market-leading performer during the next eventual equity bull market.

ETF Investment Opinion

I rate BOTZ a buy. The fund is selling at nearly half of its 2021 all-time high of $40 a share. The most notable progressions in my long-term story here are the unfolding of the artificial intelligence rally and the alarming introduction of generative artificial intelligence to society. I think growth investors could benefit from adding BOTZ to their portfolio with a three- to five-year time frame in mind.

[ad_2]