[ad_1]

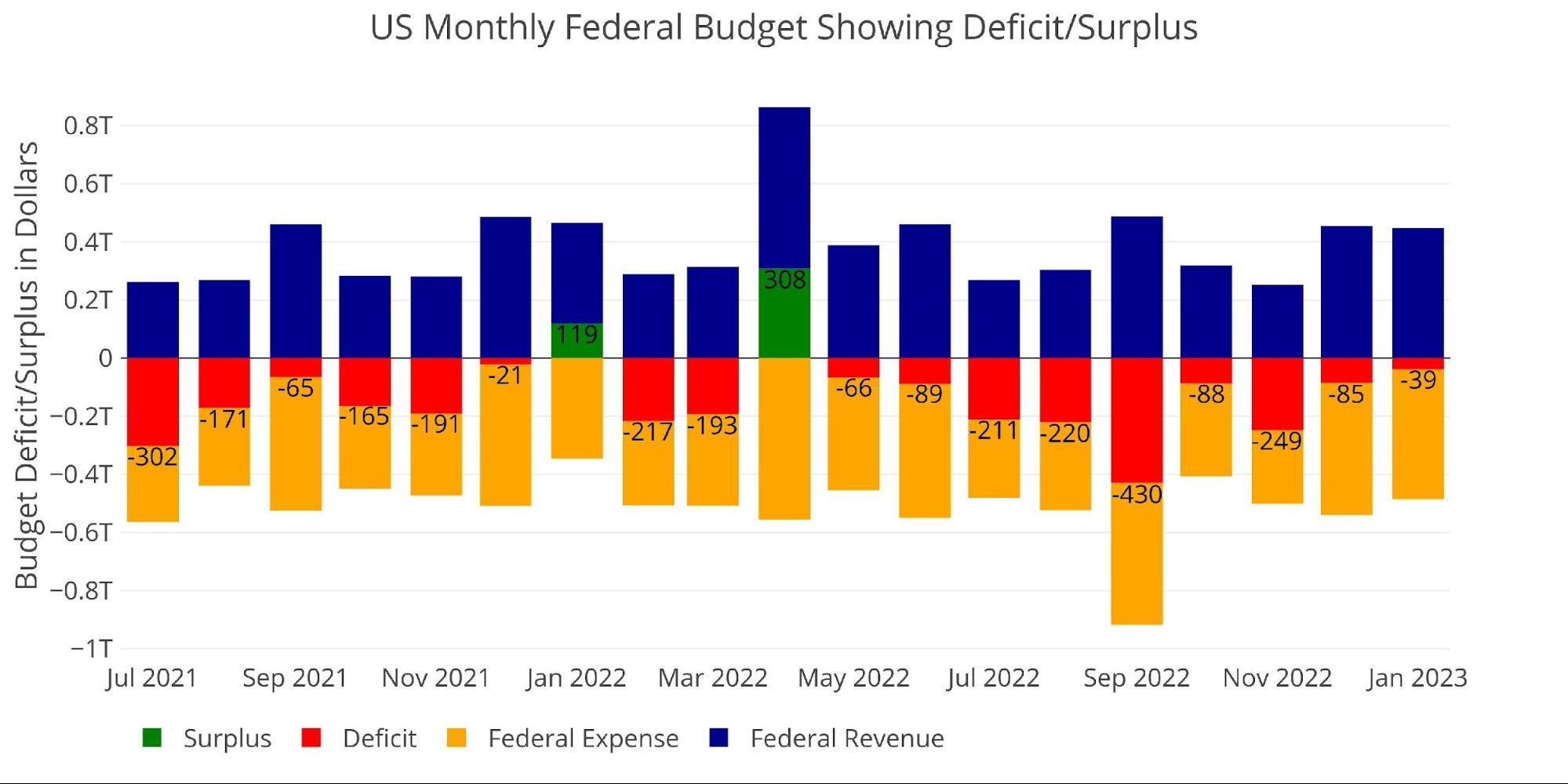

The Federal Government ran a deficit of -$39B in January. While that may not seem like much, it looks worse when compared to the average January.

Figure: 1 Monthly Federal Budget

The chart below shows the month of January historically. The government actually ran a surplus in January the four years leading up to 2020. Even last year the government ran a surplus greater than $118B. YoY the chart shows that expenses increased by a wide margin while revenue decreased.

Figure: 2 Historical Deficit/Surplus for January

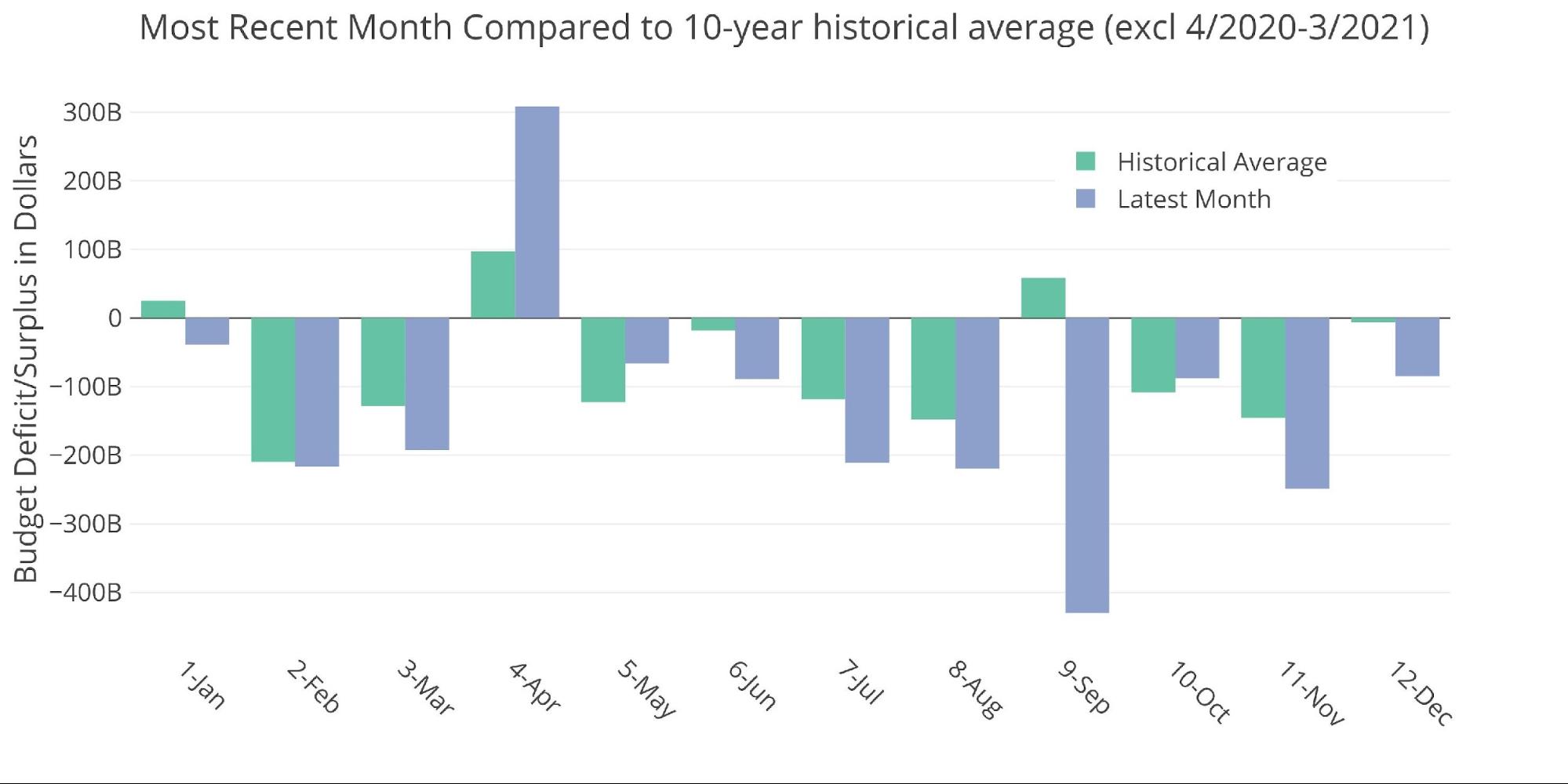

For the decade before Covid, January averaged a surplus of $25B, so this January is definitely off the mark. Let’s look through the data…

Figure: 3 Current vs Historical

The Sankey diagram below shows the distribution of spending and revenue. The Deficit represented only 8% of total spending while Income Taxes accounted for 54% of the total spent.

Figure: 4 Monthly Federal Budget Sankey

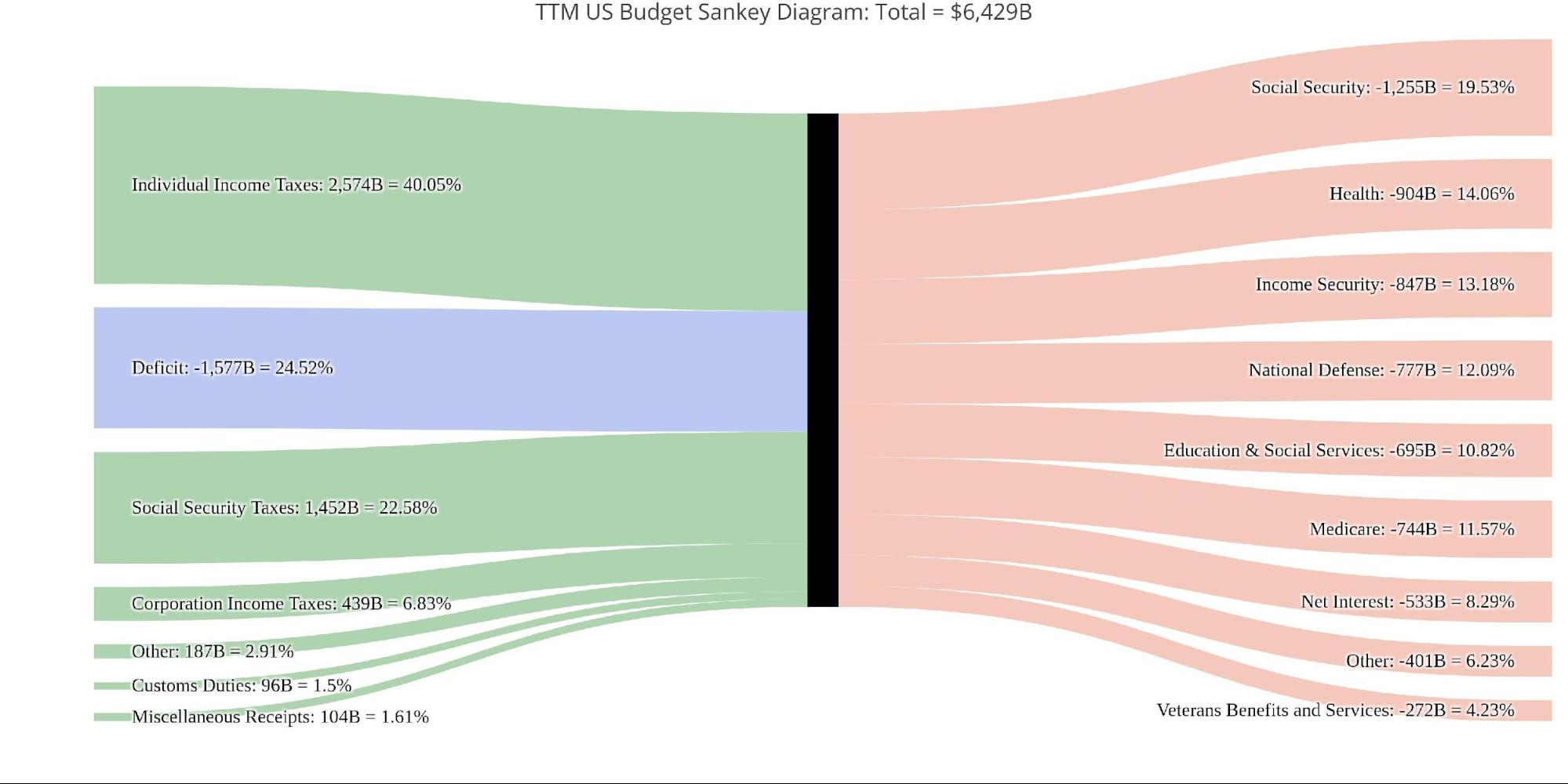

Looking at the TTM, the January deficit saw a very different distribution where the deficit represented 24.52% of overall spending with Income Taxes only covering 40%.

Figure: 5 TTM Federal Budget Sankey

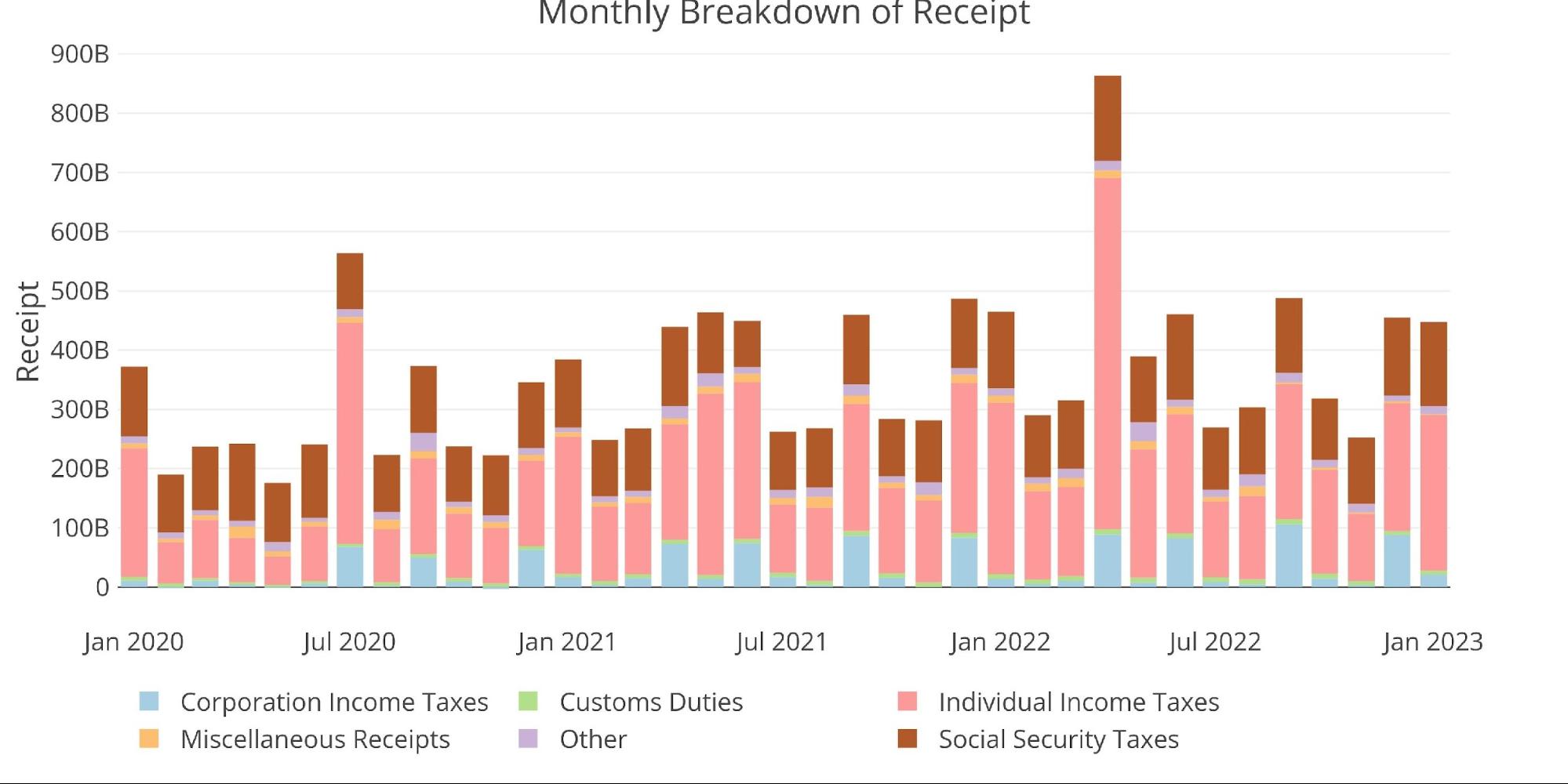

January saw the largest monthly revenue from Net Income Taxes since April of last year. This helped offset the MoM fall in corporate taxes.

Figure: 6 Monthly Receipts

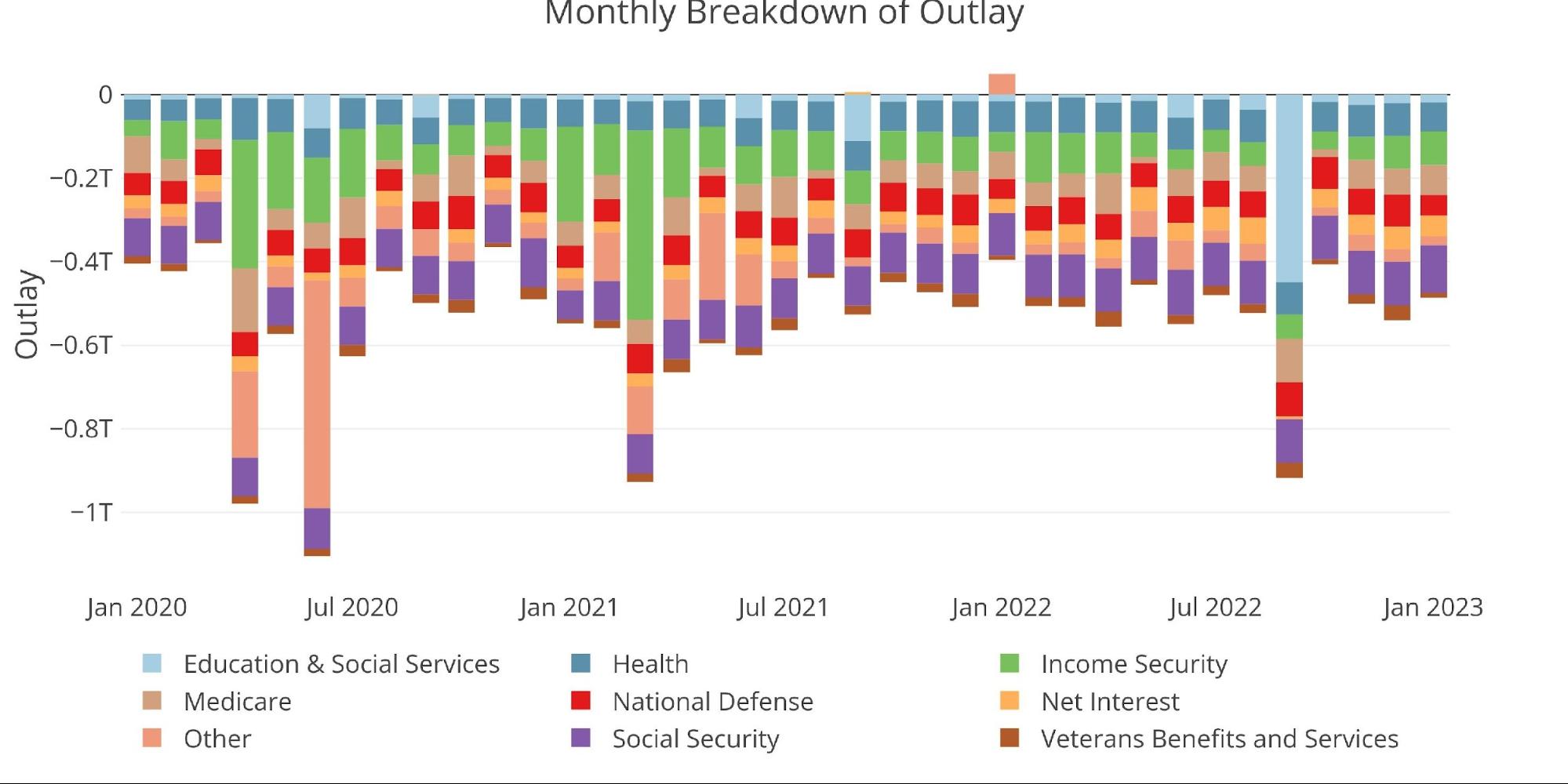

Total Expenses were down slightly, mostly attributable to a drop in National Defense spending.

Figure: 7 Monthly Outlays

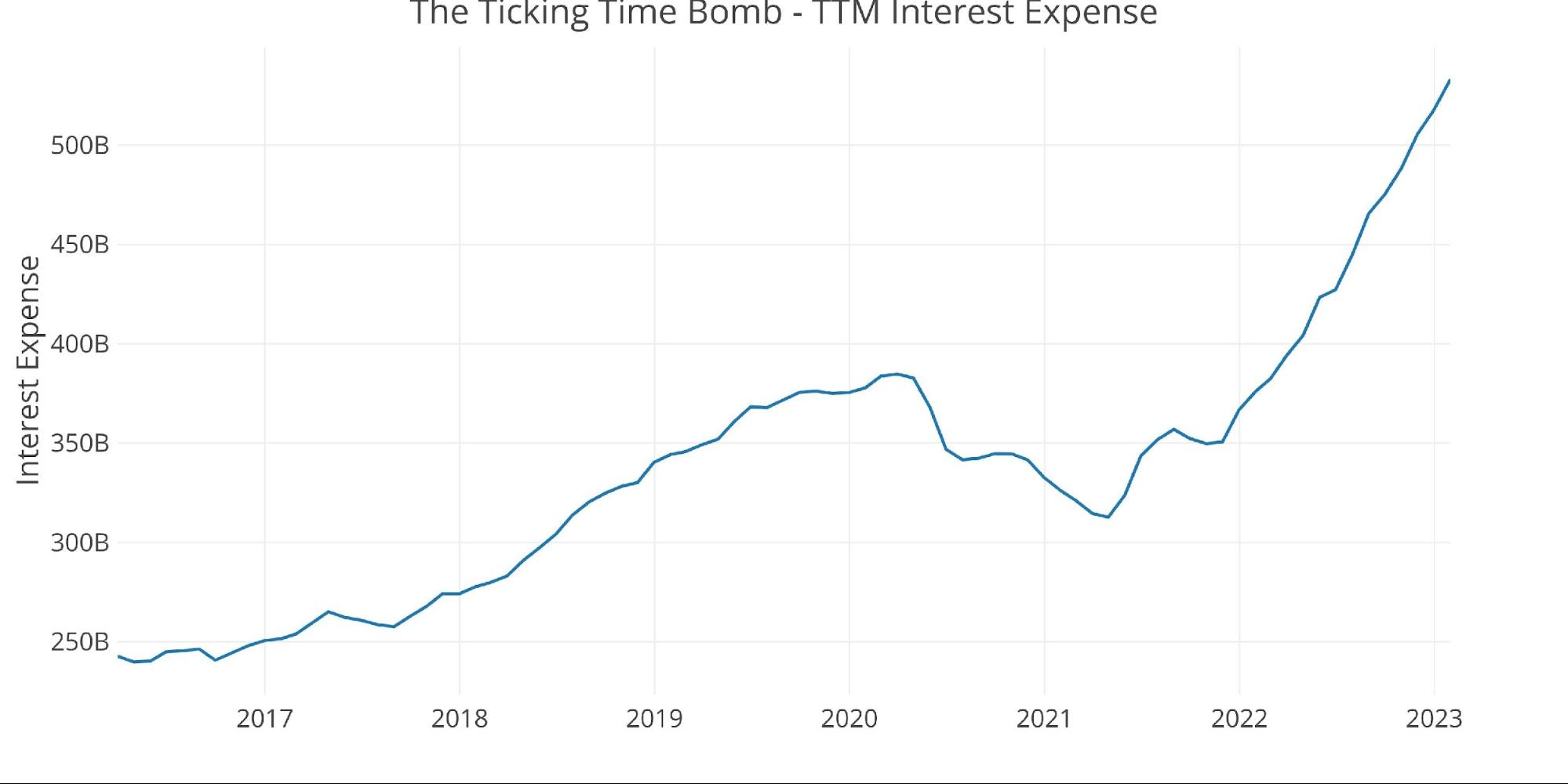

As discussed in the debt analysis, the total net interest payments on the national debt are still exploding higher as interest rates rise. In the latest period, the TTM interest expense was $533B dollars. Annualizing out the January Net Interest Expense pushes the total to almost $600B. That is just on debt servicing!

Figure: 8 TTM Interest Expense

The table below goes deeper into the numbers of each category. The key takeaways from the charts and table:

Outlays

YoY only Health saw a reduction in spending

6 categories saw a percentage increase greater than 10%

Net Interest Expense increased 42% on a TTM Basis and is up 63% since Jan 2021

On a TTM basis, 3 of the top 4 largest categories (Social Security, Medicate, and Health) saw expenses increase more than 5%

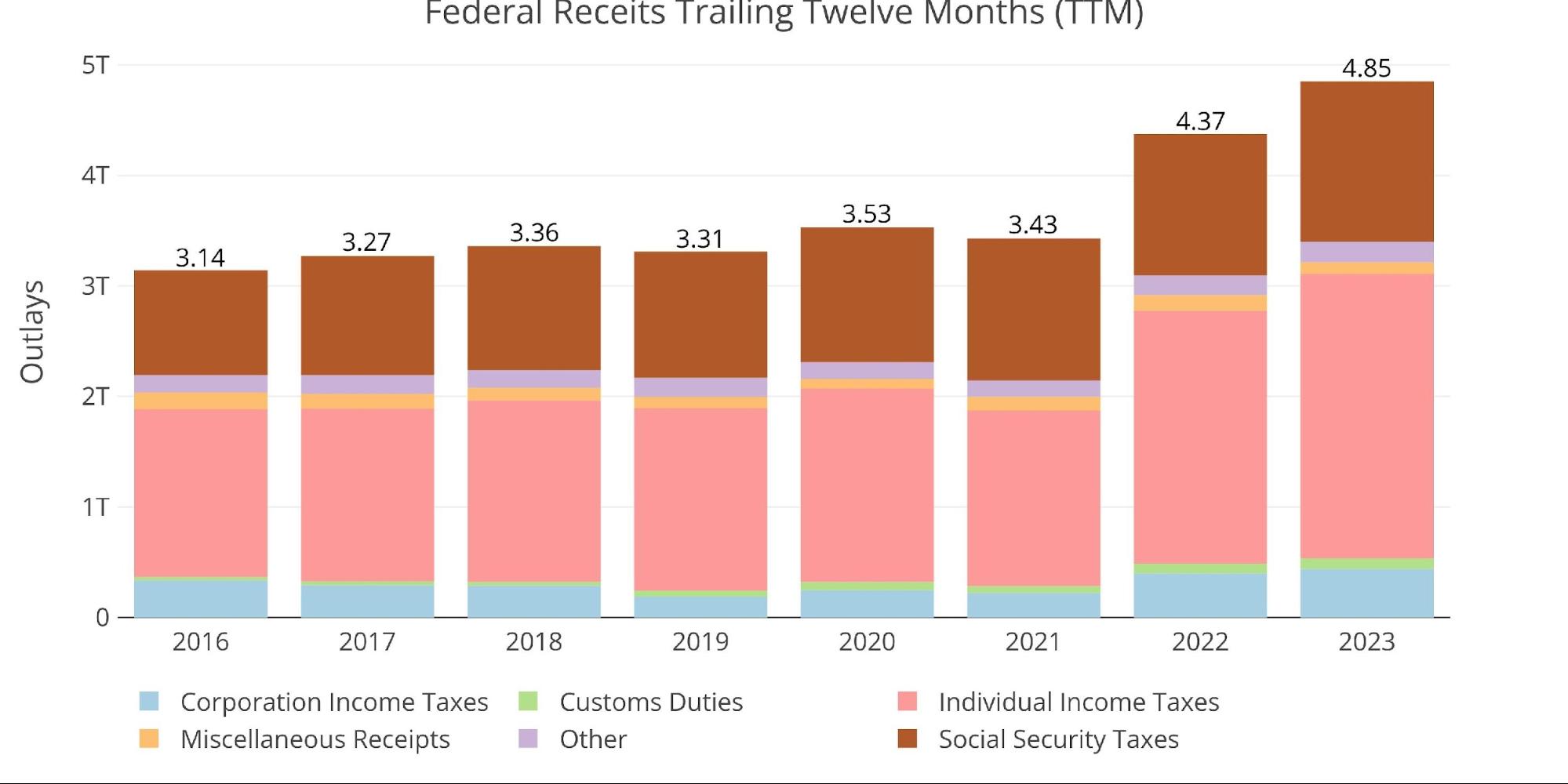

Receipts

Individual Income Taxes were down 10% YoY but 22% higher than the 12-month average

Similar to last month, this is a problematic trend of falling tax revenues

On a TTM basis, Social Security Revenue was up 13.6% which is a massive burden on the working middle class

Also, on a TTM Basis, Corporate Taxes were up 10%.

Total

Total Outlays in January rose 40% YoY while Revenues fell by 4%

The picture is rosier on a TTM basis with Expenses falling 3.6% and Revenues increasing 11%, but this is likely temporary as the 2021 figure still captures the massive Biden stimulus package in early 2021

Most importantly, the total TTM Deficit was $1.58T which is much higher than the $1.4T last month.

Figure: 9 US Budget Detail

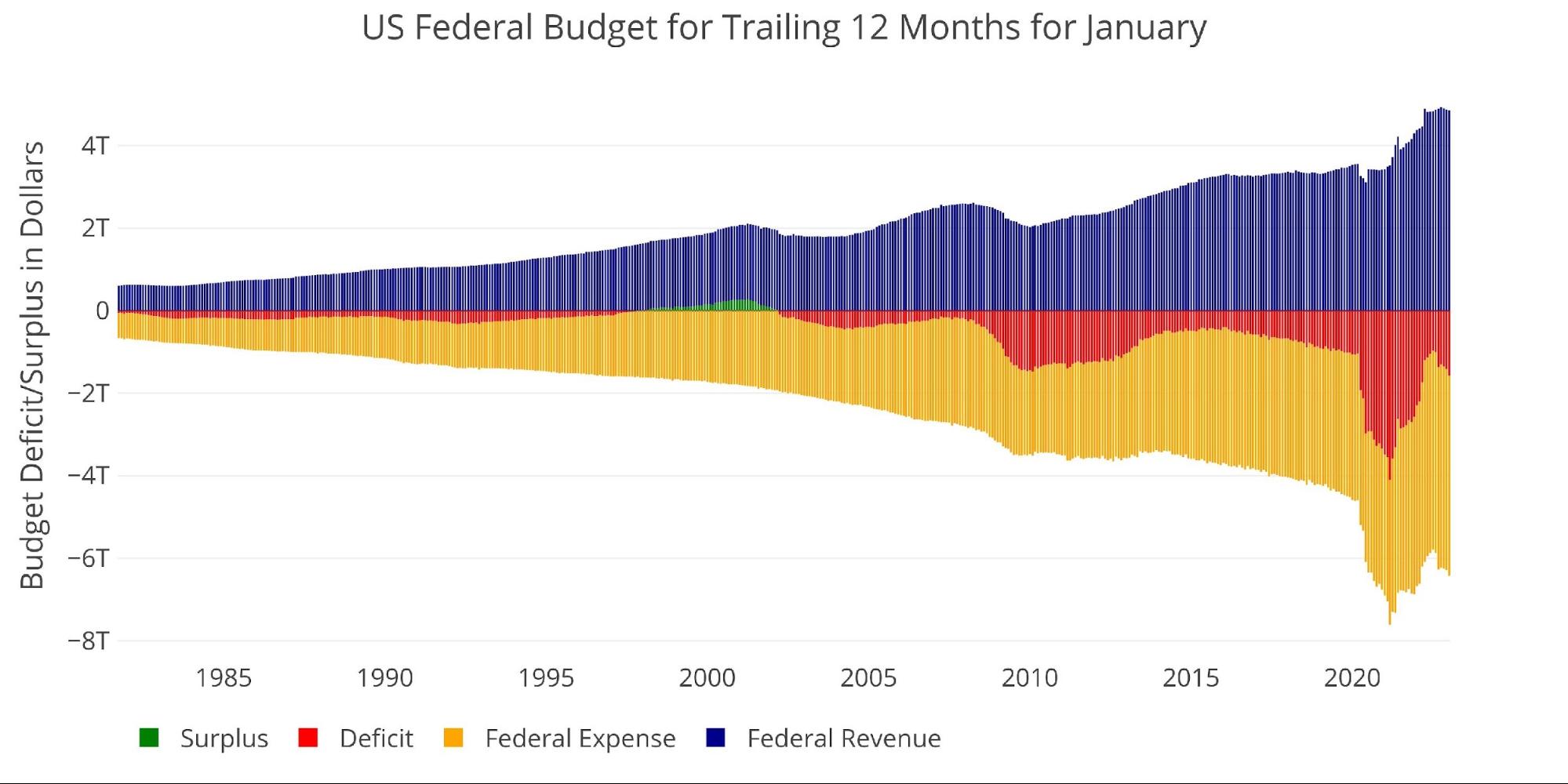

Historical Perspective

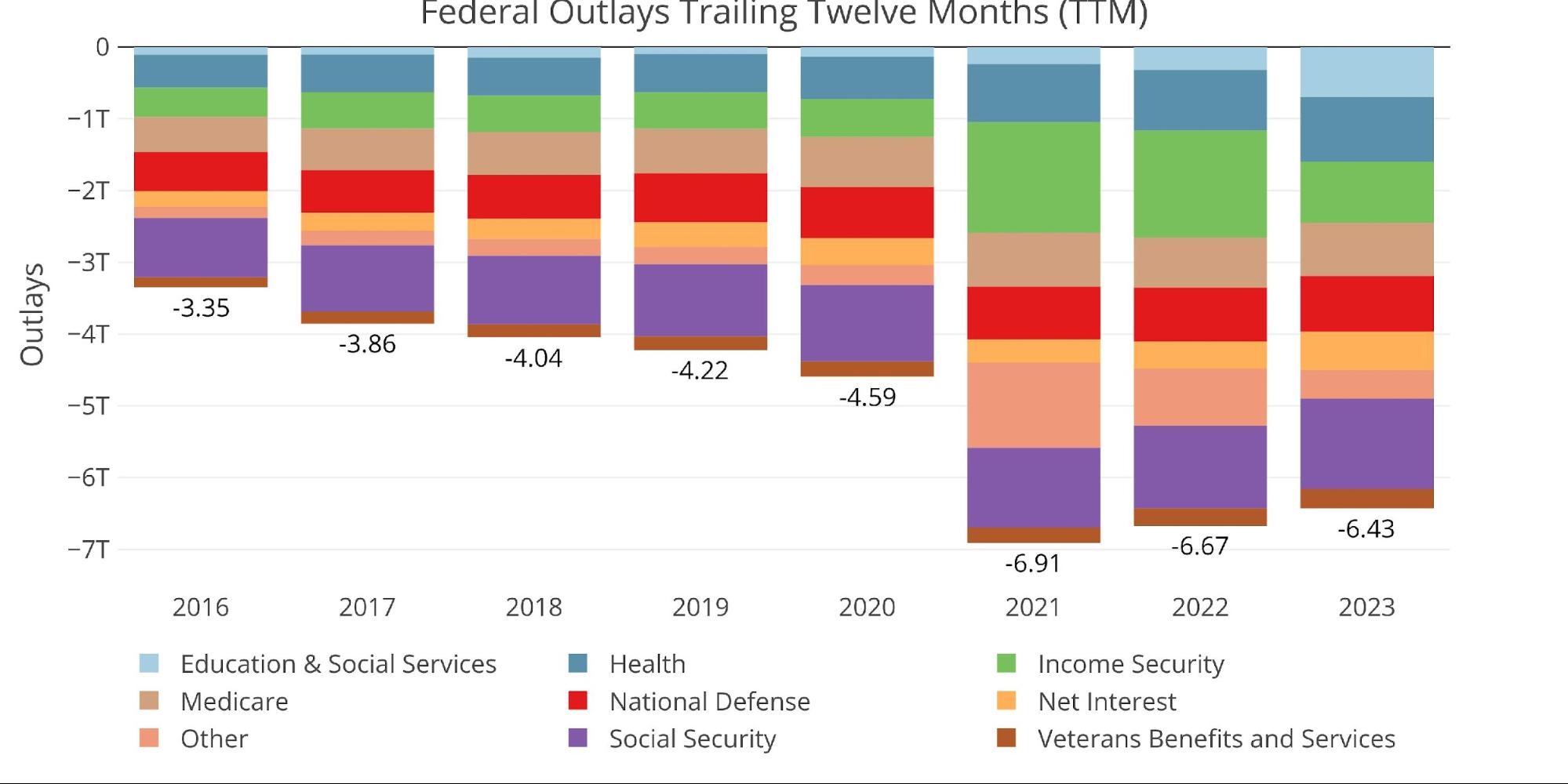

Zooming out and looking over the history of the budget back to 1980 shows a complete picture. It shows how a new level of spending has been reached that is far above pre-Covid levels. While a similar increase in tax revenues has helped, revenues have already started coming back down. This is extremely problematic as it is much harder to cut spending and/or raise taxes. If this trend continues, budget deficits could well exceed $2T in short order.

Figure: 10 Trailing 12 Months (TTM)

The next two charts zoom in on the recent periods to show the change when compared to pre-Covid.

As shown below, total Receipts have surged higher in the last two years driven by Social Security, Corporate Taxes, and Individual Taxes. In two years, total revenue has climbed by $1.42T, or 41%.

Figure: 11 Annual Federal Receipts

Spending has also seen a massive surge, blasting well past $6T per year for the last three years.

Figure: 12 Annual Federal Expenses

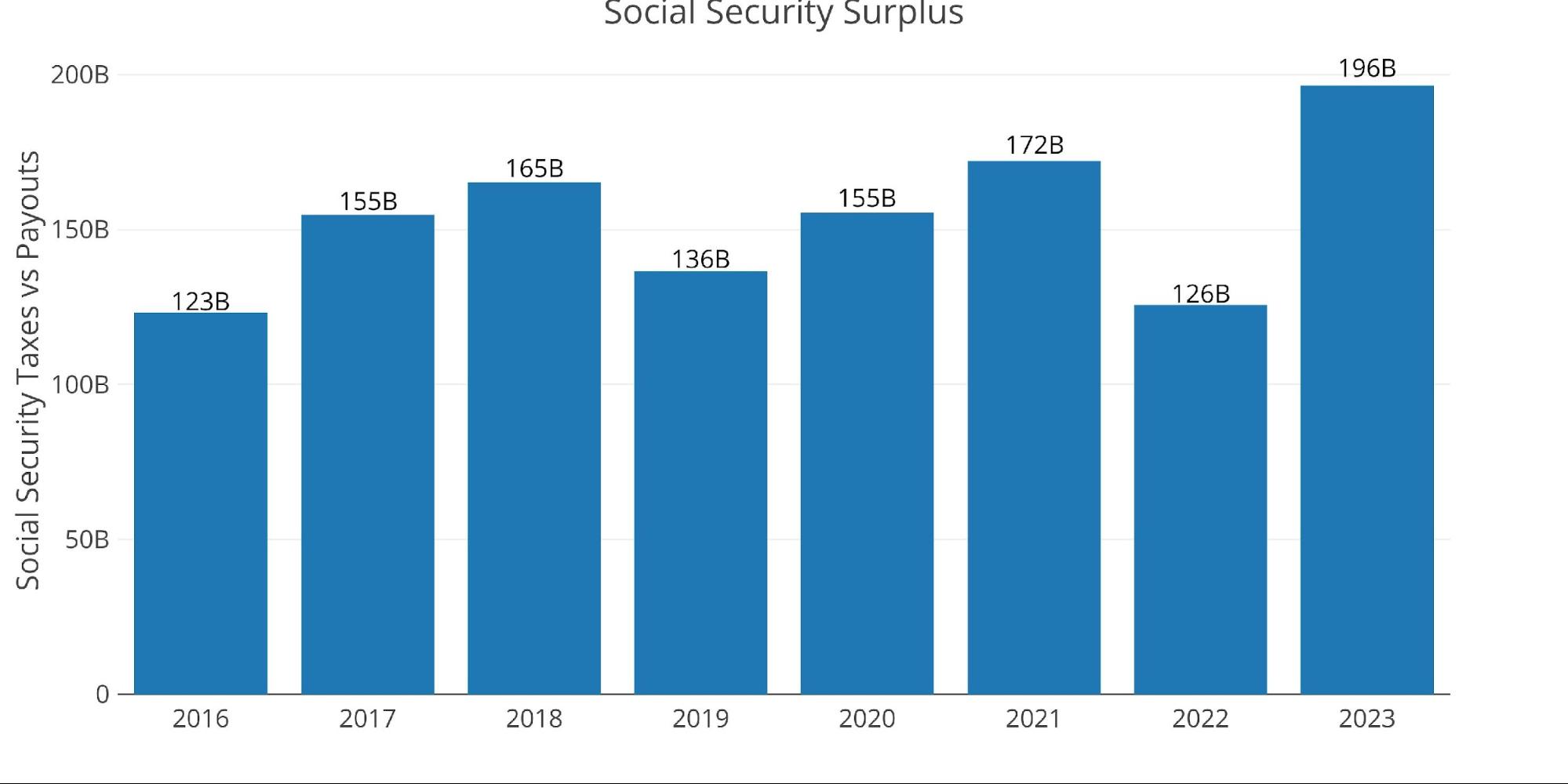

One bright spot for the Federal Government is that Social Security remains solvent (for now). The difference between revenue and payouts can be seen below. This comes at a price of course, over the last 10 years, the level of wages subject to Social Security tax has increased 41% from 113k to 160k in 2023. The increase from 2022 to 2023 was a whopping 9%, one of the biggest moves upward on record.

Figure: 13 Social Security

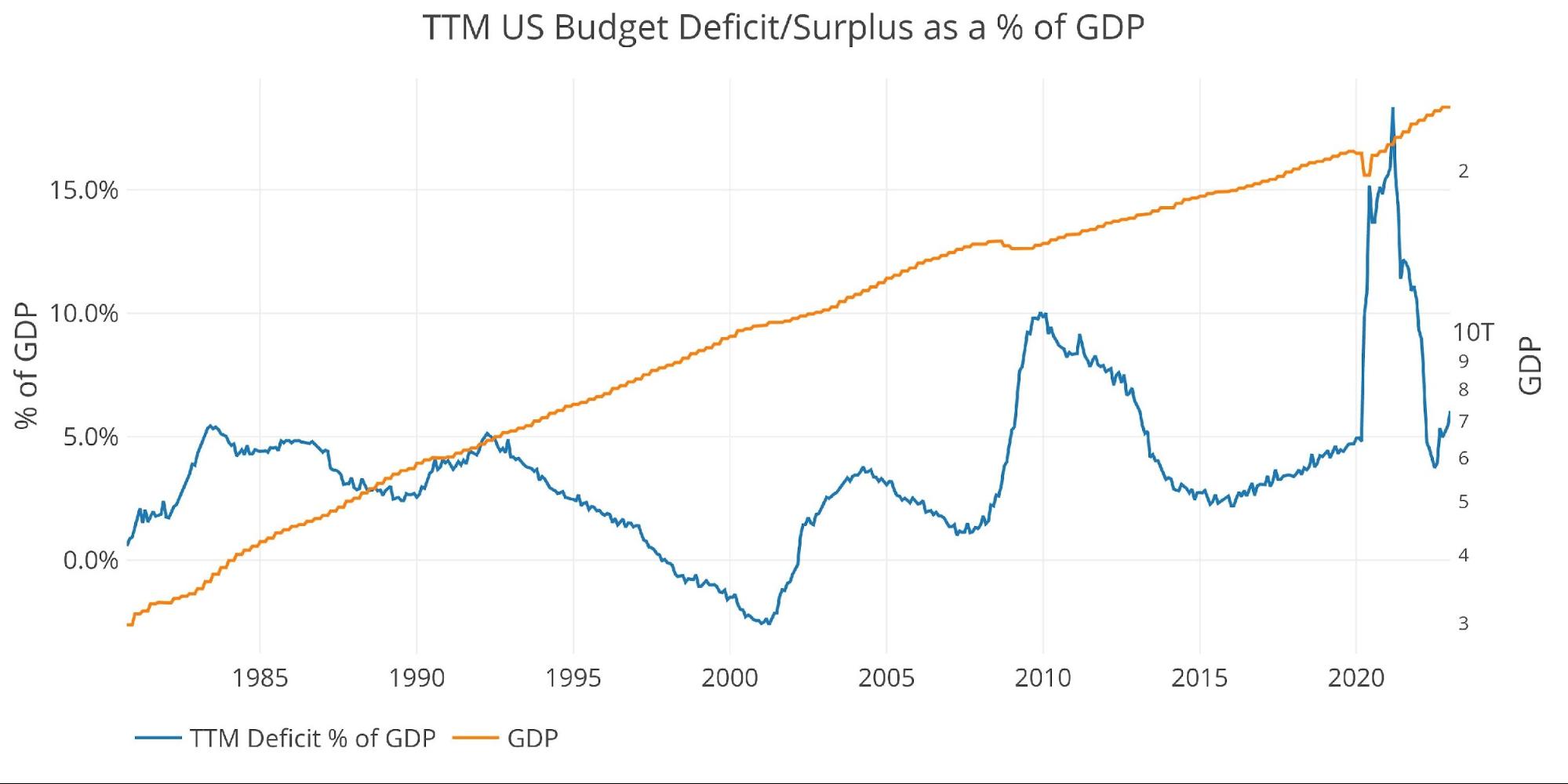

Despite massive expenditures driving huge deficits, the Deficit is down YoY as mentioned above. This has brought the TTM Deficit compared to GDP down to pre-Covid levels. It has moved back up in recent months and is now at 6% of GDP, up from 3.9% as recently as August.

Note: GDP Axis is set to log scale

Figure: 14 TTM vs GDP

Wrapping Up

Tax Revenues are falling while elevated levels of spending are not. This is very problematic for the Treasury. Interest Expense alone is chewing up more than $500B in tax revenues. There is a perfect storm brewing as the labor market continues to weaken, the stock market stays choppy, and corporations report fewer revenues. All of this will lead to less tax revenue. Add in the high probability of a recession, where the government will be asked to spend more and the Treasury could blow past the record budget deficits of the Covid era.

Sure, the Fed is talking tough and holding tight. But that can only last so long before the math catches up to them. In the recent Schiff Gold podcast, Mike Maharrey stressed the fact that these things take a long time to play out. He specifically quoted an article from September 2007 that discussed how inflation was coming down and that the Fed should get the soft landing it desires. Whoops, spoke a bit too soon. This time around is no different, everyone is jumping to the conclusion that the Fed has already won.

Sorry, but no. These things take time to play out. Usually longer than most people expect (including myself). We are still in the very early innings of this. When something breaks, look out below. 2008 will look like sunshine and rainbows.

Data Source: Monthly Treasury Statement

Data Updated: Monthly on eighth business day

Last Updated: Period ending Jan 2023

US Debt interactive charts and graphs can always be found on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/USDebt/

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

[ad_2]