[ad_1]

ClaudioVentrella

Investment Rundown

As far as growth stories go in the oil industry, it can be hard to identify really solid investment opportunities as cash flows might be inconsistent or margins hard to maintain. That doesn’t seem to be the case with Cactus, Inc. (NYSE:WHD), a company that has had a raging start to 2023 as revenues 57% YoY and it became the best quarter for the company ever and momentum doesn’t seem to slow down, which makes the recent pullback in the share price very intriguing as you are getting an even better entry point.

Many companies in the industry are highly affected by the cycles and lack consistent or high average margins, but WHD has shown to be an outperformer in this aspect. The total adjusted EBITDA margin between 2014 – 2022 was an impressive 33%. I think this highlights the solid business model the company has established and I expect more robust operational performances ahead. Rating WHD a buy.

Company Segments

In WHD two primary segments make up the company, the pressure control segment, and the spoolable technologies segment. The primary revenues are however made from the pressure control segment, which generated $194 million in the last quarter, or around 83% of the total amount.

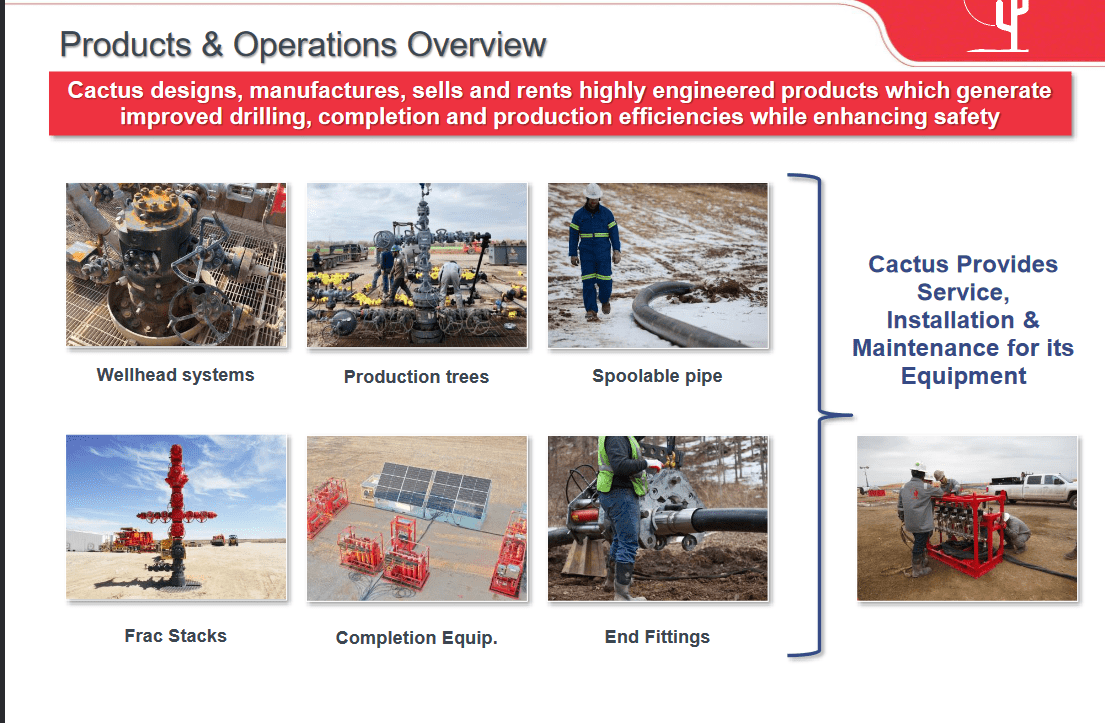

Product Offerings (Investor Presentation)

As part of the pressure control segment, they offer customers wellhead systems and services that come along with the product, like installation and maintenance for it. Noting from the last report is that this segment experienced significant growth as a result of higher drilling activity in the industry. The increase of 3.7% sequentially was a very impressive result and showcases the position that WHD has in the industry, as they describe themselves as a leading pure-play equipment solutions provider in onshore markets. The benefit and competitive advantage that WHD has regarding its drilling equipment is the lack of “hot work” necessary to utilize it. The amount of time saved using the products they provide is also a major benefit customer see, as fewer trips into confined spaces are necessary.

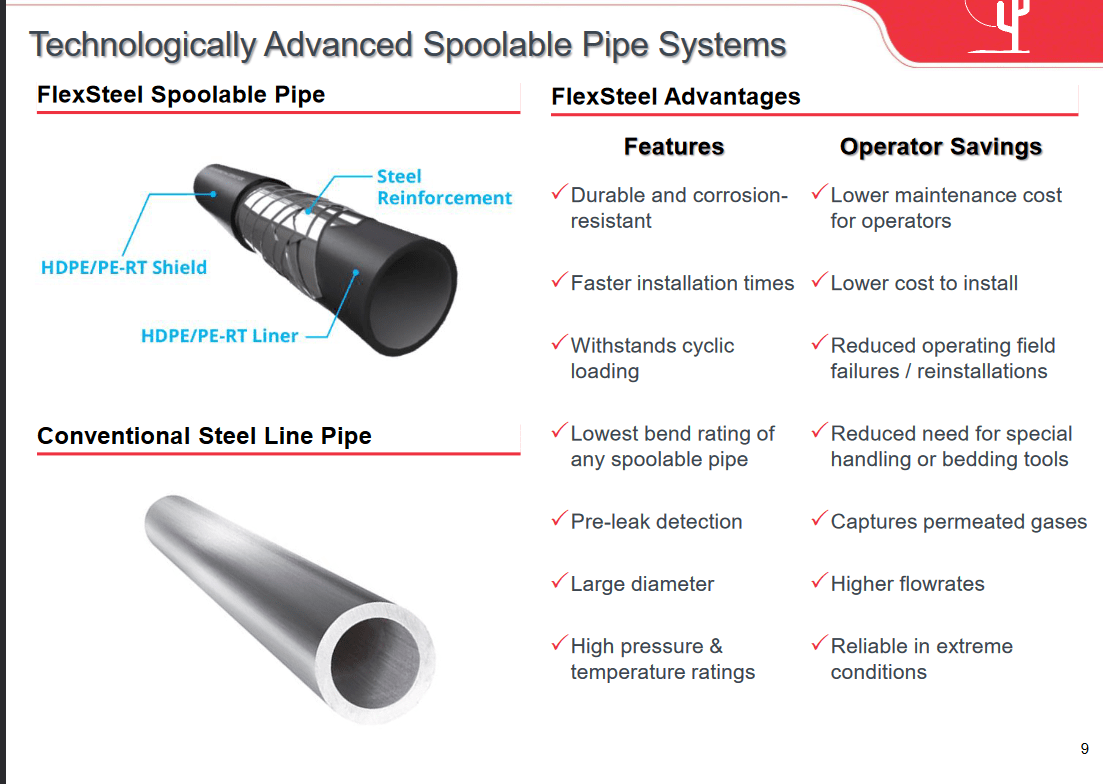

Company Products (Investor Presentation)

One more exciting part of the company is the spoolable technologies the company is engaging in. WHD here offers a more advanced FlexSteel Spoolable Pipe that is aimed to be more durable and reinforced than the conventional steel line pipe. As WHD acquired the company HighRidge Resources earlier this year, the revenues from this only account for one month in total. This means that future performance here will be important to watch. As for now, the results are impressive I think and the adjusted EBITDA margin was 30.5%. As for where the revenues might be in the coming quarter, around $90 – $100 million seems reasonable given the performance of the first quarter. That would make the discrepancy between the two segments quite equal and the acquisitions will certainly help field strong growth for years to come.

Markets They Are In

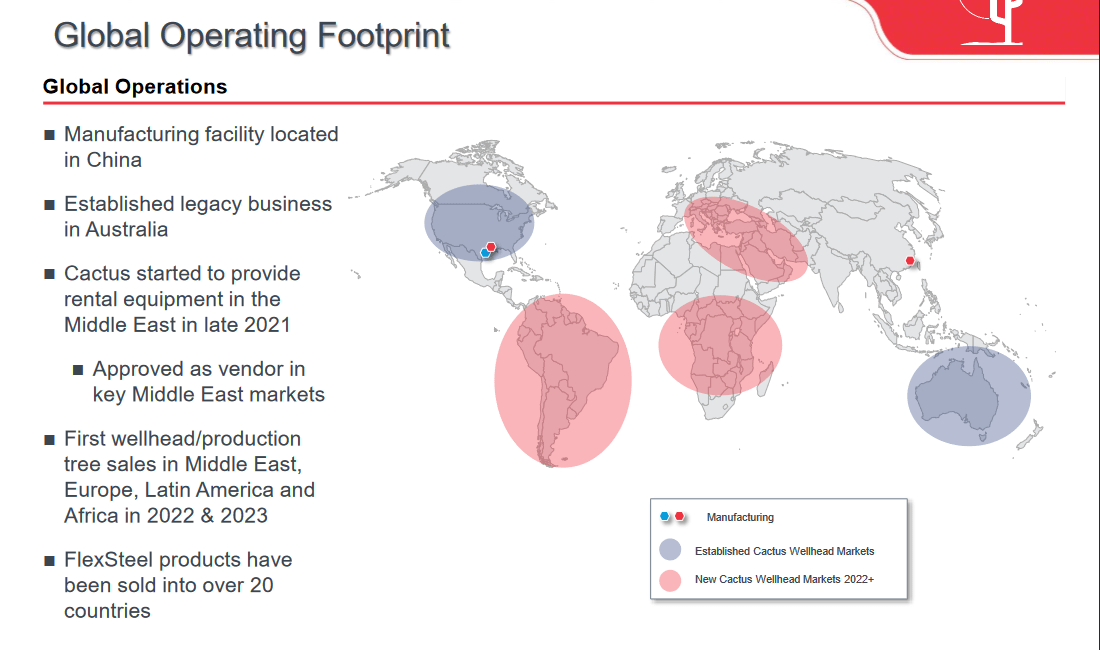

So far WHD has managed to gain a global footprint and has a presence in all the major oil markets. The more established markets they are in are North America and Australia. But they are gaining ground in both the Middle East and Latin America. With rental equipment approved in the Middle East, I think we should be looking out for any comments or progress regarding this in the coming quarters. But the FlexSteel line will also be interesting to watch, as it has already been sold in over 20 different countries.

Market Footprint (Investor Presentation)

Earnings Highlights

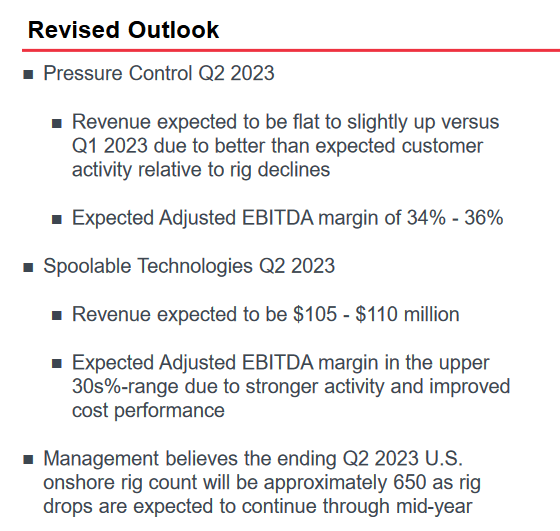

As mentioned in the beginning, WHD had a raging start to the year as revenues grew by 57% YoY, a result of both the acquisitions of FlexSteel and a higher drilling activity in the industry. This momentum seems to remain somewhat and Q2 of 2023 will see pressure control revenues slightly up and an adjusted EBITDA margin of 34 – 36%. On the higher end of that, it would mean a QoQ improvement and could be viewed as a catalyst and cause the share price to perhaps ditch the downward trend it is in and begin moving upwards.

2023 Outlook (Earnings Presentation)

As for the spoolable technologies segment, here the revenues are expected to be in the range of where I think they would reach, $105 – $110 million. Adjusted EBITDA margins are estimated to be in the high 30s in Q2 FY2023 as a result of stronger-than-expected activity and improved cost performance within the segment, according to the company’s own expectations in the last earnings presentation.

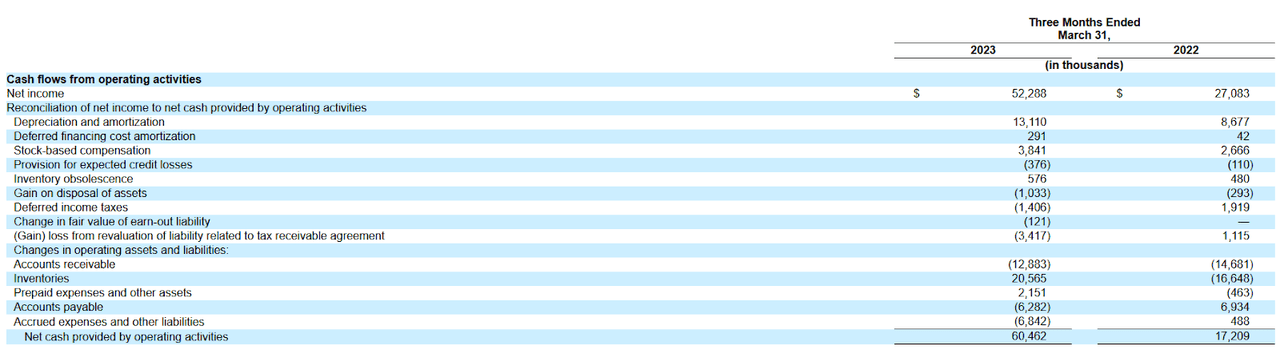

Cash Statement (Earnings Report)

Looking at the cash flows from the quarter I think that WHD made strong improvements. Back in Q1 2022 the net cash provided by operating activities was $17 million but has since improved to $60 million. This sort of improvement has heavily helped WHD in being able to announce a new buyback plan. of $150 million. The strong expectations of cash generation from the two segments were the reason for this news. If used all right now it would reduce the outstanding shares by around 5.1%. I think this plays into the investment case very well here in that WHD is also a value play in that stronger cash flows will convert into increasing dividends and buybacks.

Risks

The primary risk I associate with WHD right now is volatility in the commodity market that would cause drilling activity to halt. So far it remains strong, but as we have seen in the US, the pushback against drilling for oil is quite strong and could cause some delayed projects. But with the news that Biden would approve some drilling projects I think the industry isn’t facing as many challenges as one might think. Oil is still a major part of our energy generation and I don’t see any new legislation changing that in the short term.

Final Words

Right now, WHD offers inventors a solid opportunity to gain exposure to the oil industry through a “pick & shovel” play. As they supply equipment to the industry they are also exposed to cycles in the industry, but the historical performance of the company shows they have been able to maintain very strong margins and weather the storms efficiently. With the acquisition and introduction of FlexSteel to the company I think revenues will continue to climb as drilling activities remain high.

With the announcement of a buyback program of $150 million, I think the current share price is very intriguing to get into. As the shares have been in a steady decline since the early parts of this year I think a catalyst would be necessary to get it back into an upwards trend. That could be a surprise in margin expansion or improved revenues. Either way, I think the long-term remains very solid, and am rating WHD stock a buy as a result.

[ad_2]