[ad_1]

Introduction

Since its inception in 2010, Bitcoin has seen its value and popularity rise exponentially, creating the foundation of a market that reached $1 trillion in value in a decade. Cryptocurrencies have seen increased adoption in the wake of broader macroeconomic turmoil, with millions of new users onboarding the decentralized world of cryptocurrencies as a hedge against traditional finance.

Despite its current growth, some believe the crypto industry will have a limited life. Its critics expect the increase to plateau and decrease as regulatory pressures and internal market struggles create more user losses.

However, many expect the novel technology to follow the same adoption curve as the internet and telephones did before it.

This report examines the factors that could contribute to Bitcoin’s growth and help the crypto industry reach 1 billion users by 2025.

The diffusion of innovations

The diffusion of innovation theory best describes the rate at which new technologies are adopted and spread. It explains how the adoption of any new technology follows a bell curve — a small group of innovators and early adopters at the beginning make way for a larger group of early majority adopters, followed by an even larger group of late majority adopters. Finally, the bell curve ends with a small group of late adopters.

The ubiquitous bell curve graph has been applied to everything from steam engines to telephones, showing how fast the technologies have been adopted by broader society.

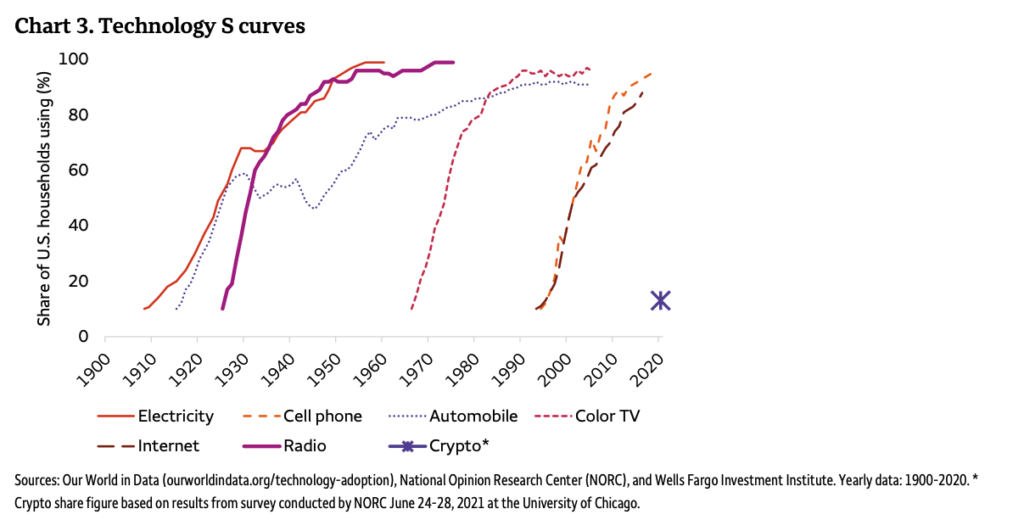

Applying the scale to Bitcoin shows that the crypto market is still in its early days. A 2022 report from Wells Fargo calculated that cryptocurrencies still haven’t reached an adoption inflection point, comparing them to the popularity of the internet in the mid-to-late 1990s.

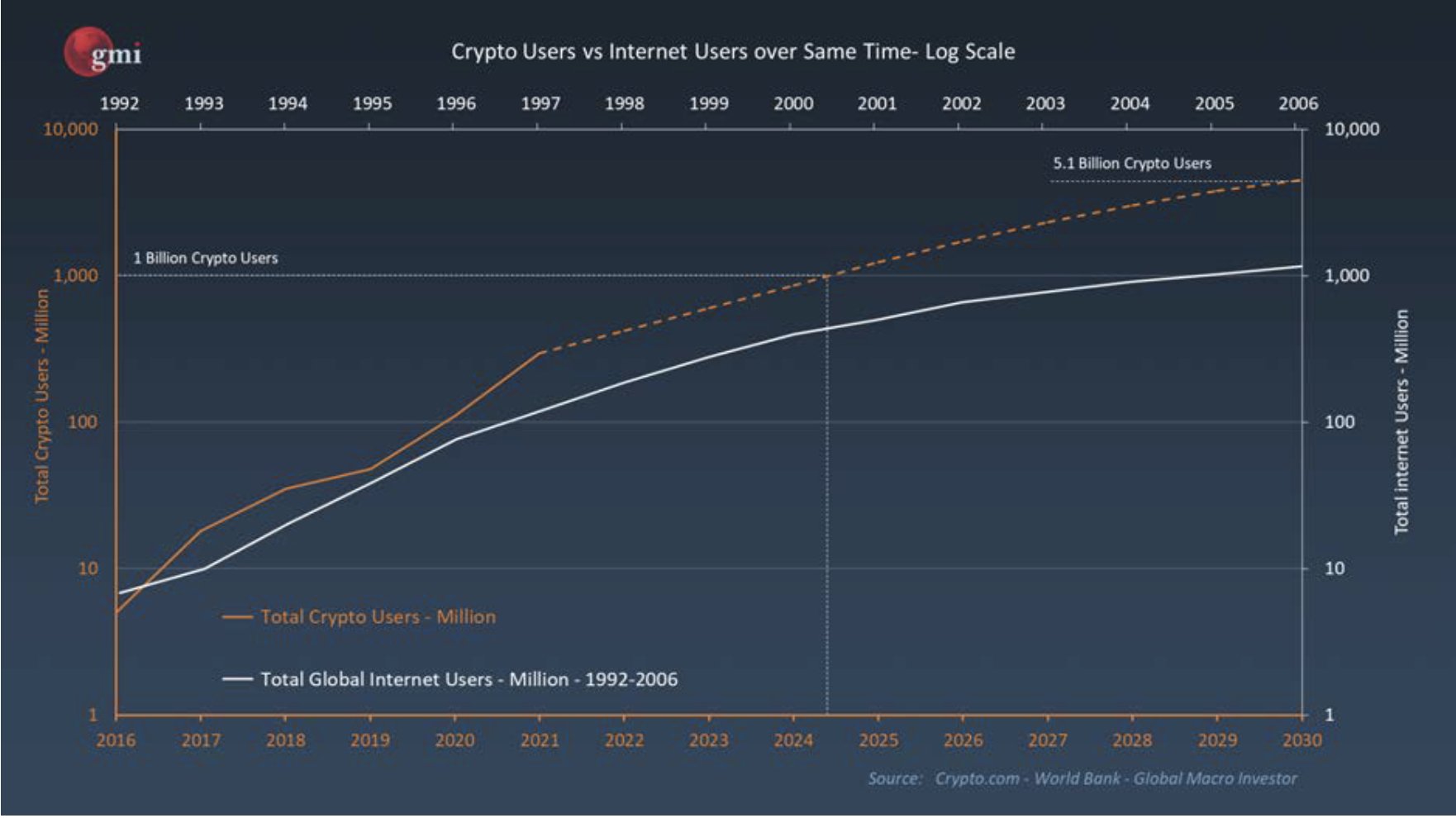

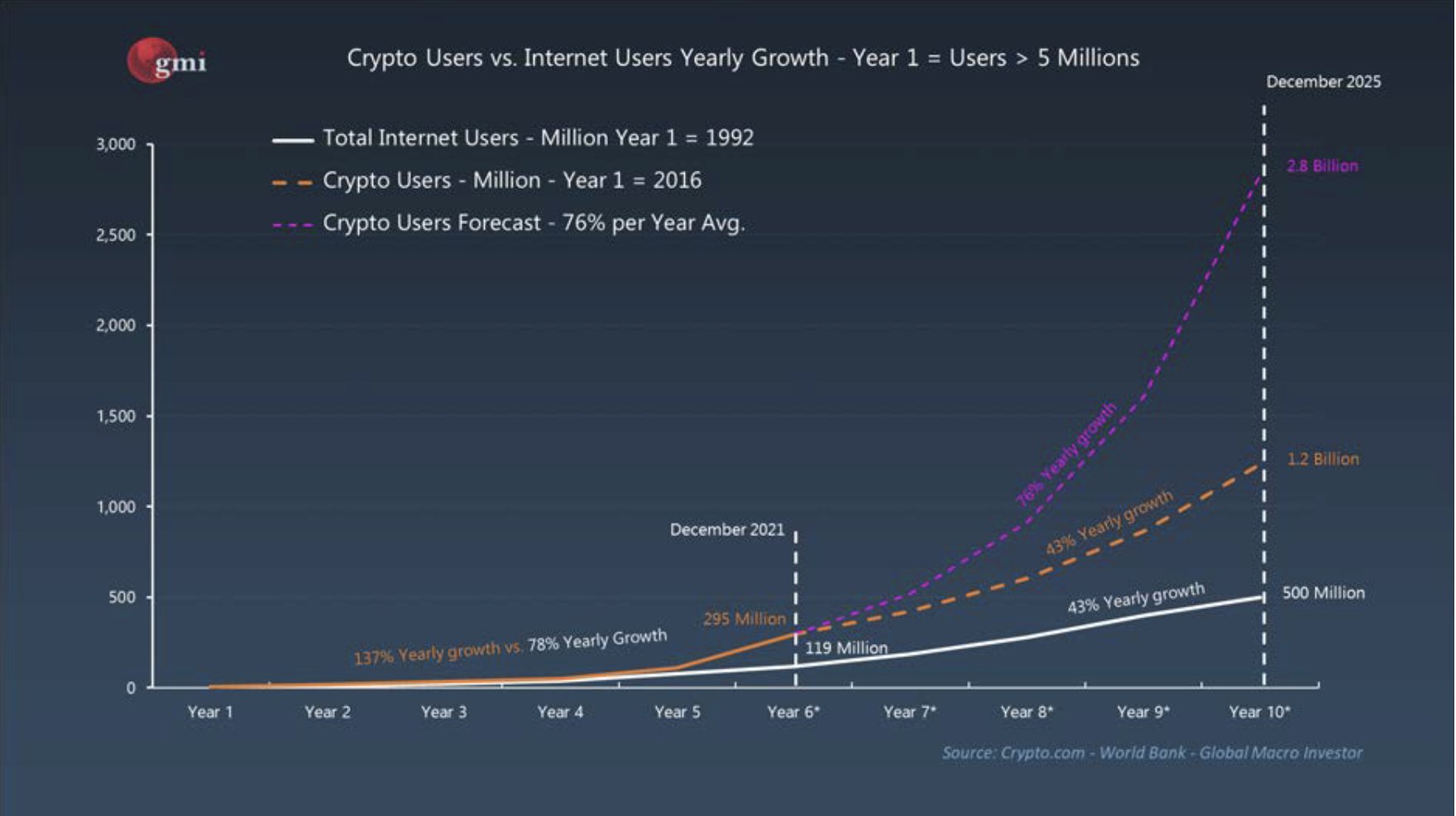

Comparing Bitcoin to the internet has become the go-to case study for those rooting for the success of the crypto industry. Data from Global Macro Investor found that cryptocurrencies have seen the fastest adoption rate of any rate technology in history, recording a 137% growth per annum.

Aside from the exponential growth both the internet and Bitcoin experienced in their early years, the two technologies bear many other similarities. Both saw their popularity rise after a small group of tech-savvy users brought them to the mainstream. Both struggled with attracting a wider audience due to the technical knowledge required to use it. Both experienced regulatory pressure as government agencies struggled with policing the technology.

The problem with defining Bitcoin adoption

Calculating crypto adoption is highly complicated. Unlike the internet, which requires looking at the number of people with direct access to an internet connection, cryptocurrencies and their adoption are much harder to quantify.

Adoption can be measured through the amount of capital flowing into the market. While this method certainly puts the value of the market into perspective, it tells little about the actual number of active users.

It can also be measured through transaction volume and the number of transactions on a given network.

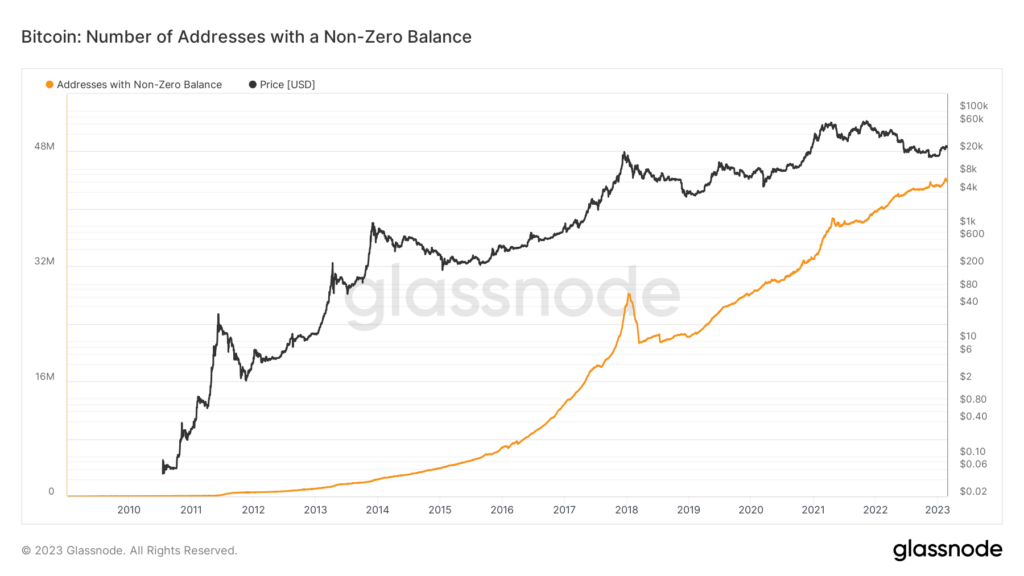

Another, more reliable way of measuring adoption is calculating the number of users. However, this presents another set of problems due to the pseudonymous nature of blockchain technology. Simply counting crypto addresses won’t provide a reliable result, as one address doesn’t equal one user.

For this report, a rise in non-zero Bitcoin addresses and the number of active users on centralized exchanges are a sign of increasing adoption.

Calculating crypto adoption

The number of users on centralized exchanges can be used as a proxy for broader crypto adoption.

Take, for example, Coinbase. In 2021, around 25% of the entire crypto market used the U.S.-based exchange, making it one of the most popular cryptocurrency services in the world. As of February 2023, the exchange has around 110 million verified users.

With an average year-on-year growth in users of 92%, Coinbase outpaces the internet with an average YoY growth of 43%. If the exchange continues to increase its user base at the internet’s 43% conservative estimate, it could see its user base triple by 2025.

Comparing the size of the crypto user base to the internet further confirms the industry’s potential for growth.

Some experts believe that the current state of the crypto industry is on par with the internet in 1999. At the time, the new technology slowly made way for what will later be known as the dot-com boom and had around 248 million users. The internet took six more years before it reached 1 billion users in 2005.

Some estimates show that the crypto industry could have around 605 million users in 2023. Applying the 43% YoY growth average the internet saw to cryptocurrencies shows that the sector could reach 1.2 billion users by 2025.

Even at the 17% YoY growth average the internet experienced between 2002 and 2006, the crypto industry could see over 900 million users in 2025.

According to the diffusion of innovation model, a technology is in its early phase even when it reaches 13.5% of the market.

Given that the 605 million crypto users in 2023 represent 7.5% of the world population, we can safely say that the industry is still in its early phase. The 605 million users are still considered early adopters, as crypto would take another 700 million users to reach the early majority.

Conclusion

While cryptocurrencies and the internet are inherently different technologies, they bear many similarities due to their transformative potential.

Applying the most conservative adoption rate the internet has seen to cryptocurrencies shows that not only could the industry reach 1 billion users, but it could reach it much quicker than any other technology in history.

A rise in distrust in the traditional financial system fueled by macroeconomic turmoil makes cryptocurrencies, especially Bitcoin, an extremely useful proposition for millions. As the technology continues to develop and its use cases increase, we could see this adoption rate speed up.

However, it’s important to note that these are crude estimates. Any number of black swan events could impact this adoption rate and set the industry back several years. A tectonic shift in regulatory approach could render cryptocurrencies essentially unusable in many parts of the world.

Nonetheless, putting the crypto industry’s growth into perspective shows that it’s still in its early phases, waiting for its full potential.

[ad_2]