[ad_1]

Marco Bello/Getty Images News

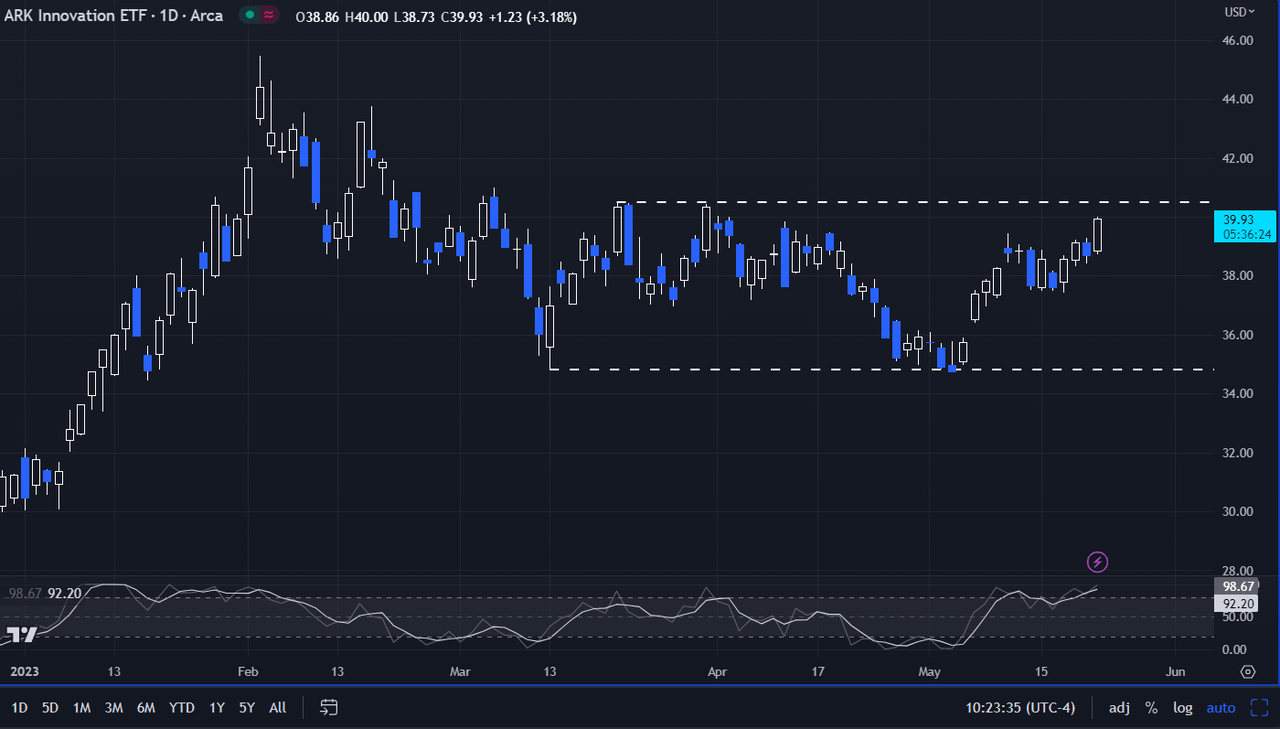

Cathie Wood’s flagship ARK Innovation ETF (NYSEARCA:ARKK) is on the move to start the trading week, with the exchange traded fund climbing to a new May high and touching levels not seen since March 31.

However, even while the exchange traded fund has outperformed the broader markets and tracked well into the green this year, Wood’s actively managed ETF has seen outflows in 2023. Year-to-date capital flows have shown that investors have pulled $90.71M from the fund.

Shares of ARKK jumped 3.5% early in Monday’s trading, crossing above $40 per share. This came amid gains from top holdings like Tesla (TSLA), Roku (ROKU), and Coinbase Global (COIN), which moved higher along with the broader Nasdaq Composite (COMP.IND). In early trading, TSLA gained 2.7%, ROKU moved up by 5.2% and COIN advanced by 3.8%.

ARKK now trades higher by 11.8% in May and is higher by 15% since its monthly low of $34.72, which it reached on May 3. Moreover, the exchange traded fund has also climbed 31.6% over the course of 2023.

Additionally, from a technical standpoint, ARKK is also approaching a key resistance zone and is showing overbought levels, according to the stochastics indicator. See below a year-to-date chart that outlines the technical points:

More on Markets:

[ad_2]