[ad_1]

Is ChatGPT, the Revolutionary AI, a Gold Bug? The AI Suggests Massive Diversification Across a Range of Cash-Like Assets and Commodities

NEW YORK, April 5, 2023 /PRNewswire/ — A new report by Gold IRA Guide found that ChatGPT’s ideal model of a “recession proof” investment portfolio includes large allocations (20%) in gold and other precious metals. This figure far exceeds the number proposed by prominent “gold bug” wealth managers such as Ray Dalio and Peter Schiff.

Q1 2023 hedge fund letters, conferences and more

Gates Capital Management Reduces Risk After Rare Down Year [Exclusive]

Gates Capital Management’s ECF Value Funds have a fantastic track record. The funds (full-name Excess Cash Flow Value Funds), which invest in an event-driven equity and credit strategy, have produced a 12.6% annualised return over the past 26 years. The funds added 7.7% overall in the second half of 2022, outperforming the 3.4% return for Read More

ChatGPT’s Recession-Proof Portfolio Breakdown

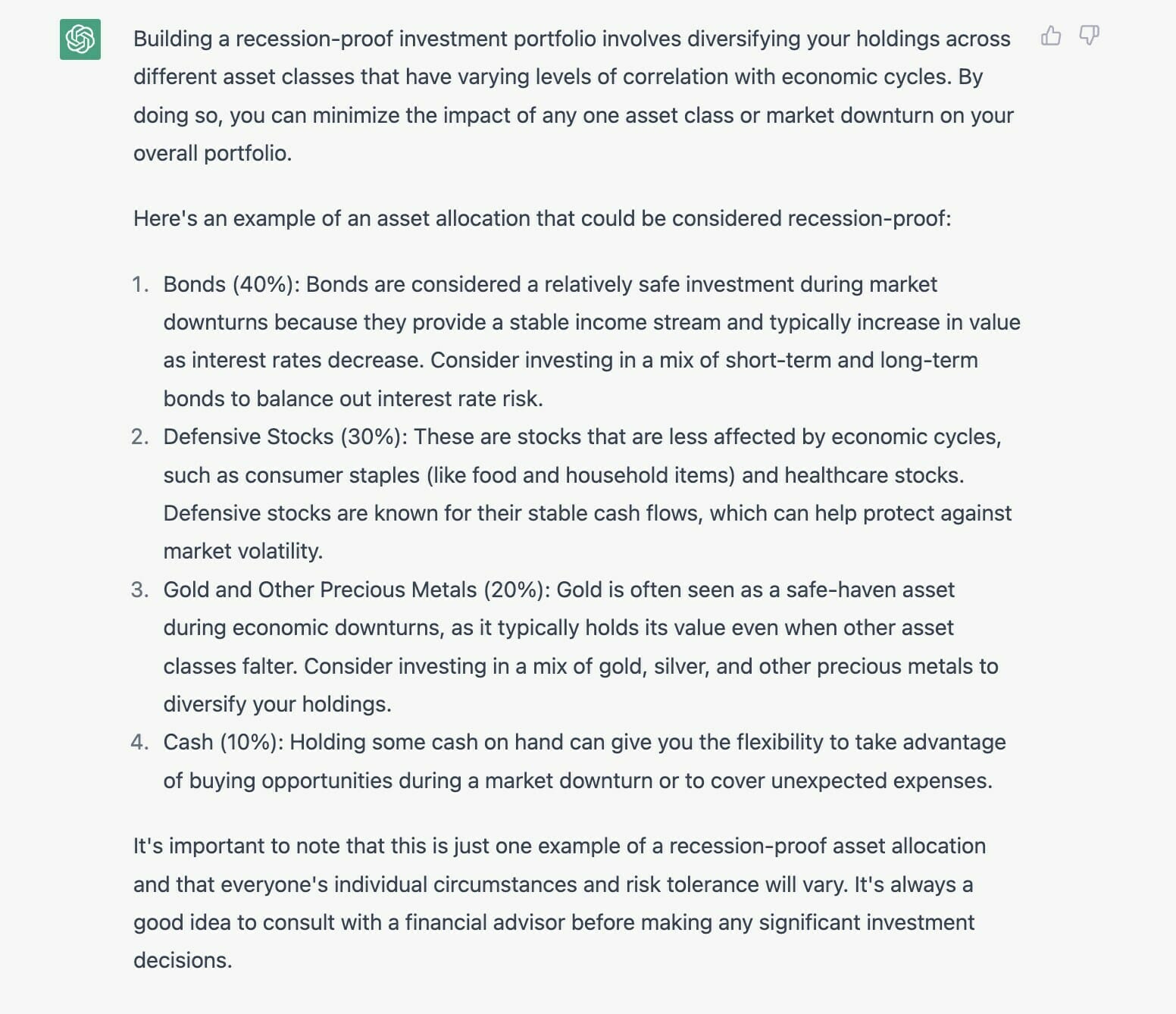

As depicted in Image 1, ChatGPT recommends investing in a mix of defensive stocks, bonds, and cash to create a truly recession-resistant portfolio. Defensive stocks such as consumer staples and healthcare stocks tend to hold up better than other sectors during a recession, while bonds provide stability and a source of fixed income.

In summary, ChatGPT recommends the following asset allocation strategy to maximally protect one’s investments from recessions:

Bonds (40%): fixed-income government and corporate bonds and Treasury bills, including publicly listed aggregate bond indices.

Defensive stocks (30%): blue chip stocks that are affected less by market fluctuations, such as healthcare, utilities, and essential consumer goods.

Gold and other metals (20%): suggested a mix of physical and “paper-backed” gold and silver assets, including gold ETFs and mining stocks

Cash and equivalents (10%): suggested U.S. dollars, money market funds, and certificates of deposit

The significance of these findings is that it offers investors a viable strategy for protecting their portfolios against economic uncertainty. In the wake of the COVID-19 pandemic and attendant economic downturn, many investors are looking for ways to shield their life savings from recessionary effects.

Report Summary

The global economy is no stranger to recessions, and with the recent bank failures and Fed policies, many investors are looking for ways to protect their portfolios from economic uncertainty. Enter gold, a precious metal that has long been touted as a safe-haven asset in times of market turmoil.

According to ChatGPT, the world’s leading artificially intelligent large language model created by Silicon Valley-based OpenAI, a well-diversified investment portfolio should include an allocation of at least 20 percent to gold and other precious as a recession hedge. This is a significant development traditional financial advisors typically advocate for a lower allocation percentage, usually in the range of 5 to 10 percent.

“Gold has historically held its value during economic downturns, making it an attractive option for investors looking to protect their portfolios,” wrote ChatGPT. “During the 2007-2009 global recession, for example, the price of gold increased by over 25%. A diversified portfolio that includes a mix of asset classes, including gold, can help mitigate the impact of market downturns and provide stability for investors.”

Overall, ChatGPT’s recommendation of a 20% allocation to gold as a recession hedge is a notable and valuable contribution to the field of investment management. Nonetheless, investors are strongly encouraged to consult with a financial advisor to determine their individual risk tolerance and develop a well-diversified investment strategy that meets their unique needs.

Read the complete report, and ChatGPT’s full model portfolio, at Gold IRA Guide’s website.

[ad_2]