[ad_1]

Torsten Asmus

By Robert Hughes

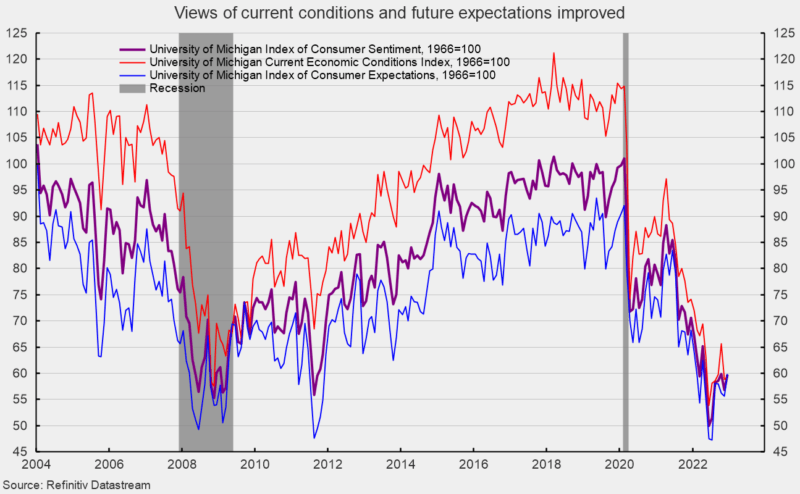

The ultimate December outcomes from the College of Michigan Surveys of Customers present general shopper sentiment improved for the month however stays close to traditionally low ranges (see first chart). The composite shopper sentiment index elevated to 59.7 in December, up from 56.8 in November. The index hit a report low of fifty.0 in June and is down from 101.0 in February 2020 on the onset of the lockdown recession. The rise in December totaled 2.9 factors or 5.1 %. The extent of the composite index stays in keeping with prior recessions.

The present financial circumstances index rose to 59.4 versus 58.8 in November (see first chart). That may be a 0.6-point or 1.0% improve for the month. This part is simply 5.6 factors above the June low of 53.8 and stays in keeping with prior recessions.

The second part – shopper expectations, one of many AIER main indicators – gained 4.3 factors, or 7.7% for the month, to 59.9. This part index is 12.6 factors above the July 2022 low of 47.3 however 32.2 factors or 35.0% beneath the February 2020 degree. This index additionally stays in keeping with prior recession ranges (see first chart).

Based on the report, “Client sentiment confirmed the preliminary studying earlier this month, rising 5% above November. Sentiment stays comparatively downbeat at 15% beneath a 12 months in the past, however customers’ extraordinarily adverse attitudes have softened this month on the premise of easing pressures from inflation.”

The report provides, “One-year enterprise circumstances surged 25%, and the long-term outlook improved a extra modest however nonetheless sizable 9%. Nonetheless, each measures are nicely beneath 2021 readings.” The report additional notes, “Assessments of non-public funds, each present and future, are primarily unchanged from November.”

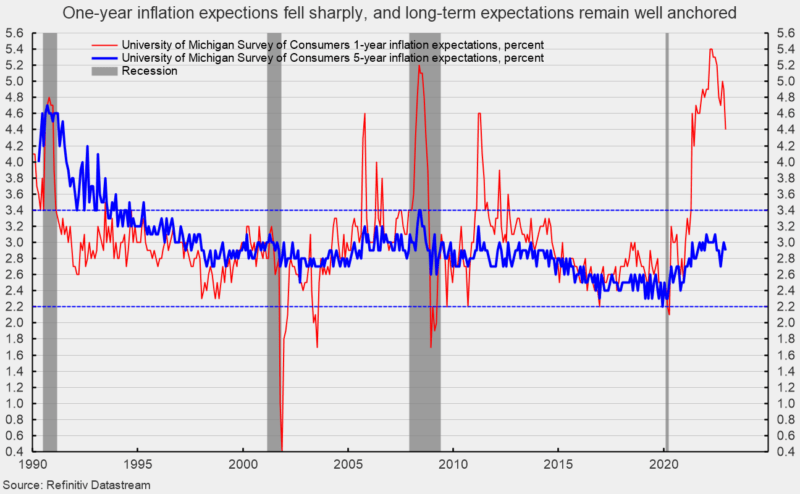

The one-year inflation expectations fell once more in December, declining for the sixth time in eight months to 4.4 %. The result’s considerably beneath the back-to-back readings of 5.4% in March and April, and the bottom degree since June 2021 (see second chart).

The five-year inflation expectations fell in December, coming in at 2.9 %. That result’s nicely inside the 25-year vary of two.2% to three.4% (see second chart).

The report states, “Yr-ahead inflation expectations improved significantly however remained elevated, falling from 4.9% in November to 4.4% in December, the bottom studying in 18 months however nonetheless nicely above two years in the past. Declines in short-run inflation expectations had been seen throughout the distribution of age, earnings, training, in addition to political celebration identification. At 2.9%, long term inflation expectations have stayed inside the slim, albeit elevated, 2.9-3.1% vary for 16 of the final 17 months.”

Moreover, “Whereas the sizable decline in short-run inflation expectations could also be welcome information, customers continued to exhibit substantial uncertainty over the long run path of costs.”

Pessimistic shopper attitudes mirror a big listing of issues, together with inflation, rising rates of interest, and falling asset costs. Total, financial dangers stay elevated as a result of affect of inflation, an aggressive Fed tightening cycle, and the continued fallout from the Russian invasion of Ukraine. Nonetheless, the decline in inflation expectations is a welcome improvement. Nonetheless, the financial outlook stays extremely unsure. Warning is warranted.

Unique Submit

Editor’s Observe: The abstract bullets for this text had been chosen by Searching for Alpha editors.

[ad_2]

Source link