[ad_1]

David Becker/Getty Images News

Investment Thesis

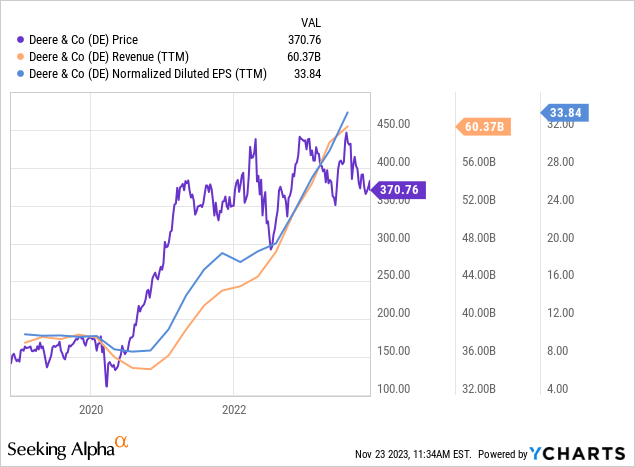

After a rally, shares of Deere & Company (NYSE:DE) have been long trading sideways without much change around 370 USD. Based on solid fundamentals, my assumptions, and a DCF model, I estimate the company’s shares intrinsic value to be much higher, and therefore, sooner or later, I believe the rally is likely to resume.

YCharts

Corporate profile

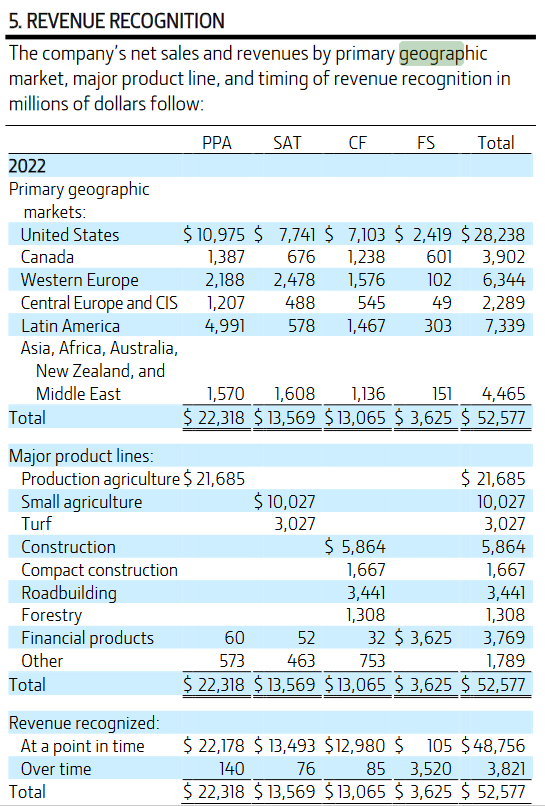

Deere & Company (DE), commonly known as John Deere, is a global leader in the agricultural and construction equipment industry. Founded in 1837 by John Deere, the company has a rich history of innovation and commitment to quality, earning its reputation as a trusted provider of machinery for farmers, construction professionals, and landscapers worldwide. Headquartered in Moline, Illinois, Deere & Company operates through three primary business segments: Agriculture and Turf, Construction and Forestry, and Financial Services. The Agriculture and Turf segment produces a diverse range of products, including tractors, combines, and precision farming technologies, catering to the evolving needs of modern agriculture. The Construction and Forestry segment focuses on equipment for construction, earth moving, and forestry applications. Complementing its core business, the Financial Services segment provides financing solutions to customers and dealers. Most of the company’s revenue comes from the United States, followed by Latin America and Europe.

10-K

Key insights from the latest quarterly earnings call

Reading through the latest quarterly earnings call transcript, the management was cautious yet optimistic about the upcoming months and raised the outlook for 2023’s net income by $0.5 billion to be between $9.75 billion and $10 billion. Brent Norwood, director of investor relations, highlighted especially positive developments in cost-cutting and operational efficiency:

As it relates to the quarter, these results underpin our commitment to operational excellence. With supply chains continuing to improve, we have been able to reduce delinquencies and improve resiliency in our supply base. In premium freight alone, we’ve been able to reduce costs by nearly 50% this year when compared to last year. Our factories ran really well in the third quarter. We saw continued progress from our supply base, enabling our operations to hit production schedules almost exactly as planned.

Financial analysis

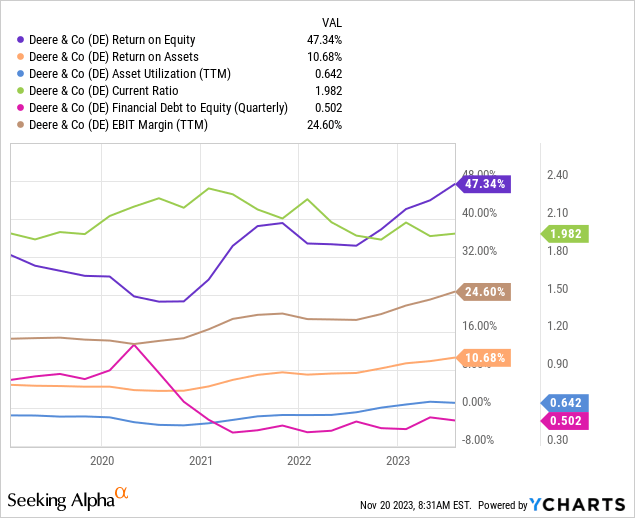

From the financial statements perspective, the company has solid profitability (ROA +-10 percent) which is further augmented with external financing (30+ percent ROE, EBIT margin of 24 percent). Roughly half of the company’s assets are financed with debt. Measured by the current ratio, the company’s ability to meet short-term obligations when they are due is also good, with the current ratio hovering above 1.

YCharts

Valuation

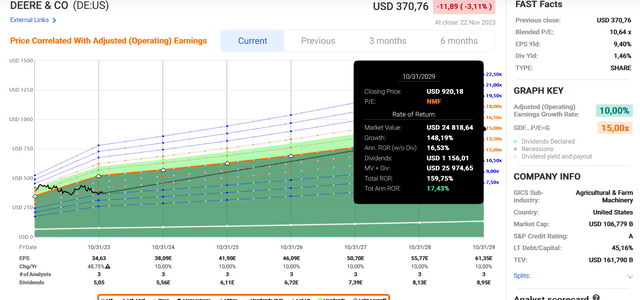

Through the lenses of FAST Graphs forecasting calculator, the company’s growth outlook appears bullish. Should the company’s shares trade at more or less the same price-earnings multiple (10.5x) in six years from now and Deere & Co.’s operating earnings expand at an annualized growth rate of around 10 percent, the shares’ fair price implies an 11 percent annualized upside potential. And this is likely to be the worst-case scenario as the price-earnings ratio could expand and shares have more than 17 percent annualized upside potential (P/E 15x).

FAST Graphs

DCF analysis

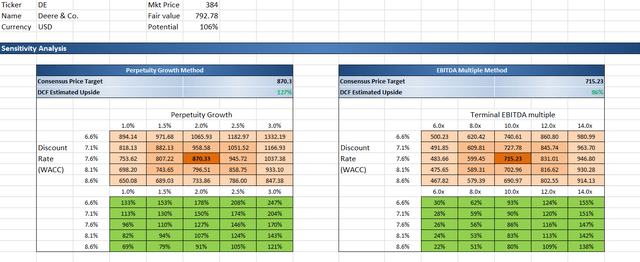

Plugging in Deere & Company’s financial statement figures into my DCF template, the company’s shares show to be considerably undervalued. Under the perpetuity growth method with a terminal growth rate of 2 percent, 9 percent annual revenue growth over the next five years and a stable operating income margin of 24 percent assumption, the model’s estimate of the intrinsic value of the stock comes at 870 USD. Under the EBITDA multiple approach of a discounted cash flow model, the intrinsic value per share of the company stands roughly at 715 USD if we assume that the appropriate exit EV/EBITDA multiple in five years’ time is around 10x.

Author’s own model

Key risks

Investing in Deere & Co. shares carries several key risks that investors should be familiar with and should carefully consider. One key risk lies in the company’s susceptibility to economic downturns and fluctuations in the agricultural sector. Deere & Co. is heavily dependent on the health of the global farming industry, and any downturn in agriculture could negatively impact the demand for its products, such as tractors and farming equipment. In particular, the company is exposed to the volatility of commodity prices, as farmers’ purchasing power is directly influenced by the prices of crops. Furthermore, the competitive landscape in the agricultural machinery sector poses a risk, as advancements in technology and the entry of new players could affect Deere & Co.’s market share and profitability. Moreover, changes in government policies related to agriculture, trade tensions, and environmental regulations may also impact the company’s operations and financial performance.

The bottom line

To sum up, Deere & Co. is a mature but growing company. Even though it might look boring for many, the company’s shares have shown to be a great long-term compounder with significant long-term alpha against the broader equity market indices. With respect to outstanding fundamentals, this characteristic is likely to persist also in the upcoming years. After all, a simple DCF model suggests the shares’ true value is as much as two times greater than the market sees it today.

[ad_2]

Source link