[ad_1]

This evaluation usually begins with gold, however the exercise in platinum is a significant occasion that shouldn’t be missed.

See the article What’s the Comex? for a little bit of backstory.

Platinum

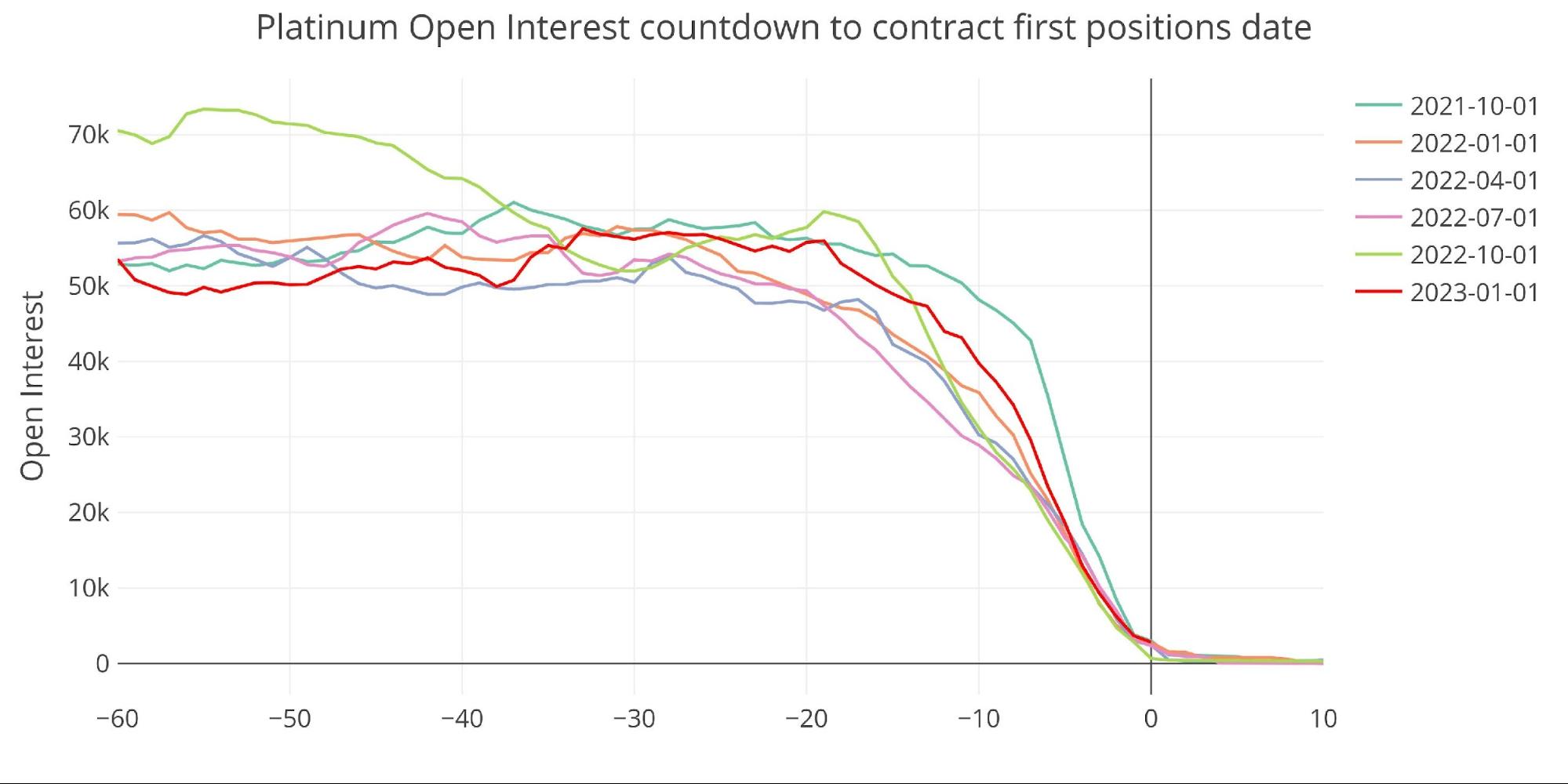

The key months in Platinum are January, April, July, and October. Throughout main months, Platinum behaves lots like silver and gold with plenty of open curiosity that dives as first place approaches. That is when contracts have to roll or stand for supply.

The present month seems to be prefer it adopted an identical trajectory as previous months.

Determine: 1 Cumulative Internet New Contracts

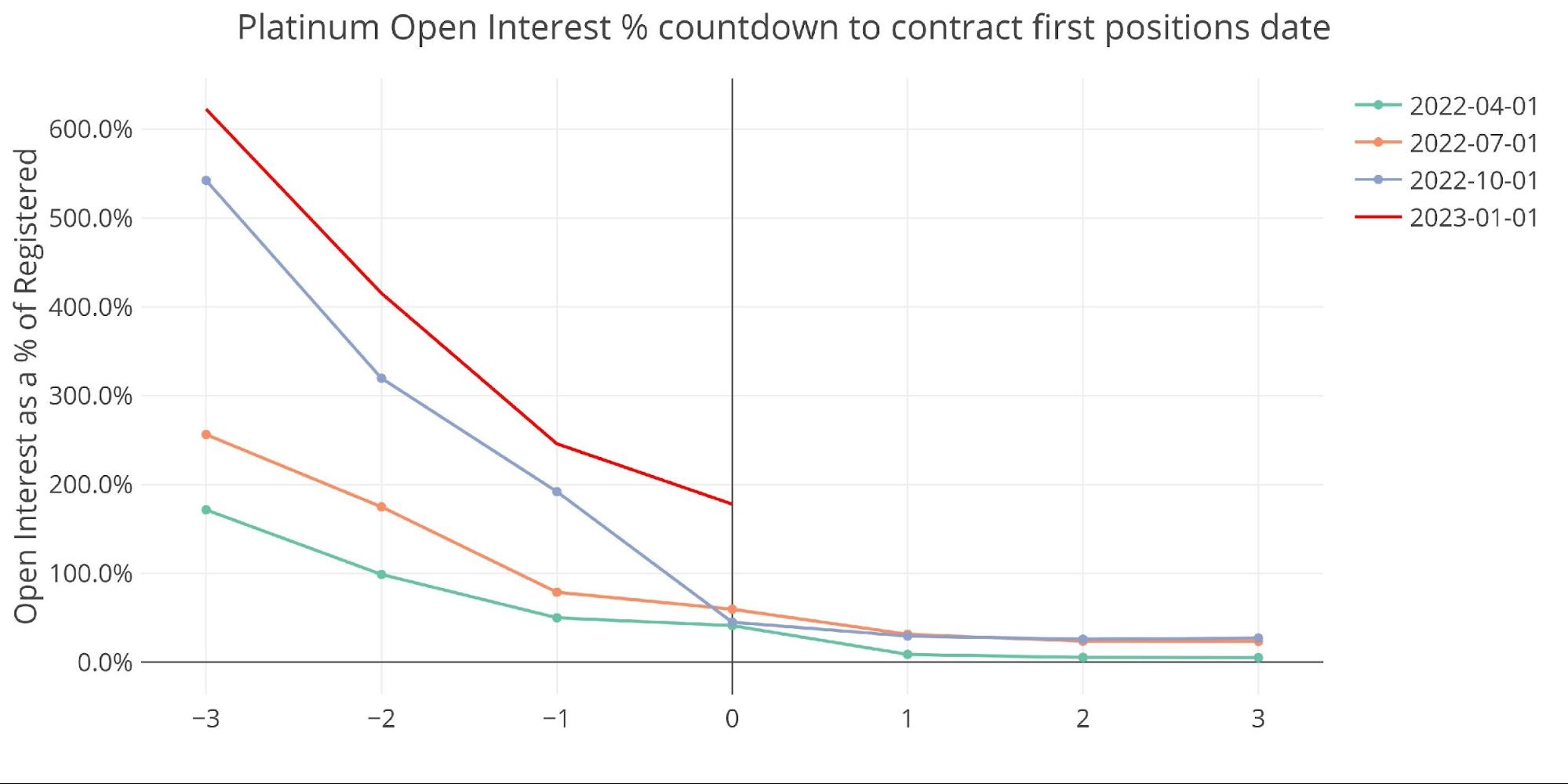

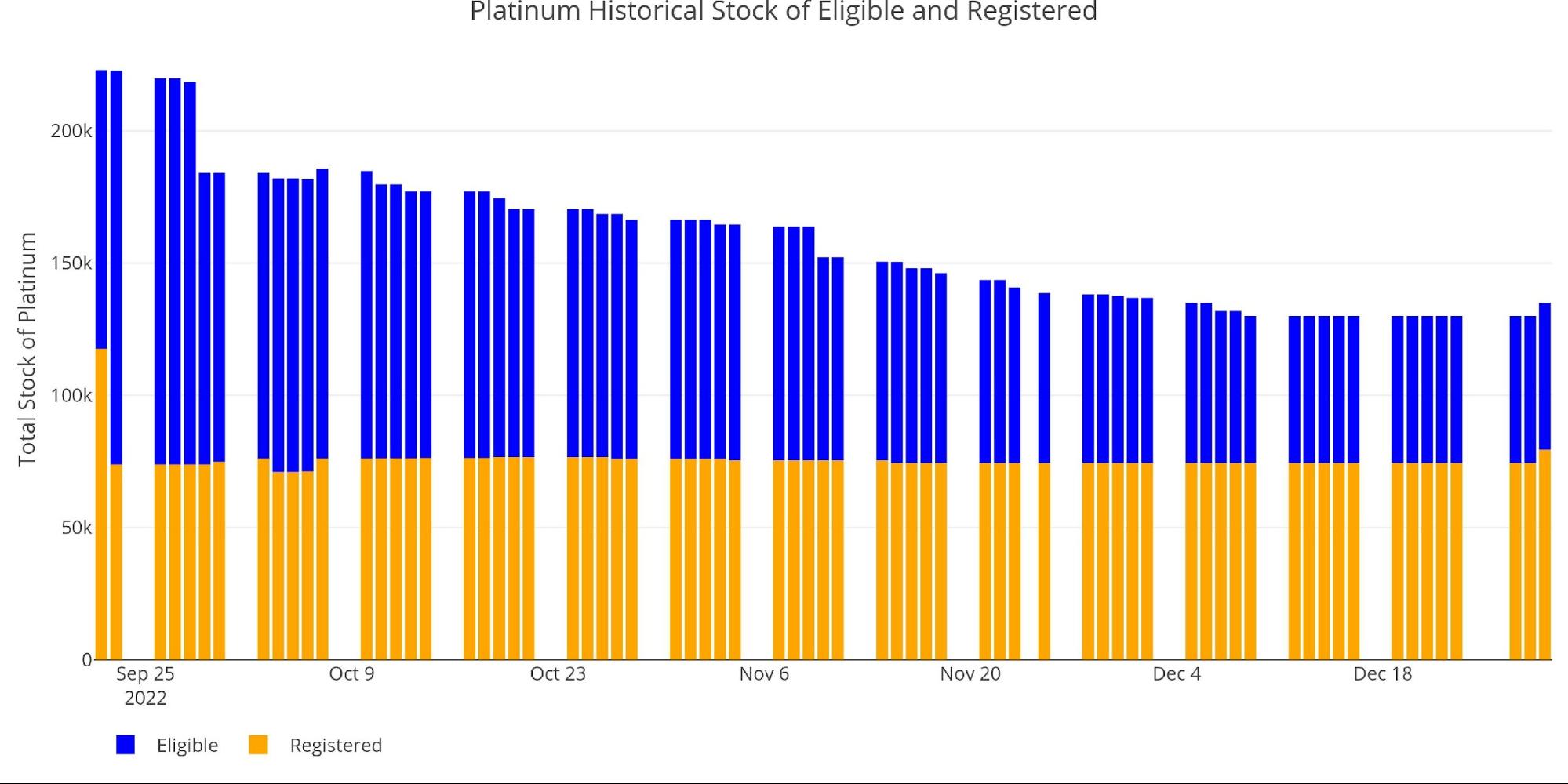

Nonetheless, once you zoom in and look carefully on the knowledge, there are some very key nuances. Registered metallic represents metallic that’s accessible to fulfill supply requests. Eligible metallic is in Comex vaults however usually owned by somebody and isn’t (but) accessible for supply.

The chart under plots the open curiosity for main months as a share of Registered. Whereas issues in October regarded fairly bleak for the Comex (OI represented 192% of Registered with 1 day to go), there was a significant drawdown in open curiosity on the ultimate day to convey OI to 45% of Registered at First Place.

This was mentioned again in September as Platinum shorts had lived to see one other day.

The January contract ended up not seeing the identical reduction. As proven under, the OI on First Place (yesterday) represented 178% of complete accessible Registered. Which means that there are 1.7 supply requests for every accessible ounce of Platinum.

Determine: 2 Platinum Countdown %

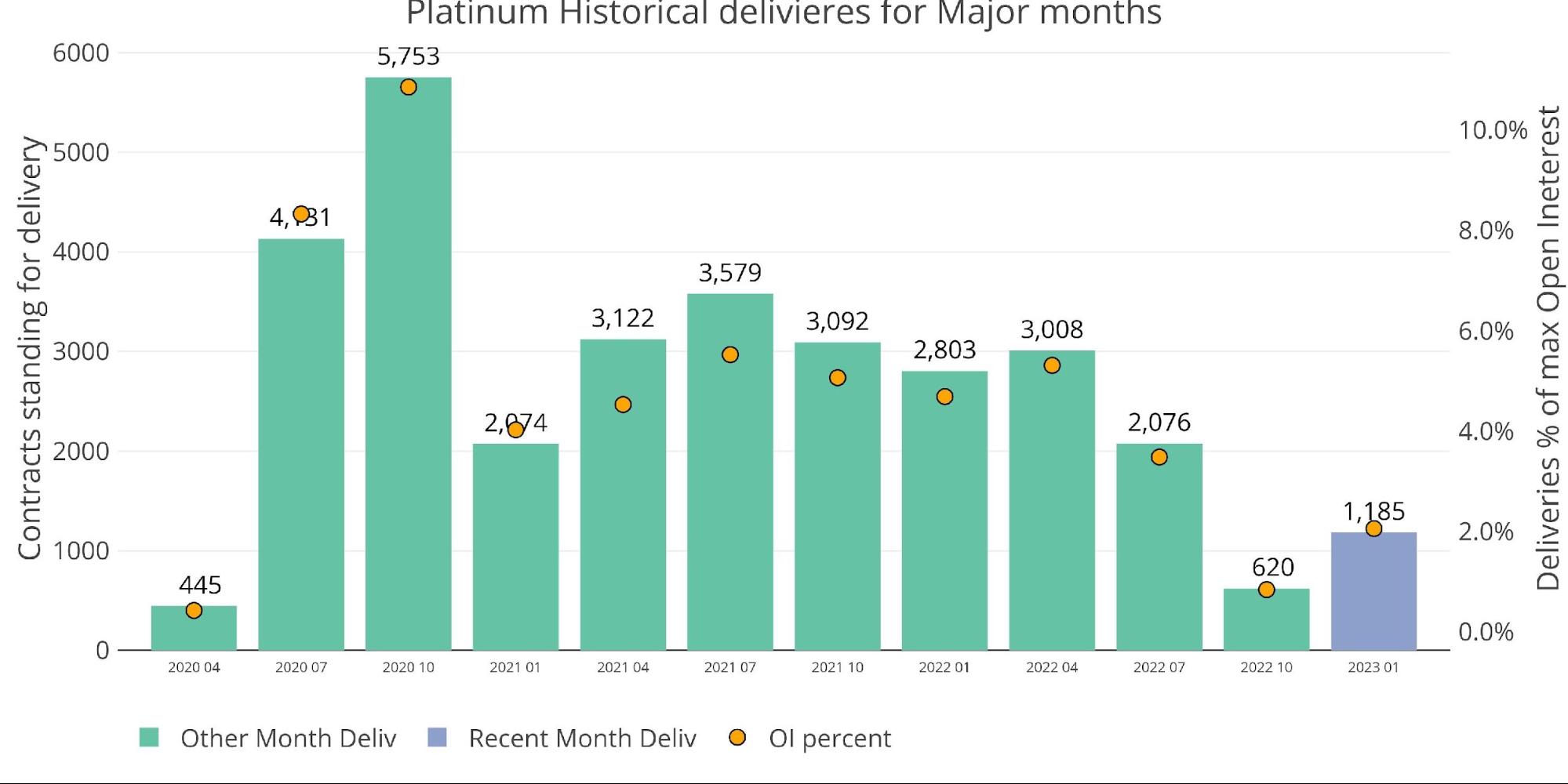

The chart under reveals main month supply quantity. First, the October month must be highlighted for a way a lot it diverged from different months. Supply quantity had been above 2k contracts (100k ounces) for over 2 years after which abruptly supply quantity drops to 620 contracts (31k ounces).

Determine: 3 Latest like-month supply quantity

Supply quantity needed to drop as a result of there have been solely about 75k ounces in Registered accessible for supply as proven under.

Actually, complete present platinum accessible in Comex vaults is round 135k ounces. Up to now 1,185 contracts (~60k ounces) have been delivered (Determine 3) with 1,640 (82k) remaining in open curiosity. This exceeds ALL platinum in Comex vaults by 8k ounces.

You could discover a slight improve in stock that occurred yesterday. This was 5,000 ounces being deposited instantly into Registered on the day earlier than First Discover. Contemplating this covers solely about 100 contracts, it won’t be almost sufficient to fulfill all of the calls for presently excellent in open curiosity.

Determine: 4 Platinum Stock

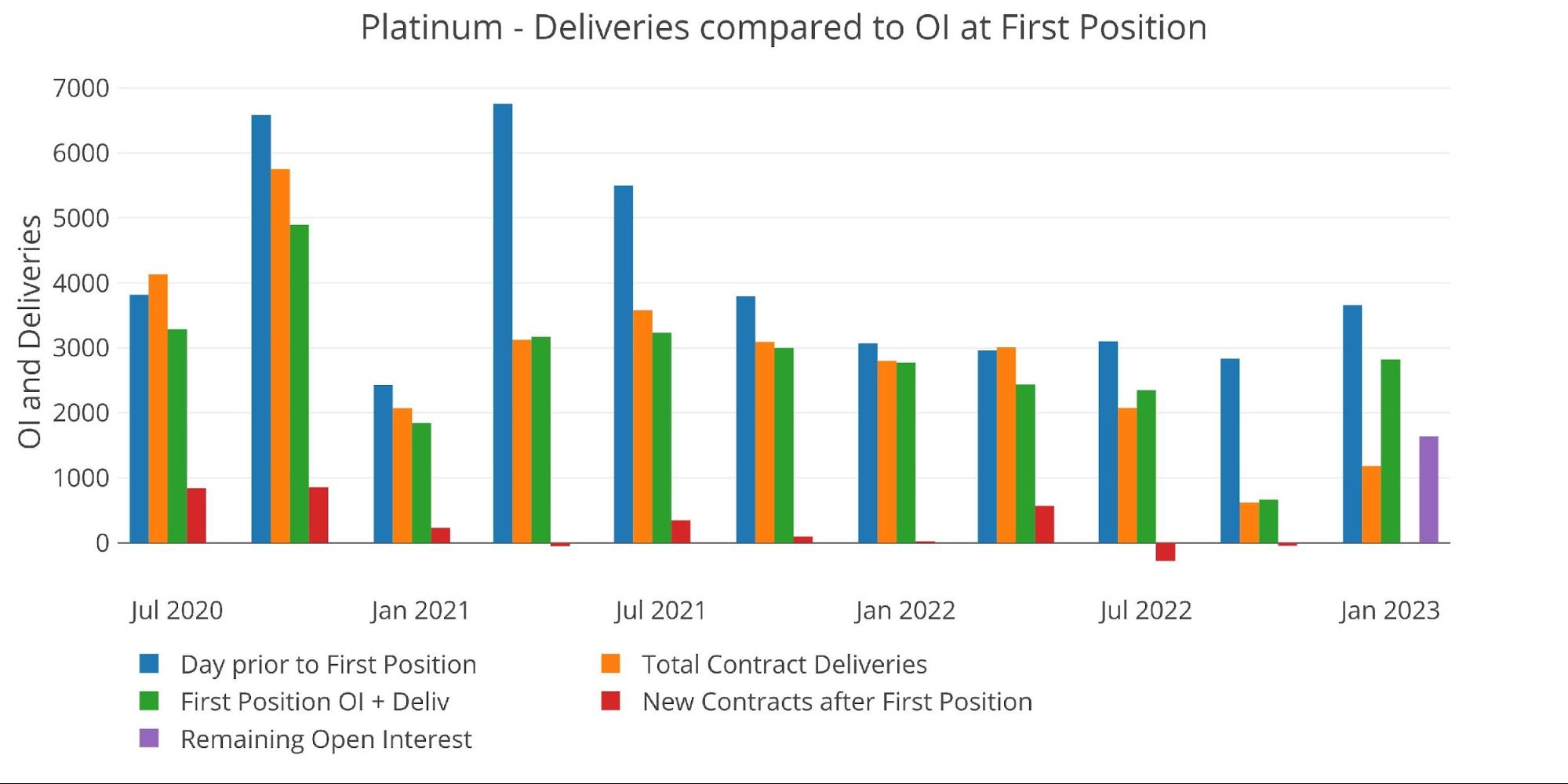

The chart under reiterates the massive drop into shut seen in October (distinction between blue and inexperienced bars), nevertheless it additionally highlights a key variable which is web new contracts (purple bars). Usually, platinum sees web new contracts open through the month for fast supply.

That has modified for the final two main months as contracts shut mid-month fairly than accept supply. Greater than probably, the pattern will proceed this month and can most likely improve. It has to as a result of there may be not sufficient metallic to ship.

Determine: 5 24-month supply and first discover

Implications

So, what does this all imply? Most likely not a lot within the fast future (i.e., platinum isn’t going to double in a single day). The Comex is a significant establishment and platinum is a small, thinly traded metallic. That stated, that is probably a preview of what’s to return in silver and gold.

Platinum has been forward of silver, and silver is forward of gold. “Forward” on this case means thinner provides of metallic and oddities within the knowledge like platinum noticed for October. As a substitute, what we’re probably about to see is a preview of what’s going to occur in silver in 2023 and gold in 2024. How will the Comex bridge the scarcity hole? What’s going to occur to the worth? What number of contracts will money settle mid-month? And what occurs in April when platinum sees one other main month?

It will play out slowly for now, nevertheless it may speed up at any time. If traders sense weak spot or a scarcity on the Comex, issues may get ugly in a short time. As silver provides have been drained over the past yr, it’s turning into extra probably that silver will see an identical occasion to platinum. When that occurs, it’ll probably not be a minor occasion, however a significant occasion. It will likely be a setup for the ultimate occasion which might be a bodily scarcity in gold.

It will be sensible to get your bodily metallic earlier than this occurs. Keep tuned!

Please observe: silver and gold are each in minor months with low supply to begin out so nothing main to report for this replace. An evaluation was offered final week and one other will comply with in a number of weeks as gold prepares to enter February – a significant supply month.

Information Supply: https://www.cmegroup.com/

Information Up to date: Nightly round 11 PM Japanese

Final Up to date: Dec 29, 2022

Gold and Silver interactive charts and graphs could be discovered on the Exploring Finance dashboard: https://exploringfinance.shinyapps.io/goldsilver/

Name 1-888-GOLD-160 and communicate with a Treasured Metals Specialist immediately!

[ad_2]