[ad_1]

Scott Olson/Getty Images News

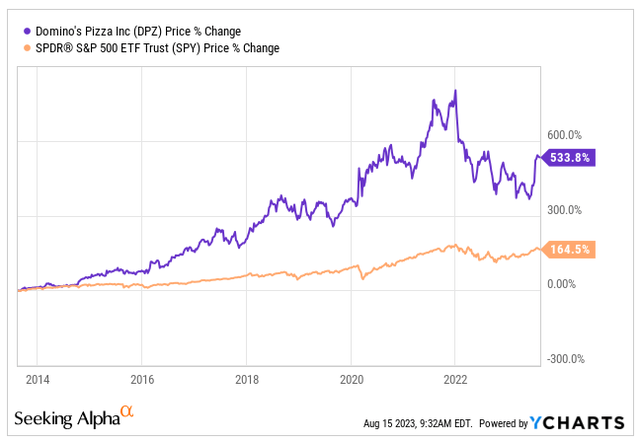

Over the last ten years, Domino’s Pizza (NYSE:DPZ), recognized as the globe’s largest pizza franchise, has proven to be an exceptional investment choice. Its stock performance has been nothing short of remarkable, surpassing the SPY (SPY) index by an impressive 369%. Often hailed as a “Wall Street Favorite,” the company has garnered significant attention, particularly during the COVID-19 period.

After all, who can resist the universal appeal of pizza?

DPZ vs. SPY Performance 10 Years (Seeking Alpha / YCHARTS)

Nevertheless, it’s worth noting that the company’s growth rate over the past three years has shown a deceleration in contrast to its historical growth patterns. Additionally, the company’s stock has experienced a substantial surge since the reveal of the Uber Deal (UBER), which is anticipated to facilitate easy Domino’s pizza orders for 70% of Uber Eats users through their app. The combination of the elevated stock price and the dwindling growth rates leads me to exercise a degree of caution. At the moment, the stock is priced around its historical averages, and based on my evaluation, it appears slightly overvalued. Considering these factors, I am inclined to classify Domino’s as a HOLD for the time being.

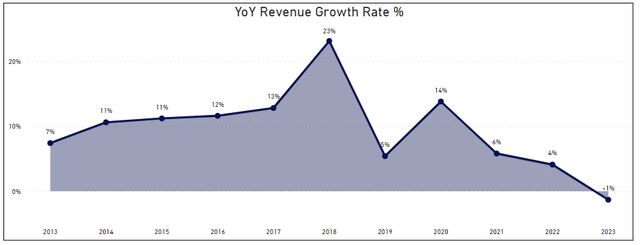

YoY Growth Rates (Author’s Graph, Data DPZ IR)

Earnings Report Q2 2023

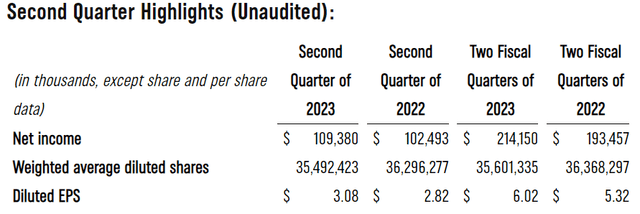

During the second quarter earnings report on July 24, 2023, Domino’s Pizza showcased a combination of outcomes. The company exceeded its projected earnings, achieving $3.08 per share as opposed to the expected $3.05 by analysts. This translates to a notable 9.2% surge compared to the same quarter in the previous year. However, on the revenue front, Domino’s Pizza fell behind, attaining $1.02 billion in contrast to the anticipated $1.07 billion. This represents a decline of 3.8% in revenue when compared to the corresponding quarter of the prior year. According to Domino’s, this decline in revenue can be primarily attributed to reduced supply chain revenues resulting from a decrease in the Company’s pricing by 2.4% for products supplied to stores, along with a decrease in order volumes. Moreover, revenues from U.S. Company-owned stores also saw a drop due to the refranchising of 114 such stores in Arizona and Utah during the fourth quarter of 2022. However, this decline was somewhat mitigated by an increase in same-store sales.

Earnings Highlights (DPZ IR)

Even with the decline in revenue, the company has disclosed that Operating Income surged by $17.3 million, marking a 9.7% increase in the second quarter of 2023 in comparison to the same period in 2022. This rise can be primarily attributed to expansion of Gross Margin from 36.4% in 2022 to 38.6% 2023 and to elevated global franchise revenues, stemming from the growth of global retail sales, excluding foreign currency impact, which stood at 5.8%.

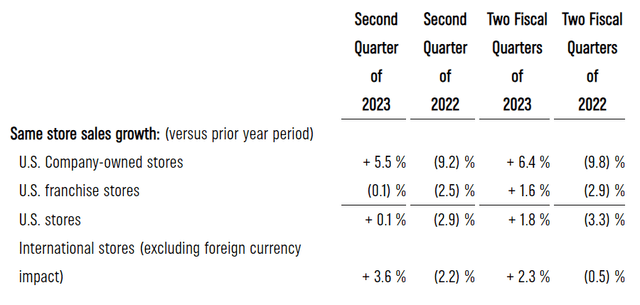

Yet, what I find particularly concerning within the earnings report is the stagnant growth of U.S. same-store sales, with a meager 0.1% increase compared to the same quarter of the previous year. This deceleration implies that the primary avenue for growth lies in the establishment of more stores within US, which poses the risk of market saturation which I will discuss more in detail in the Risks section. Nonetheless, there is a silver lining as international same-store sales, excluding the impact of foreign currency, exhibited growth of 3.6% in the second quarter of 2023.

Same-store Growth Rates (DPZ IR)

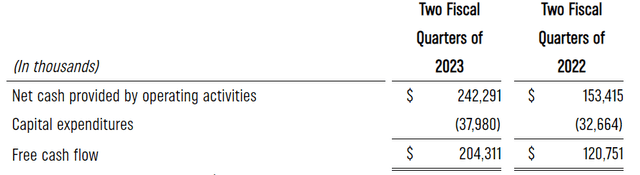

Looking at the Cash flow statement, there was a remarkable increase in Free cash flow by $83.6 million over the initial two fiscal quarters of 2023 in contrast to the corresponding period in 2022. This surge was chiefly attributed to the beneficial impact of changes in operating assets and liabilities, as well as a rise in net income. Nevertheless, this growth was somewhat counterbalanced by amplified investments in capital expenditures.

Free Cash Flow (DPZ IR)

Decelerating growth trend, but steady Profitability

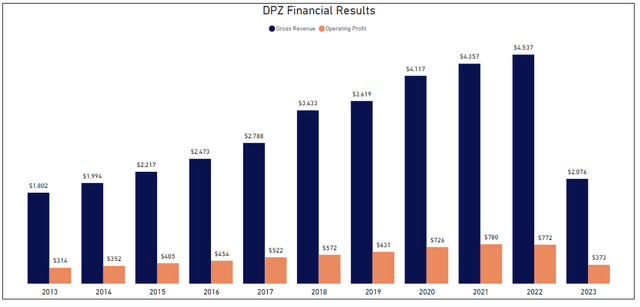

According to my analysis, Domino’s Pizza has maintained consistent growth in both Revenue and Operating Profit over the past decade. Specifically, the Revenue has displayed an impressive CAGR of 9.7%, while the Operating Income has exhibited a growth rate of 9.4% during this period. Nevertheless, this growth trajectory has experienced a deceleration in the most recent three years, with Revenue expanding by a modest 3.3% and Operating Income only increasing by 2.1%. This suggests a slowdown following several remarkable years of expansion. Furthermore, the lesser growth rate in Operating Income relative to Revenue indicates an underlying uptick in operational expenditures, primarily propelled by the commodity crisis that has exerted pressure on the overall escalation of food-related costs.

Historical Financial Results (Author’s Graph, Data DPZ IR)

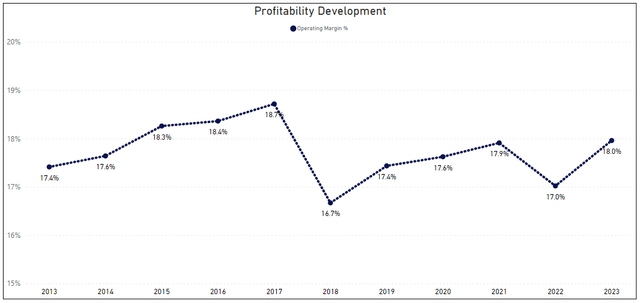

Even with the subdued growth rates observed in both Revenue and Operating Income, the Operating Income has demonstrated remarkable stability over the past decade. This stability indicates robust foundational strength within the business and substantial pricing influence despite facing cost challenges in commodities. The range has spanned from a low of 16.7% in 2018 to a record high of 18.7% in the preceding year. Presently, it stands at the company’s average of 18%. I hold an optimistic view for Domino’s to expand the profit margins, considering the advancements in the supply chain, increased automation in cooking and delivery, and the digitalization of operations.

Operating Margin Development (Author’s Graph, Data DPZ IR)

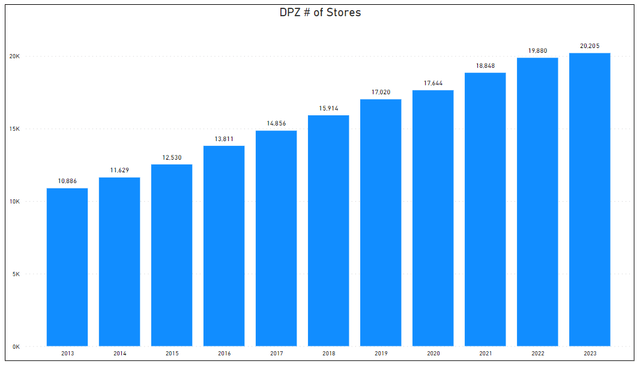

Domino’s has maintained a consistent pattern of expanding its global store count, which has served as the primary driver of its growth in recent years. As of the current date, the company has successfully opened 20,205 stores, with 33% situated in the US and 66% located outside the US, forming a well-balanced and diversified distribution.

According to my calculations, between 2013 and 2023, the company achieved a store growth rate of 5.8% CAGR. However, it’s worth noting that this growth rate has decelerated to 2.3% since 2020. Given the modest performance of same-store growth in the last couple quarters, it appears that the major portion of overall top-line expansion will likely originate from new store openings. With the recent slowdown in the pace of opening new outlets, I believe there’s a possibility that the overall top-line growth could also experience a slowdown in the coming years.

Number of DPZ Stores (DPZ IR)

Outlook & Opportunity

While Domino’s Pizza falls under the consumer discretionary category, I am inclined to argue that it could be better perceived as a defensive company due to its value-oriented propositions. These offerings, such as the Mix & Match deal of 2 meals or more for 6.99$, become attractive alternatives for individuals in times of tightened consumer spending, observed during periods of high inflation or economic uncertainty. On the other hand, during economic expansions, the company might experience an upswing in both its revenue and profits due to increased occurrence of corporate events, higher quantity of social gatherings, and greater frequency of dining out.

The recent unveiling of the Uber & Domino’s partnership, facilitating direct pizza orders through the Uber app, has generated substantial excitement and buzz within the stock market. Although Domino’s leadership projects an additional revenue potential of around $1 billion, I am inclined to adopt a stance that waits for initial data to validate the success of this collaboration. Nonetheless, this development signifies a positive stride for Domino’s, expanding their product reach to a broader customer segment with enhanced convenience. The deal is expected to provide an avenue for 70% of Uber Eats customers to conveniently order pizza through the app.

Risks & Challenges

Although making a long-term investment in Domino’s Pizza might be a prudent choice, I’d like to voice a note of caution regarding the broader issue of its franchise model. A significant portion of the company’s expansion is attributed to the establishment of new outlets, and this reliance on expansion brings forth a tangible risk of market saturation. The business faces the genuine challenge of a ceiling on the number of additional stores it can viably introduce. Currently, we are observing a decrease in the pace of new store openings, coupled with instances of closures.

In my view, it’s crucial that the company doesn’t solely depend on the strategy of opening new stores for growth. Instead, they should focus on innovative alterations to their existing menu, aiming to capture a wider range of customers. This approach becomes imperative for sustaining growth and securing a larger market share, particularly as the market nears its saturation point with an abundance of stores.

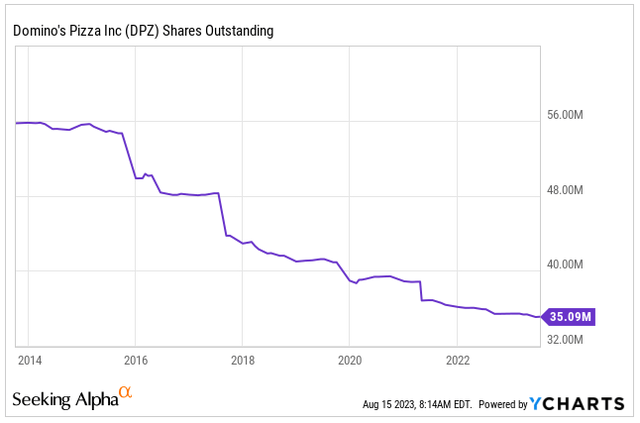

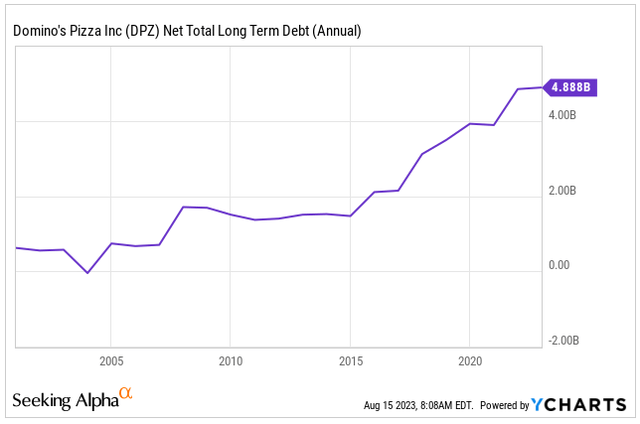

Another risk factor for Domino’s Pizza stems from their simultaneous strategies of expanding their outlets and executing stock buybacks, both funded through debt. A key area of concern is the significant debt load the company is carrying, amounting to net debt of $4.89 billion. A potential shift in approach could involve redirecting available funds from stock repurchases to debt reduction.

Shares Oustanding (Seeking Alpha / YCHARTS)

However, it’s important to note that, as of now, this substantial debt hasn’t posed a hindrance in the latest quarter. This resilience can be attributed to the staggered maturity schedule and the fixed interest rates they have secured. While they continue to generate healthy free cash flow, there’s a reduced urgency to refinance all their upcoming debt maturities at potentially higher rates.

Net Long Term Debt (Seeking Alpha / YCHARTS)

Valuation

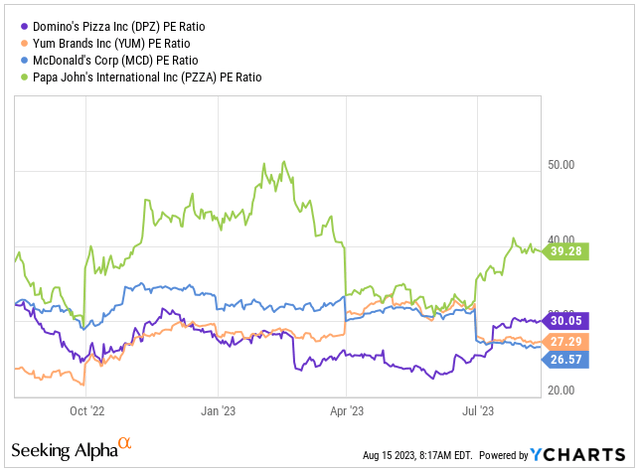

Great time to invest in Domino’s stock was between March and July 2023. During this period, the stock was trading well below its typical PE ratio, making it a great opportunity to act. If you had bought the stock in early March, you’d now be enjoying a return of around 32%, surpassing the SPY return by more than 18%.

However, since the announcement of the Uber deal on July 11th, the stock has surged by over 13%, making it more expensive and aligning with its historical averages. Presently, when we compare Domino’s Pizza to similar companies, its stock is valued at a PE ratio of 30.05x its FY23 earnings. In comparison, Yum Brands (YUM) trade at 27.29x, McDonald’s (MCD) at 26.57x, and Papa John’s (PZZA) at 39.28x.

Given these figures, I would suggest being somewhat cautious and perhaps wait for a better moment to either increase your current investment or start a new one. My recommendation stems from the belief that the potential short-term gains might be limited at this particular point in time.

PE Comparison to Peers (Seeking Alpha / YCHARTS)

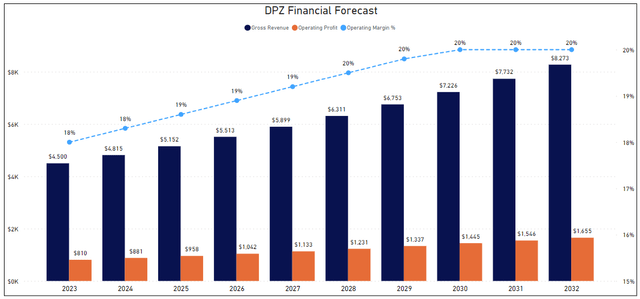

Over the past ten years, Domino’s has showcased a remarkable CAGR of 9.7% in terms of Revenue. Looking ahead, my calculations indicate that this growth trajectory is likely to persist over the next decade, albeit at a slower pace with a projected CAGR of 5.7%. This growth will be fueled by the company’s strategy of expanding its store network, capitalizing on same-store growth via introduction of innovative offerings and capitalizing on more efficient deliveries via automation.

If these projections materialize, Domino’s is anticipated to achieve a Revenue of $8.2 billion and an Operating Profit of $1.6 billion by the year 2032. Similarly, I expect the company’s Operating Margins to experience an uptick, moving from 18% to 20% by 2032. This enhancement in Operating Margins will be driven by improvements in the supply chain efficiency, economies of scale, and the company’s pricing power.

Financial Forecast (Author’s Graph)

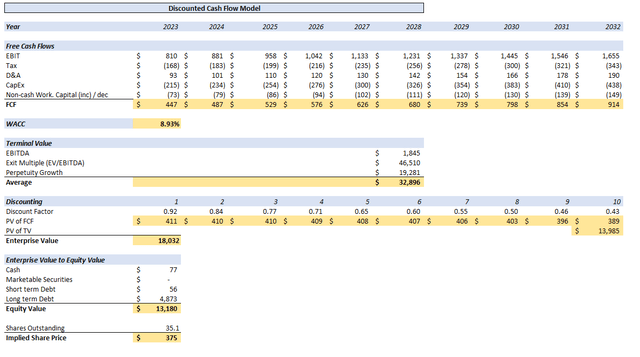

To determine Domino’s Fair Value, I’ve employed a DCF Model. Alongside the growth assumptions detailed above, I’ve factored in a WACC of 8.93%, a Tax Rate of 20.77%, and a Terminal Growth Rate of 4%. Drawing from historical data, I’ve projected Depreciation & Amortization and CAPEX to likely range between approximately 11.5% and 26.5% relative to EBIT.

The Average Terminal Value is computed by multiplying EBITDA with an EV/EBITDA ratio of 25.21 and adjusting the Perpetuity Growth Value in line with WACC. After discounting these values over the coming 10 years, PV of FCF tallies at roughly $4.04 billion, while the PV of Terminal Value reaches nearly $14 billion. This culminates in a total Enterprise Value of $18 billion. Following adjustments for Cash, Marketable Securities, Short & Long-term debt, the derived Equity Value amounts to $13.2 billion.

DCF Model Table (Author’s Table)

According to my calculations, the estimated Fair Value for the company is $375, suggesting an overvaluation of approximately 6% compared to today’s price of $397. Considering this assessment, I advise maintaining a HOLD rating at the moment and suggest waiting for a more favorable entry point.

Conclusion

As depicted throughout the article, Domino’s Pizza stands as an exceptional compounder, exhibiting remarkable growth over the past decade. It emerged as a favored choice during the COVID-19 period when homebound individuals turned to pizza delivery.

Whether facing an economic downturn or expansion, I hold the belief that the company is strategically positioned to capitalize on both scenarios through its value-driven propositions.

However, acknowledging the rally in the stock price since March, fueled at later stage by the Uber deal announcement, I express a bit of caution regarding the present valuation. It seems that the company is slightly overvalued, considering the anticipated deceleration in future growth rates. With that said, my current assessment of the company is a HOLD. I do, however, hold an interest in adding to my existing position if the stock approaches the $350 mark.

[ad_2]