[ad_1]

The market performance of Ethereum has been steadily rising since October, marking a positive and long-lasting trend. Increased buying activity has been the main driver of this positive momentum that has persisted over time, pushing the cryptocurrency beyond the vaunted $2,000 resistance mark and igniting a continuing rally.

The value of Ethereum has sharply grown as a direct result of this increased demand and market optimism, with its sights set on breaking through the crucial resistance region at $2,300. This upward trend serves as another evidence of the increasing investor trust and general bullishness surrounding Ethereum, thereby solidifying its place in the changing cryptocurrency market.

Ethereum Hits 18-Month Highs, Targets $3,000

Ethereum, the second-largest cryptocurrency in the world, is rising quickly and has reached levels not seen in the previous 18 months. With a market valuation of $285 billion, ETH is now trading 5.7% higher at $2,375 as of the time of publication. Some speculators have even shared $3,000 price predictions for ETH amid the latest market breakout.

Ethereum’s approaching resistance level poses a huge challenge to buyers of the altcoin, including the fixed barrier at $2.5K, which has frequently shown to be a significant roadblock. But if the market is able to recapture this critical area, Ethereum may go on to reach the $2.5K – or even $3.000 — in the future.

Ethereum currently trading at $2,358 territory on the daily chart: TradingView.com

As Ethereum breaks down further obstacles, investors and market watchers are keeping a close eye on the situation. A notable indication of the increased interest from institutional investors is the eagerness with which major players like VanEck, BlackRock, and Grayscale are awaiting clearance for Spot Ethereum ETFs.

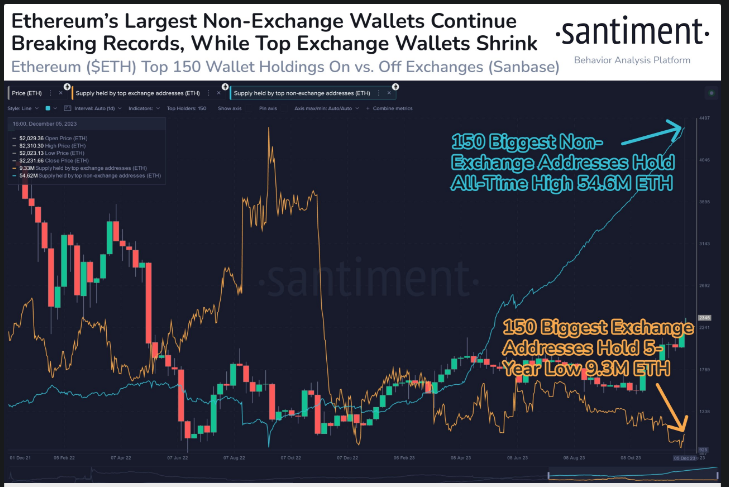

According to Santiment, an on-chain data service, Ethereum has reached $2,349, its highest price since June 2022. The amalgamation of the positive long-term trend indicating a rise in wealth for the leading non-exchange whale wallets and a decrease in sell-off power for the leading exchange whale wallets presents a propitious situation for a steady upward trend.

Ethereum’s Non-Exchange Holdings Surge To 55M ETH

A recent tweet from Santinment highlights some intriguing variations in Ethereum’s wallet mechanics. Exchange wallets saw a five-year low of 9.3 million ETH, while top non-exchange wallets are building up to a record 54.6 million ETH. This move points to upward trends, with wealth building through non-exchange transactions and decreased selling pressure.

Over the course of two months, a bearish divergence between the price and the RSI indicator grew, pointing to a possible overvaluation of Ethereum at this point. Given the current characteristics of the market, even if buyers seem to be in charge and overall sentiment is bullish, there is a significant likelihood of a brief corrective phase that involves consolidation and higher volatility in the near future.

Meanwhile, a recent ACDE meeting provided information about the impending Dencun fork of Ethereum, which is set to occur in January 2024. The Goerli network testnet fork was well-prepared for by development teams, opening the door for a larger Goerli shadow network fork in the coming weeks.

ACDE#176 happened earlier today: we discussed the state of Dencun, timelines for testnets, and how to approach planning the following network upgrade ⛓️

Agenda: https://t.co/ATVLQ7f9XpStream: https://t.co/tDM0tDKxC5

Recap below 👇 https://t.co/PhGBkYxhYN

— timbeiko.eth ☀️ (@TimBeiko) December 7, 2023

By using proto-danksharding, Dencun is expected to greatly increase data availability for layer-2 rollups. This improvement should result in lower rollup transaction costs, which will eventually help end customers.

Dencun’s overall effects include rollups that increase Ethereum’s scalability, gas fee optimization, improved network security, and the deployment of several housekeeping upgrades.

As Ethereum’s price surges to surpass the $2,300 milestone, speculation intensifies about the cryptocurrency’s potential to reach the next significant threshold of $3,000. The recent upward trajectory reflects the market’s confidence in Ethereum’s underlying technology and its role in the evolving digital landscape.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Shutterstock

[ad_2]

Source link