[ad_1]

-slav-

First Guaranty Bancshares (NASDAQ:FGBI) is a small bank headquartered in Hammond, Louisiana. It has been trading on the NASDAQ since 2015, following an uplisting from the OTC market. Despite its relatively short life as a public company, First Guaranty has been around since 1934. With a market capitalization of less than $200 million, FGBI is one of the smallest US banks now trading on a major exchange. I only found Union Bankshares (UNB) to be currently smaller, while peers Guaranty Bancshares (GNTY) and Southern First Bancshares (SFST) are slightly bigger. Given its micro-cap status, it does not really surprise me that the stock is underfollowed on Seeking Alpha. What came as a surprise instead, while looking for opportunities in the preferred shares space, is that the bank has a 6.75% preferred issue (NASDAQ:FGBIP), and its price has recently dropped more than 25%. Why is a small Louisiana bank being caught up in the recent banking storm? No apparent reason other than guilt by association. In fact, First Guaranty looks to me like a great asymmetric risk/reward opportunity.

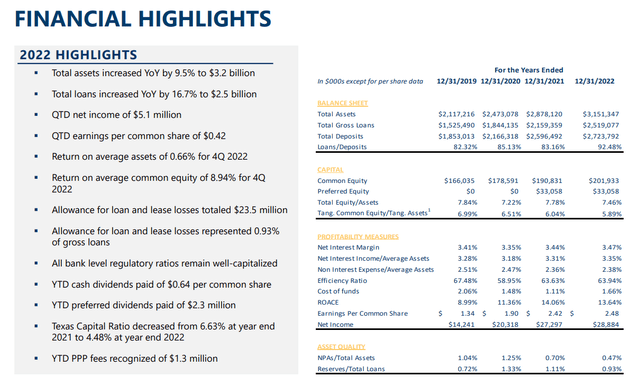

FGBI: FY2022 results snapshot

The bank presented its 2022 financials at the end of January, earning $2.48 per share, a modest +2.5% increase over 2021 results, but nevertheless an increase in a difficult year where most of the top US financial institutions registered an EPS decrease. A closer look at the results reveals that the bank pushed a bit on the accelerator pedal, increasing loans to make up for any lost ground. NII was stable YoY, but rising costs pressured the lender, so the loan-to-Deposit ratio (LDR) increased from 83.16% to 92.48%. The loan coverage remains nevertheless strong enough, and total deposits increased during 2022 from $2.60 billion to $2.72 billion. Non-performing loans (NPA) as a percentage of the total also decreased from 0.7% at the end of 2021 to 0.47% at the end of last year.

FGBI Q4 2022 investor presentation

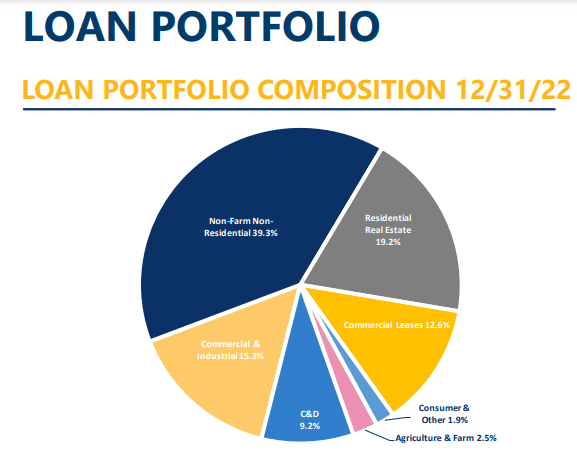

A fair loan and deposits composition

The bank’s loan exposure appears fairly diversified, albeit maybe not of the safest type, tilted towards “nonfarm nonresidential” loans accounting for almost 40% of the total loan portfolio, with residential loans accounting for slightly less than 20%.

FGBI Q4 2022 investor presentation

On the other hand, demand deposits accounted for 73% of the total deposits portfolio, while savings and time deposits covered the remaining 27%. The weighted average rate for deposits was 1.2%, against a loan yield of 5.48%. I don’t see any risk of venture capital money fleeing from FGBI simply because VCs are not First Guaranty customers.

Although I couldn’t find out what percentage of total deposits is protected by FDIC insurance, FGBI is a member, and I would assume that for a small institution such as First Guaranty, the percentage of protected deposits would be very high, negating “bank run” fears.

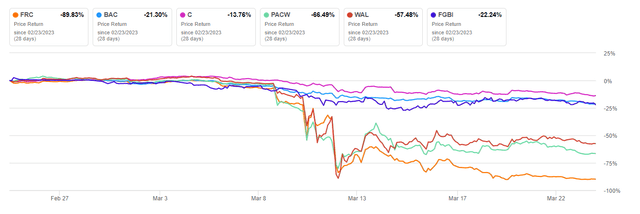

Share price action and return potential

Over the past few weeks, the movement of FGBI common shares seems to have aligned with that of larger peers who are not considered to be at immediate risk. Although FGBI’s share performance hasn’t been great and has fallen by about 22% over the last month, this decline is similar to that of Bank of America (BAC) over the same time frame.

The graph below illustrates the stagnant movement of FGBI shares during the week between March 8th and March 13th. There is little to no correlation between FGBI’s movements and those of peers such as First Republic Bank (FRC), PacWest Bancorp (PACW), or Western Alliance Bancorporation (WAL).

Seeking Alpha – 1M return FGBI vs peers

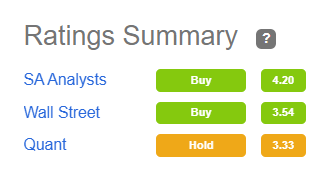

That being said, the market views FGBI’s common shares as “safe,” and FGBI shares are currently trading at an interesting valuation of 6.5x trailing earnings and 0.7x price/book value. Compared to First Guaranty’s 5-year average of 11x P/E and 1.1x P/B, which seem fair, there could be a 60% upside from current levels. BAC, on the other hand, trades at “only” about a ~30% discount from its own 5-year P/B average, while Citigroup has roughly the same upside of 60% to its average P/B. Both C and BAC are widely viewed as buy ideas by the analyst communities of Seeking Alpha and Wall Street.

Seeking Alpha – Citigroup ratings

However, I like the thinly traded preferred FGBIP even more here. A big word of caution is needed as the average volume is extremely low at roughly 2500 shares per day. But if you manage to scoop these preferred shares up at a price of $18-$18.50 as they have been trading most recently, there is a well-covered yield in excess of 9% and almost 40% upside potential to par value. FGBIP shares held up well until March 14, but then unexpectedly sank 30% in the span of three short days.

Seeking Alpha – 1M return FGBI vs FGBIP

I do not see any risk of a dividend suspension for the $1.69 annual dividend. Besides, the bank is profitable, and this issue (series A) is the only one of the bank, it is not big in size (less than $34M total) and the resulting $2.3 million annual interest payment is easily covered.

While the issue is perpetual with no call date, the face-value rate of 6.75% is, in my opinion, high enough to entice trading back to par value even in the current market environment. Shares were indeed trading as high as $25 until February 15th, and with increasing chances of no further rate hikes from the Fed going forward, I believe the current discount is entirely unjustified.

Are FGBI shares a buy?

First Guaranty Bancshares is a small Louisiana bank that is relatively unaffected by the ongoing troubles of larger operators such as Silvergate or First Republic Bank. While common shares have recently underperformed the broader market, they remain a safe choice from a fundamental perspective. FGBI appears to be an interesting micro-cap idea, as the bank runs reliable, profitable operations and currently sports an attractive valuation compared to its historical averages.

However, for conservative retail investors unwilling to take on specific micro-cap risks, the preferred shares seem to offer an asymmetric risk/reward opportunity here. I say “retail” investors because clearly, with such small volumes, FGBIP seems off-limits to funds. And here probably lies the opportunity. After a sharp fall during the current month, which is not justified by the bank’s performance, FGBIP trades at distressed levels, with a 40% upside to par value and a very safe 9% dividend yield. Disconnects in the preferred shares space tend to appear frequently in periods of heightened market volatility, and I think this is no exception.

I have little doubt that a small issue such as FGBIP can sink just because of a big sale and struggle to recover for a while by flying under the radar. However, this kind of disconnect also tends to disappear quickly once the market stabilizes. Therefore, I believe that First Guaranty Preferred shares will return to trade close to the par value within 12 months, providing an outsized return to investors.

[ad_2]