[ad_1]

Dazman/E+ by way of Getty Pictures

We have now beforehand coated Golden Ocean Group Restricted (NASDAQ:GOGL) right here as a post-FQ2’22-earnings article in September 2022. The corporate had beforehand reported stellar efficiency, attributed to the elevated TCE charges, which have ballooned by 50% for the Capesize vessels and 47.5% for Panamax vessels, in comparison with pre-pandemic ranges. Many traders have been involved concerning the normalization of its TCE charges affecting its stellar dividend yields, because of the worsening macroeconomic outlook then.

For this text, we will likely be specializing in the IMO 2023, triggering reasonable tailwinds to the delivery fleets from decrease steaming rules. The 30Y low-order e book might also mood a few of the recessionary headwinds, because of the restricted availability of environment friendly fleets. Moreover, the speedy reopening cadence in China could enhance demand for commodities, particularly Iron Ore, prompting the restoration of TCE charges.

The Dry-Bulk Funding Thesis Stays Sturdy By 2024

GOGL has been overly overwhelmed with a -51.94% plunge from its peak inventory value of $16.46. Nonetheless, issues could also be bettering shifting ahead, regardless of the short-term market volatility.

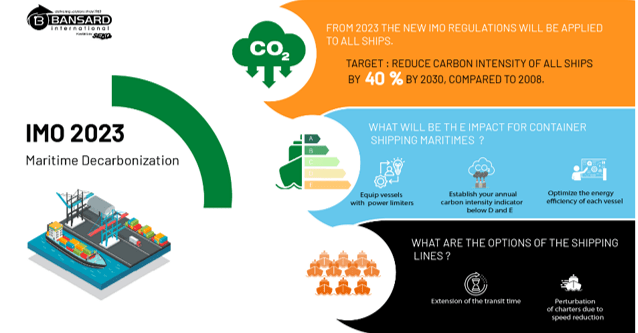

IMO 2023 Maritime Decarbonization

Bansard

Firstly, the Worldwide Maritime Group [IMO] has launched decarbonization rules that may take impact from 2023 onwards to enhance power effectivity and modernize delivery fleets. The regulation additionally goals to restrict carbon emissions by -40% by 2030 and -70% by 2050.

These have resulted in elevated off-hires days for a lot of firms, akin to GOGL at 753 days and Star Bulk Carriers (SBLK) at 1.26K days over the previous 9 months, with the previous recording elevated dry-docking bills of $11.7M (+18.2% YoY) and the latter $29M (+20.9% YoY) on the similar time. These are primarily attributed to the businesses’ steady upgrading and upkeep efforts to realize improved Carbon Depth Indicator [CII] rankings, with GOGL reporting a mean fleet ranking of B and a fleet age of 6 years up to now. Nonetheless, the identical can’t be mentioned of many different firms, with the latter suggesting that as much as 75% of the worldwide getting older fleet as non-compliant with IMO 2023 and, due to this fact, requiring sluggish steaming.

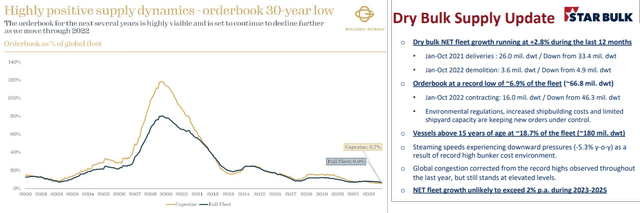

30Y Low Order E book For World Fleet

SBLK & GOGL

Notably, the availability of environment friendly dry bulk fleets will nonetheless be restricted with the 30Y document low order e book. As a result of rising inflationary stress throughout uncooked supplies, labor, and power costs, dry bulk shipbuilding prices have additionally risen by almost 33% over the previous two years. That is the steepest improve in twenty years, suggesting minimal fleet progress over the subsequent few years, whereas most fleets proceed getting older. In consequence, the common age of dry bulk fleets has risen to 11.4 years by mid-2022, which additional worsened the availability facet as a consequence of slower steaming rules.

As well as, many delivery firms additionally select to decelerate their ahead investments as a consequence of falling TCE charges, complicated gasoline rules, and unsure macroeconomic outlooks. John Hatley, GM at Finnish marine know-how firm Wartsila, mentioned:

We have now a conflict between an business that may be very long-term investment-oriented and a really quick tempo of change… They ( ship house owners ) would slightly look ahead to possibly the entire lifetime of the ship of 20 years, however that is much more unsure now due to the tempo of change. (Reuters)

These could set off notable tailwinds to GOGL certainly, as a consequence of its youthful fleet age, improved effectivity, and optimized crusing pace. Moreover, the corporate diligently divested 5 getting older non-core fleets in 2022, whereas placing in new orders for elongated 2024/2025 deliveries, because of the diminished shipyard capability. The sale has additionally aided in one other -$20M deleveraging to $1.06B of long-term money owed within the final quarter. These factors to the administration’s extremely competent ahead funding, regardless of the unsure short-term outlook.

5Y Baltic Dry Index

Buying and selling Economics

Whereas the Baltic Dry Index has additionally tragically plunged under the 2019 common, we’re not overly involved now, since GOGL guided respectable FQ4’22 TCE charges of $23.1K for 75% of Capesize out there days and $19.1K for 78% of Panamax. These numbers recommend a notable plunge of -24.6% and -30.7% from pandemic heights, nevertheless, an growth of 13% and a couple of.2% from pre-pandemic ranges, respectively. The numbers for FQ1’23 could appear much less promising at $21.3K for 4% of Capesize and $21.1K for 21% of Panamax. Nonetheless, these are primarily attributed to the rising recessionary fears, as an alternative of elementary international demand.

We’re assured that these charges will get well reasonably, as a consequence of China’s speedy reopening cadence. Many commodity shares akin to BHP Group Restricted (BHP), Rio Tinto Group (RIO), and Freeport-McMoRan (FCX) have rallied upon the nation’s stress-free of Zero Covid Coverage. Regardless of the continual lockdown in FY2021, the nation accounted for 43.07% of world iron-ore demand at 1.12B tonnes and 53.19% of world copper demand at 12.5M tonnes.

Whereas China’s property market suffered in 2022, issues could rapidly turnabout because of the regulator’s new supportive measures shifting ahead. The nation will likely be rolling out a 16-point plan, together with new financing insurance policies towards debt-ridden builders, loosening down-payment necessities for brand new homebuyers, and easing earlier cooling-down measures, amongst others. For instance, the China Securities Regulatory Fee has already introduced that certified property builders could safe back-door financing by way of different listed firms, reversing a decade-old coverage.

Whereas these methods could in a roundabout way set off the quick restoration of the property market within the nation, early indicators already show optimistic sufficient for the resultant restoration of commodity and dry-bulk charges forward. A number of authorities stimulus packages, together with 300B Yuan ($43B) in infrastructure investments and 1T Yuan ($140B) in semiconductors, could additional contribute to this cadence certainly. John Woods, chief funding officer from Credit score Suisse, mentioned:

Authorities have been urged to help the basic demand for housing and ‘affordable financing calls for’ of builders. Within the coming months, we anticipate China to additional ease property insurance policies, which may probably enhance financial progress and company earnings in flip. (South China Morning Put up)

Due to this fact, it isn’t shocking that market analysts are bullishly predicting that iron ore costs could get well to $150/ton by H1’23, suggesting a wonderful 35.74% upside potential, just like peak June 2022 ranges. It is very important spotlight that 98% of all iron ores produced are used to make metal, of which over 50% are attributed to the worldwide housing and development sector. As well as, as much as 77% of Capesize fleets are used to move iron ores over the previous 5 years, suggesting the shut linkage in spot costs.

In consequence, the elevated demand and costs for iron ore might also set off the restoration of TCE charges, greater than doubling the Baltic Change Dry Index to $2.5K, triggering tailwinds to GOGL’s improved monetary efficiency by means of 2024.

So, Is GOGL Inventory A Purchase, Promote, or Maintain?

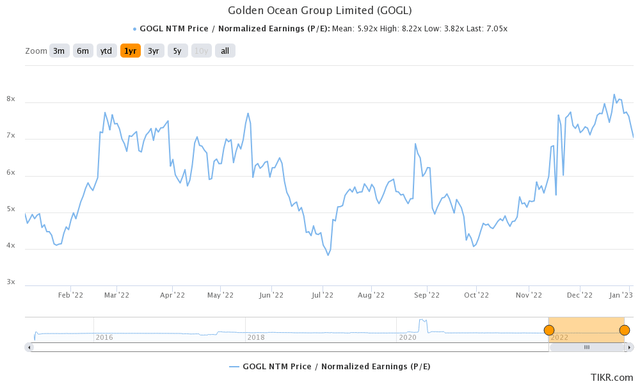

GOGL 1Y P/E Valuations

S&P Capital IQ

GOGL is presently buying and selling at an NTM P/E of seven.05x, greater than the FY2022 imply of 5.92x, although barely decrease than the FY2021 imply of seven.31x. Primarily based on its projected FY2024 EPS of $1.59 and present P/E valuations, we’re an aggressive value goal of $11.21, suggesting a wonderful 39.6% upside potential from present ranges. Primarily based on the consensus estimates’ projected dividend of $1.11 by FY2024, we’re additionally a stellar ahead yield of 13.8% then, in comparison with its 4Y common of 10.62% and sector median of 1.69%.

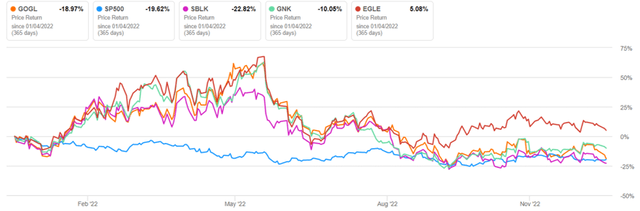

GOGL 1Y Inventory Value

Looking for Alpha

Apparently, this optimism isn’t mirrored in lots of dry bulk inventory costs, with GOGL, SBLK, and Genco Transport & Buying and selling Ltd (GNK) nonetheless buying and selling sideways after the drastic correction since mid-2022. Eagle Bulk Transport Inc. (EGLE) could be the notable exception, rising from the ashes by 5.08% over the previous 12 months in opposition to the S&P 500 Index’s decline of -19.62% on the similar time.

Whereas we agree that the delivery business, significantly dry bulk, is very cyclical in nature and, due to this fact, risky, nobody can refute that GOGL’s dividend yields look stellar for short-term trades. The mixture of document low order books and slower steaming from 2023 onwards means that its prospects stay sturdy over the subsequent few quarters, regardless of the 70% probability of a recession in 2023. China’s financial exercise might also rebound from Q2’23 onwards after the stabilization of COVID instances, with market analysts projecting a GDP of 4.7% in 2023, in opposition to 2022 numbers of three% and 2019’s 6%.

With the GOGL inventory already buying and selling near its earlier help stage of $7s, the risk-reward ratio appears fairly enticing right here. Due to this fact, we proceed to price the inventory as a Purchase, with the caveat that traders ought to keep on their toes and monitor the market carefully.

[ad_2]