[ad_1]

Jarretera

Summary

Readers may find my previous coverage via this link. My previous rating was a buy as I gained more confidence in HelloFresh’s (OTCPK:HLFFF) EBITDA trajectory, supported by a normalization in CAC and growth in its Factor75 business. I am reiterating my buy rating as I continue to expect growth to accelerate as the Factor business unit becomes a larger part of the business and its growth momentum continues at the current pace.

Financials / Valuation

Revenues for 3Q23 were reported by HelloFresh on October 26th, totaling €1.8 billion. The 3.5% fx-neutral growth in revenues is a significant increase from 0.8% growth in 2Q23. This resulted in an increase of 50 bps in adjusted EBITDA margin to 3.8%, or €69 million in adjusted EBITDA. The rise in adjusted EBTIDA resulted in a rise in EPS, which came in at -€0.06. Management reiterated FY23 revenue growth guidance of 2-8% on a currency-neutral basis. They also reaffirmed their range of €470–€540 million for adjusted EBITDA.

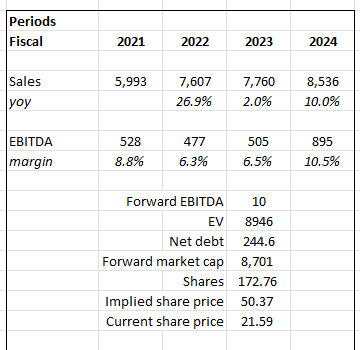

Based on author’s own math

Based on my view of the business, HelloFresh should have no issues accelerating its growth rate beyond FY23. That said, I am adjusting my growth expectations modestly downward from my previous expectations due to management’s weak guidance for a low-single-digit decline in US active customers. My expectation for EBITDA margin remains the same, as I expect growth acceleration to continue driving profits upward, especially as management continues to optimize fulfillment costs. My last valuation for HFG was that it deserves to trade at 10x forward EBITDA, as I expected adjusted EBITDA to grow with the acceleration in revenue, and my expectations remain the same. My 10x forward EBITDA outlook is largely anchored upon the stock’s historically trading average. Post-FY21 (FY20 and 21 were largely influenced by the COVID situation), the stock traded at around mid- to high-single-digit forward EBITDA, with declining revenue growth. With my expectation that growth should accelerate, I expect multiples to start inflecting back to the higher end of this range.

Comments

I maintain the perspective that the factor opportunity remains attractive, and HelloFresh is not receiving adequate recognition for the development of this business unit. Factor, as a refresher, is the RTE company that HelloFresh bought in 2020. During that period, the business had already achieved an annual revenue run-rate of $100 million. In merely ~2 years, management has managed to turn this $100 million business into almost a billion-dollar business in 2022. As mentioned in my previous post, a key part of my bullish view anchors around Factor FY25 guidance, in which management’s plan is to double segment revenue to €2 billion by 2025 with ~10% margins, implying €200+ million of adjusted EBITDA (which is ~50% of current’s adjusted EBTIDA level). The execution appears to be proceeding smoothly, as management has acknowledged its dedication to implementing their growth strategies for Factor over the preceding months. Importantly, I believe the establishment of a new manufacturing facility in Goodyear, Arizona, scheduled for September 2023, is going to facilitate a subsequent acceleration of growth in the upcoming periods. Moreover, the accomplishment of milestones in the previous quarter, such as the successful launch of Factor in the Netherlands and Belgium, instills a sense of assurance and certainty that progress is being made according to plan. Everything seems to be moving in the right direction for management to realize their vision of expanding the brand into additional European markets in 2024 and beyond. One thing to note is that because it usually takes around two to three years to reach full capacity due to training and optimizing facilities, I expect to see Factor’s growth pick up speed over time in the near future. As such, as the business unit gets more mature and Factor becomes a larger mix of the business (as it grows), I see potential for HelloFresh growth to further accelerate.

From a profit angle, procurement expenses should also increase as a percentage of revenue, as there are much more ingredients required to support the entire factor business. However, I anticipate that the expenses related to fulfillment will decrease as HelloFresh effectively implements their internal strategies aimed at reducing this particular cost component.

“We continued to reduce our relative fulfillment expenses by, one, optimizing our fulfillment center footprint, secondly, by driving our process standardization, and thirdly, by ramping up the use of technology and automation.” Source: 3Q23 earnings

In addition to the fantastic quarter, management has announced up to a €150 million buy-back in shares and certain convertible bonds issued in May 2020, so I am increasingly bullish on the stock. Although this represents only a small fraction of the company’s total market cap (around 4%), I take it as a sign that management is committed to being shareholder friendly as the company grows and profits increase.

Risk & conclusion

Despite positive growth in active consumers on a group level, I highlighted the near-term risk that management is now forecasting a low-single-digit decline in US active consumers for meal kits this year in the most recent earnings update. Keep in mind that the back-to-school period is one of the primary marketing investment windows, making the month of October a pivotal catalyst month with a great deal of customer capture opportunity. Despite this surge in marketing, the company is planning for a decline in active customers in the United States. My concern is that this will frighten short-term investors (who aren’t looking at the long-term potential of Factor) and drive down the stock price in the short term.

In conclusion, HelloFresh’s growth trajectory remains robust, with a positive outlook supported by the expanding Factor business unit. The recent financial results, including a substantial increase in revenues and adjusted EBITDA margin, reinforce the company’s positive momentum. While management’s conservative guidance for a low-single-digit decline in US active customers is a near-term concern, the long-term potential of Factor, and its impressive growth and execution, continue to underpin a bullish perspective. Moreover, management’s commitment to shareholder-friendly initiatives, such as the share buy-back program, demonstrates confidence in the company’s future.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

[ad_2]